yorkfoto

The outlook for Southeast Asia (additionally the ‘Affiliation of Southeast Asian Nations’ or ASEAN) has improved considerably during the last 12 months, with inflation effectively below management and the final of the area’s central banks, the Financial Authority of Singapore (i.e., the Singaporean central financial institution or ‘MAS’) transferring towards the finish its tightening cycle. On the demand facet, the mixture of softening inflation developments and a financial coverage pivot bodes effectively for home consumption. Exterior demand tailwinds from post-COVID/reopening tourism restoration must also assist the area’s tourism-dependent economies. Alongside easing commodity costs, which have been a tailwind for company earnings on the fee facet, anticipate extra upward revisions on the horizon. Maybe essentially the most compelling motive to personal ASEAN, although, is its elevated attractiveness as an FDI vacation spot as corporates speed up their ‘China+1’ diversification technique (i.e., corporates constructing different footprints to scale back their China dependence). Having lagged this 12 months vs. different ‘multipolar’ performs like Mexico, the World X FTSE Southeast Asia ETF (NYSEARCA:ASEA) portfolio, at present priced at ~11x fwd earnings, screens attractively.

Fund Overview – Low-Value Publicity to a Financials-Heavy Southeast Asian Portfolio

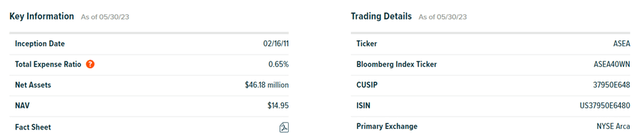

The US-listed World X FTSE Southeast Asia ETF seeks to trace, earlier than bills, the yield and worth efficiency of the FTSE/ASEAN 40 Index, comprising the most important 40 ASEAN firms (by market cap) throughout the FTSE All-World Index. Every index constituent can also be topic to liquidity standards, most notably a >20% turnover of shares excellent within the final twelve months (on a free float-adjusted foundation). The ETF held ~$46m of web property on the time of writing and charged a 0.7% expense ratio, making it a cheap possibility for US buyers seeking to entry ASEAN equities. A abstract of key details concerning the ETF is listed within the graphic under:

World X

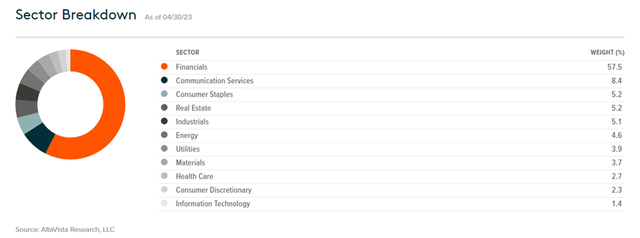

The fund is unfold throughout 42 holdings, with Financials making up the most important sector allocation at 57.5%. No different sector has a >10% allocation. The 4 sectors with portfolio weightings above a 5% threshold are Communication Providers (8.4%), Shopper Staples (5.2%), Actual Property (5.2%), and Industrials (5.1%). On a cumulative foundation, the highest 5 sectors accounted for ~81% of the entire portfolio, making ASEA one of many extra top-heavy ETFs in Asia. Given the fund’s outsized publicity to main banks within the area, its fairness beta stands at a comparatively low 0.76 to the MSCI EAFE (EFA), a proxy for developed markets ex-North America, and 0.62 to the MSCI Rising Markets (EEM). The portfolio additionally maintains a low normal deviation at 17.3%, highlighting its through-cycle defensiveness.

World X

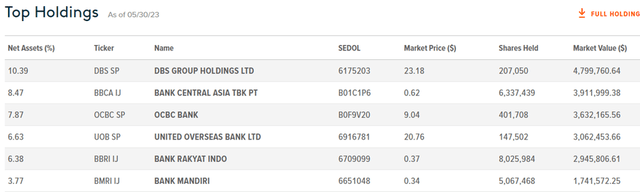

Consistent with its financials-focused sector allocation, ASEA’s six largest holdings are main banks. At 10.4%, Singapore-based DBS Group (OTCPK:DBSDF) is the most important financial institution holding, adopted by Indonesia-based PT Financial institution Central Asia (OTCPK:PBCRF). Two different Singaporean banks, OCBC Financial institution (OTCPK:OVCHY) and United Abroad Financial institution (OTCPK:UOVEY), are on the top-six listing, together with Indonesian leaders PT Financial institution Rakyat Indonesia (OTCPK:BKRKY) and PT Financial institution Mandiri (OTCPK:PPERY). In complete, the 5 largest holdings (all main banks) contribute ~40% of the general portfolio. Reflecting the fund’s focus on the regional banking sector, the underlying portfolio trades at a modest premium to e book worth at 1.3x, screening fairly relative to the portfolio’s ~12% return on fairness. The place the valuations stand out, although, is on P/E – given the area’s outsized progress potential (ex-Singapore), the 11.5x 2023 earnings valuation is not demanding in any respect.

World X

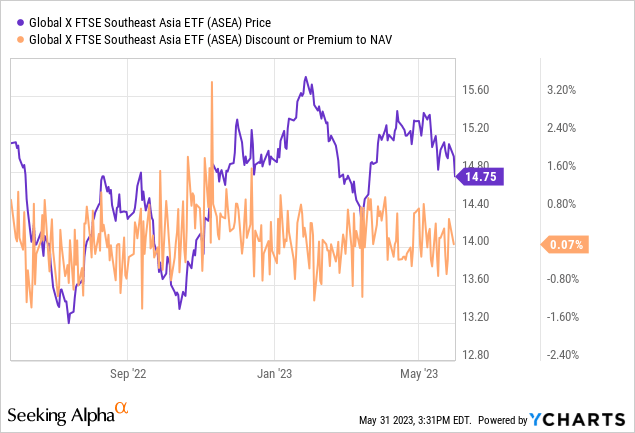

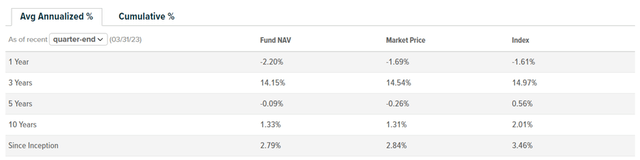

Fund Efficiency – Lackluster Capital Development; Regular Distribution

On a YTD foundation, the ETF has been largely flat however has annualized at a 2.8% tempo in market worth and NAV phrases since its inception in 2011. Given the fund’s low beta, it’s maybe unsurprising that efficiency has been secure by the cycles. In contrast to many different Asian ETFs, ASEA skilled a restricted % drawdown by final 12 months’s tightening cycle and the 2020/2021 pandemic. Since then, the fund has recovered its losses, most just lately helped by the easing of China’s ‘zero-COVID’ restrictions. Nonetheless, the annualized acquire during the last ten years is not nice at +1.3%, although this largely displays the fairness underperformance all through the area. Relative to its largest nation exposures (proxied by the iShares MSCI Singapore Capped ETF (EWS) and iShares MSCI Indonesia ETF (EIDO)), ASEA has outperformed during the last decade.

World X

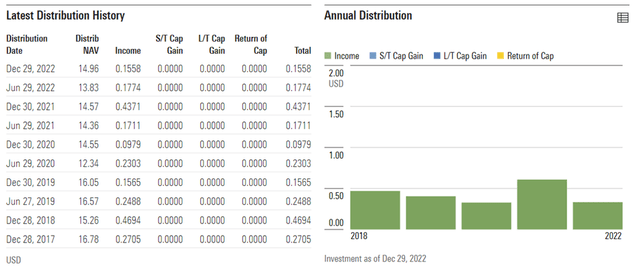

The semi-annual distribution is derived completely from earnings, with the fund’s outsized publicity to dividend-paying financial institution shares supporting a lot of the capital return. At a 30-day yield of two.9%, ASEA presents an honest earnings stream, which has typically been sustained by the cycles. Whereas the fund has suffered a decline in payout by the COVID-impacted years, in step with earnings, a pending tourism-led restoration this 12 months ought to kickstart a return to long-term distribution progress.

