The worldwide tariff warfare sparked by US President Donald Trump’s blanket 10% tariff on all international locations – efficient April 5 – continues to escalate, sending shockwaves by means of international markets. In a pointy retaliation, China has introduced an 84% tariff on US imports, following Washington’s transfer to extend tariffs on Chinese language items to 104%.

Bitcoin Reveals Weak point Amid Rising International Tariffs

This rising financial rigidity has injected vital volatility into conventional and digital asset markets, with Bitcoin (BTC) displaying indicators of weak point amid rising uncertainty.

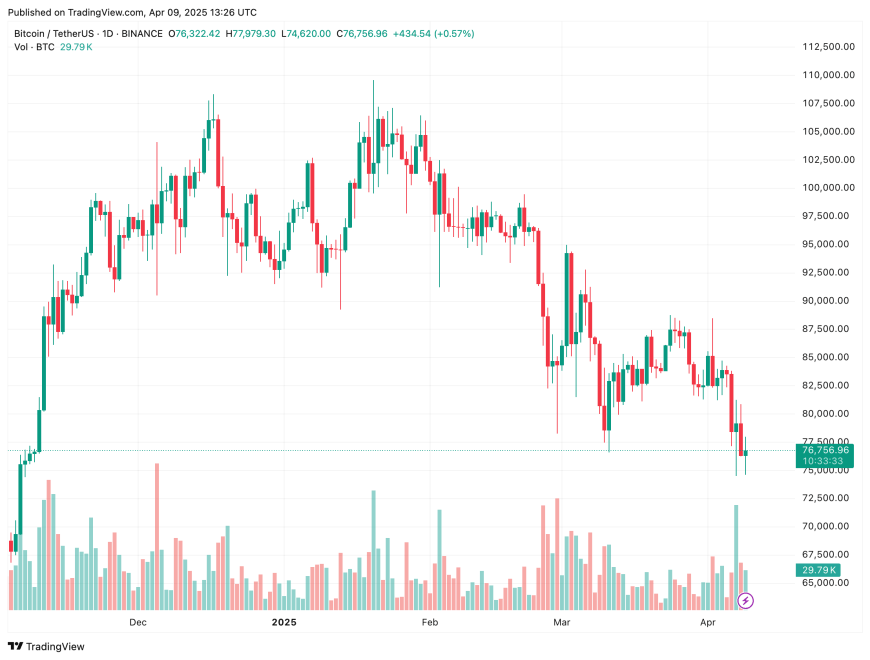

Over the previous seven days, Bitcoin has dropped by 9.1%, falling from roughly $87,100 on April 2 to round $76,000 on the time of writing. The weak point isn’t remoted, as altcoins like Ethereum (ETH), Solana (SOL), and XRP have posted double-digit losses, underperforming even the flagship cryptocurrency.

In the meantime, the likelihood of a worldwide recession has spiked to 68%, its highest degree because the top of the COVID-19 pandemic. Main fairness markets are additionally below stress, with the Dow Jones Industrial Common plunging 9.8% over the previous 5 days – considered one of its sharpest short-term declines in current reminiscence.

Regardless of the grim macroeconomic backdrop, outstanding crypto analyst CryptoGoos believes there’s no want for panic but. Sharing a historic BTC value chart, the analyst famous that “each bull market sees main corrections,” and that the present dip shouldn’t be uncommon.

In a separate publish on X, CryptoGoos additionally highlighted that crypto whales – wallets with substantial BTC holdings – are accumulating at an unprecedented fee. Whereas this might sign confidence from institutional gamers, it might additionally recommend potential volatility forward, as massive buyers can manipulate costs and set off “bull traps” to shake out retail merchants.

However, analyst Grasp of Crypto introduced a extra optimistic outlook. Pointing to a bullish divergence forming on the day by day BTC chart, the analyst instructed that Bitcoin may goal $83,500 within the brief time period if present assist ranges maintain.

Is BTC Heading To $65,000?

