We’re diving headfirst into the greatest finance video games for college kids – the final word technique to rework cash administration from a chore into an attractive problem. This put up is your all-access cross to the highest video games that educate monetary literacy for each age degree. Prepare to find how levelling up your monetary smarts might be severely enjoyable and extremely rewarding.

Key Takeaways

- Gamifying monetary literacy isn’t only a gimmick. Ranges, rewards, and immediate suggestions rework dry ideas into partaking challenges, motivating college students to overcome important cash administration abilities.

- One measurement doesn’t match all. Age-appropriate finance video games arm youthful college students with fundamental cash smarts, whereas devoted platforms like PersonalFinanceLab for Ok-12 and StockTrak for larger schooling supply subtle simulations to deal with real-world monetary hurdles head-on.

- Heavy hitters like Visa’s Sensible Cash Abilities and brainy platforms like Khan Academy supply a one-two punch of stable sources and hands-on gameplay, complementing the deep, curriculum-integrated experiences offered by instructional software program leaders.

Find out how to Gamify Monetary Literacy?

Gamifying monetary literacy is like giving conventional monetary schooling a much-needed adrenaline shot. It transforms studying into an interactive enviornment the place college students really need to take part. Clear objectives and targets aren’t simply targets; they’re quests – like hitting a financial savings milestone or acing a troublesome monetary choice. Wish to crank up the joy? Toss in factors, badges, and leaderboards. Abruptly, studying isn’t nearly data; it’s about bragging rights and outsmarting the competitors (and your self!).

Ranges and development aren’t simply steps; they’re a climb. Every new problem unlocked, every new device mastered, delivers successful of accomplishment that retains college students hungry for extra. Instantaneous suggestions? That’s the sport displaying you the instant ripple impact of your monetary selections – study quick, adapt quicker. And the most effective half? Danger-free experimentation. That is your monetary sandbox. Make errors, study from them, and emerge wiser with none real-world pockets wounds.

Digital currencies and rewards aren’t simply pixels; they’re high-fives for sensible monetary habits, making the artwork of managing cash an attractive quest on the trail to understanding investing.

How do you educate monetary literacy in a enjoyable method?

Let’s be actual: “enjoyable” and “monetary literacy” haven’t at all times been greatest buds. However gamification is altering the sport, making it the cool new methodology to wire monetary abilities and ideas into younger minds. Sprinkling in parts like:

- Ranges that problem and reward

- Rewards that really feel like actual wins

- Tutorials that information, not dictate

…all of the sudden, studying feels much less like a lecture and extra like an journey. Video games create a secure atmosphere the place college students can get their fingers soiled managing funds, making choices, and seeing outcomes with out the sting of real-world penalties.

Completely different ages, totally different arenas. For the youthful crowd, video games are about cracking the code of fundamental cash ideas – recognizing cash, understanding their value. For teenagers, it’s about getting into relatable monetary dilemmas with video games like ‘Would You Relatively?’, forcing decision-making and cranking up engagement. This isn’t nearly making finance “enjoyable”; it’s about making it stick. It’s laying the groundwork for monetary freedom, empowering sensible monetary decision-making, and constructing a rock-solid understanding of private finance.

Fashionable Finance Video games for Excessive College College students

Highschool marks an important stage the place understanding learn how to handle cash can considerably affect a pupil’s future path. Monetary literacy video games function helpful instruments, offering an attractive technique to follow and find out about:

- Successfully dealing with their funds

- Creating and sticking to a finances

- Establishing a necessary emergency fund

These capabilities are extra than simply classes; they’re foundational abilities for his or her grownup lives. Via interactive calculators that simplify advanced calculations and real-life simulations that immerse them in decision-making situations, these video games assist monetary ideas turn out to be clear and relatable. Whereas many free video games present wonderful introductions, instructional establishments looking for thorough, curriculum-integrated options will uncover distinctive depth in platforms particularly developed for structured studying environments.

Sensible Cash Abilities

Visa’s Sensible Cash Abilities program is a complete monetary literacy schooling useful resource designed to empower people with important cash administration data. This system gives an enormous library of free instructional sources, together with:

- Articles

- Calculators

- Lesson plans

- Interactive video games tailor-made for numerous age teams.

