Information reveals the Bitcoin Funding Price has remained unfavourable in the course of the newest value rally, an indication that quick conduct is dominant.

Bitcoin Funding Charges Are Pink At The Second

In a brand new publish on X, on-chain analyst Checkmate has talked in regards to the development within the Funding Price of Bitcoin. The “Funding Price” refers to an indicator that retains monitor of the quantity of periodic price that futures market merchants are exchanging between one another proper now.

When the worth of this metric is optimistic, it means the lengthy contract holders are paying a premium to the quick contract ones with the intention to maintain onto their positions. Such a development suggests a bullish sentiment is shared by nearly all of traders on derivatives platforms.

Alternatively, the indicator being beneath the zero mark implies the quick holders are outweighing the lengthy ones and a bearish sentiment is the dominant one.

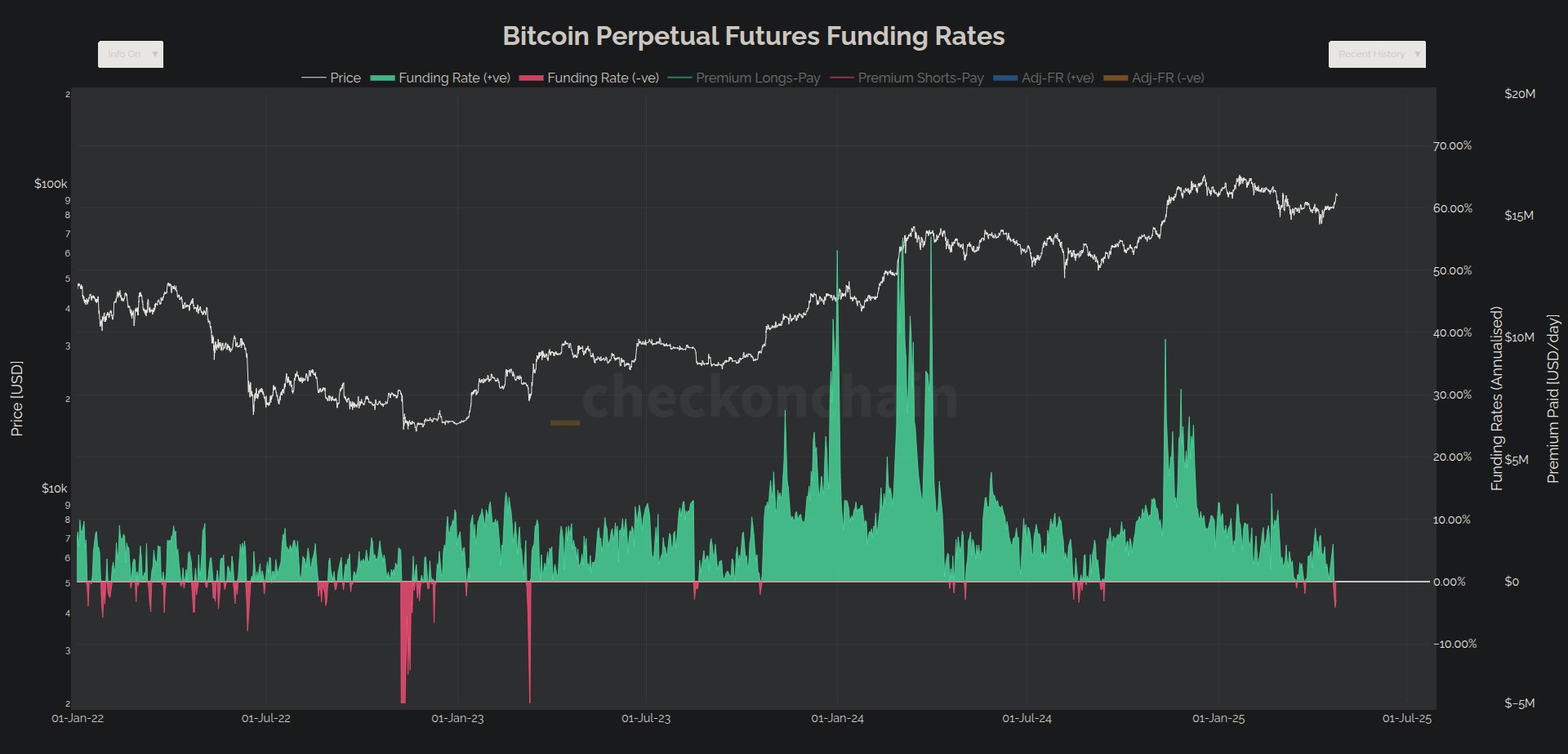

Now, right here is the chart shared by the analyst that reveals the development within the Bitcoin Funding Price over the previous couple of years:

The worth of the metric appears to have dipped into the unfavourable area in current days | Supply: @_Checkmatey_ on X

As is seen within the above graph, the Bitcoin Funding Price has slipped into the unfavourable territory just lately, which suggests quick conduct has develop into extra dominant on the exchanges.

