kertlis/E+ by way of Getty Photos

Thesis

BlackRock Floating Price Revenue Belief (NYSE:BGT) is a closed finish fund. The automobile focuses on leveraged loans and has present revenue as its major purpose. The CEF comes from the BlackRock household of funds, and presently sports activities a 5 star Morningstar score. One of many defining traits of this asset class is the quick length profile, and the CEF doesn’t disappoint from this standpoint, with an general length of solely 0.27 years.

We have now been bullish this asset class for some time now, with Purchase rankings assigned to BGT’s rivals:

- VVR: A ten% Yielding CEF That Is Truly Growing Its Distribution rated a Purchase late final 12 months and up 19% since

- FTSL: Unleveraged Floating Price Loans, 8.4% Yield rated a Purchase mid 2023 and up since

When a leveraged mortgage CEF it is very important get a way of the analysis capabilities of the asset administration platform, the fund’s leverage ratio, credit score danger profile and historic track-record. BGT comes from a premier international asset supervisor, has a small ‘CCC’ bucket and a conservative leverage ratio of 25% (there are leveraged mortgage CEFs with 35%+ leverage ratios for example). The fund has a really sturdy historic efficiency and benchmarks favorably with the golden requirements within the leveraged mortgage CEF house.

Whereas the Fed is signaling it’s performed elevating charges for now, however knowledge dependent, the markets are pricing a excessive price setting for longer:

Price Minimize Possibilities (CME)

If we have a look at the ahead Fed Funds curve and the implied price possibilities, we are going to discover that market members usually are not pricing in a Fed reduce (above 50% chance) till mid 2024. A excessive price setting for longer interprets into floating price belongings with the ability to go a excessive price of curiosity to holders till the Fed begins slicing. Moreover, the great thing about the asset class resides in its quick length, therefore even when now we have an surprising spike in inflation and the Fed is compelled to lift charges once more, floating price loans is not going to have a destructive value affect.

At this juncture, with some deteriorating fundamentals however yields greater for longer, leveraged mortgage funds simply make sense as a excessive dividend supplier. Mounted price funds run the chance of upper charges, whereas equities are held in place by the ‘Magnificent 7’ solely. As a retail investor, if you do not need to attend it out in money, then floating price loans is the place to allocate capital in immediately’s setting.

There’s a lot to love about BGT – beginning with the asset supervisor and the profile of the collateral pool, and ending with the floating price nature of the underlying loans and the sturdy historic efficiency. The primary danger issue to concentrate on and contemplate is a credit score unfold shock, the place the market sells off and credit score spreads bounce a lot greater, thus affecting the pricing. The identical danger is borne by the fastened price excessive yield market, so all else equal in under funding grade credit, a retail investor ought to select floating price loans given their length hedge on this rate of interest setting.

Analytics

AUM: $0.26 billion.

Sharpe Ratio: 0.83 (3Y).

Std. Deviation: 5.7 (3Y).

Yield: 11.7%.

Premium/Low cost to NAV: -8%.

Z-Stat: 0.47.

Leverage Ratio: 25%

Period: 0.27 years

Composition: Leveraged Loans

Efficiency

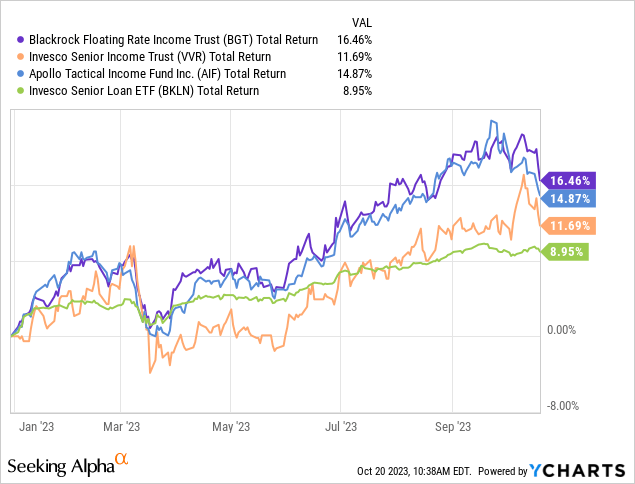

The CEF has outperformed this 12 months when in comparison with its peer-group:

We’re benchmarking the CEF in opposition to a number of the ‘golden requirements’ within the house, specifically the Invesco Senior Revenue Belief (VVR) and the Apollo Tactical Revenue Fund (AIF), in addition to the unleveraged ETF Invesco Senior Mortgage ETF (BKLN). BGT outperforms all its CEF friends, whereas BKLN lags as a result of its lack of leverage.

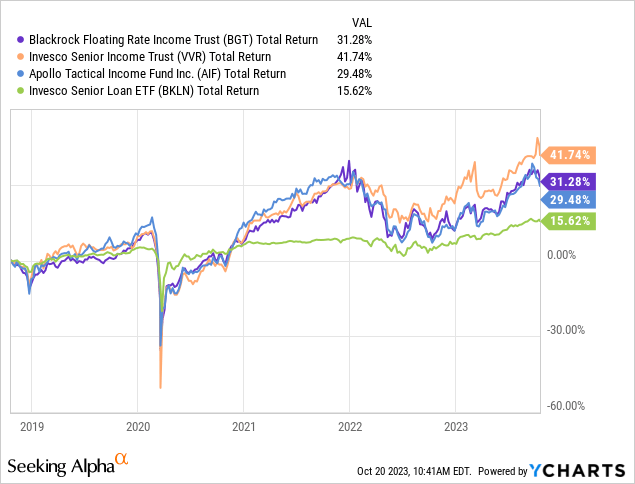

Long term the story is comparable, with BGT managing to put up extraordinarily sturdy complete returns:

On a 5-year lookback VVR is the winner, nonetheless BGT and AIF have comparable complete return profiles.

Premium/Low cost to NAV

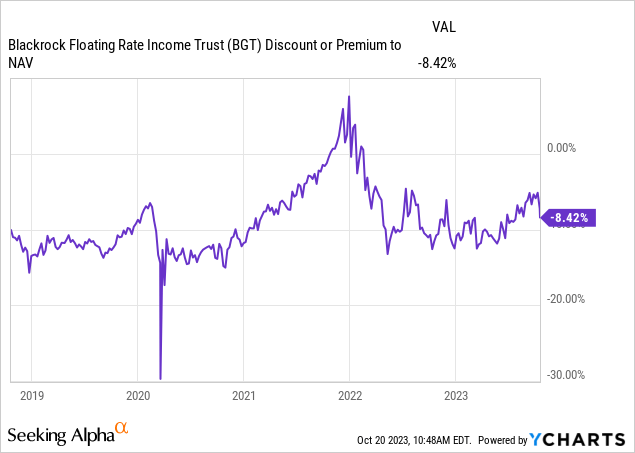

The fund’s low cost to NAV has an in depth correlation to rates of interest:

Throughout normalized rate of interest environments the CEF has a really secure low cost to NAV that fluctuates round -10%. Through the important financial easing skilled in 2020/2021, the CEF narrowed to flat to NAV as a result of its excessive yield.

We don’t count on a lot of a windfall from low cost narrowing within the subsequent 12 months, and wouldn’t have a look at this issue as additive to the CEF’s returns for now.

Distributions

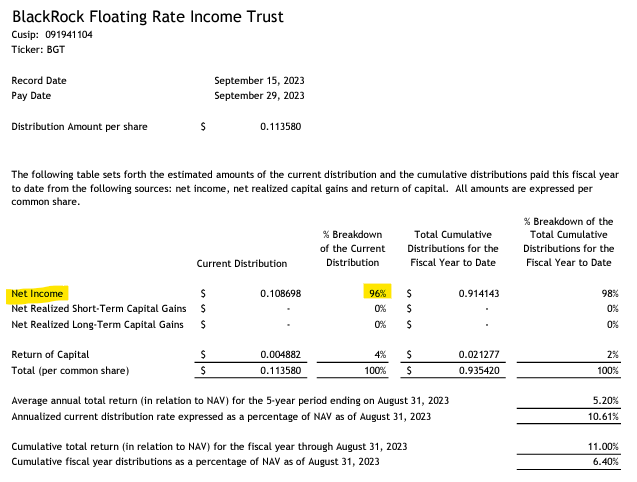

The fund does a very good job of overlaying its distribution yield:

Part 19a Discover (Part 19 Discover)

As of the September cost date, 96% of the distribution got here from the revenue acquired from the underlying loans, with solely a 4% ROC utilization.

The mathematics is smart, with SOFR at 5.3% and spreads on leveraged loans at roughly 5%. While you add leverage on prime you’ll be able to see how the fund obtains its 11.7% distribution yield. As charges keep excessive for longer, count on an excellent protection for this distribution yield.

Collateral

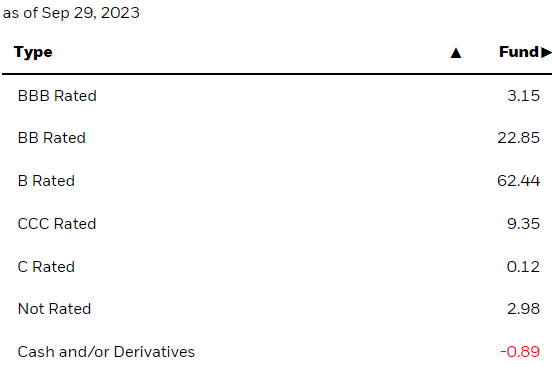

The fund is a middle-of the street one, with no extreme credit score danger:

Rankings (Fund Web site)

The title is obese ‘B’ names which make up 62% of the portfolio, whereas the riskiest collateral, specifically ‘CCC’ loans, symbolize simply 9.35% of the fund.

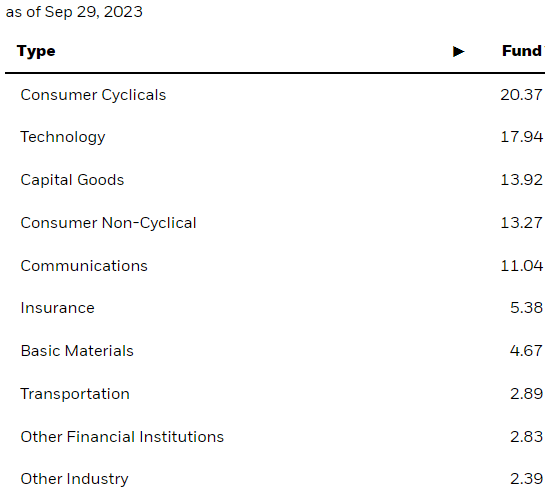

The identical composition function might be discovered within the sectoral distribution, the place the trade focus is balanced out:

Sectors (Fund Truth Sheet)

As an investor you do not need to see any sector above 25% of a fund, as a result of it could symbolize an obese positioning in a sure sector. Whereas there are various funds which specialize on sure corners of the market, they’re very forthcoming about their slim focus and danger components. In a middle-of-the-road leveraged mortgage CEF you need to see diversification.

Conclusion

BGT is a hard and fast revenue closed finish fund. The CEF focuses on leveraged loans and comes from a premier asset supervisor. The fund has very sturdy historic returns, matching and even beating different ‘golden requirements’ within the house, specifically VVR and AIF.

The CEF has a conservative composition, with a low 25% leverage ratio and a collateral pool that doesn’t take extreme dangers by way of ‘CCC’ credit. The fund nearly absolutely covers its distribution, and we count on it to proceed to take action till the Fed begins slicing charges. Though the CEF trades at a -8% low cost to NAV, we don’t count on important fluctuations there, and no actual windfall from buying and selling this danger issue right here.

We like BGT for what it’s, specifically a automobile that extracts a excessive yield from a floating price under funding grade asset class. Each loans and BGT have low normal deviations, and have confirmed to be a really worthwhile device because the Fed began elevating charges in 2022. We’re nonetheless bullish on this asset class and like this 5 star mortgage CEF right here.