Educators can seamlessly combine these sources into the classroom, making monetary schooling accessible and fascinating for college kids. Fashionable video games like “Monetary Soccer” and “The Payoff” are a part of this initiative, utilizing partaking themes and simulations to show private finance.

Monetary Soccer

Monetary Soccer, developed by Visa as a part of their Sensible Cash Abilities initiative, blends monetary literacy with the joy of American soccer (or soccer). This interactive sport makes studying about cash administration enjoyable and fascinating. Gamers advance down the sector and rating touchdowns by answering monetary questions accurately, making it a fast-paced, 3D expertise that appeals to college students and adults alike. The aggressive aspect motivates gamers to study and carry out higher, reinforcing sensible monetary choices in an gratifying method.

Incorporating Monetary Soccer into classroom curricula can successfully educate important monetary ideas reminiscent of saving, spending, budgeting, and credit score administration. The sport covers key matters and offers immediate suggestions, permitting college students to see the influence of their monetary selections in actual time. This interactive strategy makes monetary schooling accessible and fascinating, serving to college students develop helpful cash administration abilities.

The Payoff

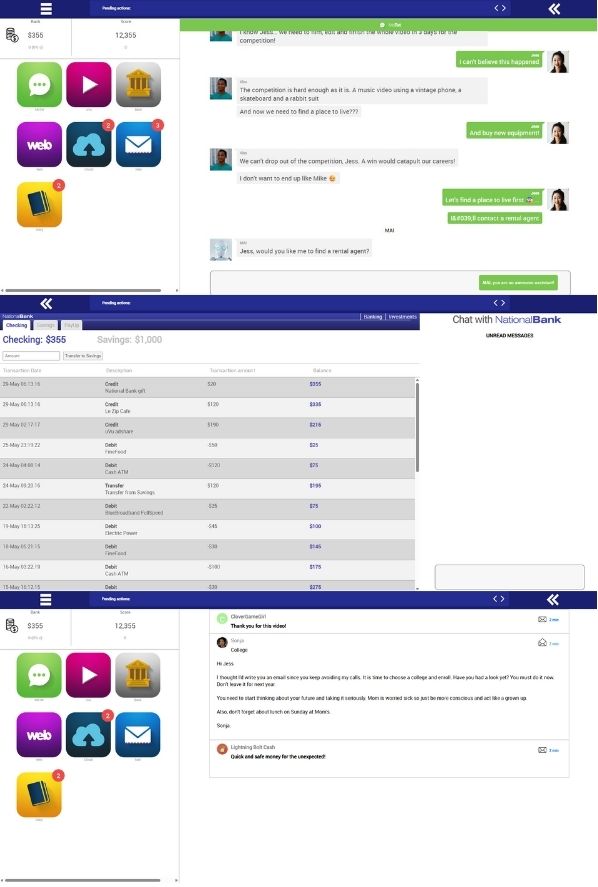

The Payoff, one other partaking sport from Visa’s Sensible Cash Abilities program, immerses gamers in a relatable storyline the place they act as aspiring video bloggers making ready for a contest. The sport interface mimics a cell phone, permitting gamers to work together with chat, banking apps, emails, and pretend web sites, making the expertise really feel genuine and acquainted. This immersive simulation teaches college students elementary monetary ideas via decision-making situations, emphasizing the significance of saving, learn how to pay payments, and the implications of monetary selections.

Visa offers in depth classroom sources to assist educators, together with:

- A instructor’s information

- Detailed lesson plans

- Scholar handouts

- Assessments

- A glossary of monetary phrases

These sources make it straightforward for academics to combine The Payoff into their curricula, offering a structured and fascinating method for college kids to follow managing cash and making sensible monetary choices for his or her wealth profit.

NextGen Private Finance Arcade Video games

Subsequent Gen Private Finance (NGPF) gives an acclaimed assortment of free, web-based interactive video games designed to supply fast engagement and centered studying on particular private finance ideas. These “bite-sized” video games, sometimes lasting 10-25 minutes, are accompanied by strong curriculum sources, making them extremely helpful for educators.