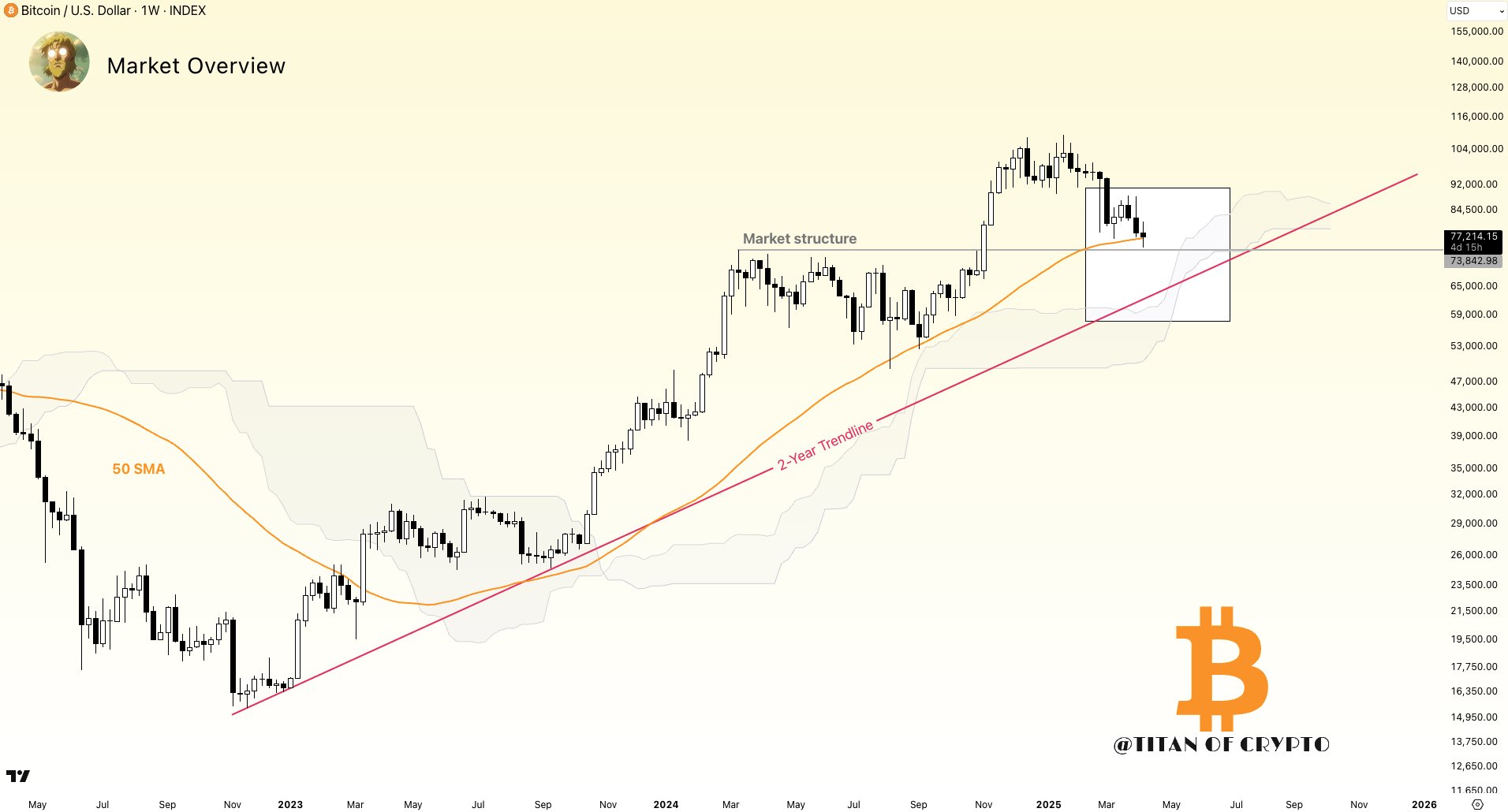

Nevertheless, not all specialists share this enthusiasm. Commentator Titan of Crypto warned that BTC is approaching a essential inflection level. He shared the next weekly chart displaying Bitcoin testing two traditionally robust assist ranges – the 50-week easy shifting common (SMA) close to $73,000, and a 2-year rising trendline round $65,000.

Regardless of conflicting short-term views, a current Binance Analysis report emphasised Bitcoin’s underlying power. The report famous that, regardless of mounting tariff pressures, BTC’s March 2025 month-to-month shut maintained the asset’s bullish market construction. On the time of writing, BTC is buying and selling at $76,756, down 4.1% over the previous 24 hours.

Featured Picture from Unsplash.com, charts from X and TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.