Australian Dollar, AUD/USD, China PMI, Market Sentiment, Technical Forecast – Talking Points

- Risk-off Wall Street move threatens to drag Asia-Pacific markets on Friday

- Chinese PMI data may help revive APAC sentiment if the data beats estimates

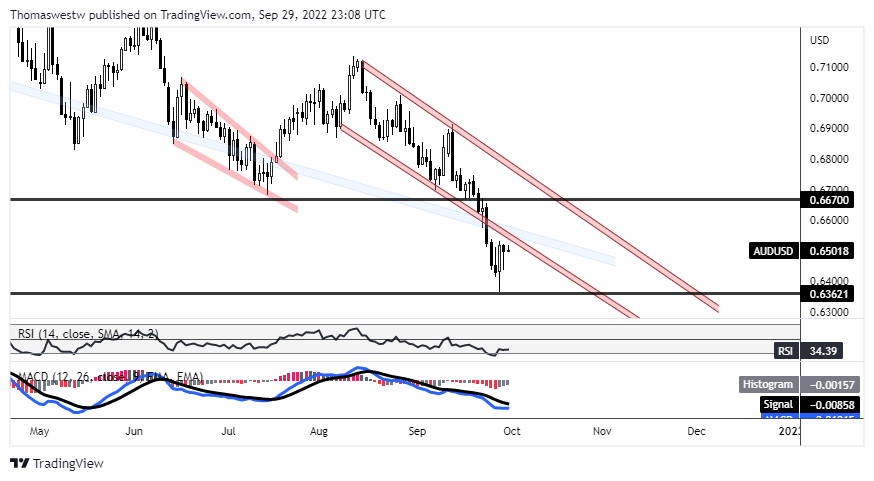

- AUD/USD eyes recently surrendered channel range as oscillators stagnate

Discover what kind of forex trader you are

Friday’s Asia-Pacific Outlook

Asia-Pacific equity markets are at risk after US stocks fell overnight, led lower by a big 4.91% drop in Apple stock, a heavily-weighted S&P 500 component. Several Federal Reserve members, including Mary Daly and James Bullard, beat the drum on the FOMC’s hawkish outlook, which kept Fed funds futures stiffly priced. Rate traders see a 68% chance that the Fed hikes by 75-basis points at the November 02 meeting. The US Dollar DXY Index dropped for a second day, however, likely letting steam out after an outsized move over the past several weeks.

The Australian Dollar is in focus ahead of Chinese economic data on tap. The National Bureau of Statistics (NBS) is set to report the data for the manufacturing and services sectors at 01:30 UTC, with analysts expecting those purchasing managers’ indexes (PMIs) to cross the wires at 49.7 and 52.4. That would be little changed from 49.4 and 52.6 in August, although a surprise move above 50 in manufacturing may spur some upside in iron ore and other industrial steel prices. That would likely bode well for the beaten-down AUD/USD.

The Caixin PMI manufacturing gauge, a PMI that focuses on smaller-sized firms compared to NBS data, is due out shortly after at 01:45 UTC. The Chinese Yuan gained nearly 1% overnight against the Greenback, but USD/CNH remains above the 7 level, and 1-week risk reversals show traders remain biased towards call options. Iron ore prices in China are down more than 5% from the September high set two weeks ago. The Australian Dollar is on the back foot against its major peers, with EUR/AUD rising to its highest level since July.

Elsewhere, Japan is due to print an August update on its unemployment rate, and industrial production and retail sales data for the same period are due out. Analysts see retail sales rising to 2.8% from a year ago, which would be up from July’s 2.4%. The Reserve Bank of India (RBI) is poised to hike its benchmark rate to 5.9%. USD/INR is on track to record a monthly gain of around 2.5%.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

Australian Dollar – Technical Forecast

The Australian Dollar, after setting a fresh 2022 low this week against the US Dollar, is drifting back towards channel support. Prices broke that channel range to the downside late last week. If prices retake the former support level (which may serve as resistance now), it may put prices on a better footing.

AUD/USD – Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter