mgrafx/iStock through Getty Photographs

Introduction

Permit me to begin this text the way in which I begin loads of actual estate-focused articles: By mentioning that I am a choosy actual property investor. Whereas I’ve quite a few REITs on my watchlist, I solely personal two self-storage REITs whereas I’m penning this.

I consider that loads of actual property investments are a waste of cash. The market has some nice performs with subdued yields and excessive progress that generate sturdy whole returns. The market additionally has some slow-growth performs with excessive yields and sluggish progress that additionally generate satisfying whole returns. Within the center, we’re coping with REITs that haven’t any actual edge.

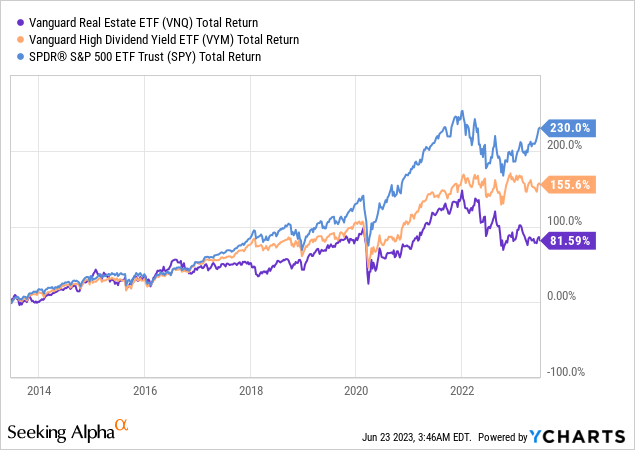

Basically, it is truthful to say that REITs should be dealt with with care. Over the previous ten years, the distinguished actual property ETF (VNQ) has returned simply 82%. The S&P 500 returned 230%. Excessive-yield shares returned 156%.

On this article, I wish to current a conservative REIT play. AvalonBay Communities (NYSE:AVB) is the nation’s largest residential REIT with a portfolio of top-tier belongings in nice areas.

It comes with an honest yield and an A-rated stability sheet on prime of a low-volatility inventory value historical past.

Nevertheless, in gentle of present financial (actual property) woes, I can even clarify why its conservative yield might be a little bit of a problem, as even faster-growing friends supply comparable or larger yields on account of inventory value weak spot.

Now, let’s get to it!

What’s AVB?

AvalonBay is the biggest residential REIT in america. The corporate focuses on creating, buying, proudly owning, and working multifamily residence communities.

Its strategic focus is on main metropolitan areas characterised by sturdy employment progress, excessive value of homeownership, and various high quality of life.

Whereas I am unsure what range has to do with the technique of a residential REIT, the corporate is correct when it focuses on areas with a excessive value of homeownership. In any case, that is when renting turns into extra enticing, particularly within the present surroundings of mortgage charges near 7% on prime of elevated dwelling costs.

As of January 31, 2023, AvalonBay owned or held possession pursuits in 275 working residence communities, masking 82,411 residence properties throughout 12 states and the District of Columbia.

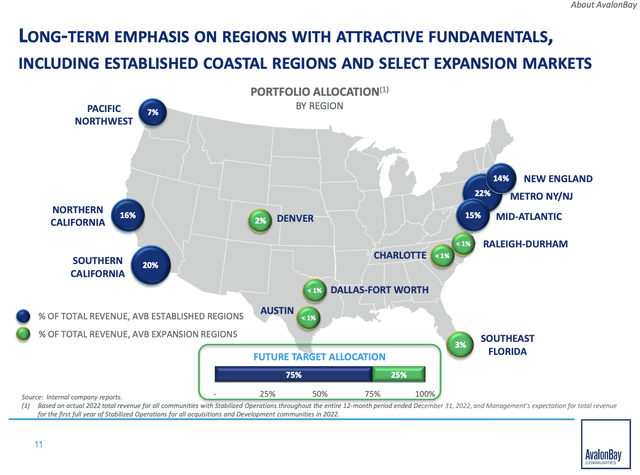

Most of its belongings are positioned in California and the NY/NJ metro space, which is smart, given the corporate’s feedback on affordability. The corporate targets to take a position roughly 75% of its cash in these areas, which implies this regional breakdown will not see main modifications sooner or later.

