NoDerog

Church & Dwight Co., Inc. (NYSE:CHD) has been a prime performing shopper merchandise firm, outperforming the S&P 500 prior to now decade by counting on its acquisition-led enterprise technique.

Nonetheless, it’s at present valued at 27.6x Fwd P/E with margin contraction headwinds and slowing natural development. This implies CHD’s outperformance streak could also be coming to an finish. Making use of the sector median a number of of 19x Fwd P/E to CHD’s 2023 earnings estimates counsel greater than 25% draw back to present costs.

I’d keep away from CHD’s shares.

Firm Overview

Church & Dwight Co. Inc. is a number one American shopper merchandise firm specializing in private care and family merchandise. CHD owns fifteen ‘Energy Manufacturers’, together with ARM & HAMMER, TROJAN, OXICLEAN, ORAJEL, SPINBRUSH, WATERPIK, and THERABREATH (Determine 1).

Determine 1 – CHD’s energy manufacturers (CHD investor presentation)

Roughly 85% of the corporate’s revenues and income are derived from these 15 manufacturers, and every model is ranked #1 or #2 in its respective class.

CHD’s enterprise is pretty evenly cut up between family merchandise (45%) and private care (49%) with specialty merchandise representing 6% of revenues (Determine 2).

Determine 2 – CHD enterprise combine (CHD investor presentation)

CHD Has A Lengthy Historical past Of Development Via Acquisitions…

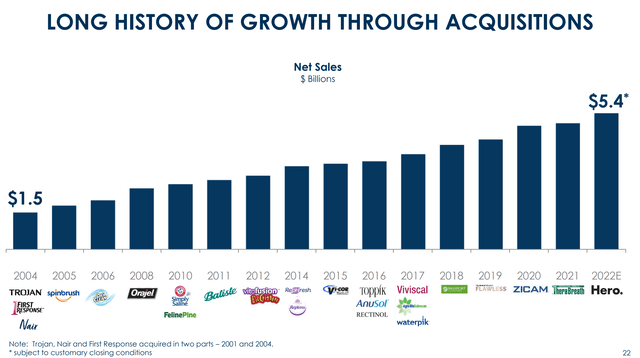

CHD has had a protracted historical past of pursuing development by way of acquisitions. Ranging from the core Arm & Hammer (“A&H”) franchise, CHD has added 14 of its 15 ‘Energy Manufacturers’ since 2001, taking internet revenues from $1.5 billion in 2004 to ~$5.4 billion in 2022 (Determine 3).

Determine 3 – CHD has grown by way of acquisitions (CHD investor presentation)

CHD’s acquisition mannequin is to focus on asset gentle class leaders with excessive development and margins, and apply CHD’s manufacturing, logistics and buying experience (Determine 4).

Determine 4 – CHD’s acquisition technique (CHD investor presentation)

…Main To An Glorious Monetary Mannequin…

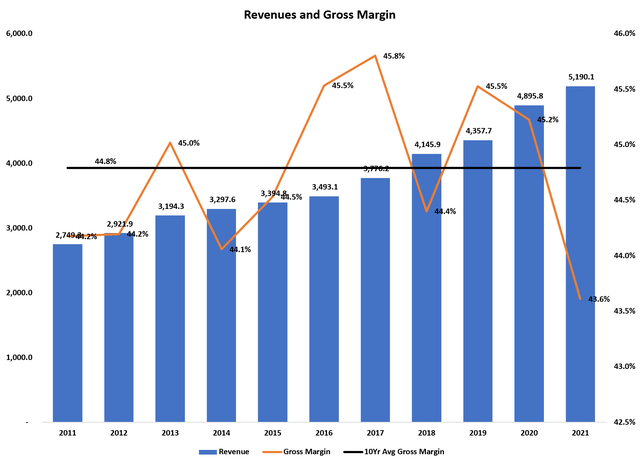

CHD’s acquisition-led enterprise mannequin has underpinned sturdy monetary working outcomes prior to now decade, with revenues rising nearly 90% from 2011 to 2021, and common gross margins of 44.8% over that interval (Determine 5).

Determine 5 – CHD historic revenues and gross margin (Creator created with information from roic.ai)

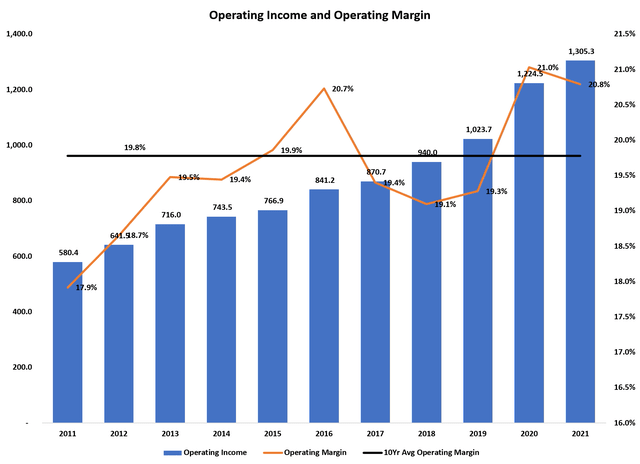

Equally, working earnings greater than doubled from $580 million to $1.3 billion in that timeframe, with working margins increasing 290 bps from 17.9% to twenty.8% (Determine 6).

Determine 6 – CHD historic working income and margin (Creator created with information from roic.ai)

…And Sturdy Inventory Outperformance

CHD’s wonderful monetary outcomes have translated into sturdy inventory efficiency, with CHD shares returning nearly 470% in whole returns for the reason that starting of 2011 vs. solely 300% for the S&P 500 (Determine 7).

Determine 7 – CHD has massively outperformed the market (Searching for Alpha)

Sector A number of At Multi-Decade Highs

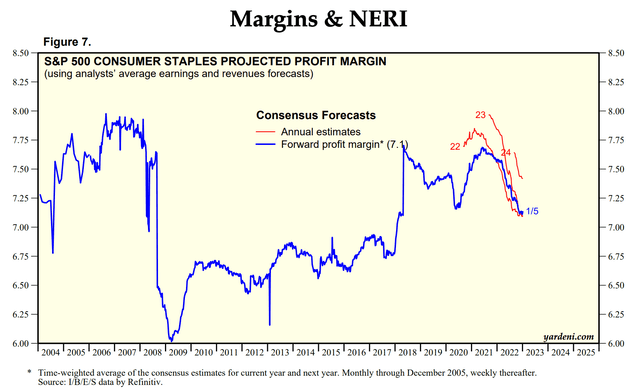

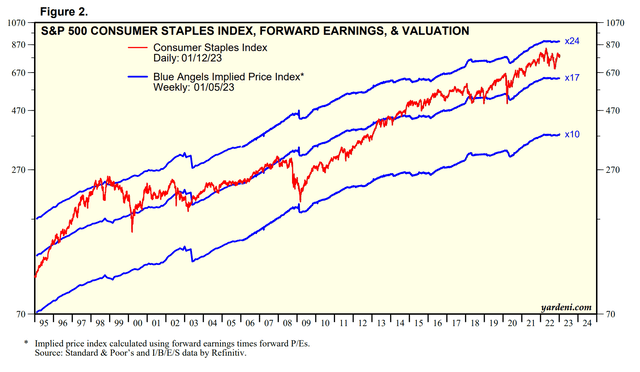

CHD’s sturdy inventory efficiency prior to now decade is partly pushed by tailwinds that benefited the patron staples sector. Client staples exited the Nice Monetary Disaster (“GFC”) at depressed valuations of ~10x Fwd P/E after revenue margins collapsed. Over the previous decade, as revenue margins recovered, valuation multiples expanded to 19x at present (Determine 8).

Determine 8 – Client staple sector revenue margins are rolling over (yardeni.com)

Nonetheless, as we enter 2023, we’re seeing the revenue margin tailwind flip right into a headwind for the sector, as analyst consensus count on revenue margins to contract considerably within the coming years as a result of inflation pressures. For shopper staples shares, it’s onerous to see how valuation multiples can stay at multi-decade highs (final seen within the late Nineties), with contracting revenue margins (Determine 9).