Fashionable titles that supply distinctive, experiential studying alternatives embrace:

- “Payback”

- “SPENT”

- “Cash Magic”

- “The Uber Recreation”

These video games assist educate college students develop important math abilities in a enjoyable and interactive method.

Time for Payback

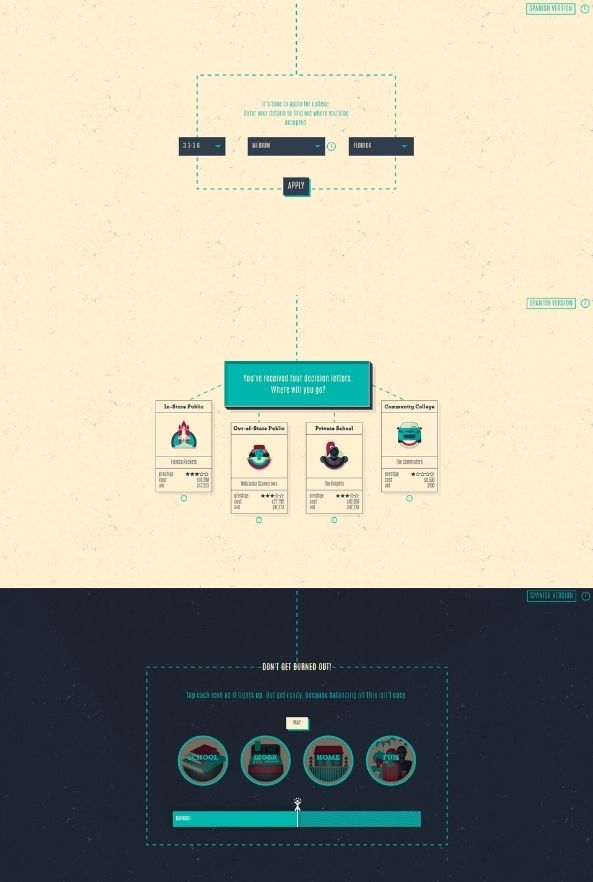

Payback focuses on the essential choice of paying for school, making it extremely related to highschool college students. The sport permits college students to:

- Choose their careers and majors, displaying the influence on job prospects and pupil mortgage debt

- Make selections about pupil loans, part-time jobs, and residing bills

- Expertise the implications of those selections on their total debt, focus, consideration, and happiness

This consequence-driven studying empowers college students to navigate advanced monetary choices associated to larger schooling.

The target of graduating with out extreme debt is a sensible and comprehensible purpose for college kids. Payback’s simulation helps college students perceive the implications of pupil debt, make lifelike choices about school financing, and expertise the implications of those selections. This sport is a superb device for educating monetary literacy and making ready college students for the monetary realities of school life.

Cash Magic

Cash Magic options an attractive narrative with a personality named Enzo, a magician aiming to get to Las Vegas to carry out. The visually interesting graphics and story-driven gameplay make the budgeting course of enjoyable for college kids. Gamers assist Enzo handle a finances, make spending choices, and attain a financial savings purpose, educating elementary ideas of incomes, saving, and spending correctly in a sensible state of affairs.

The sport emphasizes the idea of alternative price and making tradeoffs when managing restricted monetary sources. College students study to handle cash correctly by making spending choices and seeing the instant influence on their faux finances and progress in direction of their saving cash purpose, understanding how spending impacts their monetary objectives.

Cash Magic is right for center faculty or early highschool college students who’re new to budgeting ideas.

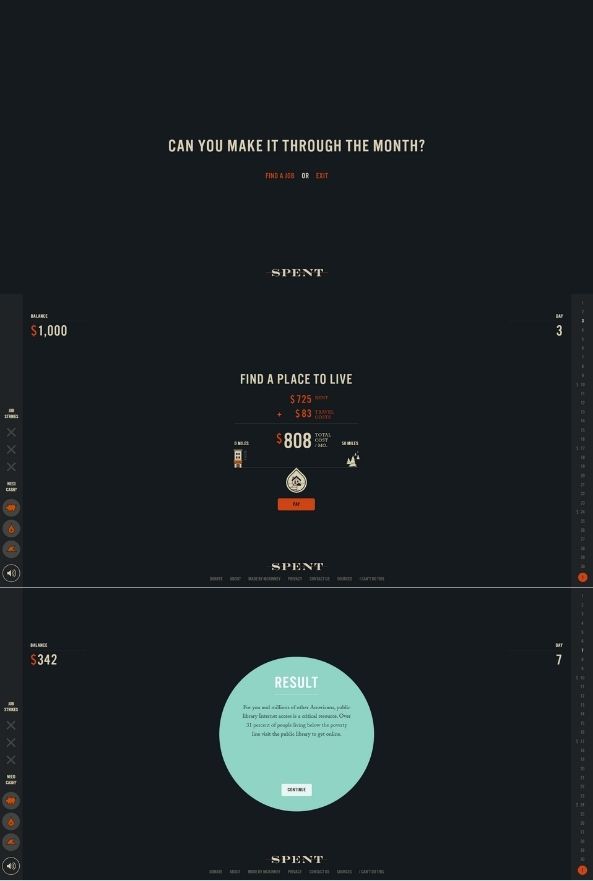

SPENT

SPENT gives a strong and empathetic expertise by simulating the troublesome actuality of residing paycheck-to-paycheck with a really restricted finances. Gamers should make powerful selections about which important bills to pay and which to sacrifice, illustrating the tough monetary realities confronted by many. This eye-opening sport raises consciousness about monetary hardship and the stress of managing inadequate earnings.

The sport presents lifelike situations that require gamers to juggle tasks and restricted funds, making it a concise however impactful studying expertise. With a brief playtime of roughly 10 minutes, SPENT is definitely accessible and delivers a powerful message about poverty and monetary hardship. It’s an efficient device for fostering social consciousness alongside monetary literacy.

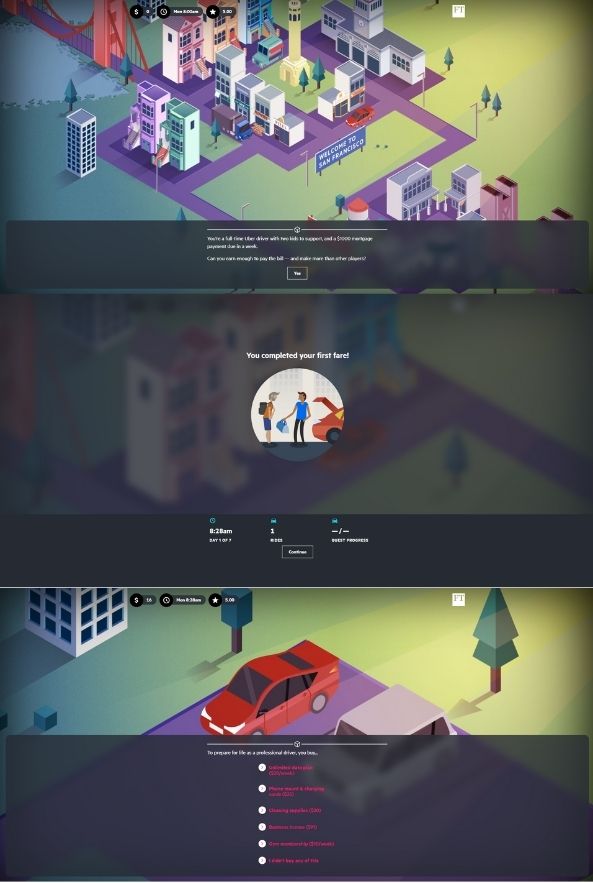

The Uber Recreation

The Uber Recreation explores the realities of working within the gig financial system, a well timed and related subject for college kids contemplating future profession paths. Gamers act as an Uber driver needing to earn a certain quantity inside a good deadline, managing monetary tasks reminiscent of mortgage funds and assist for youngsters. This lifelike strain simulation helps college students perceive the professionals and cons of gig work and the monetary choices concerned.

Developed from precise information reporting and that includes insights gathered from a number of Uber drivers, The Uber Recreation promotes essential analysis of gig work as a possible profession. Linking the hassle of taking up gig jobs to assembly important monetary obligations helps college students join work to monetary objectives and replicate on their profession choices.

