On-chain information exhibits the Bitcoin long-term holders have began a section of distribution not too long ago. Right here’s what this might imply for BTC’s worth.

Bitcoin Lengthy-Time period Holders Have Simply Offered Over 177,000 Tokens

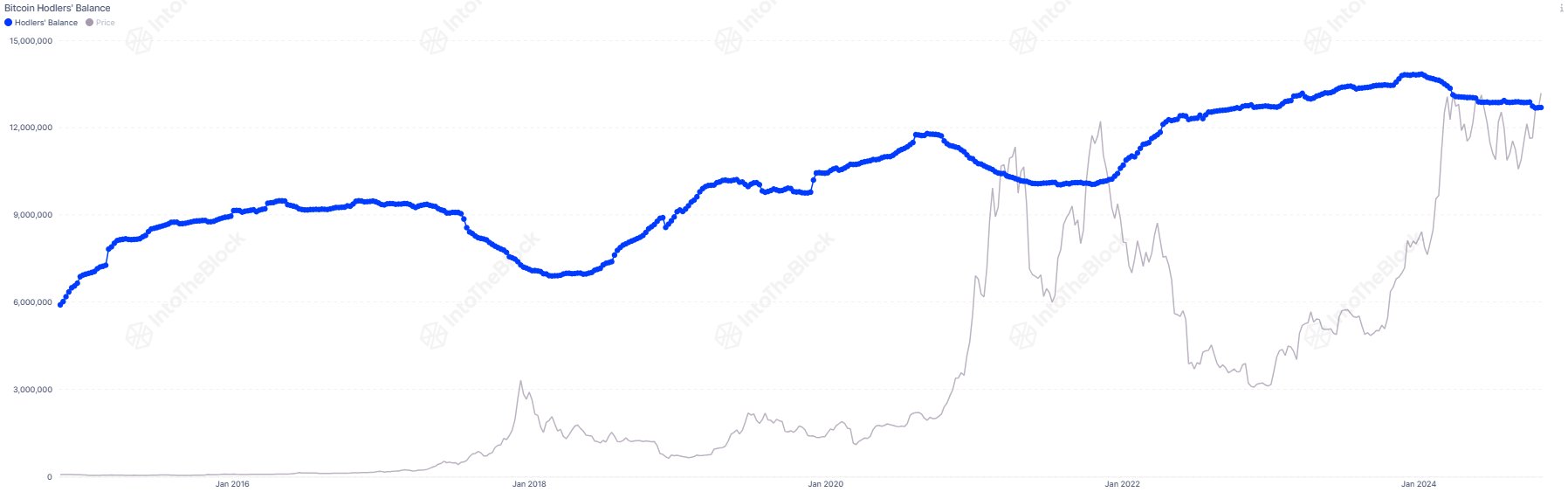

As identified by CryptoQuant neighborhood analyst Maartunn in a brand new publish on X, outdated cash have seen a destructive steadiness change not too long ago. Beneath is the chart from the market intelligence platform IntoTheBlock cited by the analyst, which exhibits the steadiness modifications for various holder teams on the Bitcoin community.

The teams right here have been divided primarily based on holding time: buyers who purchased their cash inside the previous month fall contained in the <1 Month cohort (coloured in yellow), whereas those that purchased between one and twelve months in the past are put into the 1-12 Months group (pink).

Within the context of the present subject, neither of those is of focus; the related cohort is the third one (blue), which accommodates the buyers who’ve been holding for greater than twelve months.

Statistically, the longer an investor holds onto their cash, the much less seemingly they grow to be to promote mentioned cash at any level. Thus, the 12+ Months cohort would come with probably the most resolute of the arms on the community.

From the chart, it’s obvious that these HODLers had been busy accumulating throughout the 2022 bear market and the 2023 restoration rally, however the development has seen a shift in 2024.

In the course of the first quarter of the yr, the steadiness change of this Bitcoin cohort turned considerably crimson, implying that the long-term holders have been taking the beneficial properties of their persistence.

These diamond arms ultimately noticed their promoting stress dry up because the cryptocurrency’s consolidation following its new all-time excessive (ATH) stretched on till lastly, their steadiness change hit utterly impartial ranges.

Just lately, as bullish waves have returned for Bitcoin, the steadiness change for the group has turned crimson once more, implying these HODLers have began promoting as soon as extra.

As for what this might imply for the cryptocurrency, maybe historic sample may shed some mild. “Lengthy-Time period Holder exercise typically acts as a contrarian indicator,” says Maartunn. “LTHs have a tendency to purchase (improve holdings) throughout worth dips and promote (scale back holdings) throughout worth surges.”

It’s seen from the chart, nevertheless, that whereas the LTHs do time their promoting with bull runs, the precise high of the cryptocurrency doesn’t happen till their distribution has gone on for a prolonged interval. This might doubtlessly suggest obtainable room for BTC to go within the present rally, earlier than a ceiling is hit.

One thing which will invalidate the sample, although, is the truth that the dimensions of promoting from the LTHs has been much less intense this cycle, as IntoTheBlock has identified in an X publish.

“Whereas long-term holders are promoting, it’s much less aggressive than in previous bull peaks,” notes the analytics agency. Thus, it’s doable that the present Bitcoin cycle is establishing a brand new dynamic available in the market.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $68,800, down greater than 3% over the previous week.