Meet Athenian, a brand new startup that analyzes your software program supply workflow and provides you insights. When corporations undertake a instrument like Athenian, they’re looking for methods to ship new options at a quicker tempo and repair bugs extra rapidly.

The startup raised a $6 million seed spherical led by Level 9. Frst, Xavier Niel, 20VC, Abstraction Capital and Air Road Capital are additionally collaborating within the spherical. Some enterprise angels, equivalent to Renaud Visage, Julien Lemoine and Sam Ramji are investing within the firm as properly.

Athenian isn’t the primary firm making an attempt to supply analytics for software program improvement. However founder and CEO Eiso Kant informed me that instruments like Jellyfish and Code Local weather focus an excessive amount of on particular person efficiency. In different phrases, engineers hate them as a result of they really feel like surveillance software program.

Athenian needed to start out over from scratch and give attention to groups and occasions as a substitute of people. Once you begin utilizing the product, you first join it to numerous information sources, equivalent to GitHub, Jira and your CI/CD system. Athenian then often fetches new information from these sources.

After that, you get “a real graph of all of the occasions which might be taking place within the group from the planning work to suggestions from prospects,” Kant informed me.

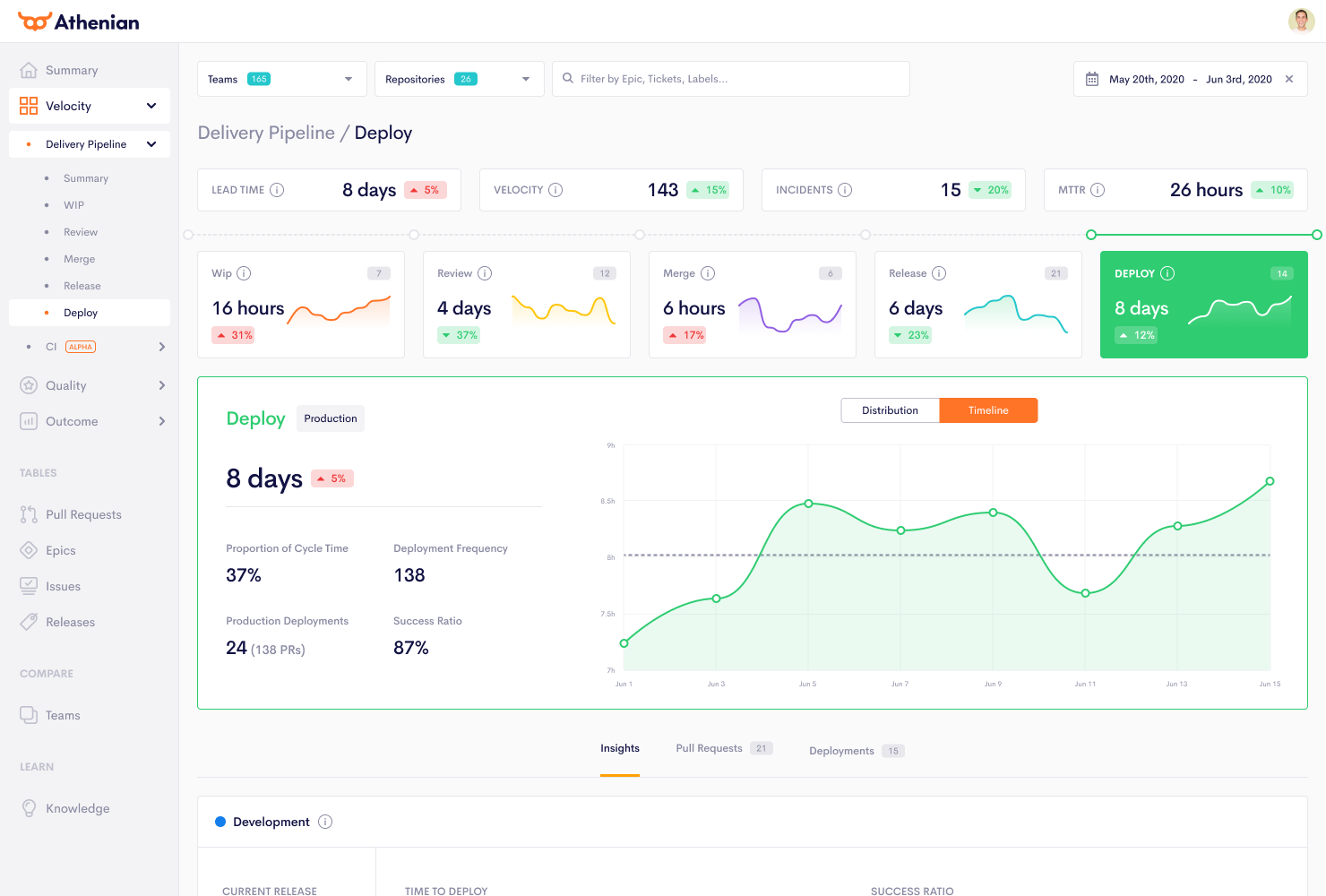

The startup breaks down your pipeline in a number of classes, equivalent to ‘plan & design’, ‘evaluation’ and ‘launch’. You possibly can see the discharge frequency, the variety of excellent bugs and different metrics that assist you get an summary.

