by Jim Quinn

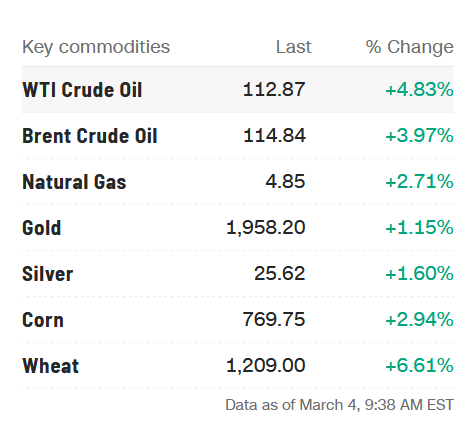

All the charts beneath are from this morning. These share modifications are for immediately versus yesterday. I do know the MSM and Biden need you centered on Putin, however you’re about to be kicked within the balls when going to the grocery retailer, filling your tank, and heating your house. What has occurred for the reason that US/NATO provoked battle within the Ukraine, is on high of the already 7.5% inflation (actually 15%) we had been combating.

By we, I imply the decrease and center class. The oligarchs and uber-rich don’t give a flying fuck about inflation. They even have their puppet Powell proceed to maintain rates of interest at zero and printing billions per day to maintain their financial institution accounts rising. The final time inflation was this excessive, Volcker raised charges to twenty%.

these charts, understanding the Fed is doing nothing, ought to persuade you we’re approaching the end-game. When oil costs skyrocketed in 2008 and meals costs rose, the worldwide economic system seized up, revolutions broke out within the Center East (hunger makes folks ornery), and international inventory markets crashed. We’re quickly approaching the purpose of no return. Are you prepared?

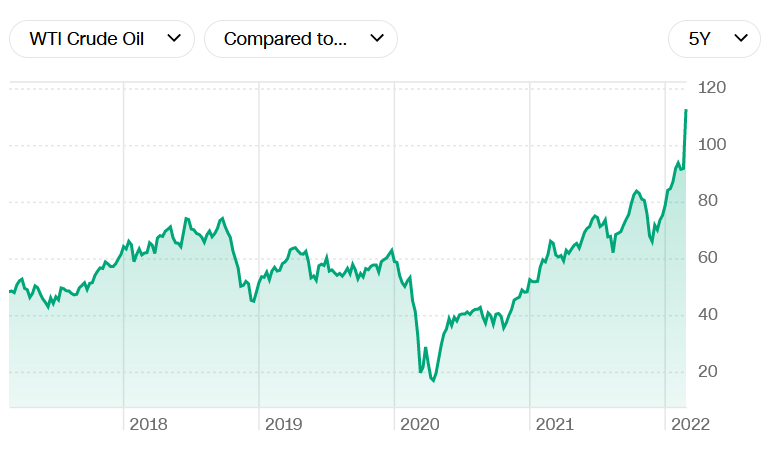

Oil hasn’t been this excessive since 2014 and is up 350% from the 2020 low and 100% from pre-Covid ranges. Take into consideration Joe the following time you fill-up.

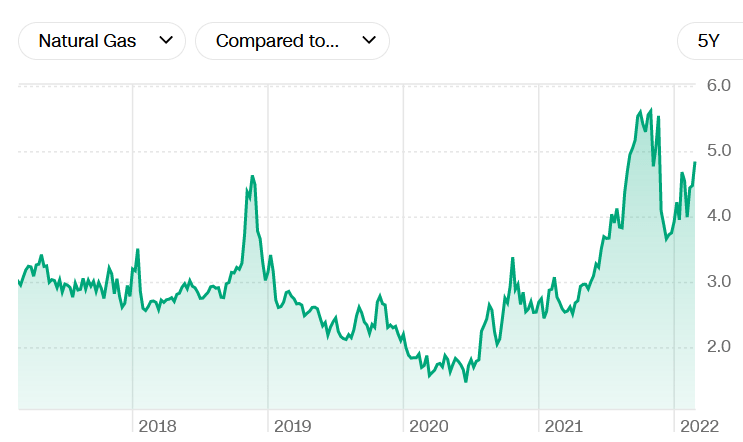

Pure fuel is up 200% from the 2020 lows and 100% from pre-Covid ranges. Time to show that thermostat down.

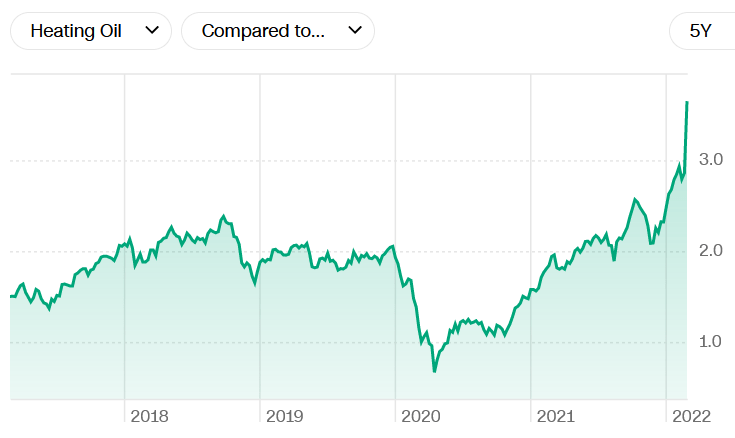

Heating oil is up 350% from the 2020 lows and 90% from pre-Covid ranges. I’m positive all the agricultural of us within the nation are appreciating that now.

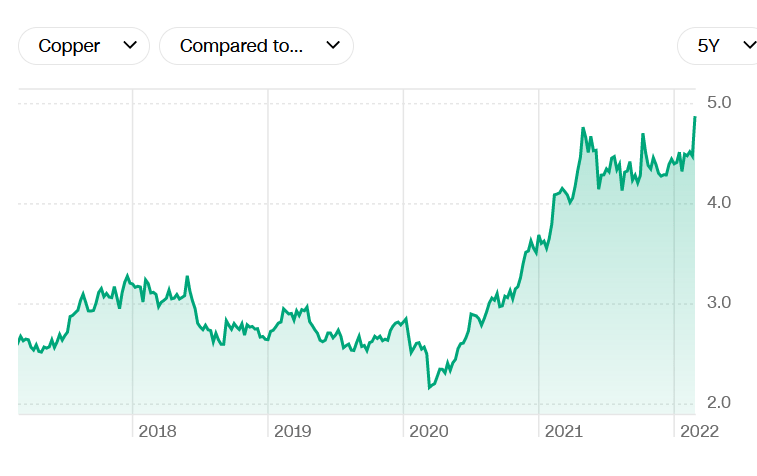

Copper costs are up 100% from the 2020 lows and 65% from pre-Covid ranges. Fortunate for the federal government they not put copper of their pennies. I ponder if all these new houses use copper pipes.

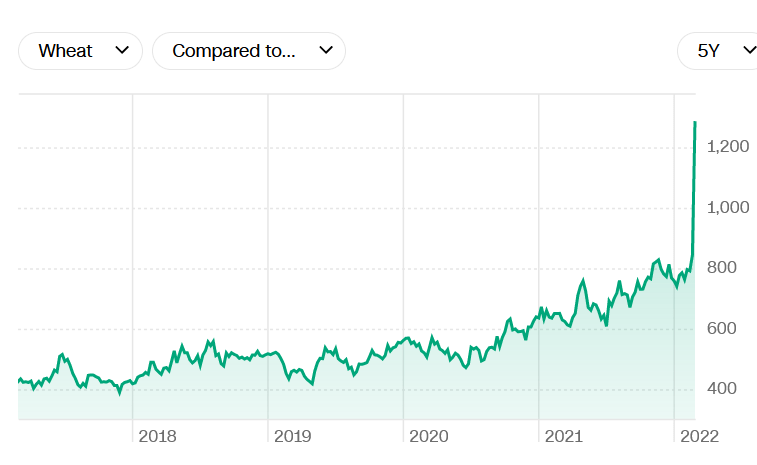

Wheat costs are actually up 150% from the 2020 lows and 170% from pre-Covid ranges. It positive is fortunate the meals in our grocery shops doesn’t use a lot wheat. You could want a credit score line improve to your subsequent journey to Piggly Wiggly.

