Derek White

Fundamental Thesis:

Investing requires setting apart biases and prejudices to objectively study investments. As a lifelong Yankee fan (proud proprietor of World Collection rings with my final identify on them), I’m shunting my loyalties and popping out in favor of the Atlanta Braves (NASDAQ:BATRK) (NASDAQ:BATRA), which was not too long ago cut up off from Liberty Media in July of final 12 months. A former monitoring inventory, the 2 share lessons now signify a C-corp. Economically they’re the identical. BATRA has one vote per share (~10 million shares excellent) and BATRK is non-voting (~50 million shares excellent). There may be additionally BATRB, with fewer than 1 million shares that’s quoted within the OTC market. For liquidity functions, BATRK is the primary topic of this pitch.

There are only a few publicly traded sports activities groups. MSG Sports activities (MSGS) and Manchester United (MANU) are among the few. Most groups are privately owned by rich people or households. Given this dynamic and the attractiveness of the asset, I consider that post-spin out, the Braves is an acquisition goal for quite a few potential patrons.

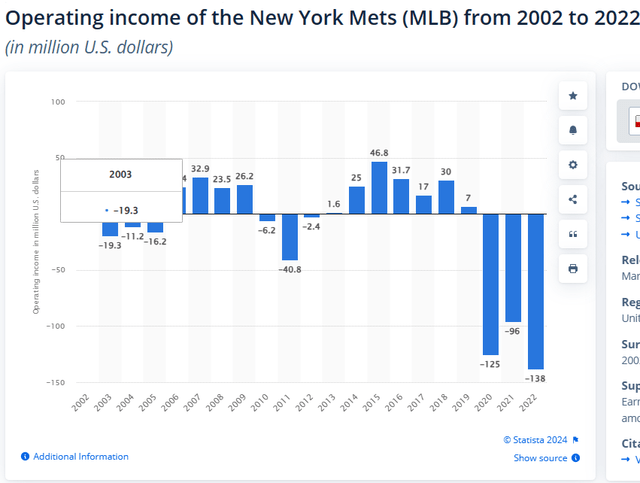

When the groups commerce, the costs normally do not mirror underlying present economics. For instance, the New York Mets have been purchased by Steve Cohen in 2020 for $2.42 billion. Notably, the sale didn’t embrace the workforce’s tv rights, the stadium, or any land across the stadium. It was simply the workforce. Covid induced extreme losses and Cohen incurred main losses ramped up payroll after the acquisition. Nevertheless, even earlier years, one can see beneath, weren’t money movement gushers to justify a value of $2.42 billion.

New York Mets Income (Statista)

For that reason, sport groups usually commerce on a a number of of income. The Mets have been offered for over 6x income (once more with out the excessive margin tv rights). MANU trades at 5x, however traded over 6x income when it appeared like the entire workforce can be offered earlier final 12 months. MSGS goes for about 6x income, reflective of what some individuals name the “Jimmy Dolan low cost”.

The Braves, like something John Malone controls, have been constantly worthwhile and management their tv rights in addition to The Battery, a major mixed-used actual property improvement round their stadium, Belief Park (they lease the stadium). The Battery throws off significant NOI along with the workforce’s historic profitability.

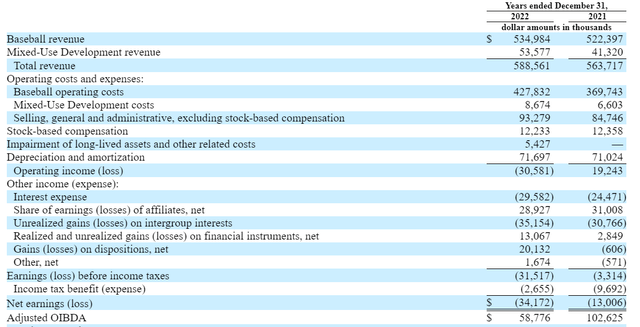

Beneath is an OIBDA (working earnings earlier than D&A) profile from 2022 and 2021. There was a slight dip in ’22 due to some elevated participant salaries and the bump from the workforce’s 2021 World Collection win.

