Shares completed the day greater, with the scheduled for in the present day. The gained round 90%. Know-how names bounced again yesterday, whereas the (RSP) moved decrease by about 50, giving again the day earlier than yesterday’s positive aspects.

The RSP stays round resistance on the 61.8% retracement degree, which might proceed to counsel that the current rally within the equal-weight sector seems to be a rebound till the ETF breaks out and strikes greater.

Bear Steepening to Resume?

At this time’s Fed assembly will considerably have an effect on the place charges go and whether or not the yield curve steepens. If the indicators that it’ll not be reducing rates of interest additional, at the least over the close to time period, I might suppose that we’d doubtless see the yield curve steepen additional. It’s potential to say that the has shaped a flag sample and that the subsequent huge transfer might be for it to rise additional within the type of a bear steepener.

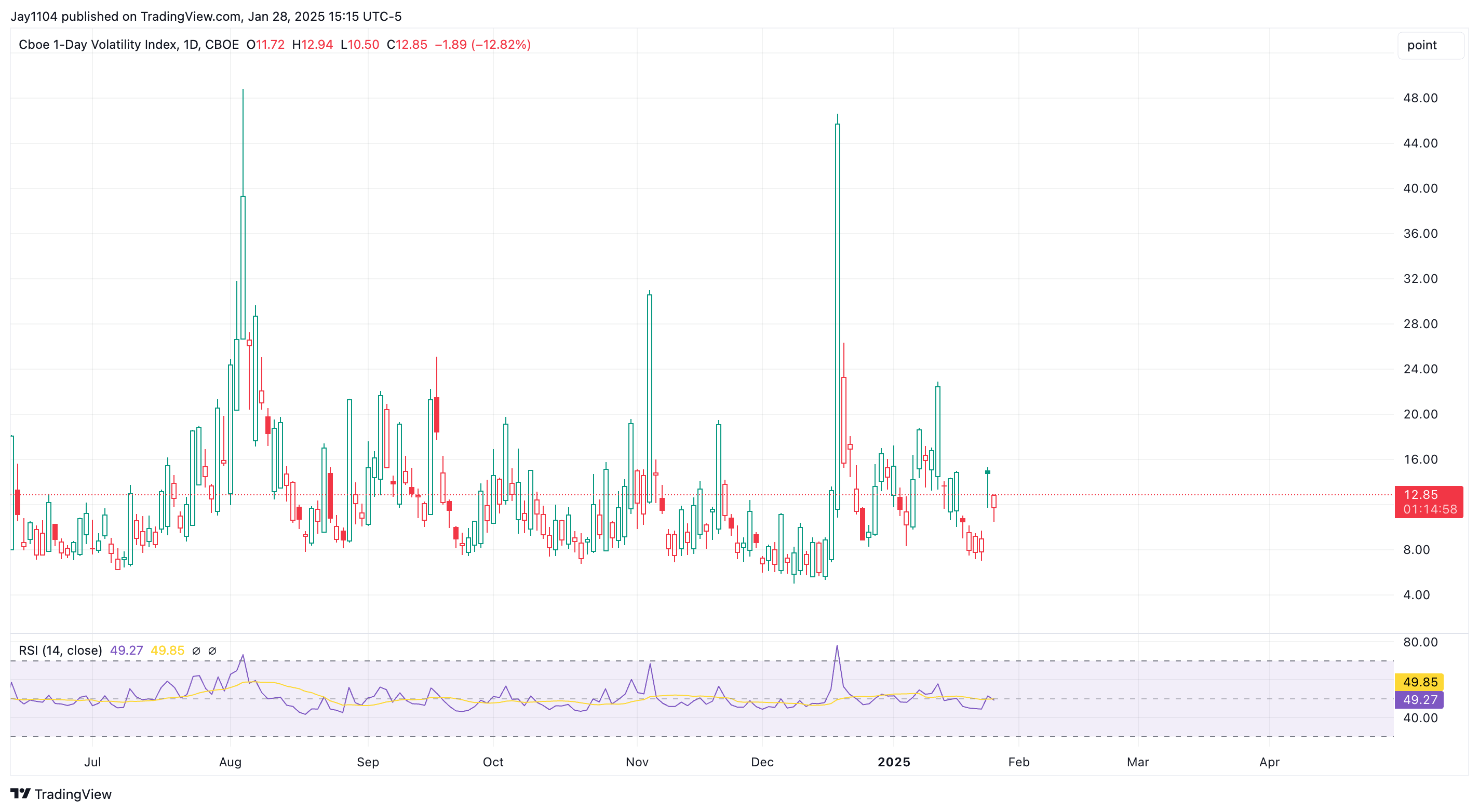

In fact, a lot of what occurs following in the present day’s Fed assembly has way more to do with implied volatility ranges than that of the choice itself. The 1-Day trades round 13, a fairly low degree 1 day forward of the Fed. Until it rises sharply in the present day within the lead-up to that assembly, the S&P 500 will doubtless have a muted transfer post-FOMC and is weak to maneuver decrease ought to Powell come throughout as extra hawkish. Given IV is so low, ought to the Fed shock the market and are available throughout as extra hawkish, implied volatility may spike.

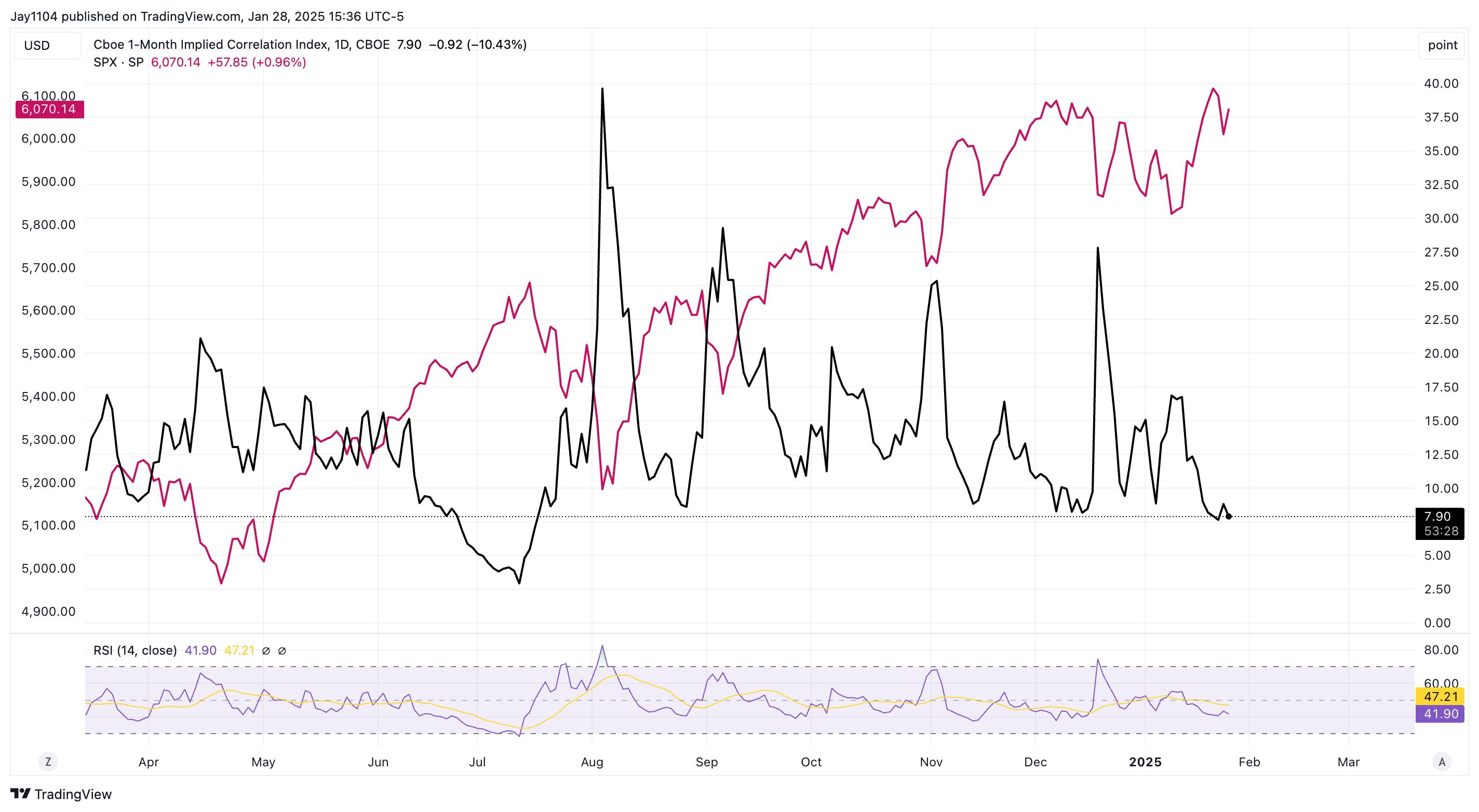

Moreover, we noticed the VIX additionally transfer decrease yesterday, permitting the implied correlation to drop. Once more, the 1-month implied correlation index is at a low worth of simply 8, and there’s the chance that after we get previous earnings later this week, this index may begin to rise as implied volatility resets. Traditionally, low studying within the implied correlation could be related to short-term market tops.

Authentic Publish