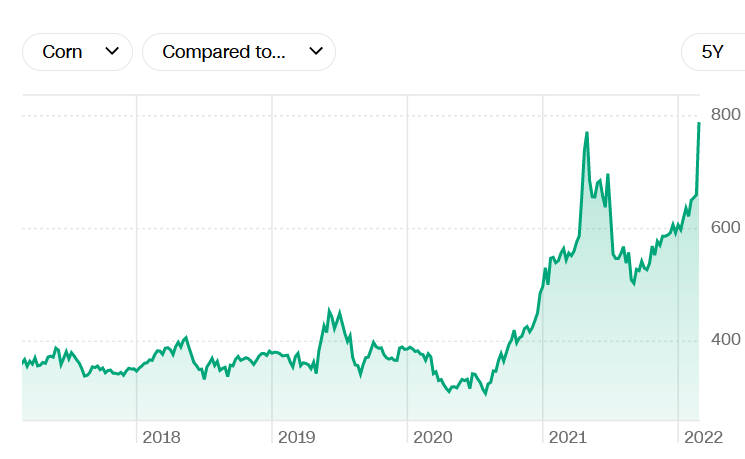

Corn costs are up 170% from the 2020 lows and 100% from pre-Covid ranges. Refill on corn-pops and popcorn quick. Doesn’t our ethanol gas use some corn?

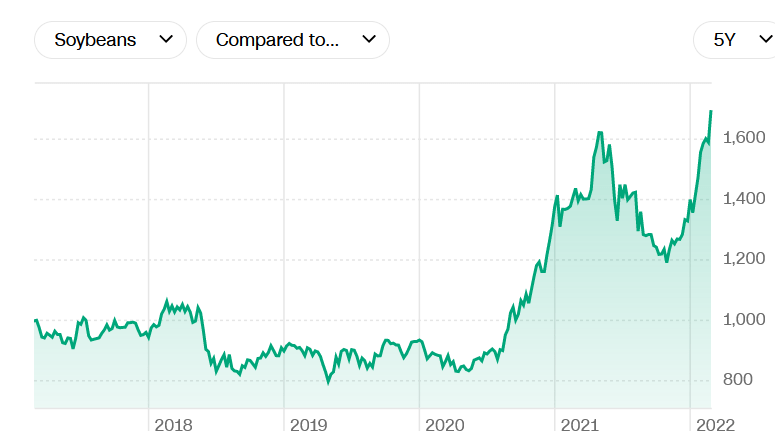

Soybean prices are up 100% from the 2020 lows and the pre-Covid ranges. You won’t notice what number of merchandise embody soybeans, however you’ll quickly.

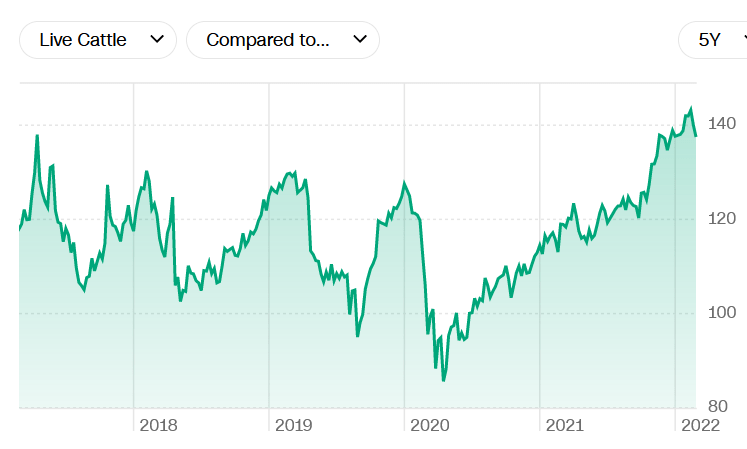

Reside cattle costs are up 65% from the 2020 lows and 20% from pre-Covid ranges. Purchase these steaks now, as a result of cattle feed may be going barely larger.

That is the man to thank, with an honorable point out to Powell and the Congress parasites who handed the trillions in spending payments. This cannot be sustained, so it won’t. The one query is whether or not it ends in a hyper-inflationary melancholy or a deflationary melancholy when all the pieces implodes as international struggle breaks out. Having fun with this Fourth Turning but?