- Invoice Gross, a.okay.a the “bond king,” says the Fed “is aware of nothing” in an unique interview with Investing.com

- The central financial institution’s inflated steadiness sheet means a Volcker second received’t work

- As we enter a brand new period for the worldwide financial system, money appears extra enticing

Legendary investor Invoice Gross isn’t pulling any punches. In his newest letter to the general public, the celebrity fund supervisor and co-founder of Pacific Funding Administration Firm (PIMCO) painted a slightly difficult image of the U.S. (and international) financial system going ahead.

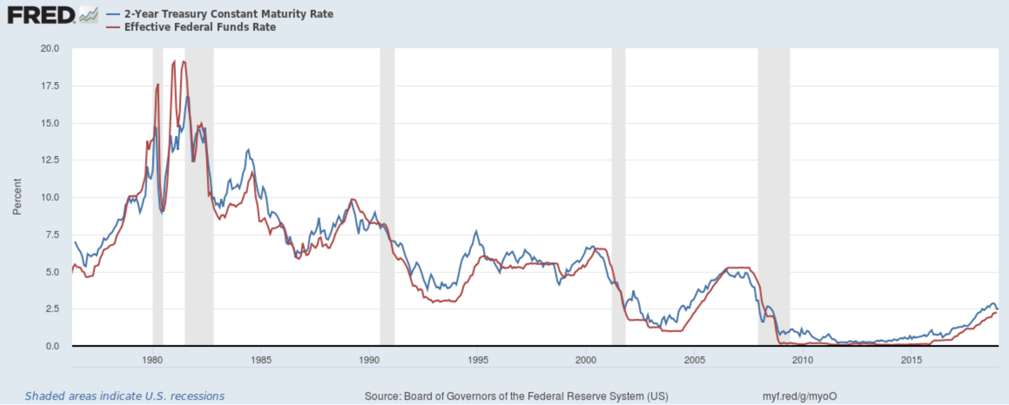

Based on Mr. Gross, Jerome Powell has been deploying the identical ways as Paul Volcker within the late Seventies and early Nineteen Eighties, however with out bearing in mind the very fact the financial system is way more leveraged now. As he explains, if the Fed’s cease at 4.5%, we will nonetheless see solely a ‘delicate recession’; nonetheless, something above 5% would result in a extreme international recession.

“Latest occasions within the U.Ok., cracks within the Chinese language property-based financial system, struggle and a freeze in Europe, and an excellent robust accelerating inflation in rising market economies, level to the conclusion that as we speak’s 2022 international financial system by no means resembles Volcker’s in 1979.”

Supply: Yardeni Analysis

Invoice Gross revolutionized the funding world by creating the primary investable marketplace for fixed-income securities and made a fortune by beating the marketplace for many years in a row by buying and selling bonds. Nevertheless, late final 12 months, he turned on the very asset that made him “bond king,” calling U.S. Treasuries “rubbish.” For sure, he was proper, as bonds went on to one in every of their worst selloffs in historical past.

In an unique interview for Investing.com early this week, the legendary investor was blunt to say money is the perfect funding in the mean time, because the Fed has “already gone too far.” In his direct fashion, Mr. Gross additionally famous that traders should acknowledge the brand new period for the worldwide financial system could also be brewing and make investments accordingly.

Investing.com: You latterly said that the U.S. financial system may face up to a 4.5% rate of interest with solely a ‘delicate recession’; nonetheless, 5% can be the breaking level. Why do you draw the road at that individual level?

Invoice Gross: Actual federal funds markets are at an approximate 2% price, a stage that, in prior financial cycles, has induced future recessions. On this cycle, monetary and financial leverage is far larger than witnessed previous to the Nice Recession, which argues for a good decrease yield, implying the Fed has already gone too far.

IC: We’re already very close to your cited breaking level—particularly if the Fed raises charges by the anticipated 50bps at its December assembly. Do you suppose Powell doesn’t share the identical ideas as you do?

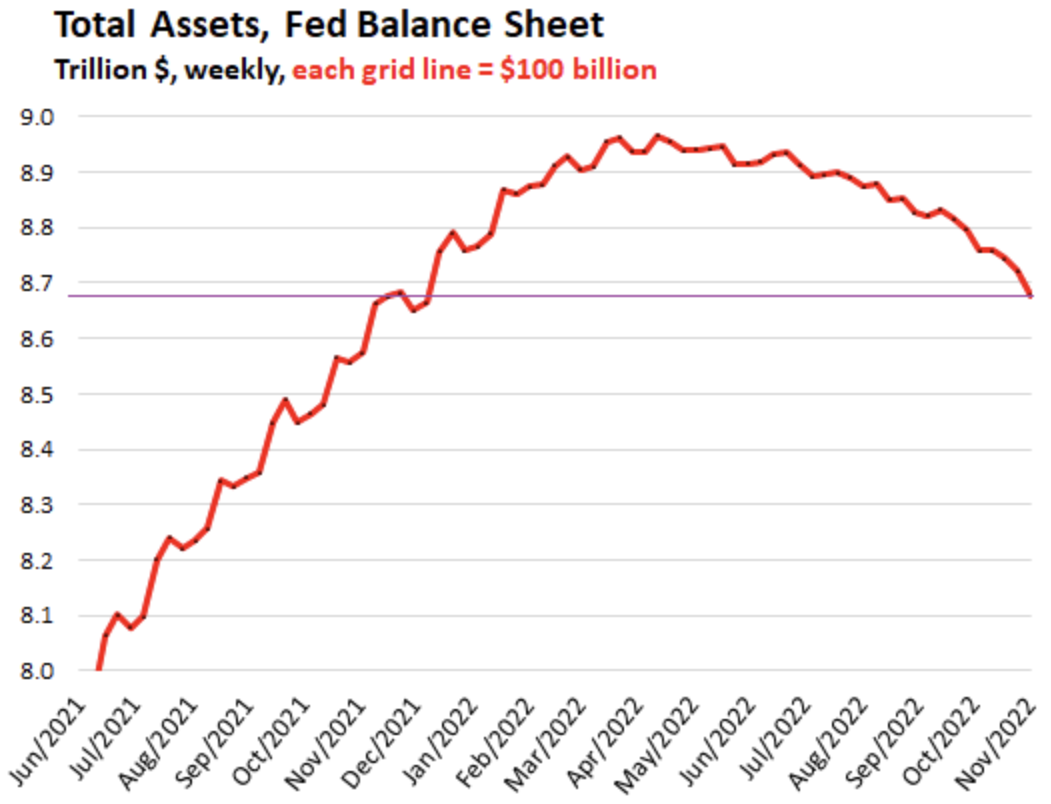

BG: The Fed, as Jim Cramer as soon as mentioned, “is aware of nothing.” Can anybody doubt that primarily based upon the previous few years’ expertise of 0% yields, incessant quantitate easing (QE), and the growth of its steadiness sheet from $1 trillion to $8.7 trillion?

Supply: Wolf Road

IC: Does the Fed suppose the U.S. financial system truly wants a ‘delicate recession’ to be extra economically environment friendly in the long term?

BG: Sure – it wants a recession to extend unemployment and decrease wage positive aspects.

IC: Do you suppose U.S. bonds are oversold?

BG: Arduous to say an “oversold” bond market. A disaster equivalent to witnessed with crypto or probably with the devaluing would flip issues shortly.

Supply: Fed

IC: Is that this a greater time to purchase shares or bonds? Or neither?

BG: Money!

IC: Are we getting into a brand new period for the worldwide financial system? Or are we dealing with only a short-term headwind?

BG: A brand new period. We’re deglobalizing, and fairness traders acknowledge future headwinds related to international warming, geopolitical conflicts, and growing old demographics.

Disclosure: Thomas Monteiro doesn’t personal U.S. authorities bonds.