Morningstar

Confluence of Tailwinds to Increase ASEAN Prospects

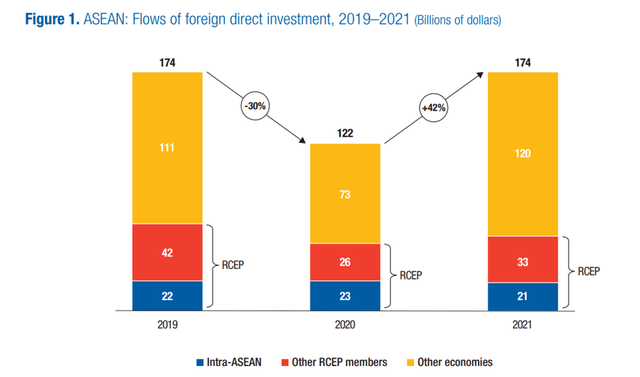

Southeast Asia’s enchantment as a overseas direct funding (FDIs) vacation spot hasn’t waned, with inflows already again to pre-COVID ranges and effectively on their approach to crossing $200bn this 12 months. Indonesia has stood out so far, helped by its pure sources and coverage incentives to draw EV-related FDI (battery and manufacturing amenities), most notably from North Asia. FDI from the EU and North America has largely flowed into the colourful electronics ecosystem in north Malaysia (e.g., Intel’s (INTC) $7bn packaging facility), whereas Vietnam has been a beneficiary of either side, given its low-cost, comparatively well-educated labor pressure and proximity to China, in addition to its commerce agreements with the West. In order US-China geopolitical tensions proceed to escalate, driving ‘friend-shoring’ and ‘China+1’ diversification methods, the neutrality of ASEAN nations positions the area to be among the many greatest beneficiaries. The ASEA ETF, given its outsized publicity to the main banks (primarily by way of the ASEAN monetary hub, Singapore), ought to broadly observe this regional macro development.

InvestASEAN

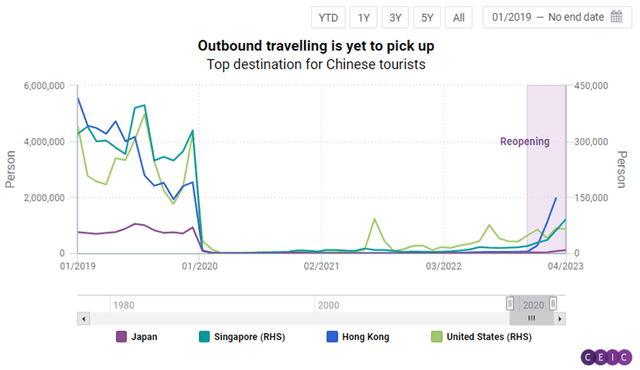

Within the close to time period, the return of Chinese language vacationers shall be a key progress driver for the area. Inbound arrivals from China have lengthy been the most important contributor to tourism within the area, so the ‘COVID-zero’ influence hit ASEAN significantly arduous. However ex-China journey has since recovered a lot of its pre-COVID losses, and with China’s providers restoration additionally gaining traction, I anticipate arrivals to proceed choosing up in H2 (vs. the gradual rise in Chinese language outbound journey so far). Within the face of rising export headwinds this 12 months, a tourism restoration would provide significant progress assist for ASEAN within the meantime. Thailand, the ASEA ETF’s third-largest nation publicity, stands to reap essentially the most GDP profit from a tourism rebound, although the area as a complete must also see more healthy present account balances and stabilized FX consequently.

CEIC

A Low-Value Automobile to Experience the Multi-Pronged Southeast Asian Development Story

The near-and long-term outlooks for ASEAN equities seem compelling. Having suffered from the one-two punch of cost-push inflation and declining tourism within the pandemic-affected years, these headwinds are lastly starting to reverse. Easing international commodity and vitality costs mustn’t solely enhance consumption but in addition decrease enter prices, in flip permitting for improved company margins. And with inbound tourism already on the rise post-reopening, continued momentum right here ought to present a further catalyst for equities, given the area’s sturdy dependence on tourism. Lengthy-term tailwinds from FDI inflows have solely accelerated within the meantime, with ASEAN, by advantage of its commerce ties to each the US and China, presenting buyers with a novel alternative to hedge in opposition to geopolitical tensions. The financials-heavy ASEA portfolio hasn’t fairly re-rated as a lot as comparable ‘China+1’ beneficiaries both; at ~11x fwd P/E for a bunch of high-quality ASEAN franchises, value-focused buyers ought to discover lots to love right here.