Australian Greenback, AUD/USD, Chinese language Knowledge, Rising Wedge – Asia Pacific Market Open

- Australian Greenback falls on disappointing Chinese language knowledge

- Slowing China has draw back penalties for Australia

- AUD/USD bearish reversal warnings proceed rising

Advisable by Daniel Dubrovsky

The best way to Commerce AUD/USD

The Australian Greenback weakened barely within the wake of a disappointing spherical of key Chinese language financial figures. Industrial manufacturing rose simply 2.2% y/y in November versus the three.5% estimate. This represents a slowdown from 5.0% in October.

In the meantime, retail gross sales shrank 5.9% y/y for a similar interval, a lot worse than the -4.0% consensus. This additionally represents an acceleration from the -0.5% hunch in October. That is because the surveyed jobless price climbed to five.7% versus the 5.6% estimate, rising from 5.5% prior.

China is Australia’s largest buying and selling companion. As such, financial outcomes within the former usually suggest knock-on impacts for the latter. On this case, a slowing China might damage Australia’s output down the highway, maybe inspiring the Reserve Financial institution of Australia to regulate its coverage course.

Furthermore, China is an outward-facing financial system that continues to be weak within the wake of slowing international progress triggered by the quickest tightening by central banks in many years. Which may offset among the anticipated boosts to Covid restrictions being eased in current weeks.

Now, the sentiment-linked Australian Greenback awaits the European Central Financial institution and Financial institution of England December rate of interest bulletins. All eyes are on the ECB’s method to quantitative tightening and financial updates from the BoE. The risk of volatility after the Fed is not quite over yet.

AUD/USD Market Response to China Knowledge

Chart Created in TradingView

Australian Greenback Technical Evaluation

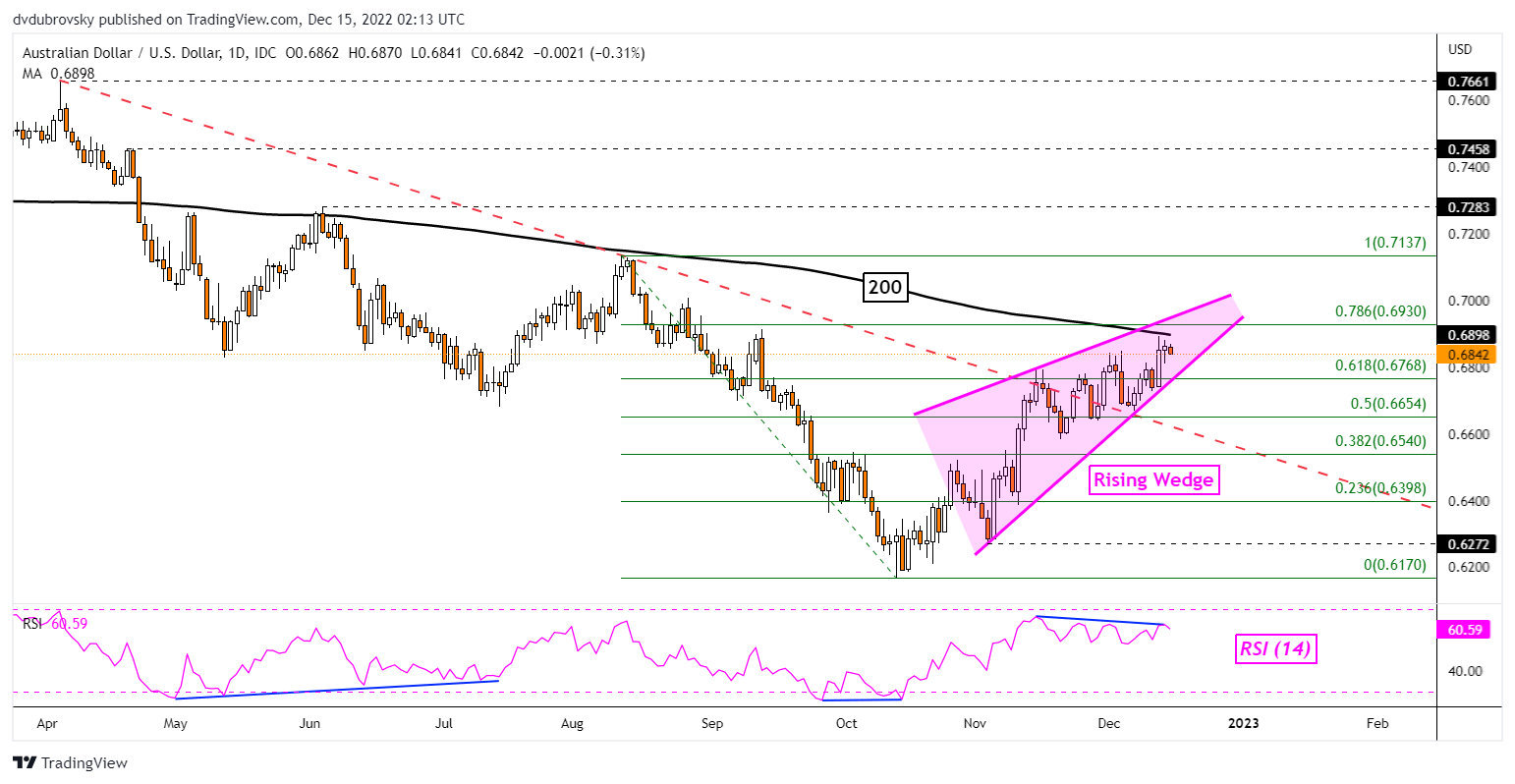

On the every day chart, the Australian Greenback seems to be buying and selling inside a bearish Rising Wedge chart formation. Since costs stay throughout the boundaries of the sample, the development might stay upward. However, a draw back breakout dangers opening the door to resuming the broader downtrend from earlier this yr. In the meantime, destructive RSI divergence reveals that upside momentum is fading. That may at instances precede a flip decrease. That is because the 200-day Easy Shifting Common stays in play as key resistance.

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication

AUD/USD Each day Chart

Chart Created in TradingView

— Written by Daniel Dubrovsky, Senior Strategist for DailyFX.com

To contact Daniel, comply with him on Twitter:@ddubrovskyFX