AvalonBay Communities

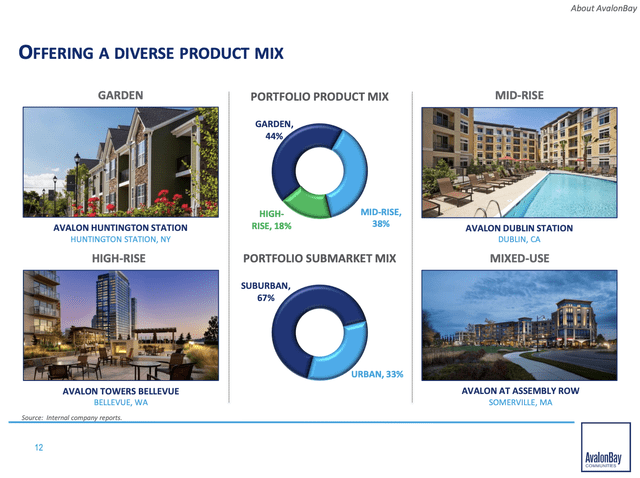

Moreover, 44% of its belongings include some type of a backyard. 38% of its belongings are mid-rise buildings. Solely 18% are high-rise residences.

I consider that is a positive asset combine, as I am not eager to put money into corporations that primarily supply high-rise properties. I consider that the pandemic has prompted a long-term shift in direction of different housing choices.

AvalonBay Communities

Moreover, the corporate operates 4 core manufacturers, every focusing on particular buyer segments and submarkets.

- The Avalon model focuses on upscale residence residing and high-end facilities.

- AVA targets high-energy, transit-served neighborhoods with smaller residences designed for roommates and energetic widespread areas.

- Eaves by Avalon caters to the value-conscious section in suburban areas.

- The Kanso model, launched in 2020, gives a reasonable value level, simplicity, and high-quality residence properties with out in depth neighborhood facilities, using know-how and sensible entry.

With that mentioned, in its 2022 10-Okay, the corporate talked about that it goals to ship superior risk-adjusted returns by investing in markets with (the aforementioned) favorable traits.

I’ve to say that the corporate is doing precisely that.

A Favorable Danger/Adjusted Efficiency

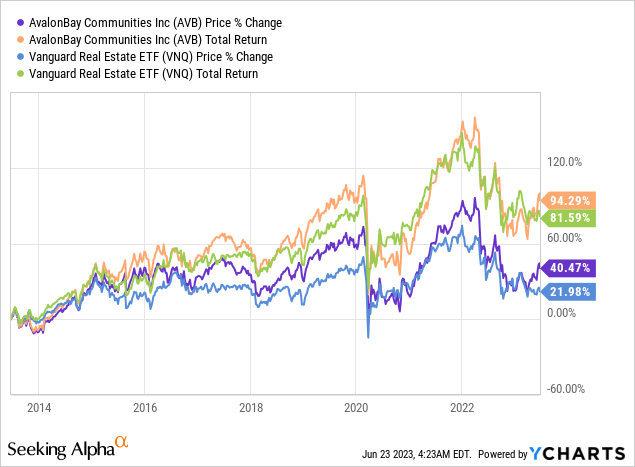

Over the previous ten years, AVB has returned 94%, which beats the VNQ ETF by roughly 13 factors. Word that each belongings nearly transfer in lockstep. It additionally implies that AVB has underperformed the S&P 500 by a large margin throughout this time interval, as VNQ did not sustain with the market and its non-REIT high-yield friends.

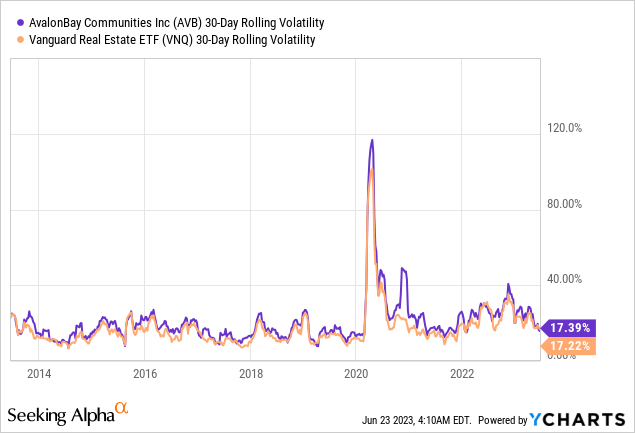

Whereas AVB’s inventory value is not quickly rising, it nonetheless has one main benefit: It has very low volatility. Wanting on the chart under, we see that AVB shares are barely extra unstable than the VNQ ETF. That is outstanding, as we’re evaluating a single inventory to a basket of greater than 160 shares.

It is smart, as AVB has a low-risk portfolio. It is not depending on shopper well being like retail REITs, industrial demand, or different cyclical points.

The corporate additionally comes with an honest yield and a robust dividend observe report.

About Its Dividend

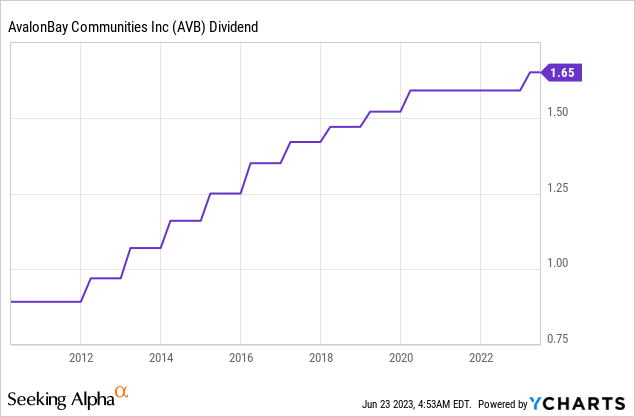

AvalonBay at present pays a $1.65 per share per quarter dividend. This interprets to a yield of three.6%. The VNQ ETF yields 4.3%. The median sector yield is 5.0%.

In different phrases, AVB has a below-average yield.

On this case, it helps that the corporate has a well-covered dividend with a fantastic observe report.

Whereas the corporate did not hike its dividend throughout the pandemic, traditionally it hiked its dividend on a constant foundation, even throughout the Nice Monetary Disaster, when loads of REITs (even in housing) needed to minimize their payout.

- On common, over the previous ten years, the dividend has been hiked by 4.9% per yr.

- That quantity has fallen to 2.3% on a five-year foundation on account of the pandemic.

- The latest hike was on February 8, when the corporate hiked by 3.8%.

- The corporate’s adjusted funds from operations (“AFFO”) payout ratio is 70%, which is under the median sector payout ratio of 75%.

The excellent news continues, as AVB’s dividend can also be backed by a wholesome stability sheet and a robust monetary efficiency regardless of ongoing woes in the actual property market.

Enterprise Replace & Stability Sheet

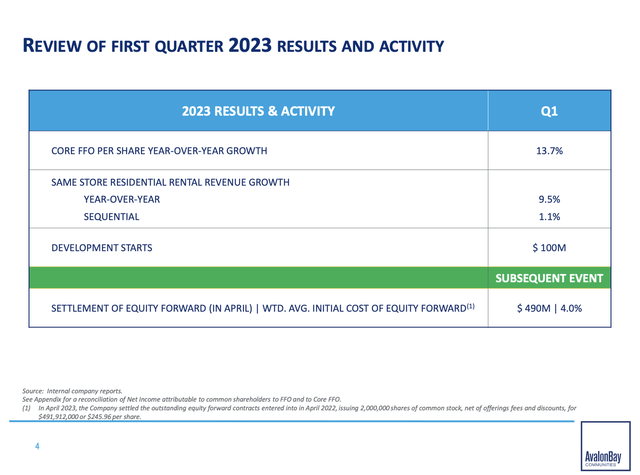

For instance, within the first quarter, AVB skilled vital earnings progress, with core FFO rising by 13.7%.

