Chinese Yuan, USD/CNH, Dow Jones, Iron Ore, Australian Dollar, Market Sentiment – Talking Points

- Asia-Pacific stocks look primed to take advantage of an upbeat Wall Street session

- Australia’s Westpac leading index is due out as iron ore prices face rising headwinds

- USD/CNH treads higher as RSI crossover puts the September swing high in focus

Discover what kind of forex trader you are

Wednesday’s Asia-Pacific Outlook

Asia-Pacific markets look set to move higher following a risk-on rally in New York that sent Wall Street stocks higher for the second day. The Dow Jones gained 1.12% on Tuesday. Netflix surged over 10% in after-hours trading following its third-quarter earnings report, which impressed investors by posting better-than-expected numbers across various metrics. The streaming giant added 2.41 million paid subscribers, which doubled its forecast.

The risk-sensitive Australian Dollar rose against the US Dollar amid the risk-on flows, but the New Zealand Dollar outperformed, with AUD/NZD dropping around 0.6%. Recent stagnation in iron ore prices, a key export for Australia, is weighing on the commodity-sensitive currency. Rio Tinto and Vale, two major miners, warned that demand may fall as China’s economic situation weighs on the industrial metal’s outlook. Both miners produced the above estimates in their respective quarterly reports, further pressuring prices.

Today’s economic docket is sparse, which leaves prevailing risk trends in control. That bodes well for today’s trading session, especially around the equity space. The Reserve Bank of Australia’s policy minutes, released Tuesday, underscored the impact of rising rates abroad, stating:

“External inflationary pressures might ease quickly given that the global outlook had deteriorated. Commodity prices had generally declined and supply chain pressures had begun to ease…”

While the Federal Reserve’s rate hiking cycle has perhaps peaked, US rates remain higher versus the RBA, which should keep pressure on the AUD/USD. Today, Australia’s Westpac leading index for September is due out. The economic docket is sparse elsewhere, which leaves prevailing risk trends at the helm of the market. Elsewhere, China’s currency remains under pressure after the delay of third-quarter GDP data.

Recommended by Thomas Westwater

Get Your Free AUD Forecast

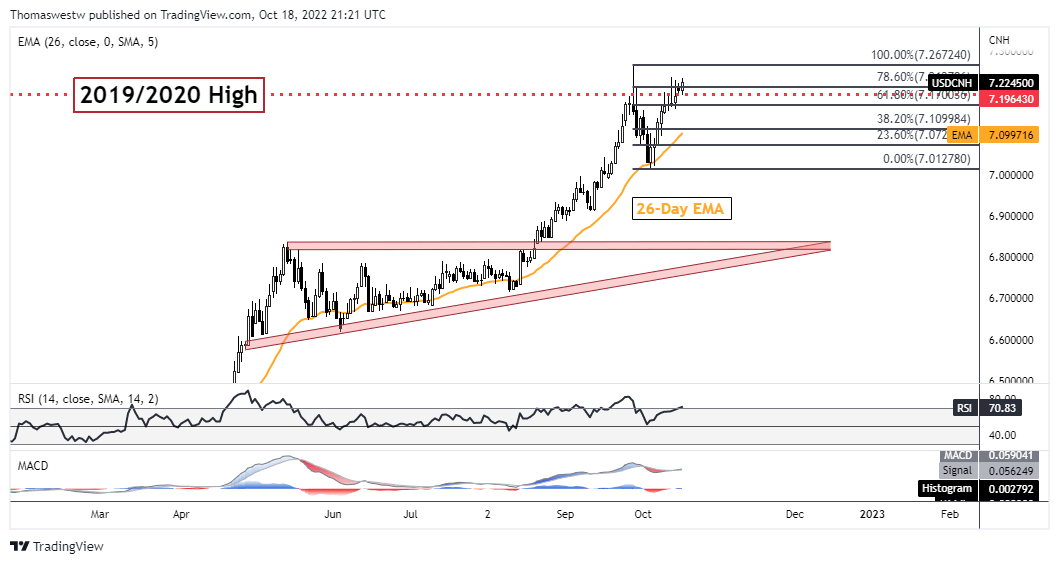

Chinese Yuan Technical Outlook

The Chinese Yuan is at its weakest level against the Dollar on record (ignoring an intraday move from late September). USD/CNH’s Relative Strength Index (RSI) crossed above the 70 level, suggesting overbought levels. That doesn’t necessarily mean a pullback is afoot. A move higher to the intraday swing high at 7.2672 may be on the cards, as the trend remains positive.

USD/CNH Daily Chart

Chart created with TradingView

Recommended by Thomas Westwater

Options for Beginners

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter