Bitcoin (BTC), Ethereum (ETH) Worth Evaluation:

Beneficial by Tammy Da Costa

Get Your Free Bitcoin Forecast

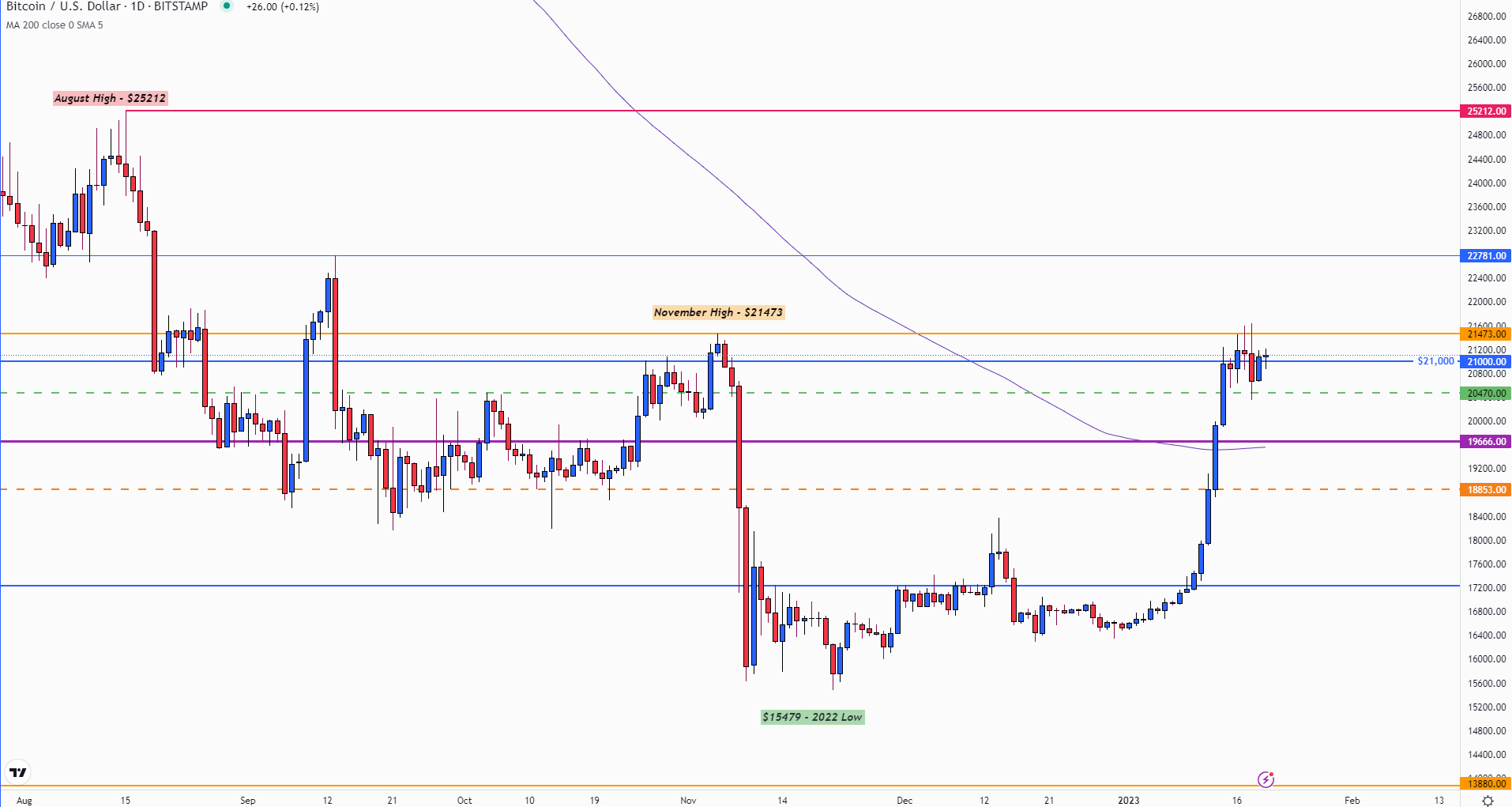

Bitcoin costs have fallen again right into a slim vary of assist and resistance, forming round the important thing psychological degree of $21000. After experiencing a robust begin to 2023, main cryptocurrencies have snapped again from their latest rally that has been driving value motion over the previous two-weeks.

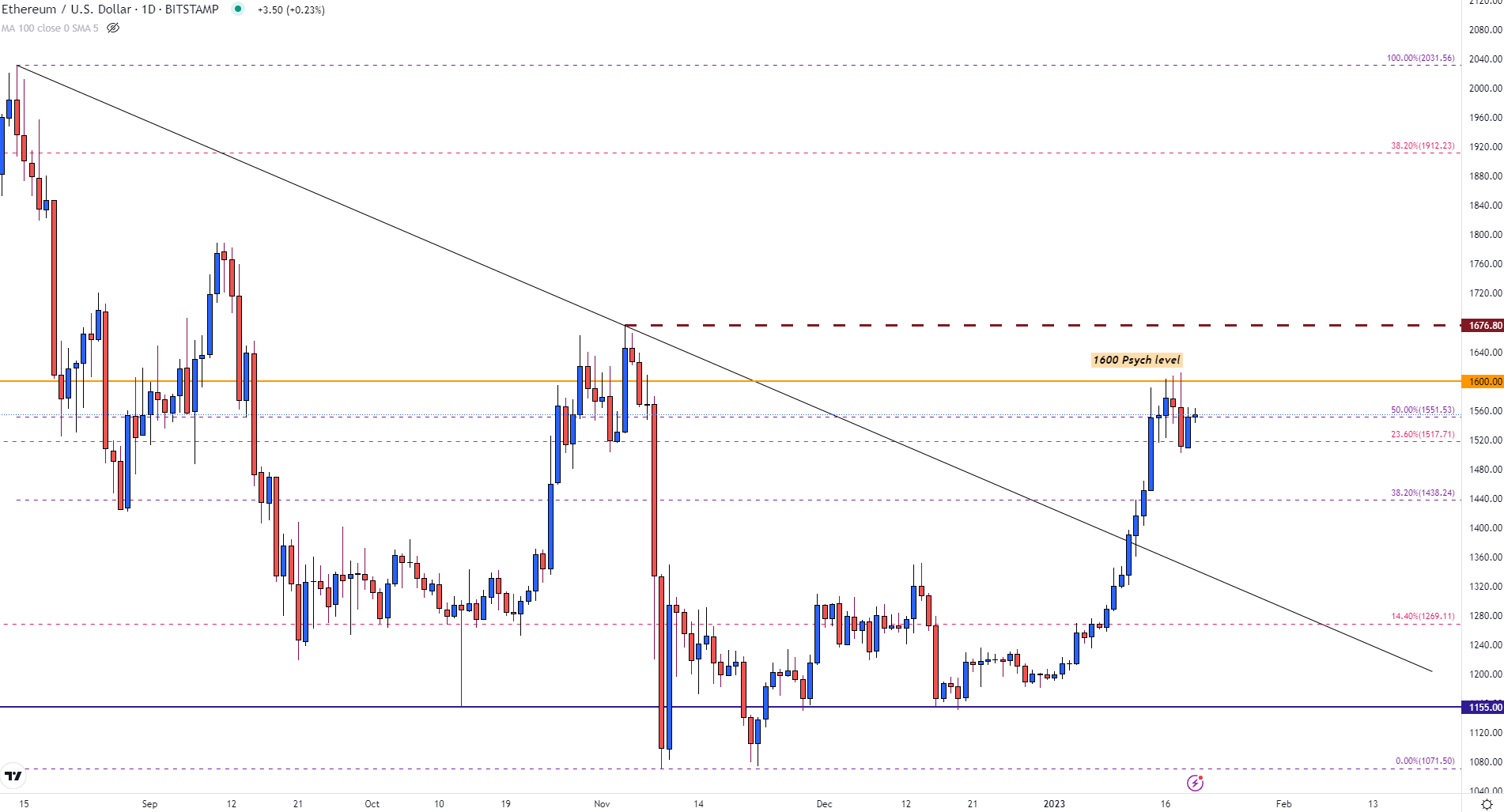

With BTC/USD retreating from a four-month excessive of $21646 earlier this week, Ethereum (ETH) has skilled marginal losses, falling under $1600.

Bitcoin (BTC/USD) Technical Evaluation

After a brief breach of the November 2022 excessive of $21473, Bitcoin costs rose modestly earlier than reaching a recent 4 month excessive of $21646. Though a shift in sentiment and a rise in bullish momentum triggered the restoration, technical ranges have supplied a further catalyst for value motion.

Beneficial by Tammy Da Costa

The Fundamentals of Vary Buying and selling

On the weekly chart under, a transparent break of prior resistance at $17792 facilitated the rally that drove costs 22% increased final week. As final week’s transfer is represented by an extended, full-bodied candle, the formation of a low-bodied candle this week means that bulls could also be dropping steam.

With the tip of the candlestick wick showing barely above the Nov excessive, failure to realize traction above $21600 has positioned further stress on the upside transfer.

Bitcoin (BTC) Weekly Chart

Chart ready by Tammy Da Costa utilizing TradingView

From a short-term standpoint, BTC/USD is buying and selling above psychological assist at the moment holding at $21000. Whereas the present day by day candle struggles to find out a transparent directional bias, upside beneficial properties have gave the impression to be restricted. With the 14.4% Fibonacci retracement of the 2022 transfer offering assist at $20195, a break under might see costs falling again in the direction of the 2017 excessive of $19666.

Bitcoin (BTC/USD) Each day Chart

Chart ready by Tammy Da Costa utilizing TradingView

In the meantime, as Bitcoin costs stay above the 200-day MA (shifting common) at $19557, a retest of $21600 and above $22000 might enable for bullish continuation in the direction of the September 2022 excessive of $22781.

Ethereum (ETH/USD) Technical Evaluation

ETH/USD Each day Chart

Chart ready by Tammy Da Costa utilizing TradingView

After peaking at $1611, the second largest cryptocurrency (Ethereum) fell again under $1600 earlier than stabilizing across the mid-point of the August – November transfer at $1551. With a break of the 23.6% Fibonacci of the 2022 transfer at $1517 drawing consideration to $1500, the draw back might achieve traction if costs retest this zone.

— Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and observe Tammy on Twitter: @Tams707