Australian Greenback, AUD/USD, GDP, S&P ASX 200, CPI, RBA -Speaking Factors

- The Australian Greenback has misplaced floor after GDP disillusioned

- Stagflation would possibly undermine the prospect of a delicate touchdown

- The RBA is anticipated to hike subsequent week. Is that good or dangerous for AUD?

Commerce Smarter – Join the DailyFX Publication

Obtain well timed and compelling market commentary from the DailyFX staff

Subscribe to Publication

The Australian Greenback sunk beneath 67 cents after 4Q quarter-on-quarter GDP got here in at 0.5% moderately than the 0.8% forecast and in opposition to the earlier 0.7% that was revised up from 0.6%.

Annual GDP to the top of December was 2.7% as anticipated reveal extra upward revisions to prior quarters. The prior learn was 5.9%..

As we speak’s GDP figures arrive forward of the Reserve Financial institution of Australia’s financial coverage assembly subsequent Tuesday. They’re anticipated to extend their money price goal by 25 foundation factors (bp) to three.60%. In the event that they do, it will likely be the tenth hike for the reason that lift-off in Could final yr.

The most recent inflation learn is manner above the RBA’s goal band of 2-3% at 7.8% year-on-year. As we speak’s knowledge comes on the again of yesterday’s retail gross sales and present account.

The fourth quarter present account surplus got here in at AUD 14.1 billion in opposition to AUD 5.5 forecast and the earlier print revised as much as AUD 0.8 billion from AUD -2.3 billion.

Month-on-month retail gross sales for January have been up 1.9% moderately than 1.5% anticipated and -4.0% prior.

The elemental knowledge factors towards combined indicators for the financial system however the RBA appear to have little selection however to tighten additional within the close to time period with inflation so rampant.

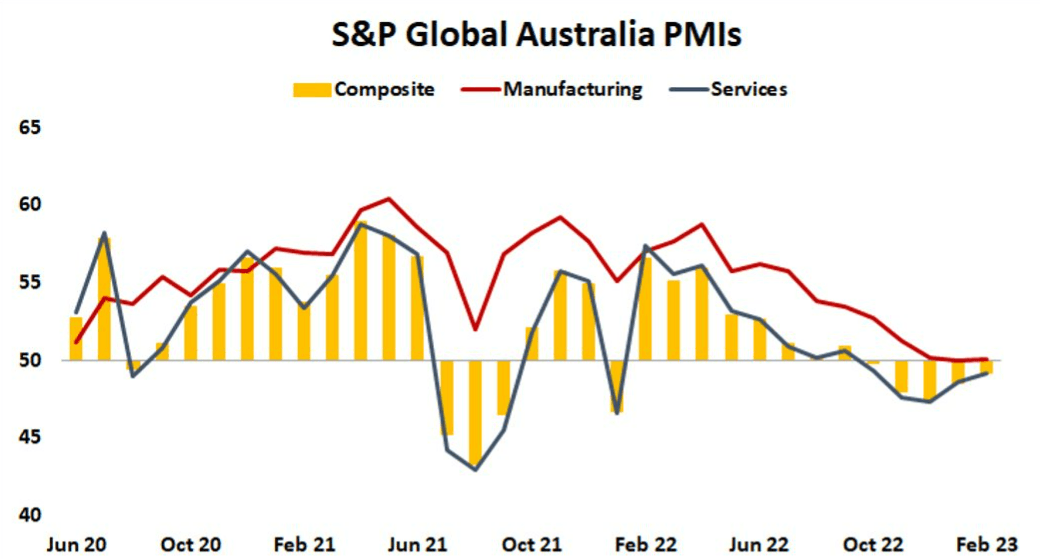

The image down the observe appears to be considerably opaque with a excessive diploma of uncertainty. Some main indicators could be a harbinger of the headwinds forward. Housing costs have continued to slide decrease and enterprise sentiment surveys are deteriorating.

Supply; Bloomberg

Supply; Bloomberg

Probably compounding the issue might be the so-called ‘mortgage cliff’ the place fastened price debtors shall be re-adjusting the repayments at over 300 bp greater.

All of this illustrates the tough street forward for the RBA. The most recent unemployment knowledge confirmed the labour market loosening a fraction however nonetheless comparatively tight by historic measures with the unemployment price at 3.7%. Reining in worth pressures at a time of softening combination demand would possibly result in deepening stagflation.

This state of affairs could be bearish for AUD/USD however in flip, a decrease trade price might help the home financial system, particularly if China is ready to ignite its progress plans. The upcoming Nationwide; Folks’s Congress (NPC), which begins this weekend, might provide some insights into this prospect.

Beneficial by Daniel McCarthy

The right way to Commerce AUD/USD

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel through @DanMcCathyFX on Twitter