Crypto analyst Ali Martinez has shared some vital insights into the present Bitcoin (BTC) market primarily based on UTXO Realized Value Distribution (URPD). Utilizing this metric, the famend market knowledgeable has highlighted key assist and resistance ranges with a doubtlessly sturdy affect on BTC’s fast value motion.

Following one other week of widespread market uncertainty, Bitcoin costs stay in consolidation, failing to make an efficient breakout above $84,380.

Bitcoin Bull Run: $97,532 Holds Key To Renewed Bullish Momentum

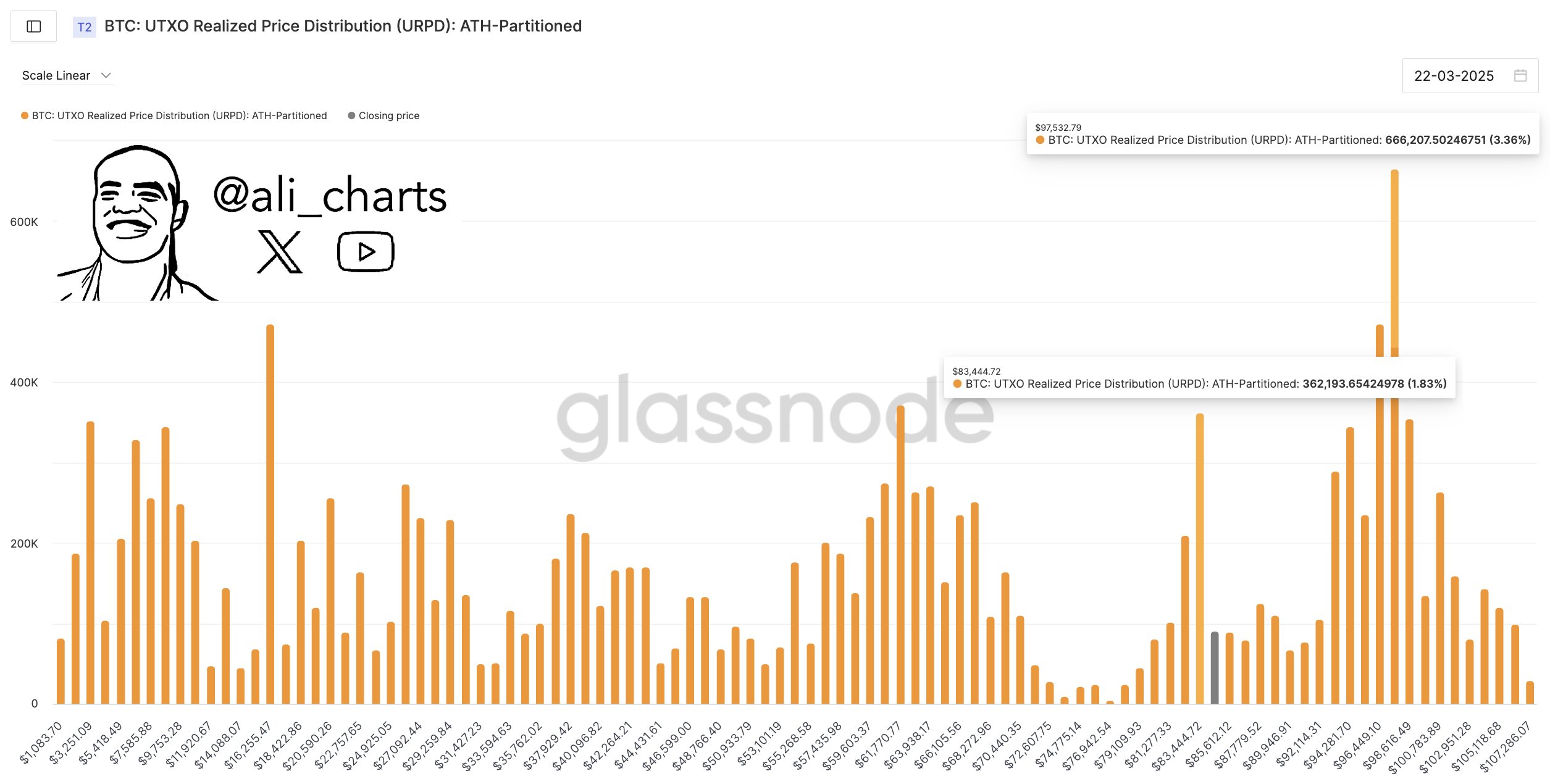

In on-chain evaluation, the Unspent Transaction Output (UTXO) represents the rest of Bitcoin after each transaction which can be utilized as enter in a brand new transaction. Subsequently, the UTXO Realized Value Distribution permits analysts to determine value ranges at which Bitcoin’s present provide was final moved. By highlighting value ranges with excessive concentrations of UTXOs, the URPD is a vital metric in discovering resistance and assist ranges.

In an X put up on March 22 by Martinez, information from Glassnode exhibits a powerful cluster of UTXOs round $83,444 indicating that many buyers have their value foundation round this stage. At present, BTC’s value is effectively above this assist stage exhibiting intent of a possible upswing. Nonetheless, Martinez notes {that a} stiff resistance awaits market bulls on the $97,532 value stage which additionally hosts an enormous quantity of UTXOs.

The analyst explains {that a} profitable clearance of this resistance value stage would sign a renewed bullish momentum in a BTC market that has undergone important correction up to now few months. In a extremely constructive state of affairs, Bitcoin is prone to surge in direction of new all-time highs. Nonetheless, failure to maneuver previous $97,532 could drive BTC to stay in consolidation and even retrace to decrease assist ranges.

Bitcoin Rearing To Resume Uptrend?

In different developments, Martinez has recommended Bitcoin’s present correction is probably going nonetheless ongoing primarily based on the Bitcoin Sharpe Ratio. For context, the Sharpe Ratio determines whether or not BTC’s returns are at present definitely worth the stage of threat concerned in the mean time.

The analyst explains that finest market entries have occurred when the Bitcoin Sharpe ratio is at low threat, presenting a positive shopping for alternative. Nonetheless, the present Sharpe ratio signifies excessive threat suggesting that potential BTC buyers would possibly have to train persistence.

Martinez stated:

We’re not there but, however getting shut would possibly sign a chief shopping for window!

On the time of writing, BTC continues to commerce at $84,075 following a 0.27% value enhance within the final 24 hours. Nonetheless, the asset’s each day buying and selling quantity has crashed by 46.41% as market engagement falls.

Featured picture from MorningStar, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.