EUR/USD ANALYSIS

- EZ CPI report reveals softening headline inflation with core remaining sticky.

- Jackson Gap in focus subsequent week.

- Bears stalk key assist zone.

Advisable by Warren Venketas

Get Your Free EUR Forecast

EURO FUNDAMENTAL BACKDROP

The euro prolonged its slide downward this Friday after euro space inflation (see financial calendar beneath) confirmed marginal indicators of slowing on the headline print (each MoM and YoY). That being stated, the all essential core inflation determine remained elevated with meals ,alcohol and tobacco in addition to providers the very best contributors. Building output contracted highlighting issues across the eurozone economic system and with Chinese language development fears gaining traction, this might weigh additional on the Europe, exposing the euro to additional draw back.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to E-newsletter

EUR/USD ECONOMIC CALENDAR (GMT +02:00)

Supply: DailyFX financial calendar

From a USD perspective, the dollar has discovered assist by way of a spike in US brief time period Treasury yields (2-year) in addition to danger averse traders in response to uncertainty in China. The secure haven enchantment of the dollar is considered one of many elements that has stored the DXY buoyant however wanting forward, subsequent weeks Jackson Gap Financial Symposium may change momentum ought to Fed Chair Jerome Powell determine to reorientate the narrative to considered one of a extra accommodative/dovish financial coverage outlook.

TECHNICAL ANALYSIS

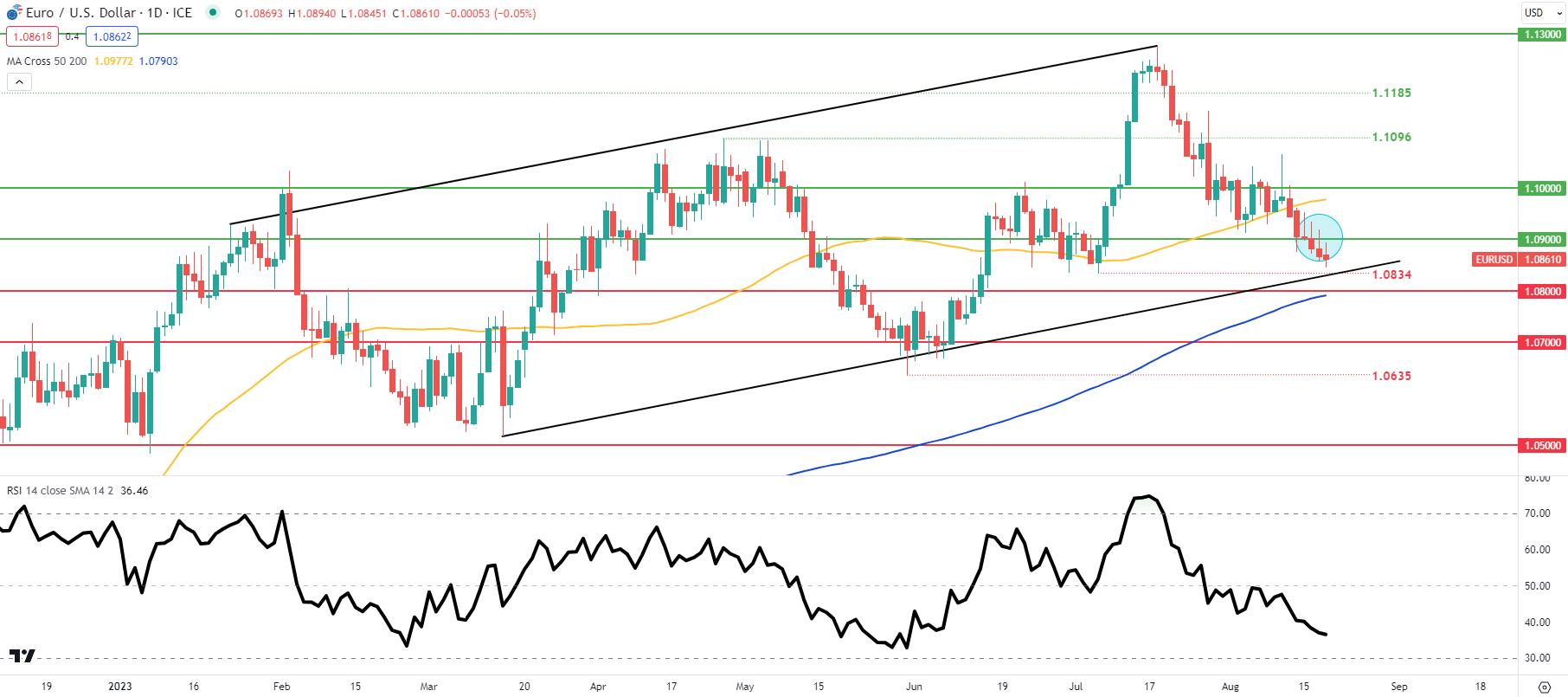

EUR/USD DAILY CHART

Chart ready by Warren Venketas, IG

Each day EUR/USD value motion is nearing channel assist (black) after a succession of lengthy higher wicks candles (blue). Present fundamentals are in favor of additional greenback power short-term and with no excessive impression financial knowledge to talk between now and Jackson Gap, merchants shall be cautious because the symposium traditionally brings about giant unstable market reactions.

Resistance ranges:

- 50-day shifting common (yellow)

- 1.0900

Assist ranges:

- 1.0834/Channel assist

- 1.0800

IG CLIENT SENTIMENT DATA: BEARISH

IGCS reveals retail merchants are at the moment neither NET LONG on EUR/USD, with 61% of merchants at the moment holding lengthy positions (as of this writing). Obtain the newest sentiment information (beneath) to see how every day and weekly positional adjustments have an effect on EUR/USD sentiment and outlook.

Introduction to Technical Evaluation

Market Sentiment

Advisable by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas