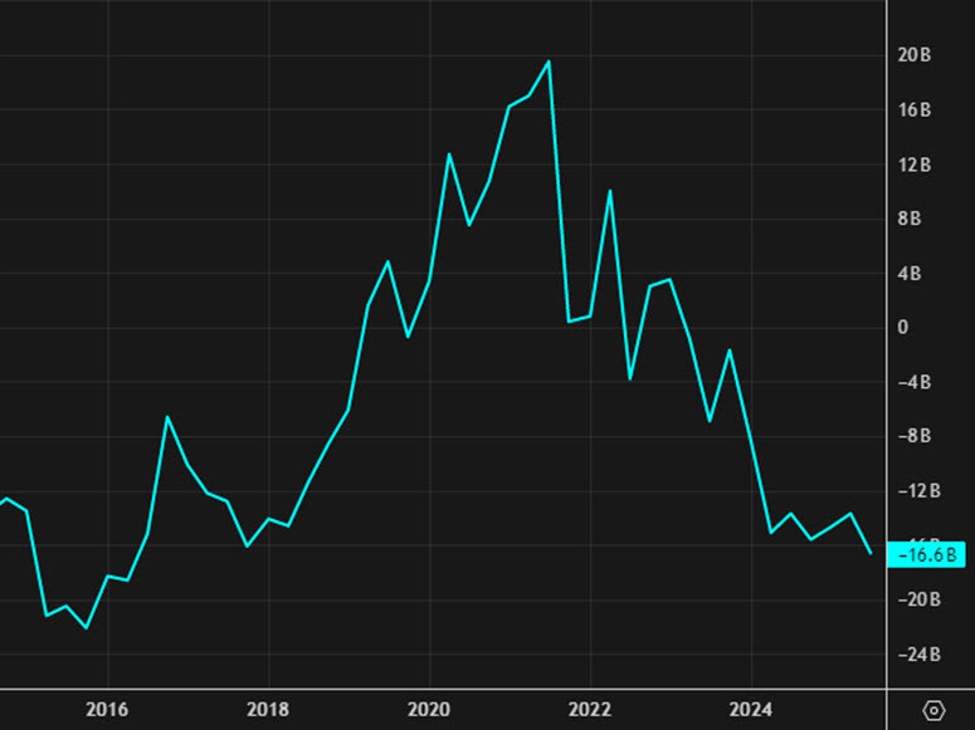

- Prior was -13.7B (revised to -16.15B)

- Internet exports contribution -0.% vs -0.1% anticipated

-

Items and Companies Stability: +$2.49bn vs +$2.78bn prior

-

Internet Major Revenue: -$18.69bn vs -$18.99bn prior.

-

Phrases of Commerce: +0.3% q/q.

That is the worst studying since 2016. The ABS notes that the autumn was led by the web secondary earnings deficit widening, although this was partially cushioned by an enchancment in web major earnings.

For merchants eyeing tomorrow’s Q3 GDP print, the important thing takeaway right here is the web export contribution. The stability on items and companies is predicted to detract 0.1 proportion factors from the headline development determine. It’s not a large drag, but it surely’s a headwind nonetheless for the Australian economic system. The consensus tomorrow is +0.7% q/q and +2.2% y/y.