- Crude oil and AUD wrestle on obscure Chinese language stimulus measures

- Experiences counsel Israel could not assault Iranian oil property, sending crude sharply decrease

Overview

Already on the backfoot because of a scarcity of element from China’s stimulus replace over the weekend, the value and had been hit with even larger headwinds late within the North American session on stories Israel is unlikely to assault Iranian power property in retaliation for a missile strike earlier this month.

Citing two officers aware of negotiations, the Washington Submit reported that Israeli Prime Minister Benjamin Netanyahu advised US officers that Israel is ready to strike Iranian navy targets, somewhat than its power or nuclear services.

Crude Crushed as Geopolitical Danger Premium Unwinds

With a geopolitical threat premium constructed into the worth, the headlines generated a direct and enormous response in crude oil markets, seeing front-month and WTI contracts tumble round 5%.

WTI on the day by day chart, you’ll be able to see the big bearish candle generated by the report, seeing the worth slice by means of the uptrend courting again to the lows caught on October 1.

The worth is now approaching $71.07, a degree which has acted as each assist and resistance over latest months. Given its proximity, it gives an honest degree to construct setups round relying on how the worth interacts with the extent.

RSI (14) has damaged the uptrend it was sitting in from late October, producing a bearish sign on momentum which is but to be confirmed by MACD. Whereas latest headlines are undoubtedly bearish for crude, I’ve been round lengthy sufficient to know that bearish or bullish fundamentals doesn’t at all times equate to bearish or bullish value motion.

If the worth had been to interrupt $71.07 and maintain there, one choice could be to promote with a good cease above the extent for defense. Attainable targets embrace $70 and $66.33. The three-candle night star sample accomplished with the most recent leg decrease warns of elevated draw back dangers.

Alternatively, if we noticed a take a look at and bounce from $71.07, you could possibly flip the commerce round, initiating longs with a good cease beneath for defense. Potential targets embrace $74.46 or $76 the place the worth struggled to interrupt above late final week.

AUD/USD Weak spot Displays China Disappointment

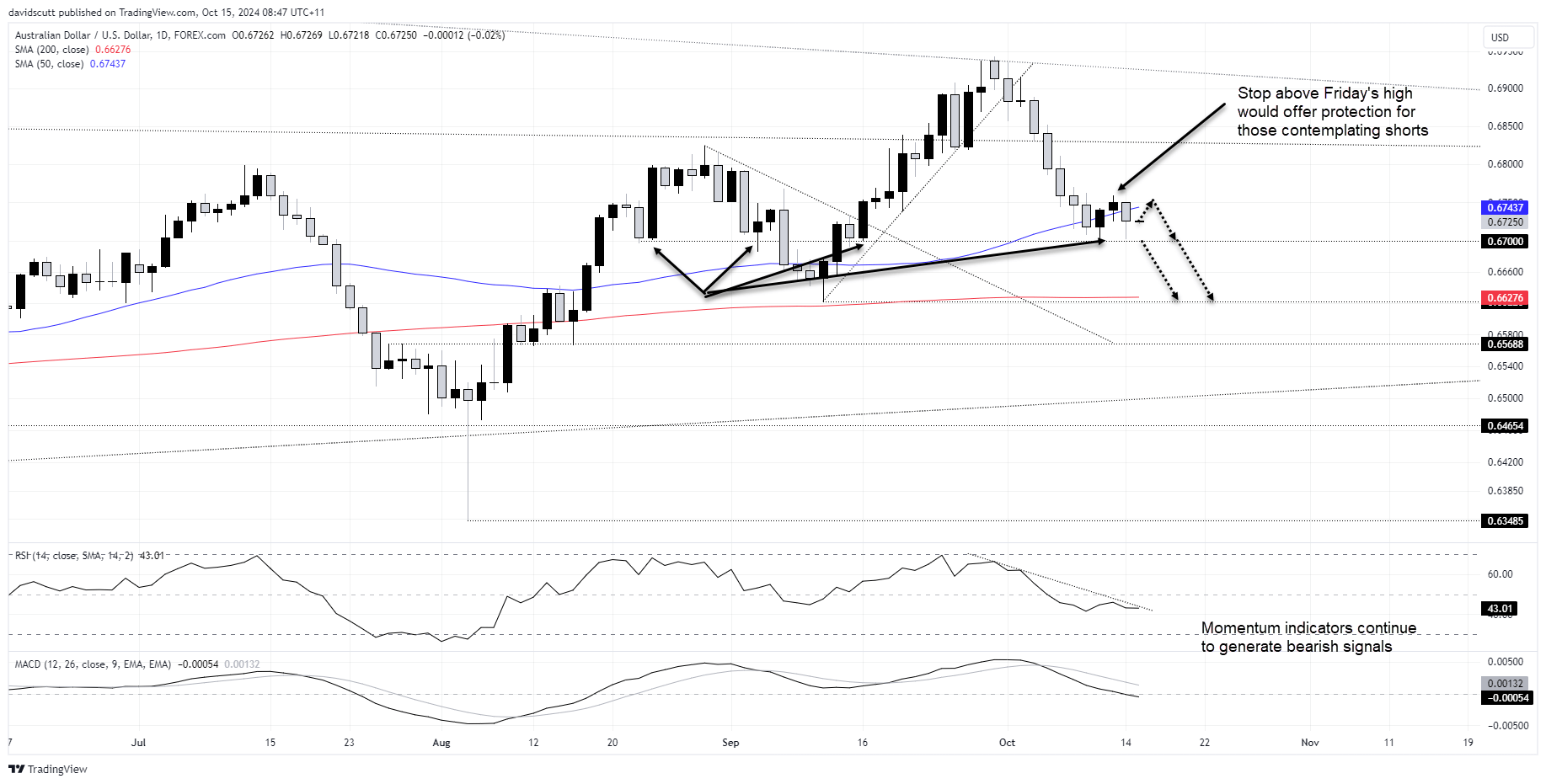

Whereas not impacted to the identical diploma as crude markets, the commodity-linked AUD/USD eased decrease on the headlines, reversing a lot of the modest positive aspects achieved within the earlier two periods.

With RSI (14) and MACD persevering with to supply bearish alerts on value momentum, and three-candle night star sample warning of elevated draw back dangers, promoting rallies is most well-liked to purchasing dips within the near-term.

If the worth had been to push again in the direction of the 50-day transferring common, one choice could be to brief on the lookout for a transfer again in the direction of assist at .7000. A cease above .6760 would offer safety towards a bigger upside thrust.

Alternatively, if the worth had been to say no to .6700, see the way it interacts with the extent for clues on proceed.

If the extent had been to be damaged simply, you could possibly promote with a cease above for defense. A possible goal could be the 200-day transferring common round .6628. If the worth had been to carry .6700 you could possibly flip the commerce, initiating longs with a good cease beneath for defense. The 50-day transferring common or .6760 loom as a attainable goal.

Unique Submit