This experiential studying strategy makes the sport an efficient device for educating monetary literacy.

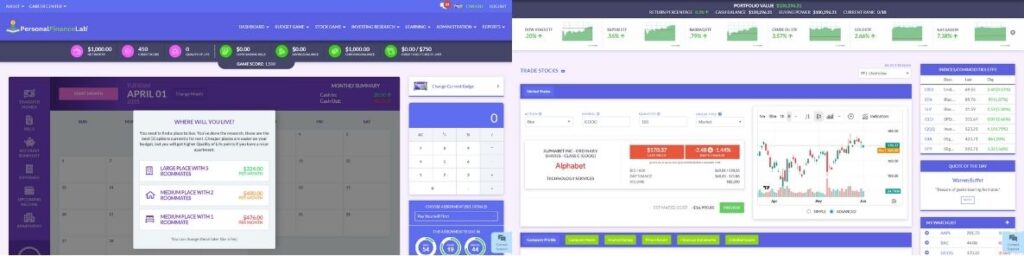

PersonalFinanceLab

A Complete Resolution for Ok-12 College students

PersonalFinanceLab gives a holistic, curriculum-integrated strategy to monetary literacy for Ok-12 college students. The platform combines a practical, long-term Finances Recreation with a dynamic Inventory Market Recreation, offering immersive twin simulations that cowl actual payments, credit score rating impacts, and high quality of life. College students handle their very own digital funds, making impactful choices that assist them develop monetary habits and confidence.

PersonalFinanceLab gives the next options:

- Over 300 standards-aligned classes, movies, and actions tightly woven with simulations, making certain deep curriculum integration and sensible ability connection.

- In depth customization and management for academics over sport parameters and assignments, permitting them to suit any classroom.

- Instruments for monitoring pupil progress, participation, and comprehension in monetary literacy actions, making it a sturdy useful resource for educators.

PersonalFinanceLab’s worth proposition goes past simply video games; it’s a whole monetary literacy platform designed for deep, sustained studying and ability improvement. With stay chat assist and customized providers for academics, the platform enhances the educating expertise and ensures college students are well-prepared for real-world monetary challenges.

Enjoyable and Interactive Monetary Literacy Video games for Youthful College students

Getting youthful college students hooked on monetary literacy early is like planting a cash tree that can bear fruit for all times. The precise video games make studying about cash an journey, not a chore, serving to them soak up fundamental monetary ideas whereas they’re having a blast. These video games are engineered to captivate children and stealthily educate them important abilities.

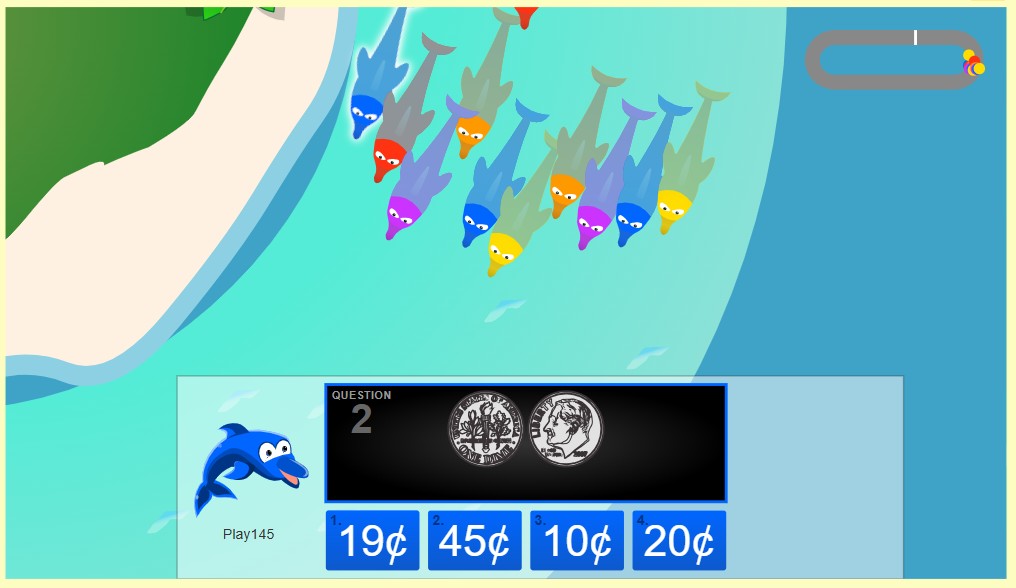

Dolphin Sprint

Dolphin Sprint throws down the gauntlet, letting gamers race in opposition to classmates in a enjoyable, interactive splash in direction of cash mastery. Constructed for the Pre-Ok to Sixth-grade crew, this sport sharpens counting, cash administration, and even multiplication abilities via addictive gameplay. Gamers need to quickly add coin values to propel their dolphin to victory, turbo-charging their psychological math.

As a web-based multiplayer showdown, Dolphin Sprint connects college students globally, all whereas they’re leveling up their money-counting prowess. To leap in, academics or mother and father must register for an educator account, protecting the educational atmosphere supervised, secure, and enjoyable.

Hit the Street

Hit the Street channels that traditional “Oregon Path” vibe into an epic cross-country monetary journey. This isn’t a passive slideshow; college students are within the driver’s seat, actively managing a finances, making powerful spending calls, and bracing for these inevitable sudden prices. They study by doing, mastering key monetary abilities like:

• Budgeting like a boss

• Saving strategically

• Spending responsibly

• Understanding debt (and learn how to keep away from its pitfalls)

Created and hosted by MyCreditUnion.gov, Hit the Street is a free, reliable instructional device. This learn-by-doing street journey helps college students really feel the strain of real-world monetary selections and make smarter choices.

Peter Pig’s Cash Counter

Peter Pig’s Cash Counter is tailored for the 5-8-year-old crowd, hitting that candy spot the place studying and play collide. Each aspect – the ideas, visuals, interactions – is completely tuned to their developmental stage.

Dropped at you by Visa as a part of their Sensible Cash Abilities powerhouse, Peter Pig’s Cash Counter even sprinkles in enjoyable info about U.S. forex, sparking curiosity past simply the numbers. With clear objectives and a motivating reward system (who doesn’t need to gown up Peter in cool gear?), it helps construct a constructive, can-do angle in direction of cash proper from the beginning.

Superior Monetary Literacy Video games for Older College students

Superior monetary literacy video games play an important function in making ready older college students for advanced monetary challenges. By partaking with these advanced sport situations, college students develop important abilities for real-world monetary administration. These superior video games present a secure house for college kids to follow making monetary choices and perceive their penalties with out real-world dangers. This hands-on expertise equips them with the data and confidence wanted to navigate monetary challenges in maturity, setting the stage for monetary freedom.

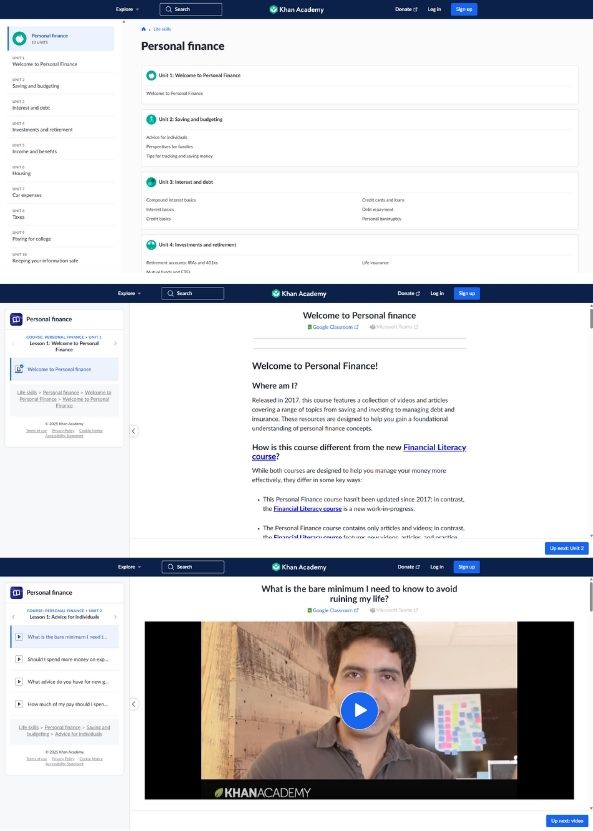

Khan Academy (Private Finance Course)

Khan Academy’s complete private finance course is a superb useful resource for highschool and school college students. The course gives free video classes and follow workouts on a wide selection of private finance matters, together with:

- Saving and budgeting

- Curiosity and debt

- Investments and retirement

- Revenue and advantages

- Housing

- Automotive bills

- Taxes

- Paying for school This free and accessible format ensures that high-quality instructional content material is accessible to everybody.

Identified for breaking down advanced matters into comprehensible parts, Khan Academy offers clear explanations and complete protection of foundational private finance areas related to school college students. The self-paced studying strategy permits college students to study at their very own pace and revisit matters as wanted, making it a helpful complement or prerequisite for extra superior finance programs.

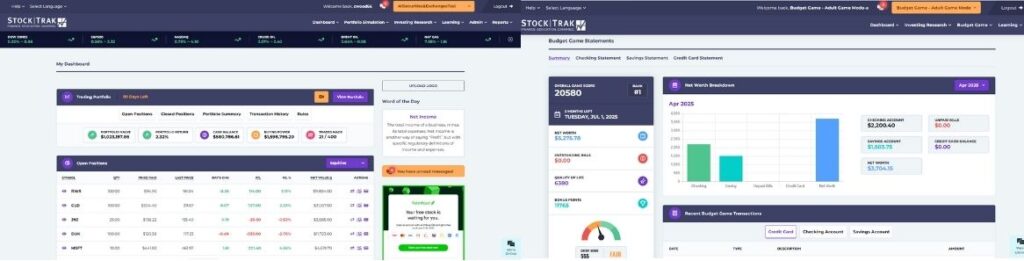

StockTrak

For school-level finance, private finance, and funding programs, StockTrak offers an industry-leading platform for stylish, real-world simulation.

This isn’t only a sport; it’s a professional-grade simulation ecosystem meticulously engineered to reflect the complexity and dynamism of real-world world finance. The Digital Investing & Portfolio Administration simulation is a powerhouse, providing real-time bid/ask costs for U.S. markets and a complete array of tradable asset lessons together with Shares, ETFs, Bonds, Mutual Funds, Choices, Futures, Futures Choices, Foreign exchange, Spot Commodities, and Cryptocurrencies. College students don’t simply commerce. They study to navigate the markets with instruments and metrics utilized by seasoned professionals.

What elevates StockTrak for educators is its strong suite of classroom administration and customization instruments, proving it’s “far more than only a inventory market sport.” Professors can customise the simulations to exactly match class targets, create detailed Assignments that information college students via monetary literacy matters, and profit from Self-grading Assignments that robotically monitor pupil exercise, pop quizzes, and efficiency. Detailed Admin Reporting Instruments present instructors with clear oversight and actionable insights.

StockTrak extends past the buying and selling ground with its immersive Private Finance Simulation. Right here, college students step into the realities of grownup monetary life: they get a job, stay on their very own, and face managing month-to-month payments. As they “roll the cube” to maneuver via 12 digital months, they set up budgets, obtain paychecks, and crucially, confront random, sudden life occasions and weekend actions designed to problem their monetary plans.

Abstract

In abstract, finance video games supply a enjoyable and interactive technique to educate college students important cash administration abilities. From youthful kids to school college students, these video games present hands-on expertise in managing cash, budgeting, and making sensible monetary choices. Applications like Visa’s Sensible Cash Abilities and NGPF’s arcade video games, together with superior simulations like StockTrak and PersonalFinanceLab, guarantee complete monetary schooling for college kids of all ages.

By gamifying monetary literacy, we will make studying about cash partaking and accessible, setting the inspiration for monetary freedom and knowledgeable monetary decision-making. Embracing these modern educating strategies will put together college students for the monetary challenges of maturity, empowering them to realize monetary success and stability.