Determine 9 – Client staple sector valuations at multi-decade highs (yardeni.com)

Shoppers Are Hurting From Inflation

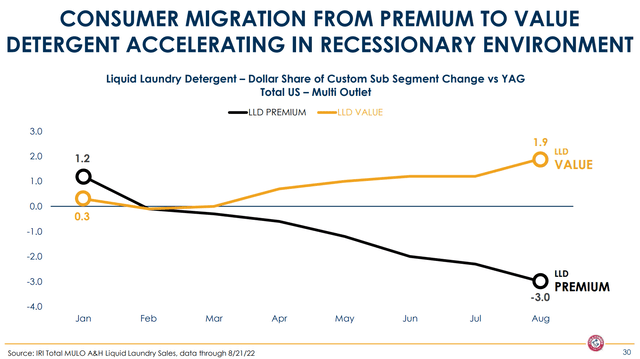

The largest situation for shopper staples firms like CHD is that the patron is hurting from the detrimental results of multi-decade excessive inflation. From a current investor presentation CHD gave on the Barclay’s International Client Staples Convention, the corporate famous that the patron has been migrating from premium to worth merchandise in a ‘recessionary setting’ (Determine 10).

Determine 10 – Shoppers have been buying and selling down (CHD investor presentation)

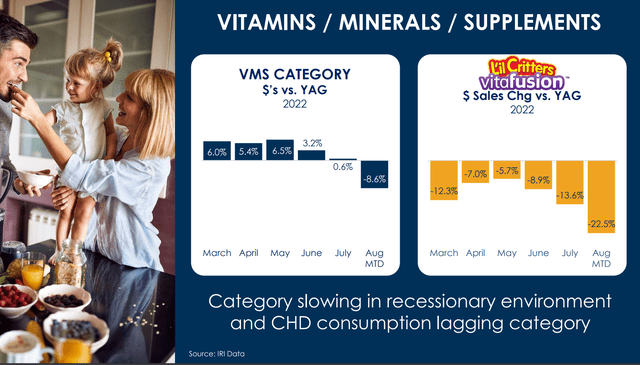

Whereas this has benefited CHD’s ‘worth’ A&H detergent, the shift to worth has been detrimental to CHD’s ‘premium’ merchandise like nutritional vitamins, the place greenback gross sales vs. the prior yr have fallen off a cliff, down 22.5% YoY in August (Determine 11).

Determine 11 – CHD’s vitamin enterprise has been onerous hit by shopper slowdown (CHD investor presentation)

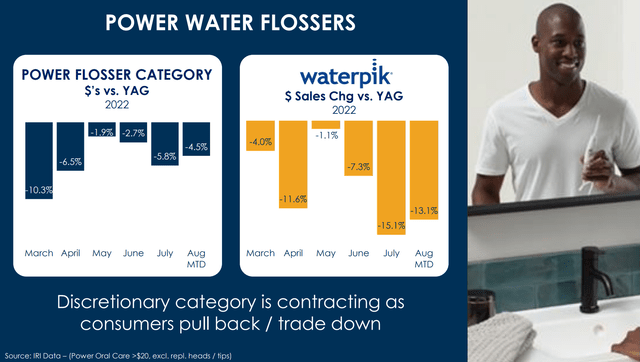

Equally, CHD’s water floss gross sales have taken a big hit as ‘customers pull again / commerce down’ (Determine 12).

Determine 12 – CHD’s water floss enterprise has been hit as nicely (CHD investor presentation)

Natural Gross sales Contracting As Quantity Declines Outpaces Worth Will increase

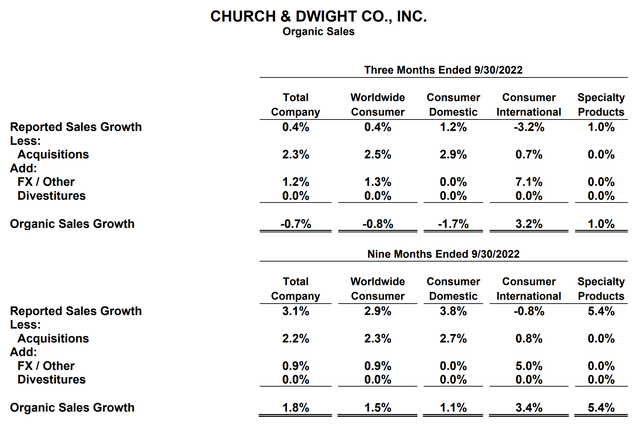

General, the corporate’s natural gross sales development fell into detrimental territory within the just lately reported Q3/2022 (Determine 13).

