tirc83

Thesis

Axon Enterprise (NASDAQ:AXON) is a kind of investments that saved arising once I was in search of new concepts and it did not enchantment to me as a result of my first thought was okay, it is only a Taser firm and due to this fact I am not concerned with it any additional. However rattling was I improper, the primary time I checked out it intently I noticed their nice enterprise mannequin and massive aggressive benefit and future progress alternatives.

I’m positive that an organization like Axon will likely be of actual profit to humanity by stopping pointless deaths and I additionally consider that Proof may enhance the standard of investigations and due to this fact assist to scale back the variety of harmless individuals convicted or assist to convict the responsible.

And I feel that investing in issues that make our lives higher will typically result in wonderful leads to the long term. Nonetheless, Axon’s valuation may be very excessive and this has a somewhat unfavourable influence on the chance/reward in the intervening time. However with the volatility of the share worth, I feel there will likely be shopping for alternatives sooner or later, as with nearly any inventory.

And when there’s unfavourable sentiment as a consequence of momentary difficulties, I’ll construct a place, as persistence is vital on this case, however the precise time will come.

Evaluation

There was some excellent news for Axon lately, with its inclusion within the S&P 500 and powerful latest outcomes. Nonetheless, the share worth fell comparatively sharply after the outcomes for no actual purpose aside from that the shares haven’t any margin for error as a consequence of their very excessive valuation and due to this fact such falls can happen. Nonetheless, this creates alternatives for brand new traders to seek out cheaper entry factors, and I feel Axon’s long-term path may have fairly a number of ups and downs. You simply should reap the benefits of Mr Market’s temper swings.

Aggressive Benefit

The mixture of physique cameras, digital proof system and Tasers has enabled Axon to construct a system that’s mission vital for patrons as soon as they use it lengthy sufficient. It makes the work of the officers simpler because the Proof System takes over an increasing number of of the work and automates it. And the extra knowledge Axon collects, the extra they will automate and drive clients additional into system dependency. And this results in unimaginably excessive switching prices and a powerful buyer relationship.

Proof is prone to be Axon’s core enterprise going ahead, which ought to result in improved margins, and I feel their R&D spending may also result in extra fascinating future alternatives as they will actually profit from AI and machine studying. In contrast to different firms, AI for them is not only a phrase that’s thrown round in earnings calls or quarterly stories to please shareholders.

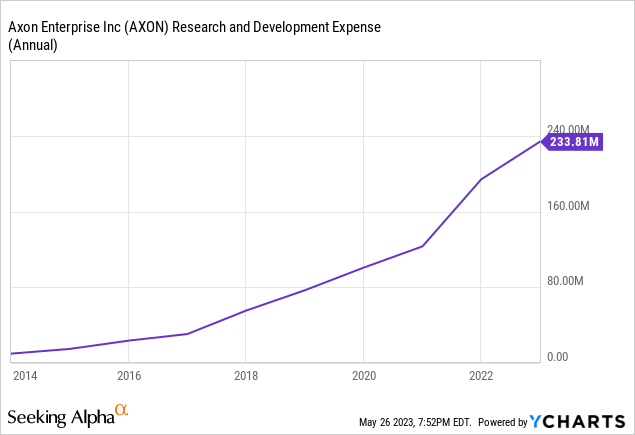

Rising R&D prices needs to be welcome information to all shareholders, as that is an funding sooner or later and long-term traders are prone to profit from this funding sooner or later.

The FedRAMP Excessive classification, the best stage of safety certification which they’ve lately achieved, can also be a powerful barrier to entry as they will now work with knowledge that different rivals can’t.

As well as, as soon as you might be within the Axon ecosystem, it’s onerous to get out as a result of all of the items are related. And thru the cloud, Axon can also be getting an increasing number of recurring income as a result of they get subscription income and their Tasers, for instance, additionally want cartridges, which can also be recurring income. Slightly than simply getting paid as soon as for a product, they’ve moved to this extra environment friendly mannequin.

Development Alternatives

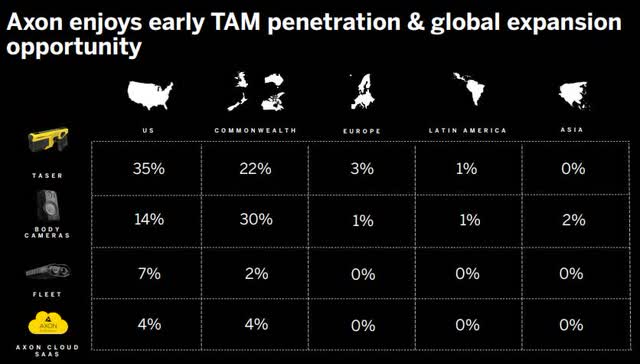

Axon Investor Deck Could 2023

This clearly reveals that TAM is under-penetrated, particularly in LA, Europe and Asia, and as soon as they get their foot within the door with the Tasers and get the purchasers of their ecosystem, the cross-sell and up-sell alternatives will likely be there. The TAM is presently $50 billion in response to their calculations.

Particularly in Europe there are an increasing number of riots and demonstrations, so I do not assume they’ll in the reduction of on police spending, somewhat the alternative, and that might profit Axon. Latin America, however, is a tough problem as a result of you will have criminals who’re actually closely armed and so they might not take the police with tasers very significantly.

Reverse DCF

Creator

The premise of the reverse DCF is the TTM diluted EPS of $1.88, which means an EPS progress of 26% over 5 years after which 25% over the subsequent 5 years. The historic progress fee during the last 10 years is just 21.90%, so if you wish to obtain a ten% CAGR, the shares are presently overvalued.

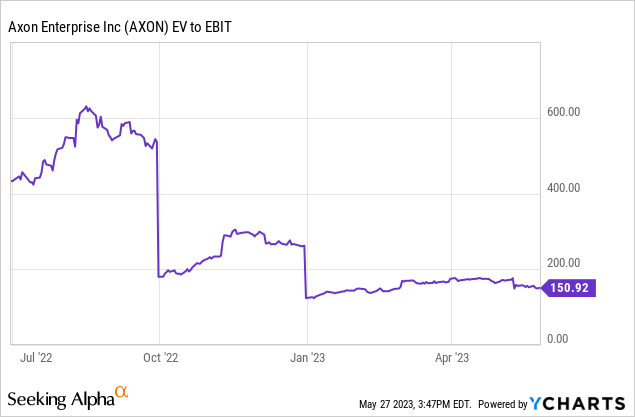

A metric like EV / EBIT additionally reveals that the shares are massively overvalued, however we’ve to confess that the valuation has improved considerably during the last 3 years. And even when we use a metric that features the expansion fee, such because the PEG ratio, we get a determine of over 2.5, which additionally reveals the overvaluation.

Conclusion

Axon is a top quality firm that I want to personal, however I might not begin a place at this valuation. Entry factors which are too excessive merely steal an excessive amount of of the long run returns, and higher entry factors are sometimes provided, which you then should reap the benefits of.

I’ve no main criticisms of Axon as an organization, because the enterprise mannequin is superb, the execution can also be top quality and the long run progress alternatives are plentiful. In addition they have sturdy limitations to entry and aggressive benefits, and day-after-day that clients use their product, they develop into extra depending on it. The pursuits of the shareholders are additionally aligned with these of the CEO, as he has a stake within the firm by means of his ~4% stake, and he has a mission with this firm that he needs to realize.