Picture Credit: Athenian

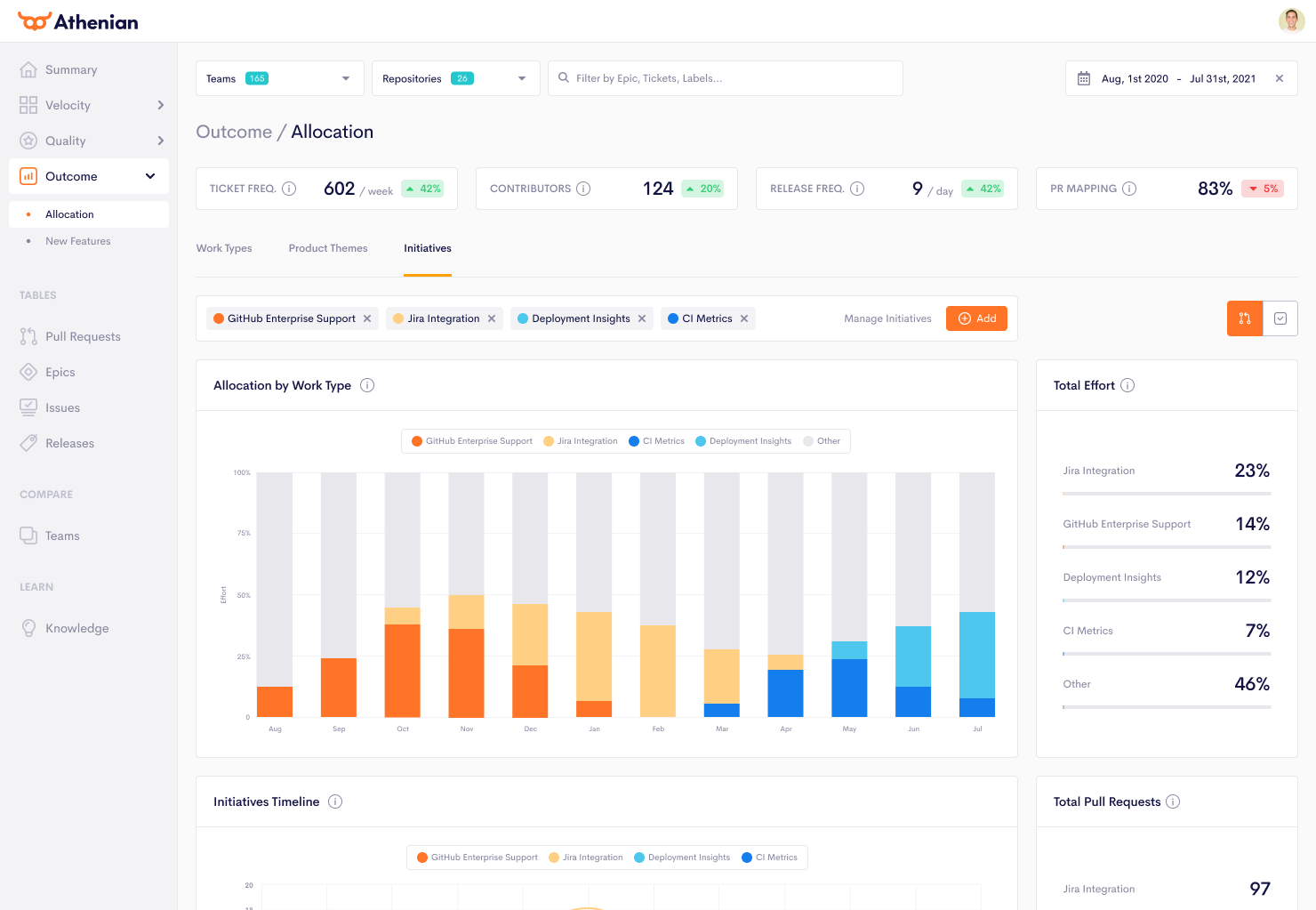

When a undertaking turns into extra complicated, the engineering group must ship new options, but in addition repair bugs and refactor some previous code to forestall technical debt from creeping up. Athenian provides you instruments to trace bugs by precedence and see how their statuses change over time. Equally, you will get insights about your CI/CD course of (steady integration and steady supply) — you’ll be able to monitor the construct failure price over time and you’ll determine bottlenecks in an effort to repair them.

I requested Eiso Kant in regards to the buyers within the firm. He gave me an extended checklist of explanation why he chosen these buyers particularly. “We set a set of 5 standards for who we needed within the firm. We wish an investor who’s deeply kindhearted as a person. They have to be extremely deep in SaaS. They should have very excessive convictions. They have to be a specialist in seed and [Series] A. And the companion we go together with must be a normal companion or a founding father of the fund,” he informed me.

It says lots about his ambitions for his firm as he doesn’t appear to be optimizing for a fast acqui-hire down the highway. How large does he need Athenian to develop into? “We wish to construct a Datadog-sized enterprise,” Kant mentioned.

Picture Credit: Athenian