Bitcoin surged almost 5% in below 24 hours yesterday, pushing decisively above the $110,000 stage and reigniting momentum throughout the crypto market. The transfer indicators rising energy from bulls, who are actually concentrating on a breakout past the all-time excessive at $112,000 to substantiate development continuation and open the door for worth discovery.

Analysts are calling this a pivotal second for Bitcoin. After weeks of consolidation and volatility, BTC has reclaimed key territory — however to maintain the rally, a clear break above the all-time excessive is essential. Till then, the danger of rejection or sharp pullbacks stays on the desk, particularly with rising macroeconomic uncertainty and skinny liquidity in spot markets.

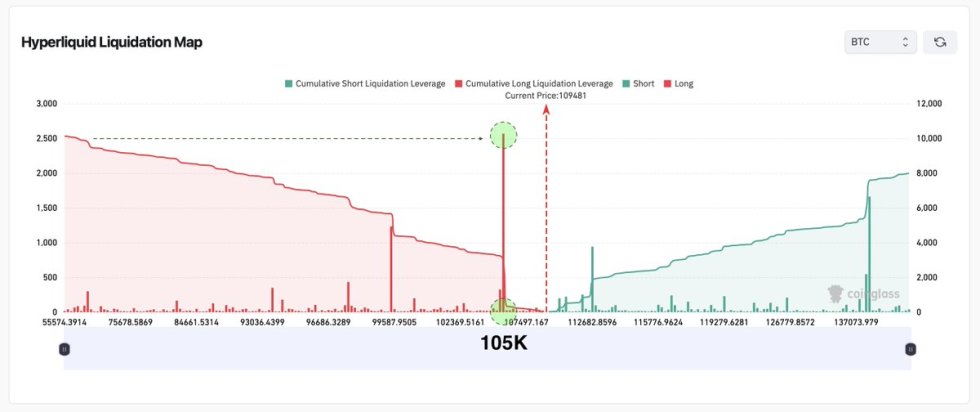

Including to the warning, knowledge from HyperLiquid’s liquidation map reveals a major cluster of lengthy place liquidations concentrated across the $105,000 mark. Bitcoin’s development stays bullish, however the market is approaching a choice level. A breakout above the ATH would verify energy and certain result in aggressive upside. Failure to comply with by means of, nonetheless, may set the stage for heightened volatility within the days forward.

Bitcoin Consolidates As Lengthy Liquidation Dangers Develop

After a powerful 50% rally that introduced Bitcoin to its all-time excessive of $112,000, the market has shifted into consolidation mode. Worth is now hovering just under ATH ranges, with bulls holding management however struggling to push decisively into worth discovery. Momentum has cooled, and BTC seems to be ready for a recent catalyst to renew the uptrend.

The latest volatility started in late Could, when macroeconomic uncertainty and market-wide retracements shook sentiment. Nevertheless, Bitcoin has held up remarkably nicely, sustaining key help ranges and defending the $105,000–$107,000 vary. This energy has helped maintain the broader bullish construction, with increased lows forming on the chart and no main breakdowns regardless of macro headwinds.

Prime analyst Axel Adler lately shared insights from HyperLiquid’s liquidation map that add complexity to the present setup. In accordance with Adler, there’s a vital focus of lengthy place liquidations clustered across the $105,000 stage. This creates a possible “magnet impact” — the place bearish momentum could possibly be drawn towards that zone to set off stop-outs and compelled liquidations, amplifying draw back stress if help breaks.

For now, Bitcoin stays rangebound between $105K and $112K. Merchants are anticipating both a clear breakout into new highs or a sweep of decrease help to check market resilience. Till a decisive transfer happens, endurance is important. With the present construction nonetheless leaning bullish, the following catalyst — whether or not macroeconomic, regulatory, or sentiment-driven — will probably decide whether or not BTC enters full worth discovery or revisits help.

BTC Retests $109K After Breakout As Bulls Defend Positive factors

Bitcoin is presently buying and selling at $109,547 on the 4-hour chart, consolidating simply above the important thing $109,300 resistance stage after a pointy breakout. The transfer above this stage, which had beforehand capped upside since late Could, marked a major shift in momentum as BTC surged almost 6% over the previous two periods. The value is now trying to stabilize after briefly hitting a excessive of $110K.

The breakout was supported by rising quantity and a clear transfer above all main transferring averages — together with the 50 SMA ($105,553), 100 SMA ($106,294), and 200 SMA ($105,615) — which now act as robust dynamic help ranges. The bullish momentum stays intact so long as the worth holds above $109,300. A profitable retest of this stage would verify it as new help and will arrange a push towards all-time highs at $112,000.

Nevertheless, if BTC fails to carry this stage, the worth could revisit the $106,000–$107,000 vary, the place consumers beforehand stepped in. The construction stays bullish general, however with resistance overhead and potential lengthy liquidation clusters beneath, volatility is prone to stay elevated.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.