Key Takeaways

- Arthur Hayes predicts Bitcoin will rise to $110,000 earlier than retracing to $76,500.

- The anticipated value surge is predicated on a shift in Federal Reserve’s financial coverage from QT to QE.

Share this text

The Fed’s money-printing shift could gasoline Bitcoin’s value surge.

BitMEX co-founder Arthur Hayes predicts that Bitcoin will blow previous $110,000 earlier than pulling again to $76,500 because the central financial institution switches from tightening to easing—which may inject liquidity into the market and drive up the digital asset’s value.

“I wager $BTC hits $110k earlier than it retests $76.5k. Y? The Fed goes from QT to QE for treasuries,” Hayes wrote on X on Sunday.

Hayes dismisses the potential detrimental influence of tariffs on Bitcoin’s value. He believes that inflation is ‘transitory’.

Markus Thielen, 10X Analysis founder, additionally initiatives potential Bitcoin rebounds. The analyst wrote in a March 23 report that Bitcoin’s value could have reached its lowest level within the current downturn and is poised for a restoration.

In line with him, the Fed’s dovish stance on inflation and Trump’s flexibility on tariffs are two catalysts that might alleviate market issues and doubtlessly enhance investor confidence.

“The Fed signaled it’d look previous short-term inflationary pressures, laying the groundwork for potential future easing,” he acknowledged.

Thielen reported that the relaxed political local weather and favorable financial forecasts have turned Bitcoin’s indicators bullish.

The analyst additionally famous supporting elements like Bitcoin holders’ habits and ETF efficiency. Thielen believes Bitcoin gained’t enter a deep bear market as a result of massive Bitcoin holders are doubtless long-term traders.

Elsewhere, the return of inflows to US-based spot Bitcoin ETFs is seen as a constructive signal, indicating lowered promoting strain from arbitrage-focused traders.

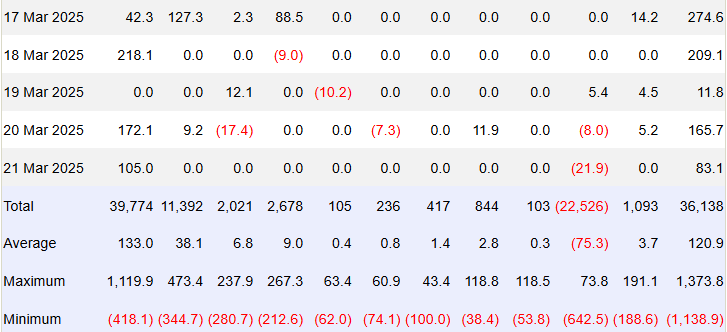

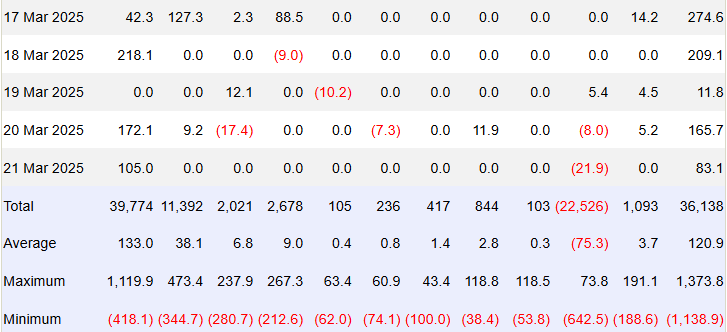

Information from Farside Buyers exhibits that US-listed spot Bitcoin ETFs collectively took in round $744 million in internet inflows final week. BlackRock alone attracted roughly $537 million in new investments.

Whereas bullish, Thielen acknowledges the dearth of a “clear catalyst” for an instantaneous parabolic rally.

Bitcoin was buying and selling at roughly $87,000 at press time, up 3.5% within the final 24 hours, per CoinGecko. The whole crypto market cap surged barely to $2.9 trillion.

Share this text