dem10

Asset costs did not replicate a lot of a change within the crypto market on Monday, however one thing pretty vital did happen. It began with Paxos Belief Firm asserting Monday morning that it’ll now not be minting Binance USD (BUSD-USD) and could be ending its relationship with Binance. In response to the press launch, Paxos is taking this step because of working with the NYDFS:

Efficient February 21, Paxos will stop issuance of latest BUSD tokens as directed by and dealing in shut coordination with the New York Division of Monetary Providers (NYDFS). Paxos Belief, a regulated establishment overseen by the NYDFS and audited by a top-four accounting agency, will proceed to handle BUSD greenback reserves.

Whereas minting is finished, Paxos will proceed redemption of BUSD and maintains that the token remains to be totally backed 1:1 and in segregated accounts. Paxos mints BUSD when a depositor sends {dollars} to Paxos. Paxos then custodies these {dollars} and creates the stablecoin greenback spinoff BUSD for dollar-denominated exercise on crypto rails.

No Peg Points But

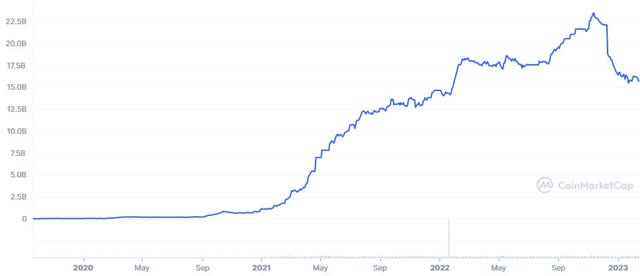

As of writing, BUSD is the seventh largest crypto coin in the whole market with a $15.6 billion market cap – although that market cap is effectively off the excessive of $23.5 billion in November of final yr:

BUSD Market Cap (CoinMarketCap)

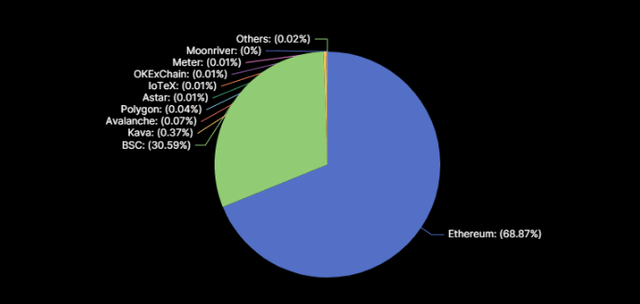

Regardless of that giant stage of redemption in a really brief period of time, BUSD’s peg has by no means gone under a $0.9996 stage at any level within the final 3 months. This could possibly be seen as a sign that there was almost no concern about Paxos’ skill to offer redemptions. Within the occasion of BUSD, the first rails the place the token exists are Ethereum (ETH-USD) and to a lesser extent Binance Good Chain (BNB-USD), however there are quite a few smaller chains with BUSD help as effectively.

BUSD Chain Breakout (Defi Llama)

Earlier than Paxos’ BUSD minting announcement may even actually be digested by the market, the corporate shared one other press launch late Monday.

The SEC Wells Discover

In a reasonably beautiful announcement late Monday afternoon, Paxos disclosed that the Securities and Alternate Fee despatched the corporate a Wells Discover earlier this month and made the declare that BUSD is an unregistered safety. This Wells Discover is critical as a result of it means the SEC is investigating or has completed an investigation into BUSD and enforcement motion is a extremely doubtless subsequent step. Paxos disagrees with the SEC’s place:

Paxos categorically disagrees with the SEC employees as a result of BUSD is just not a safety below the federal securities legal guidelines. This SEC Wells Discover pertains solely to BUSD. To be clear, there are unequivocally no different allegations towards Paxos.

The vital factor to notice from Paxos’ assertion is the Wells discover doesn’t affect Pax Greenback (USDP-USD). That is very fascinating as a result of USDP and BUSD are functionally the identical; they’re each dollar-collateralized stablecoins which are minted and managed by Paxos. The most important distinction that I can discover between the 2 cash is that one is a Binance-branded product that depends on the Binance Good Chain for many of its utility, and the opposite is just not.

Is This Extra About Binance?

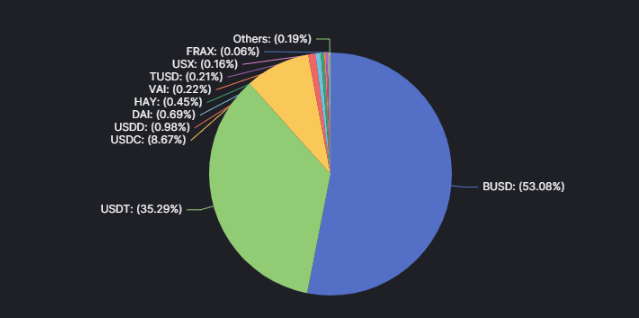

From the place I sit, there are a couple of viable prospects at play; both there are lots of extra Wells Notices coming, there’s something unsuitable with Binance particularly within the eyes of the SEC, or the SEC is being arbitrary and capricious. The latter of which is one thing that Grayscale has already accused the SEC of being. However it could realistically be one thing about Binance particularly that the SEC does not like. BUSD is used on Binance Good Chain to a big diploma. Though Binance solely accounts for 30% of the BUSD in circulation, it’s by far the most important greenback stablecoin on the community:

BSC Stablecoin Share (DeFi Llama)

Accounting for over 53% of the $9 billion in US greenback stablecoins on Binance Good Chain, BSC is reliant on BUSD to a big diploma for DeFi exercise:

| Community | Stables Mcap | Dominant Stablecoin | Dominance |

|---|---|---|---|

| Ethereum | $80.0b | USDC | 42.5% |

| Tron (TRON-USD) | $37.9b | USDT | 94.5% |

| Binance | $9.0b | BUSD | 53.1% |

| Solana (SOL-USD) | $1.8b | USDC | 53.1% |

| Polygon (MATIC-USD) | $1.7b | USDC | 47.8% |

Supply: DeFi Llama

In truth, no different blockchain with a high 10 stablecoin market cap depends on BUSD as its dominant stablecoin. Most of them are utilizing USDC. This does recommend that the SEC might even see some type of drawback with Binance particularly. In any other case, there could possibly be extra wrath coming to the broader stablecoin market.

Whether it is About Stablecoins, We Have Issues

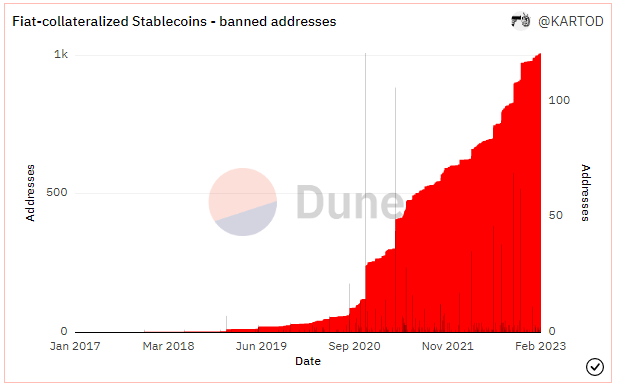

In some ways, stablecoins are the “killer app” in crypto. The primary goal of stablecoins is for dollar-denominated exercise on crypto rails. These actions may be for something from DeFi lending, taking revenue in crypto native belongings trades, service provider companies, or sure, even probably illicit exercise. The latter of which is much less doubtless over time for the reason that blockchains are clear and good contract deployments can bake-in the flexibility to freeze belongings. This is the reason we have seen a surge in banned addresses during the last couple of years:

Banned addresses (Dune Analytics/KARTOD)

The foremost issuers of those fiat-backed stablecoins like Circle or Paxos typically observe KYC/AML compliance. These monetary devices can serve completely professional functions, and stablecoins are one thing that I explored with BlockChain Response subscribers simply final week. They permit extremely low-cost, quick funds on the community layer whatever the software program interface the person chooses. If their utility in the USA is regulated away, I’d argue the largest winners could be the centralized peer-to-peer fee apps owned by corporations like PayPal (PYPL) and Block, Inc. (SQ).

Abstract

We do not but know for sure if this Wells Discover Paxos obtained is about stablecoins broadly talking or about Binance particularly. No less than for now, it seems to be prefer it could possibly be extra about Binance. If that is the case, I might be very cautious about publicity to BNB or any extremely Binance-exposed functions. I’d additionally warning any crypto advocate who might not suppose this can be a huge deal to significantly ponder the implications of what’s occurring proper now. Many have argued the federal authorities is orchestrating a coordinated crackdown on the whole crypto trade that intensified in December a couple of weeks after FTX (FTT-USD) collapsed.

Whether it is certainly discovered that BUSD is an unregistered safety, it stands to purpose that each fiat-collateralized stablecoin can also be an unregistered safety since their minting mechanisms are all very related. This would come with USDP, Circle’s USD Coin (USDC-USD), and Tether (USDT-USD). If all of these stablecoins are discovered to even be unregistered securities, we’d doubtless see an unlimited outflow from fiat-backed stables and some issues will most likely occur:

- weaker stablecoins may lose greenback pegs

- decentralized stables may see inflows

- native belongings may see inflows

- non-USD fiat-collateralized stables may see inflows

- Crypto worth may depart the ecosystem completely

On level quantity 4, there are different jurisdictions which are way more pleasant to crypto and the improvements that might finally occur on this trade might go offshore. However the bigger level is there may be effectively over $100 billion within the USD fiat-collateralized stablecoin market. If the minting of extra USD fiat-backed stables is stopped by the SEC, the redemptions will start and that worth will stream some other place.

I believe native belongings would catch a bid. Bitcoin (BTC-USD) would doubtless catch a bid as effectively. However even decentralized stablecoins or stablecoins of different fiat currencies may see exercise. The cash which are actually backed 1:1 should not see huge peg fluctuations. However the stables that are not totally backed might have peg issues. Proper or unsuitable from a legality standpoint, I personally suppose Paxos’ BUSD Wells Discover is just the start.

Editor’s Observe: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.