Determine 13 – CHD noticed detrimental natural gross sales development in Q3/2022 (CHD Q3/2022 earnings report)

That is particularly regarding, as CHD, like many shopper staples firms, has been busy elevating costs in an effort to defend margins. In reality, on the Q3/2022 earnings convention name, Richard Dierker, CHD’s CFO, commented: (creator added spotlight for emphasis)

Natural gross sales declined 0.7% as quantity was down 8.5%, partially offset by optimistic pricing of seven.8%. Matt reviewed the highest line for the segments, so I’ll go proper to gross margin for the corporate. Our third quarter gross margin was 41.7%, a 250 foundation level lower from a yr in the past.

Let me stroll you thru the Q3 bridge. Gross margin was impacted by 580 foundation factors of upper manufacturing prices, primarily associated to commodity inflation, distribution and labor. These prices have been offset by a optimistic 190 foundation level affect, largely from pricing; optimistic 20 foundation factors from acquisitions and a optimistic 120 foundation factors from productiveness.

– CFO Richard Dierker on Q3/2022 earnings name

So CHD’s gross sales quantity declines outpaced its value initiatives, resulting in declining natural gross sales development. Moreover, regardless of elevating costs by 7.8% YoY, gross margins truly fell 250 bps.

CHD’s headwinds from inflation have induced the inventory to underperform the S&P 500 by 5.7% prior to now yr (Determine 14).

Determine 14 – CHD has underperformed the S&P prior to now yr (Searching for Alpha)

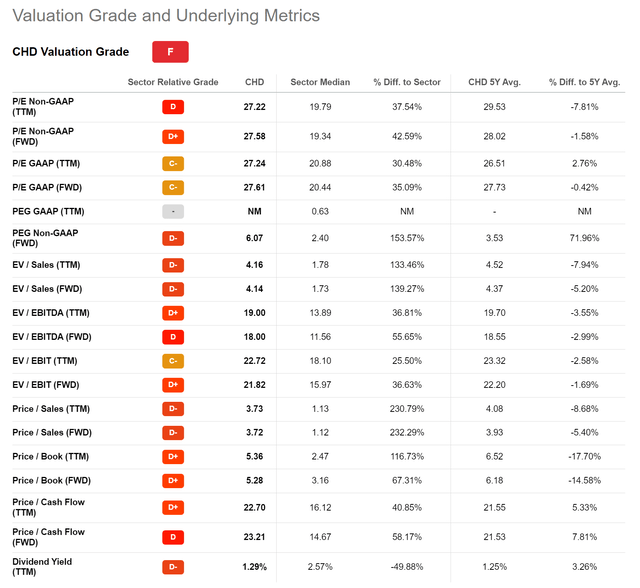

CHD Buying and selling At Premium Valuation With Subpar Development

Regardless of declining by ~20% prior to now yr, CHD’s inventory continues to commerce at a premium valuation of 27.6x Fwd P/E. This determine is 43% increased than the patron staples sector median of 19.3x (Determine 15).

Determine 15 – CHD continues to commerce at a premium valuation (Searching for Alpha)

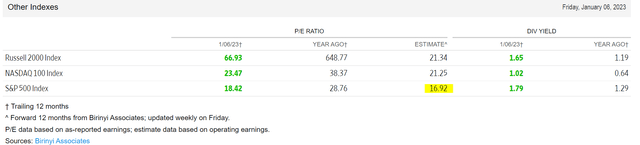

CHD can also be buying and selling at a 63% premium to the S&P 500’s Fwd P/E a number of of 16.9x (Determine 16)

Determine 16 – S&P 500 valuation a number of (wsj.com)

