Eric Francis

My earlier, and to this point solely, protection of Berkshire Hathaway Inc. (NYSE:BRK.A) (NYSE:BRK.B) was again in November 2023 after the corporate’s Q3 report. Again then, it felt a bit unusual for me to jot down about Berkshire for the primary time after 600 articles (at the moment) on Looking for Alpha and holding the inventory for a few years. However I can not even think about how unusual it should have felt for Warren Buffett to have Berkshire’s This fall report and annual letter launched with out that buddy of his for 65 years by his facet.

Berkshire’s This fall report was anticipated to be about Charlie Munger, Money, Insurance coverage and Inventory positions. And the corporate didn’t disappoint in offering wealthy particulars about every of those matters. With out additional ado, allow us to evaluate Berkshire’s This fall within the newest version of The Good, The Unhealthy, and The Ugly.

The Good

- Though this isn’t solely about This fall and even the inventory on the whole, I might like to spotlight what I imagine is one of the best attribute of Berkshire Hathaway. Simplicity and Tradition.

- Berkshire has at all times been a easy firm. I imply that with all due respects. The corporate has been constructed on a number of easy strategies: discover the suitable folks (or corporations) and belief them to do what’s finest until they present you a cause to not belief them anymore. Consider Buffett, Munger, and Ajit Jain. Consider The Coca-Cola Firm (KO). Whereas it was anticipated that Buffett would pay a becoming tribute to Munger on this report and annual letter, Buffett outdid expectations by opening the annual letter with a piece titled “Charlie Munger – The Architect of Berkshire Hathaway” and concluding that part with “Although I’ve lengthy been accountable for the development crew; Charlie ought to perpetually be credited with being the architect.“.

- The cultural side of Berkshire stands out on this remark “Even when he knew he was proper, he gave me the reins, and after I blundered he by no means – by no means –jogged my memory of my mistake.” the place like-minded persons are left to chew on their very own errors and be taught from it fairly than it being pointed negatively at them.

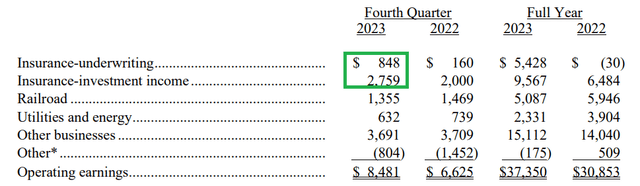

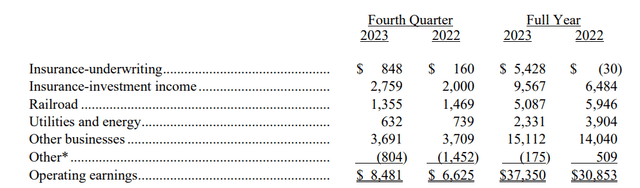

- 2023’s web revenue of ~$96 billion is a brand new file for the corporate, handily beating 2021’s ~$90 billion by greater than 6%. On the finish of This fall 2023, insurance coverage float reached $169 billion, up from the $167 billion on the finish of Q3 and up by $5 billion in comparison with 2022. Briefly, This fall and 2023 on the whole was as soon as once more an insurance coverage present as underwriting earnings quintupled in This fall.

This fall BRK Abstract (berkshirehathaway.com)

- At $167 billion, the money place is not only the very best within the firm’s historical past as soon as once more but in addition is giant sufficient to purchase all however 57 nations on this planet (individually, that’s). Money now represents 18.50% of the corporate’s market cap, down from the 20% after Q3, primarily because of the inventory’s close to 18% achieve since my Q3 evaluate.

The Unhealthy and The Ugly

- Buffett, due to Munger, had moved previous the strict value-investing ideas he learnt from Ben Graham and on many a instances purchased good corporations at honest costs. The truth that Berkshire has $167 billion money pile and doesn’t really feel compelled to apply it to acquisitions or new inventory positions ought to inform us all we have to know concerning the financial system and inventory market on the whole.

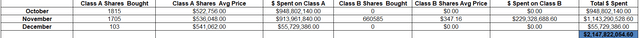

- Berkshire spent $2.2 billion in This fall in the direction of repurchases as elaborated under. Whereas that is up from the $1 billion utilized in Q3, two issues stand out: (1) that the exercise peaked in November and slowed significantly in December (the market’s low was in October) and (2) the repurchases in This fall symbolize about 1% of the corporate’s money readily available, suggesting that even Buffett doesn’t see his inventory as undervalued right here.

BRK This fall Repurchases (berkshirehathaway.com)

- Working earnings from Railroad and Utilities fell almost 8% and 15% YoY respectively in This fall whereas they declined about 15% and 40% respectively YoY on an annual foundation. If not for the insurance coverage super-show, these declines would have been way more pronounced.

Working Earnings This fall and FY 2023 (berkshirehathaway.com)

- Apple Inc. (AAPL) represented $174.3 billion of Berkshire’s complete worth on the finish of This fall, up 11% QoQ. Add that to the money pile talked about above, you get $341 billion, which is greater than 37% of the corporate’s complete price. Whereas this Apple + Money share has fallen from 40% on the finish of Q3, they nonetheless symbolize a good portion. I’m particularly involved about Apple, which is buying and selling at a ahead a number of of almost 28 whereas anticipated to develop 2024 income by 1.33%.

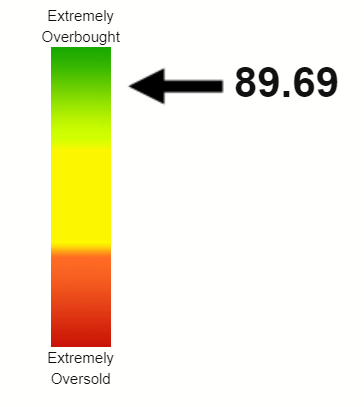

- From a valuation perspective, BRK.B is buying and selling at a ahead a number of of almost 23 and has gained almost 40% within the final yr. As a lot as I really like the corporate and its inventory, Berkshire is just not fixing the World’s starvation nor most cancers nor the instantly insatiable urge for food for something AI. Buffett can be one of many first ones to explicitly admit that his inventory is just not low cost right here and maybe, he’s admitting this implicitly by the dearth of (severe) buybacks.

BRK.B Chart (seekingalpha.com)

- Lastly, not that Buffett ever favored Technical evaluation, however even he’d cringe at seeing BRK.B’s Relative Power Index [RSI] at nearly 90 as of this writing. It is not an overstatement to say the inventory (and the market on the whole) is due for a pullback from right here.

BRKB RSI (stockrsi.com)

Conclusion

In case you had been anticipating Buffett and Berkshire to have been all emotional about Charlie Munger’s passing, you’d most likely be a bit upset. Buffett did a Munger in his annual letter to shareholders – paid the respect his good friend well-deserved after which moved onto tackle the enterprise and shareholders in Berkshire’s typical, methodical, and non-sensical trend. I do not imply to be the bearer of unhealthy information however we have so usually seen in marriages that when one long-time associate passes, the opposite often follows go well with. Age, clearly, has rather a lot to do with it however as does the truth that one doesn’t merely know life with out the opposite. Buffett is 93 and isn’t any spring hen, regardless of his nonetheless sharp thoughts. He may even joke that he’d attempt to beat Charlie to the magical 100. However truth stays that he’s leaving the world before later however most significantly for shareholders, has constructed a easy firm with tradition that’s more likely to thrive for a lot of extra many years. For that cause, I intend to at all times have an publicity to Berkshire Hathaway for the long run.

Within the quick to medium time period although, I’m downgrading the inventory to a “Maintain” as a result of valuation considerations (inventory particular and the market on the whole). I imagine the market is due for a pullback after piling on 2023’s momentum to kick begin 2024 roaringly.