This development has apparently come whereas BTC has been going by way of a restoration rally. It could naturally recommend that the futures market customers don’t assume that this run would final.

This bearish mentality can really play to the advantage of the cryptocurrency, nonetheless, as if demand retains the rally going, these shorts would find yourself discovering liquidation, thus appearing as gas for the run.

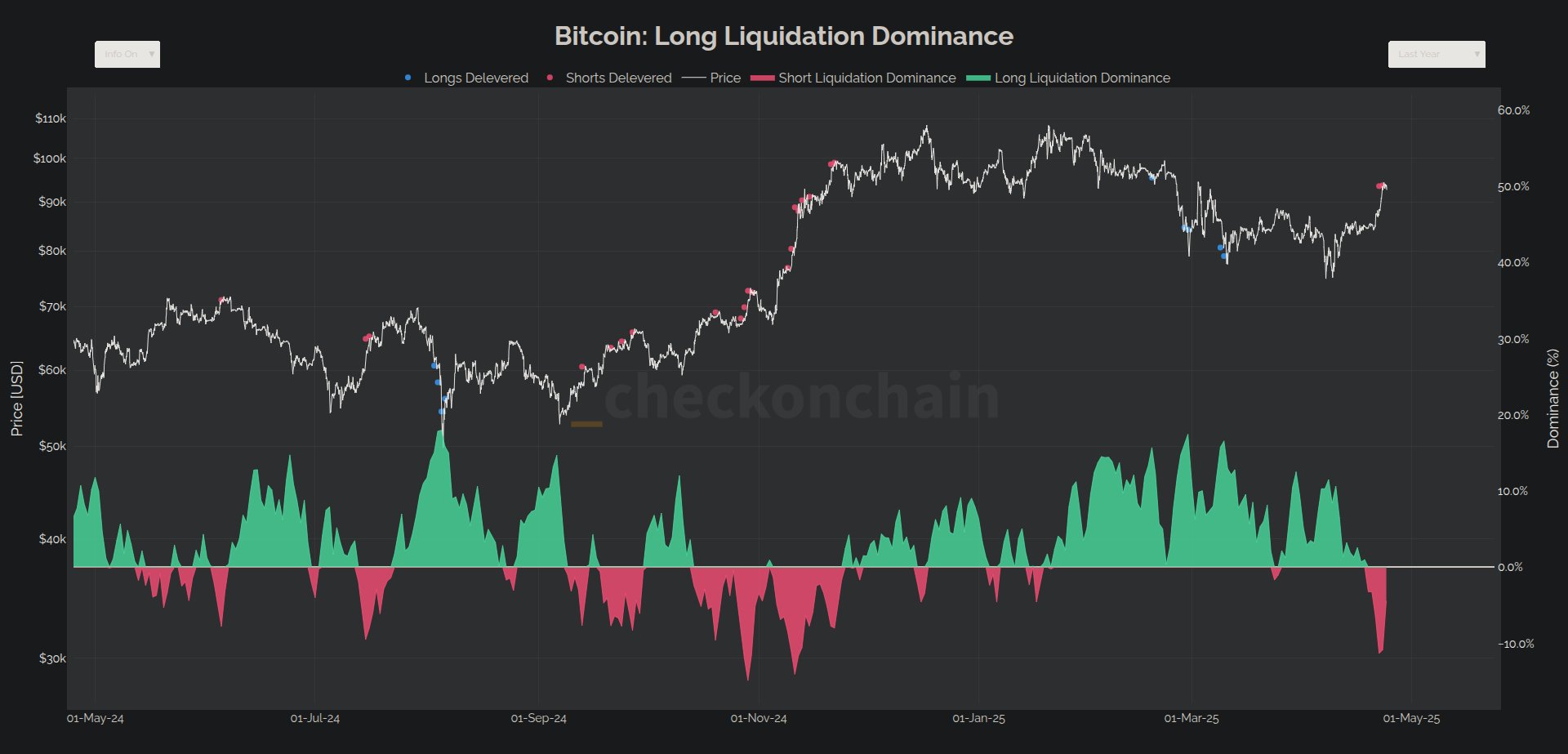

As Checkmate has famous in a reply publish, the market has already seen important quick liquidations just lately.

The development within the lengthy vs quick liquidation dominance over the previous yr | Supply: @_checkonchain on X

It now stays to be seen whether or not this development of a brief squeeze would proceed within the coming days, doubtlessly permitting the Bitcoin value restoration rally to maintain up.

Whereas futures market customers could also be getting bearish bets up, the general sentiment within the cryptocurrency sector has turned bullish following the worth surge, because the Concern & Greed Index suggests.

How the Concern & Greed Index has modified over the last twelve months | Supply: Different

The Concern & Greed Index is an indicator created by Different that makes use of varied market components to find out the sentiment current among the many traders of Bitcoin and different digital property. The metric is presently sitting at a price of 63, which means a grasping mentality is dominant among the many merchants.

BTC Value

On the time of writing, Bitcoin is buying and selling round $93,200, up greater than 9% within the final seven days.

The development within the BTC value over the last 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Different.me, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.