AvalonBay Communities

This efficiency was primarily pushed by the roll-through of leases signed the earlier yr. Moreover, rents continued to develop throughout Q1, with a 4.1% change in like-term efficient lease.

Moreover, AvalonBay exceeded its core FFO steerage by $0.05 per share, primarily on account of better-than-expected assortment charges from residents, decrease working bills, curiosity earnings, and different objects.

The corporate drew down the proceeds of its fairness ahead, leading to further capital to fund improvement tasks. The money from the drawdown was invested at 5% rates of interest, resulting in incremental earnings and a rise within the 2023 core FFO steerage by $0.10 per share on the midpoint.

Including to that, there are a selection of tailwinds that profit the corporate.

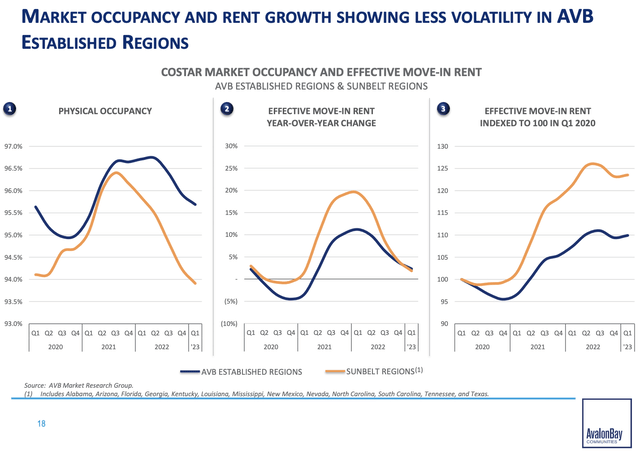

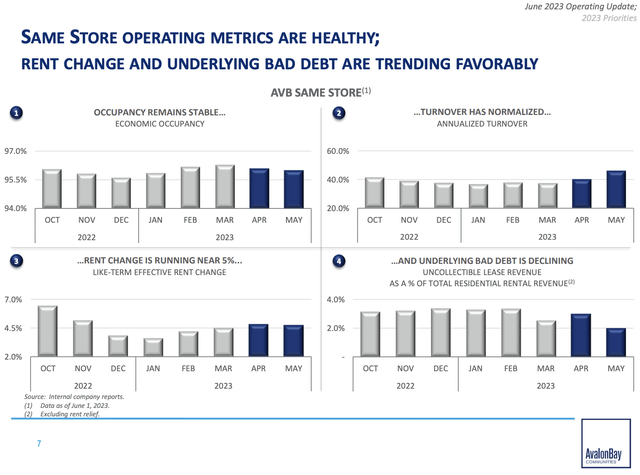

- AvalonBay’s established areas skilled much less volatility in occupancy and lease developments in comparison with the Sunbelt areas. In accordance with the corporate, this stability may be attributed to rent-to-income ratios being according to conventional ranges and restricted single-family dwelling stock on prime of upper curiosity prices, making renting extra economically favorable in its markets. The corporate had a 96% occupancy price on the finish of Might.

AvalonBay Communities

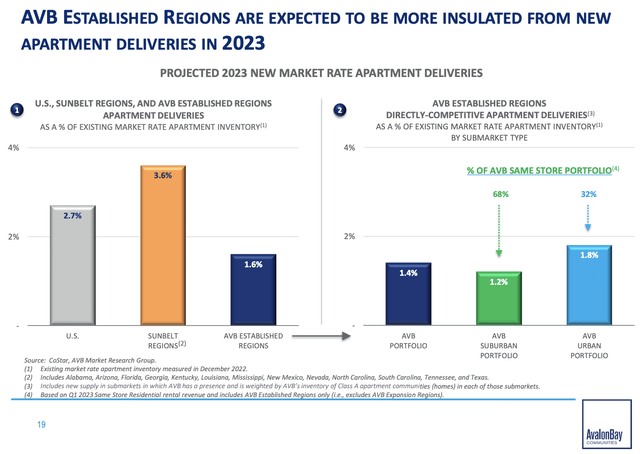

- The provision image in AvalonBay’s suburban coastal portfolio is constructive, with fewer new provide additions anticipated within the established areas (1.6% of present inventory/stock) in comparison with Sunbelt markets (3.6%). When contemplating provide straight competing with AvalonBay’s portfolio, the degrees are even decrease, at 1.4% of inventory total and 1.2% in suburban markets, which comprise a good portion of the corporate’s portfolio. These numbers are backed by feedback from different corporations that famous regulatory and value headwinds to construct new properties/buildings in states like California.

AvalonBay Communities

Throughout its 1Q23 earnings name, the corporate famous shifts within the improvement market as a result of Federal Reserve’s tightening actions in current quarters. Rivals are suspending or abandoning deliberate tasks on account of scarce third-party financing.

Therefore, efficient rents on the East and West coasts have elevated by 10% from pre-COVID ranges. Regardless of these price hikes, the corporate famous that dangerous debt (uncollected rents) declined to 2% in Might, which is a brand new low.

AvalonBay Communities

Talking of the Fed and the super strain it places on corporations with weak stability sheets, I am glad that AVB is in a a lot better spot.

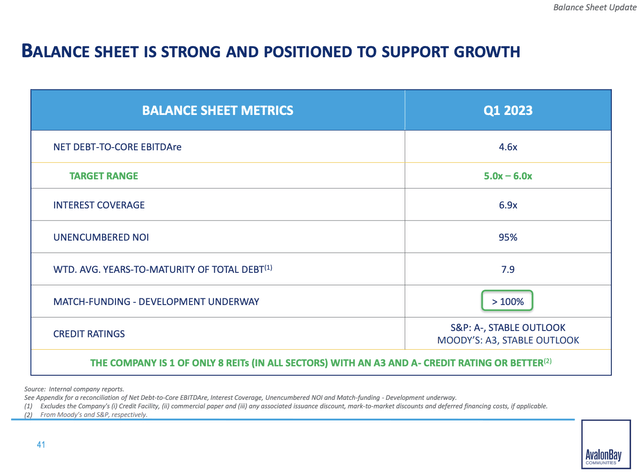

AvalonBay enjoys low leverage with a internet debt-to-EBITDA ratio of 4.6x, under the goal vary of 5x to 6x. The curiosity protection ratio and unencumbered NOI share are at near-record ranges of 6.9x and 95%, respectively.

AvalonBay Communities

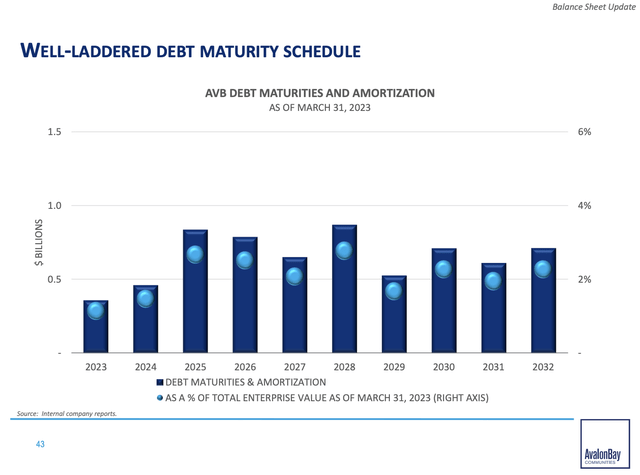

Furthermore, the corporate’s debt maturities are properly distributed, with weighted common years to maturity of about eight years, which buys loads of time within the present high-rate surroundings.

AvalonBay Communities

However wait, there’s extra.

The corporate has vital out there liquidity, which secures future funding alternatives.

As well as, as disclosed in our launch, we additionally loved super liquidity of about $2.8 billion immediately, with no borrowings underneath our $2.25 billion unsecured credit score facility and an extra $0.5 billion from simply having settled our fairness ahead that we originated a yr in the past. In consequence, we need not faucet the capital markets for an prolonged time, and we’re properly positioned to lean into our stability sheets to benefit from future funding alternatives that will emerge in our markets over time.

Because of its secure enterprise and wholesome stability sheet, the corporate enjoys an A3/A- credit standing.

Valuation & One Concern

Because of favorable developments in its markets – regardless of macroeconomic headwinds – AVB elevated its full-year core FFO steerage to $10.41 per share on the midpoint, a rise of $0.10 per share.

The steerage adjustment consists of further income from Q1 and Q2, improved working bills for the total yr, and extra core FFO from curiosity earnings on the fairness ahead proceeds, money administration, and up to date transaction timing assumptions. Similar-store steerage ranges had been unchanged.

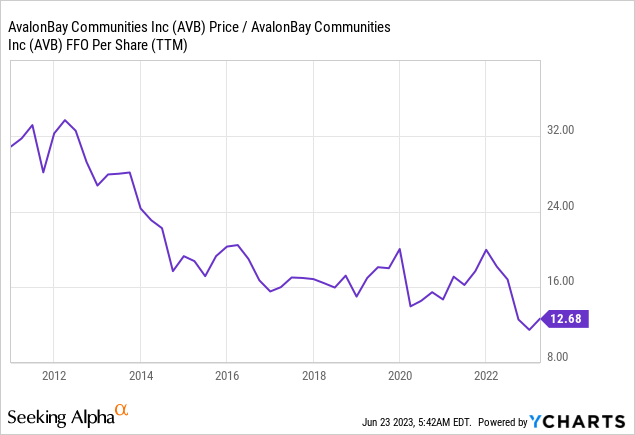

Primarily based on these numbers, AVB is buying and selling at 17.8x 2023E core FFO. The median sector valuation is 12.4x FFO.

Given the corporate’s historic valuation vary, it is a truthful worth, but nothing to put in writing dwelling about, as traders have basically included the corporate’s resilience within the present inventory value.

The present consensus value goal is $195, which is 5.4% above the present value. I agree with that.

With that mentioned, as a lot as I really like the corporate’s stability and consistency, we’re now in a market the place loads of shares have bought off, providing larger yields than AVB. Whereas most of those investments include larger dangers, in addition they include the next yield and typically larger long-term progress expectations.

Though AVB shares are buying and selling 28% under their all-time excessive, I would like to purchase corporations with larger dangers (and better potential rewards) at these ranges. This consists of self-storage and faster-growing residential REITs like Mid-America House Communities (MAA), which I mentioned on this article.

Whereas I’ll give AVB a purchase ranking, it is not a high-conviction decide, as I consider that AVB is especially for conservative traders who prefer to keep away from ETFs.

For sure, I stick to each bullish factor I’ve mentioned on this article. I am primarily avoiding AVB as a result of I am searching for a distinct danger/reward and extra aggressive progress.

Professionals & Cons

Professionals:

- Secure and constant efficiency.

- Low volatility.

- Sturdy dividend observe report.

- Diversified actual property portfolio.

- Wholesome stability sheet.

Cons:

- Beneath-average yield.

- Reasonable progress potential.

- Increased valuation in comparison with the sector.

- Competitors from higher-yielding shares.

Takeaway

AvalonBay Communities stands out as a conservative REIT possibility with its deal with top-tier residential belongings in prime areas. Whereas AVB gives an honest yield and boasts a robust dividend observe report, its conservative nature could restrict its enchantment in comparison with higher-yielding, faster-growing alternate options.

AVB’s secure efficiency and low volatility, together with a positive risk-adjusted return over the previous decade, make it a pretty alternative for conservative traders in search of stability.

With its well-covered dividend, wholesome stability sheet, and resilient enterprise mannequin, AVB gives a dependable possibility within the residential REIT house.

Nonetheless, for traders in search of larger yields and extra aggressive progress, exploring different choices may be the way in which to go.

As a lot as I like AVB, it in the end is dependent upon particular person danger preferences and progress expectations.