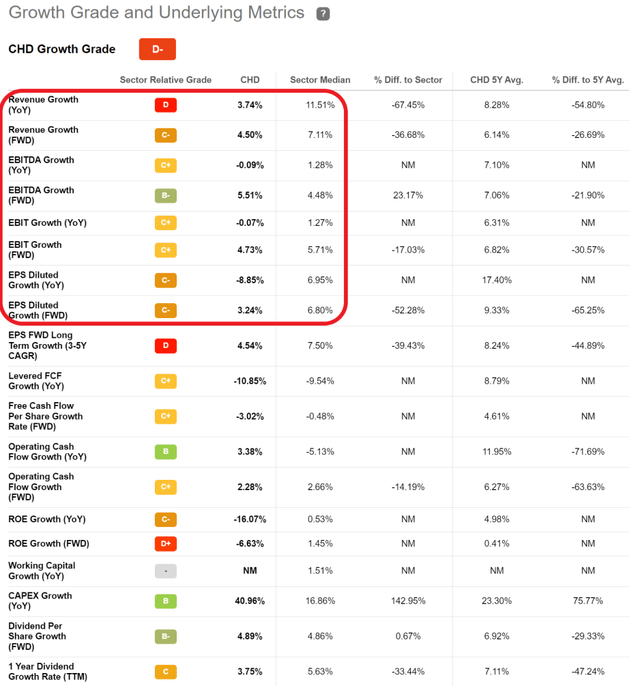

A premium valuation might be justified if CHD is rising at a a lot quicker fee than its peer group and the market. Nonetheless, if we take a look at CHD’s development metrics in Searching for Alpha, we will see that CHD’s income and earnings development have been under its friends each traditionally and on a ahead foundation (Determine 17).

Determine 17 – CHD has grown slower than its friends (Searching for Alpha)

With slower than peer development, it’s onerous to argue for a premium a number of for CHD. If we have been to worth CHD utilizing consensus 2023 EPS of $3.11 and consensus Fwd P/E a number of of 19.3x, CHD needs to be buying and selling at $60 / share, or greater than 25% draw back from CHD’s present inventory value.

Threat To My Name

The obvious upside threat to my name is a fast decline in inflation. Falling inflation may alleviate the margin pressures on CHD, permitting the corporate ample time to reprice its merchandise to realize historic 45% gross margins.

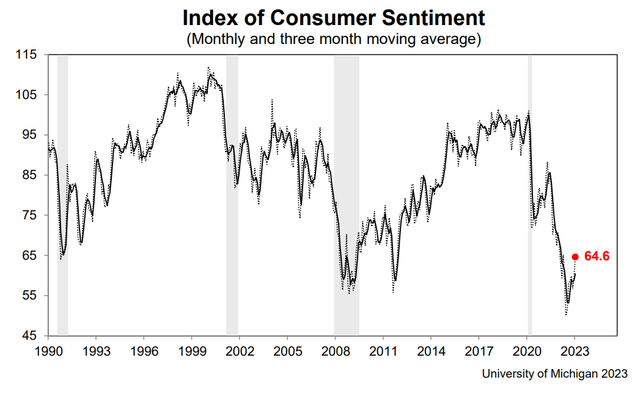

One other threat is that if shopper demand proves to be resilient, CHD’s quantity declines may reverse within the coming quarters. This threat is definitely doable, because the January College of Michigan Client Sentiment survey rebounded sharply to 64.6, far above consensus estimates for 60.5 and December’s 59.7 studying (Determine 18).

Determine 18 – College of Michigan Client Sentiment Survey confirmed sharp rebound in January (College of Michigan)

On the draw back, if the financial system enters a recession within the coming months, as many economists are predicting, then I’d count on CHD’s earnings and valuation to take an additional hit.

Conclusion

Church & Dwight Co. Inc. has been a prime performing shopper merchandise firm, delivering nearly 470% in whole returns since 2011, far outperforming the S&P 500. Nonetheless, with its valuation a number of at an elevated 27.6x Fwd P/E and development slowing to under sector median, I consider CHD is more likely to underperform within the coming years. A sector median Fwd P/E a number of of 19x suggests greater than 25% draw back to present costs.