Australian Greenback, AUD/USD, PBOC, Australian Jobs report, BoJ – Speaking Factors

- Asia-pacific markets set to open the buying and selling week with eyes on Ukraine battle

- A number of high-impact occasions later this week might put merchants in cautious stance

- AUD/USD to proceed grappling with the 200-day Easy Shifting Common

Monday’s Asia-Pacific Outlook

Asia-pacific markets face one other doubtlessly risky week amid ongoing tensions in Ukraine as Russian troops advance additional towards Kyiv, Ukraine’s capital metropolis. Peace talks between the 2 international locations have continued however with little progress to indicate regardless of immense strain on the Russian financial system from Western sanctions. The chance-sensitive Australian Greenback fell versus the US Greenback final week, reversing the development larger in latest weeks as iron ore costs helped underpin the Australian forex.

The Aussie Greenback might have additionally been harm by a slowdown in credit score progress in China. Final week, the Folks’s Financial institution of China (PBOC) reported February new Yuan loans at 1.23 trillion. That was down from January when new lending hit a file 3.98 trillion Yuan. The information indicators that lending circumstances in Asia’s financial engine slowed, which may strain Beijing to help extra stimulus within the close to time period. That may probably assist AUD going ahead, however the central financial institution might stay cautious amid the continued warfare in Ukraine.

Australia’s February job report would be the most important occasion for the APAC area this week. Analysts count on to see Australia add 40k jobs in February whereas trimming the unemployment fee down by 0.1% to 4.1%, based on a Bloomberg survey. A greater-than-expected determine would probably encourage some confidence in AUD/USD. New Zealand can also be set to report gross home product (GDP) progress knowledge for the fourth quarter. That determine is predicted to cross the wires at 3.3%, up from -0.3% in Q3.

Later this week, the Financial institution of Japan will announce an rate of interest choice. The Japanese Yen has carried out nicely towards a lot of its counterparts in latest weeks, aided by safe-haven flows. Nonetheless, the US Greenback has managed to outbid the haven forex, aided by its personal safe-haven standing. Furthermore, the US Federal Reserve is predicted to hike its benchmark fee by 25 foundation factors on Wednesday, giving the Fed a further rate of interest differential benefit towards the BoJ.

Right this moment will see retail worth index knowledge out of the Philippines together with inflation and auto gross sales knowledge from India cross the wires. Hong Kong’s fourth-quarter industrial manufacturing figures are additionally due out. Merchants might take a cautious method to buying and selling immediately given the a number of high-impact occasions that lie forward within the coming days, however the state of affairs in Ukraine nonetheless poses a big potential to inject acute volatility into international monetary markets.

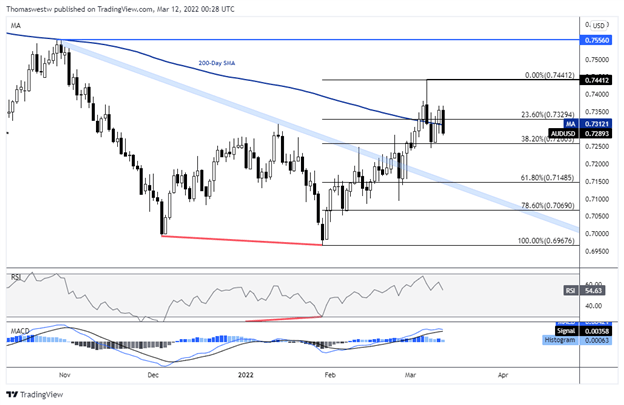

AUD/USD Technical Forecast

AUD/USD’s dance across the 200-day Easy Shifting Common (SMA) might proceed immediately. Bulls will look to climb again above the extent for a potential shot at taking out the 2022 excessive at 0.7441. Alternatively, bears will look to carry costs down. A drop beneath the 38.2% Fibonacci retracement might open the door for some weak spot. The MACD and RSI oscillators are exhibiting indicators of weakening late final week, which may put the general bias to the draw back immediately.

AUD/USD Every day Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the feedback part beneath or @FxWestwater on Twitter