Atlanta Braves Revenue Assertion 2021 and 2022 (S-1 submitting)

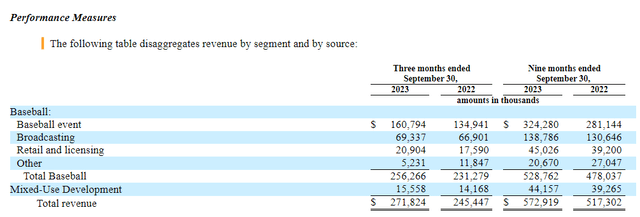

2023 is larger than 2022 by way of the tip of September due to larger revenues. Notably, the corporate’s broadcasting revenues have been larger 12 months over 12 months regardless of the chapter of its service, Diamond Sport. In chapter, Diamond Sport rejected the contracts protecting a number of groups however stored the Braves.

Atlanta Braves Income Breakout (Braves Q3 10-Q)

I consider Diamond Sport maintaining the contract speaks to the Braves’ power as a workforce and the Atlanta market’s attractiveness. Atlanta is without doubt one of the largest and quickest rising markets within the nation. There are 14 to fifteen million individuals within the Southeast who determine as Atlanta Braves followers. The workforce seems set for achievement for the following few years with quite a few their most proficient gamers younger and tied up in contracts.

Valuation:

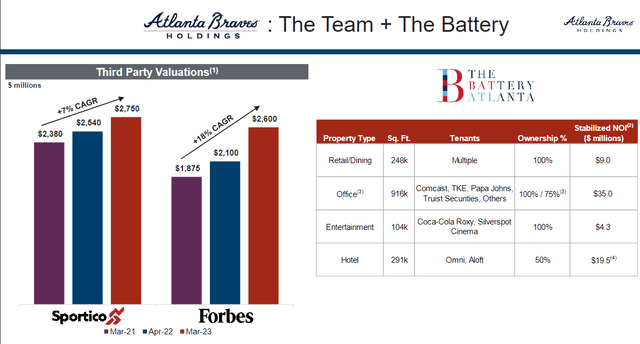

As said above, sports activities groups normally commerce for a number of of income. Nevertheless, with the Braves, one has to separate the enterprise between the true property and the workforce/broadcasting. If one utilized a 6x a number of to the baseball income (assuming 2024 finishes 10% above 2022 versus ytd developments of 15% larger), you get a $3.5 billion valuation. This valuation is supported by the Forbes valuation beneath. Notably, most groups have traded for 20-25% above the place Forbes has pinned valuation in March of ’23. The valuation pattern retains going larger, which ought to make up the distinction in March ’24.

Braves Valuation and The Battery Efficiency (Braves Investor Presentation)

The true property is a matter of cap price utilized to NOI. I feel an 8% price is just not aggressive given the individuality and high quality of the Battery, which as you may see above, throws off about $60 million of stabilized NOI. Making use of that cap price to $60 million offers a $750 million worth.

Placing that collectively, you get a price of $4.25 billion versus a present market cap of $2.42 billion and web debt of $560 million, giving an EV of $2.98 billion. The distinction would accrete to the fairness leading to a inventory value ~$60/share versus $38.50 at present.

Why Now?

Honest query. For my part, John Malone is probably the most proficient and skilled navigator of the tax in company historical past. Splitting off the Braves permits for a clear tax transaction within the occasion of a sale. Some individuals argue that two years between separation and a sale is required to keep away from unfavorable tax penalties to shareholders. Nevertheless, that provision applies solely to somebody that you’ve got been in talks with beforehand. When you’ve got not been in talks to promote an asset to somebody, you may promote it at any time when. Bioverativ and Baxalta have been offered inside 6 months of being spun off.

Which means some wealthy dude (or girl) may come alongside and purchase the entire thing now with out violating the secure harbor. I do not suppose Malone or Maffei have any sentimental attachment to the workforce. For my part, they’ve set this factor up for a sale and will accomplish that any day with out unfavorable tax penalties, which they’re allergic to.

Dangers:

The primary dangers in my thoughts are a downturn within the fortunes of the Braves, a league strike, one other pandemic, or some materials change to the broadcasting contract. Something that materially dents the revenues and earnings of the workforce will hamper worth. I feel actual property has corrected nationally however something that dented Atlanta actual property would harm as effectively.

Conclusion:

I feel the Braves are a singular asset. The workforce is effectively run and prices are set through lengthy contracts for the foreseeable future. There usually are not many class A sports activities franchises out there on the market, not to mention these connected to top quality actual property. I feel the homeowners are prepared sellers and the scenario is cleaned up for a transaction to happen. I feel one can personal the inventory right here. If one needed slightly extra juice, as of this writing, the Might $40 calls usually are not too costly (~$2.50/contract, ~29 vol).

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please pay attention to the dangers related to these shares.