AUD/USD OUTLOOK

- AUD/USD sinks to its lowest degree since November 2022 as U.S. yields vault to contemporary multi-year highs.

- This text seems at key technical ranges price watching within the coming days.

- IG consumer sentiment information factors to additional weak spot for the Aussie.

Commerce Smarter – Join the DailyFX E-newsletter

Obtain well timed and compelling market commentary from the DailyFX crew

Subscribe to E-newsletter

Most Learn: USD/JPY Smacked Decrease by Potential FX Intervention. Will the Bulls Reload?

AUD/USD TECHNICAL ANALYSIS

AUD/USD fell sharply and sank to its lowest degree in practically a 12 months on Tuesday, weighed down by hovering U.S. charges and risk-off sentiment on Wall Road. By the use of context, bond yields vaulted to contemporary multi-year highs throughout the U.S. buying and selling session after better-than-expected U.S. labor market information (JOLTS) strengthened the case for additional Fed tightening and better rates of interest for longer.

By way of technical evaluation, AUD/USD accelerated its descent and headed in the direction of the psychological 0.6300 mark after breaching help at 0.6350 earlier within the day. With sellers firmly answerable for the market, it could be a matter of time earlier than we see an assault on 0.6275. Whereas costs are more likely to set up a base on this space, a breakdown might open the door to a retest of final 12 months’s lows.

Within the occasion that AUD/USD turns round and begins to get well, preliminary resistance is situated close to the 0.6350 area. Efficiently piloting above this key ceiling might lure new consumers into the market, rekindling upward momentum and setting the stage for a doable transfer towards 0.6460. On additional energy, the bulls might develop into emboldened to launch an assault on the 0.6500 deal with.

For a whole overview of the Australian Greenback’s technical and basic prospects within the coming months, make sure that to seize your complimentary This fall buying and selling information for the Aussie. It’s free!

Beneficial by Diego Colman

Get Your Free AUD Forecast

AUD/USD TECHNICAL CHART

AUD/USD Chart Ready Utilizing TradingView

AUD/USD MARKET SENTIMENT

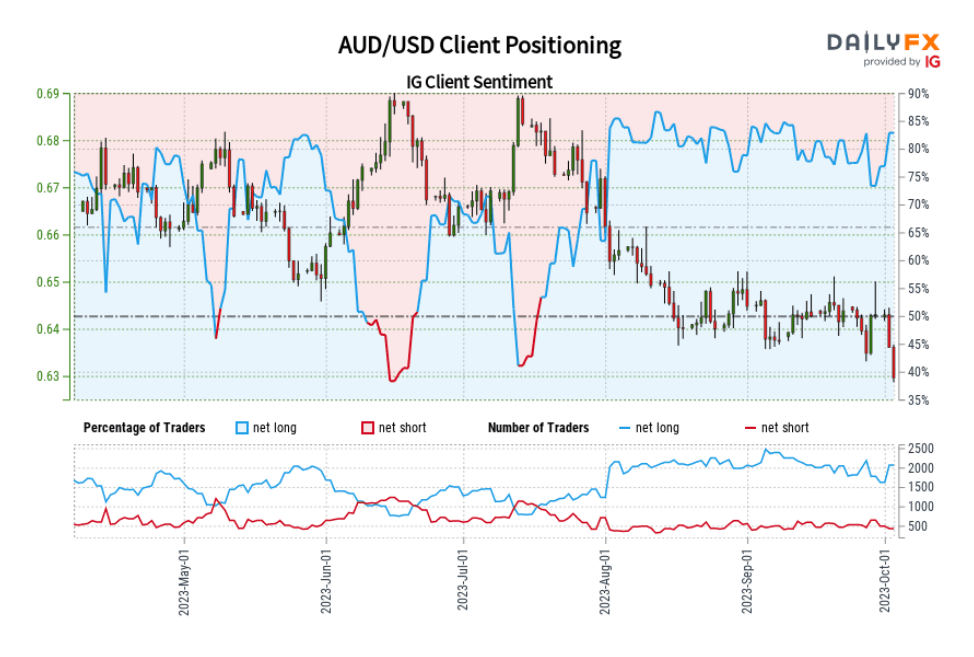

Sentiment information from IG exhibits that 84.57% of merchants are net-long, with the bullish-to-bearish ratio standing at 5.48 to 1 on the time of writing. The tally of purchasers who’re internet lengthy has risen by 18.19% since yesterday and by 7.42% over the earlier week. In the meantime, the variety of merchants net-short is down 22.28% from the earlier session and 22.14% from seven days in the past.

Taking a opposite stance on crowd sentiment, the rising bullish positions on AUD/USD, compared to each yesterday’s tally and the degrees witnessed final week, sign the potential for continued weak spot within the foreign money pair.

Uncover the ability of crowd mentality. Obtain our free sentiment information to decipher how shifts in AUD/USD’s positioning can act as key indicators for upcoming worth actions.

| Change in | Longs | Shorts | OI |

| Every day | 14% | -8% | 10% |

| Weekly | 6% | -19% | 1% |

Supply: IG Shopper Sentiment Knowledge