Australian Dollar, AUD/USD, China Holiday, Volatility, Technical Outlook – Talking Points

- Market sentiment remains fragile but fresh quarterly start may encourage risk

- China markets are closed throughout the week for the National Day holiday

- NZD/USD RSI nears oversold conditions on a monthly basis, rebound afoot?

Recommended by Thomas Westwater

Check out our new fourth-quarter AUD Forecast!

Monday’s Asia-Pacific Outlook

Global equity markets fell last week, and Wall Street ended the week on a sour note following hotter-than-expected inflation data. The Dow Jones Industrial Average, S&P 500 and Nasdaq-100 Indexes closed at fresh 2022 lows, dropping 1.71%, 1.51% and 1.73%, respectively. The US Dollar DXY Index rose almost 0.5% on Friday, although it held its losses for the week. The hotter-than-expected personal consumption expenditures price index (PCE) firmed up Fed rate hike bets, extinguishing near-term pivot hopes. The US core PCE for August rose to 4.9% from a revised 4.7% y/y.

Asia-Pacific market liquidity could be lighter-than-usual in the days ahead, posing a risk from higher volatility. China’s markets will be closed for the country’s National Day holiday, which spans from October 1 to 7. That can inject volatility into the offshore Yuan, which may bleed over into other APAC currencies, including the New Zealand Dollar and Australian Dollar. NZD/USD’s 1-week risk reversals suggested higher demand for puts last week, and it was the same case for the AUD/USD.

The People’s Bank of China (PBOC) made several moves last week to strengthen the Yuan’s position. Elsewhere, Last week, the Nikkei 225 fell 4.48%, the Hang Seng Index lost 3.96%, and the ASX 200 dropped 1.53%. The Reserve Bank of Australia (RBA) is set to announce an interest rate decision on Tuesday. The chances for a 50-bps rate hike, according to cash rate futures, is 59.6%, which leaves traders without a decisive forecast.

That said, AUD may see some wild swings around the rate decision. Of course, a smaller hike would likely weigh on the currency, although AUD/USD is perhaps overextended on a technical basis, which may contain downside volatility. Much will also depend on the US Dollar, a currency that has driven broader market sentiment over the last few months, especially with the DXY Index pushing further higher into multi-decade highs, pressure not only on emerging market economies but developed ones as well.

Discover what kind of forex trader you are

NZD/USD – Technical Forecast

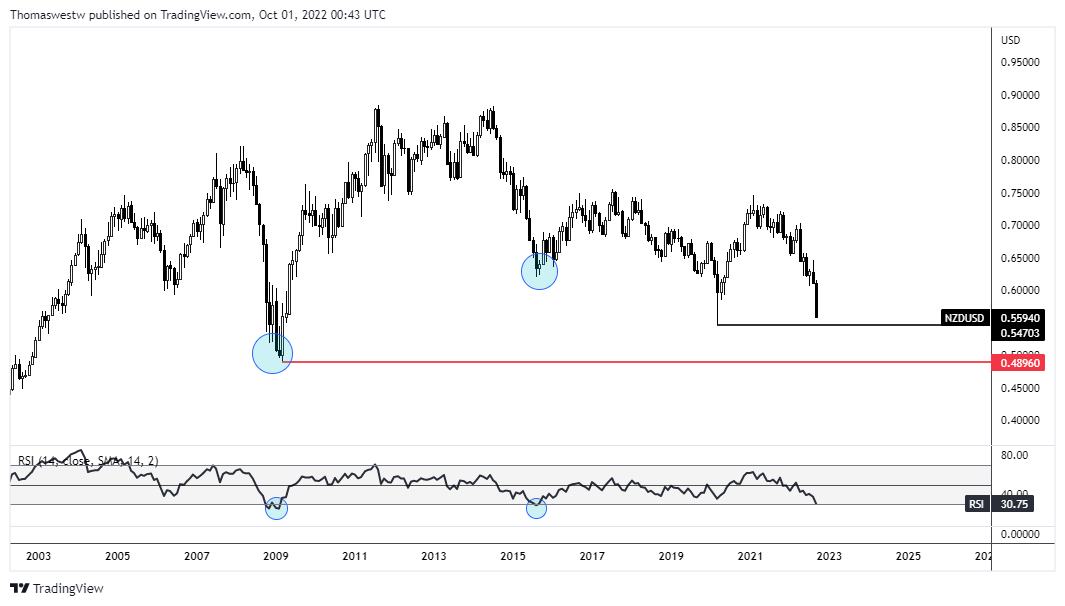

Give the quarter end, a high-altitude view of NZD/USD seems appropriate. The monthly chart reveals that the Relative Strength Index (RSI) is on the verge of crossing below the 30 mark, an area that would indicate oversold conditions. That has only occurred two times over the past twenty years (displayed on the chart below with blue circles). Each time, prices saw a fairly quick rebound. It doesn’t mean it will occur again, but if history is any guide, it’s a positive signal.

NZD/USD Monthly Chart

Chart created with TradingView

Recommended by Thomas Westwater

Improve your trading with IG Client Sentiment Data

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter