The AROON and Volatility Pivot Foreign exchange Buying and selling Technique combines two highly effective indicators that present merchants with a transparent understanding of market tendencies and potential value actions. The AROON indicator is a trend-following software designed to measure the energy and route of a development by analyzing the time elapsed for the reason that highest and lowest costs inside a specified interval. It helps merchants decide whether or not a market is trending or shifting sideways, providing beneficial insights into development reversals and confirmations. When paired with the Volatility Pivot, a software that identifies key value ranges primarily based on market volatility, the technique permits merchants to pinpoint essentially the most opportune moments to enter or exit trades.

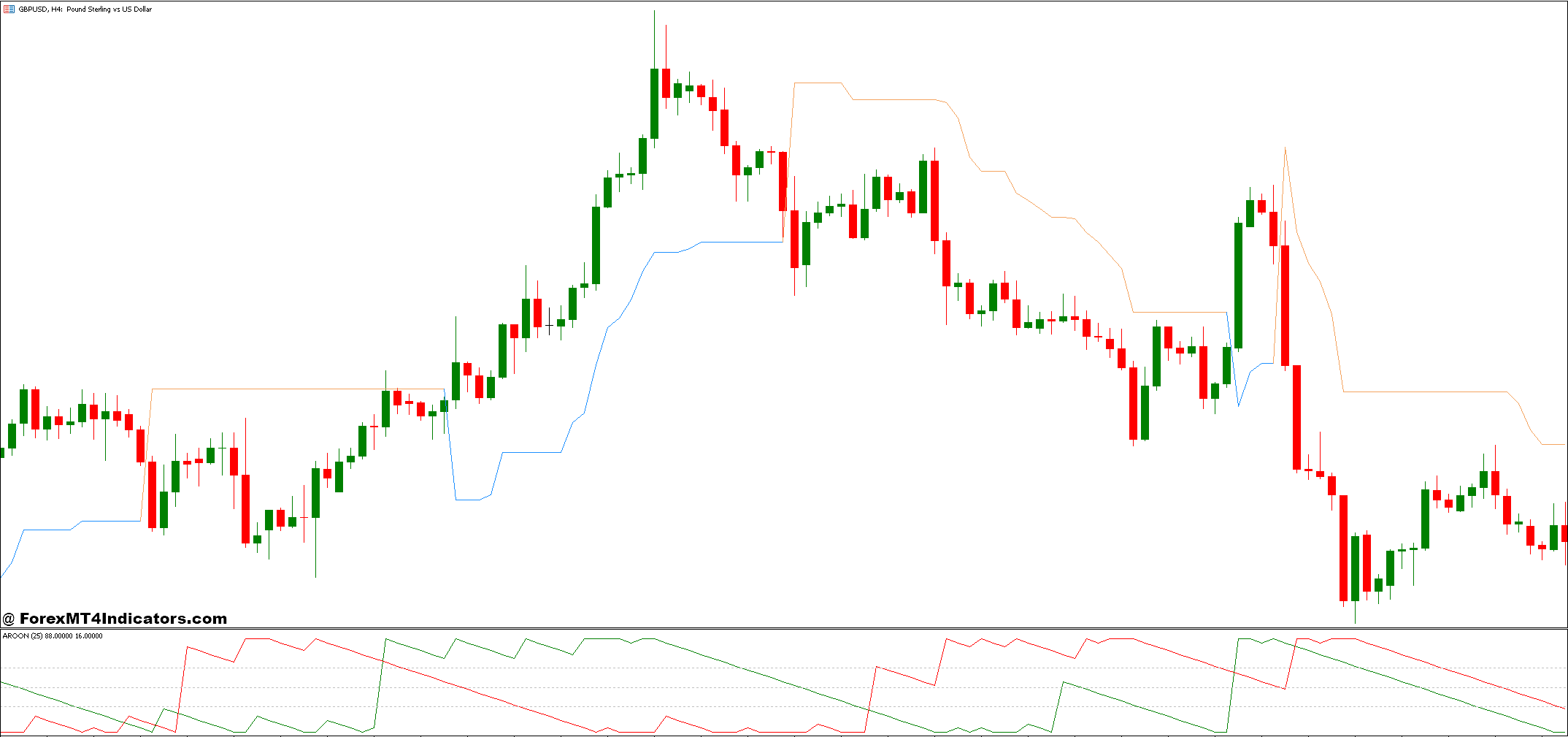

The AROON indicator works by calculating two strains: AROON Up and AROON Down. These strains symbolize the energy of the uptrend and downtrend, respectively, and their positioning relative to one another helps merchants establish the market’s development route. When the AROON Up line is above the AROON Down line, it indicators an uptrend, and when the AROON Down line is greater, it suggests a downtrend. This simplicity makes the AROON indicator a favourite amongst merchants who need to catch tendencies early. Nevertheless, the true energy of this technique emerges when AROON is used along with the Volatility Pivot indicator, which gives extra layers of research primarily based on market fluctuations.

The Volatility Pivot identifies vital value ranges that act as help or resistance, adjusting dynamically in keeping with market volatility. In contrast to conventional static pivots, the Volatility Pivot ranges adapt to the altering market circumstances, making them extra correct for predicting breakout factors or value reversals. This makes the Volatility Pivot a beneficial software for merchants who have to assess market circumstances with better precision. When mixed with the AROON indicator, the AROON and Volatility Pivot Foreign exchange Buying and selling Technique helps merchants filter out false indicators, offering a complete strategy to figuring out potential worthwhile trades. This technique not solely helps merchants keep in tune with the prevailing development but additionally gives them with the flexibleness to handle volatility, in the end enhancing their decision-making course of in Forex.

The AROON Indicator

The AROON Indicator is a trend-following software that was developed by Tushar Chande in 1995 to establish the presence and energy of tendencies available in the market. It’s significantly helpful in detecting development reversals or shifts earlier than they develop into obvious on different indicators. The AROON indicator consists of two strains: AROON Up and AROON Down. These strains measure the time it has taken for the very best and lowest costs to happen over a set interval, normally 14 durations. The essential concept is that if a development is powerful, the very best or lowest value could have occurred just lately.

- AROON Up tracks the variety of durations for the reason that highest value occurred through the specified interval, with a price between 0 and 100. A worth of 100 signifies that the very best value has occurred in the latest interval, signaling a powerful uptrend.

- AROON Down measures the variety of durations for the reason that lowest value occurred throughout the identical timeframe. A studying of 100 signifies a powerful downtrend, whereas a price of 0 means that the market is shifting upward.

Merchants use the AROON indicator to establish whether or not the market is trending or ranging. When the AROON Up line is above the AROON Down line, it indicators an uptrend, and when the AROON Down line is greater, it suggests a downtrend. The energy of those tendencies is gauged by how far aside the AROON strains are. The nearer they’re, the weaker the development, and the farther aside they’re, the stronger the development. A crossing of the AROON Up and AROON Down strains may sign a possible reversal or development shift, providing merchants key entry or exit factors.

The AROON Indicator is efficient in trending markets and may also help merchants keep available in the market for longer durations, capturing substantial value strikes. Nevertheless, it’s simplest when mixed with different instruments, such because the Volatility Pivot Indicator, to assist affirm tendencies and value motion.

The Volatility Pivot Indicator

The Volatility Pivot Indicator is a singular software that helps merchants establish vital value ranges primarily based on market volatility relatively than simply conventional help and resistance. In contrast to normal pivot factors that depend on earlier value highs, lows, and closes, the Volatility Pivot adjusts its ranges dynamically in keeping with the volatility of the market. It gives a extra correct illustration of the place value motion is prone to encounter resistance or help, which could be significantly helpful in fast-moving markets or during times of excessive volatility.

The important thing concept behind the Volatility Pivot is that the market’s value motion can usually be extra influenced by volatility than by conventional ranges of help and resistance. The indicator calculates pivot factors primarily based on a mixture of the common true vary (ATR) and volatility metrics. The result’s a set of ranges that change in response to the market’s habits, permitting merchants to adapt to totally different market circumstances. These ranges act as zones the place value might battle to maneuver past or the place a breakout would possibly happen, offering merchants with actionable insights for his or her trades.

Merchants use the Volatility Pivot Indicator to find out areas of potential value reversals or breakouts. If the value approaches a volatility pivot stage and fails to interrupt by way of, it might sign a reversal or consolidation. Alternatively, if the value breaks by way of the pivot stage with robust momentum, it may point out a possible breakout and the continuation of the development. By utilizing the Volatility Pivot Indicator along with different trend-following instruments just like the AROON indicator, merchants can considerably improve their means to navigate unstable market circumstances and make extra knowledgeable buying and selling choices.

The Volatility Pivot Indicator is very beneficial in markets that have frequent value fluctuations or during times of uncertainty, providing a versatile and adaptive strategy to cost motion. When mixed with the AROON Indicator, it may assist merchants not solely affirm tendencies but additionally fine-tune their entry and exit factors by contemplating each development energy and market volatility.

The right way to Commerce with AROON and Volatility Pivot Foreign exchange Buying and selling Technique

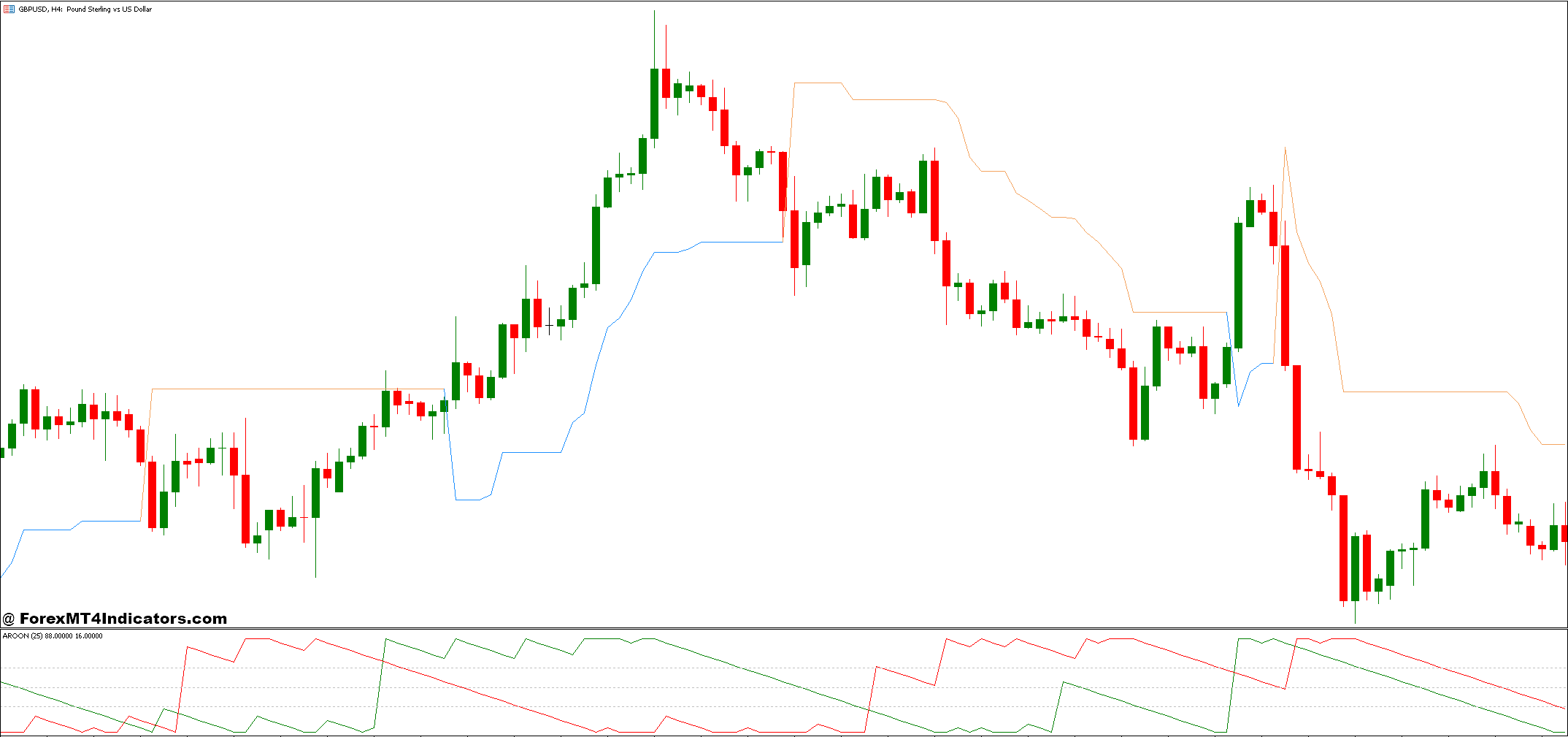

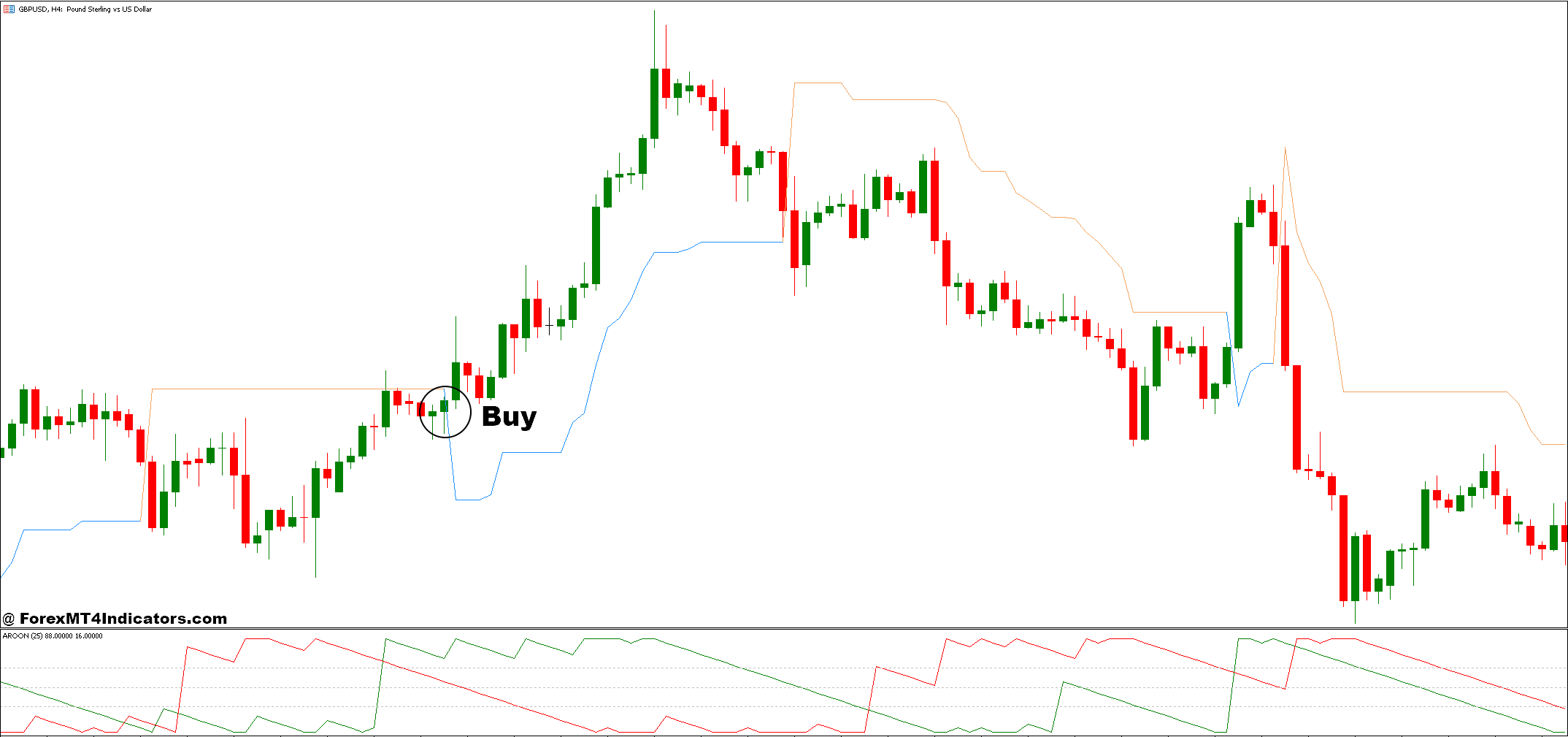

Purchase Entry

- AROON Up line is above the AROON Down line, indicating an uptrend.

- AROON Up is above 50, suggesting a powerful uptrend.

- Value approaches a volatility pivot help stage.

- Search for value to bounce off this help stage.

- Look ahead to a bullish candlestick reversal sample (e.g., bullish engulfing, hammer, or morning star) on the help stage to verify the continuation of the uptrend.

- Place cease loss just under the current volatility pivot help stage or swing low.

- Set take revenue on the subsequent volatility pivot resistance stage or a predefined risk-reward ratio.

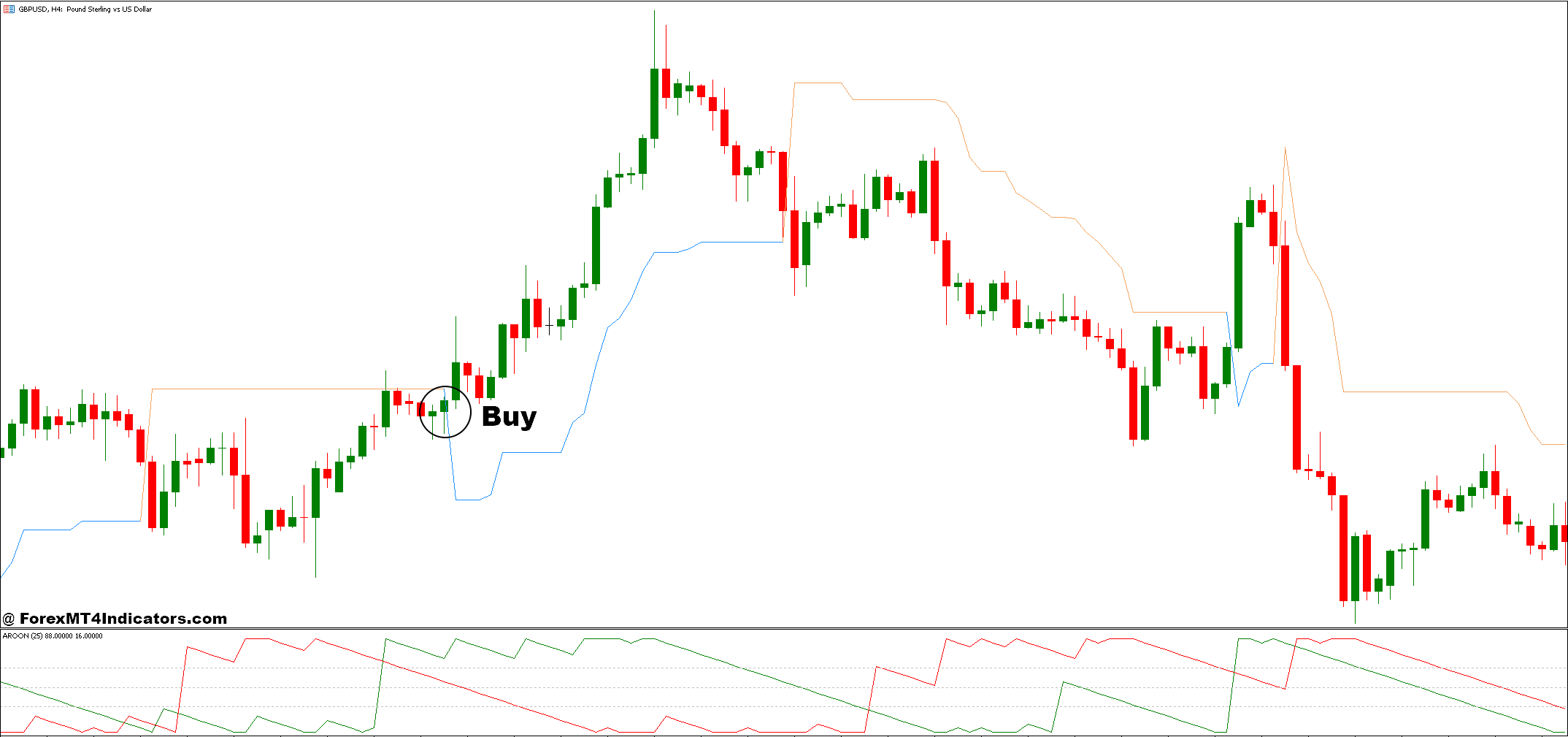

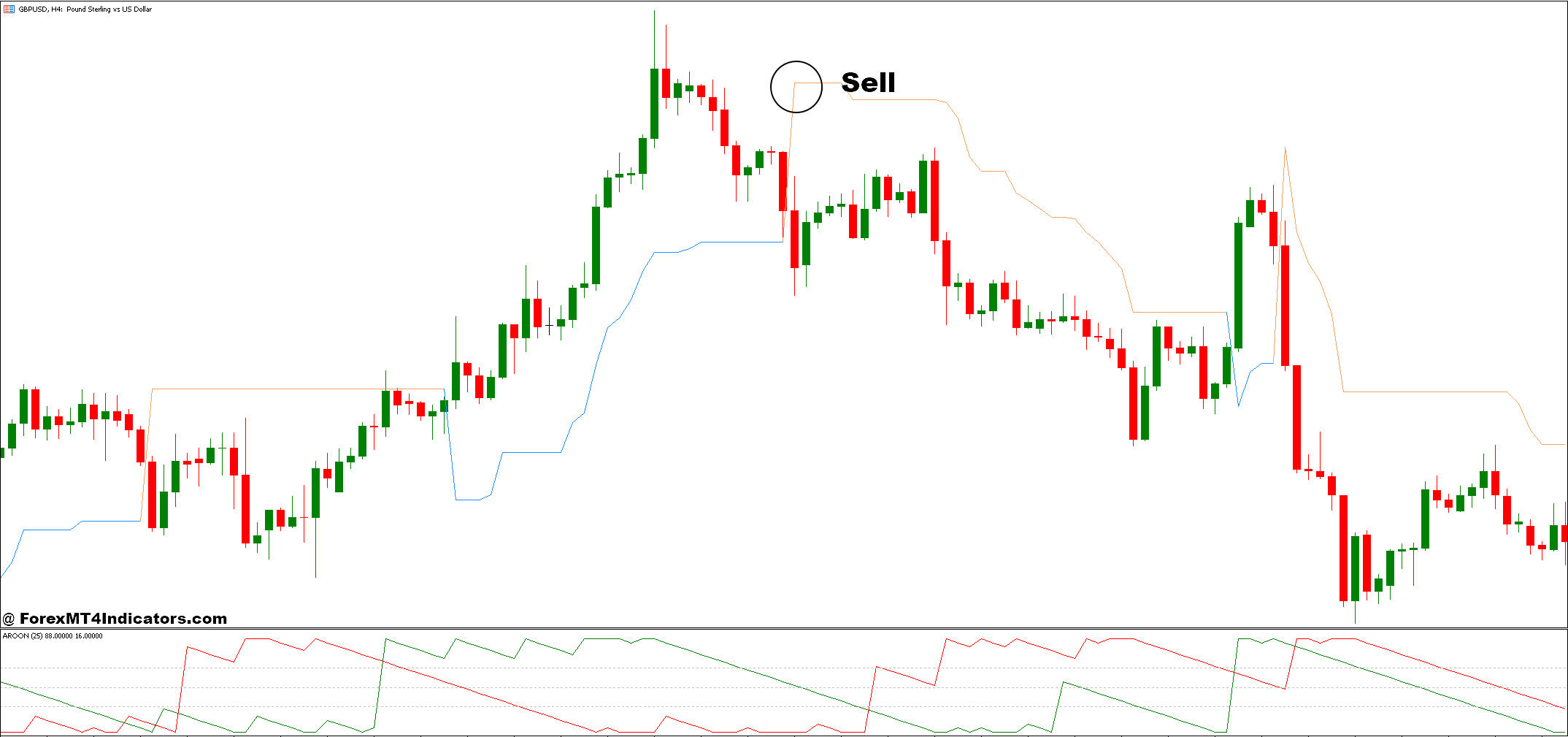

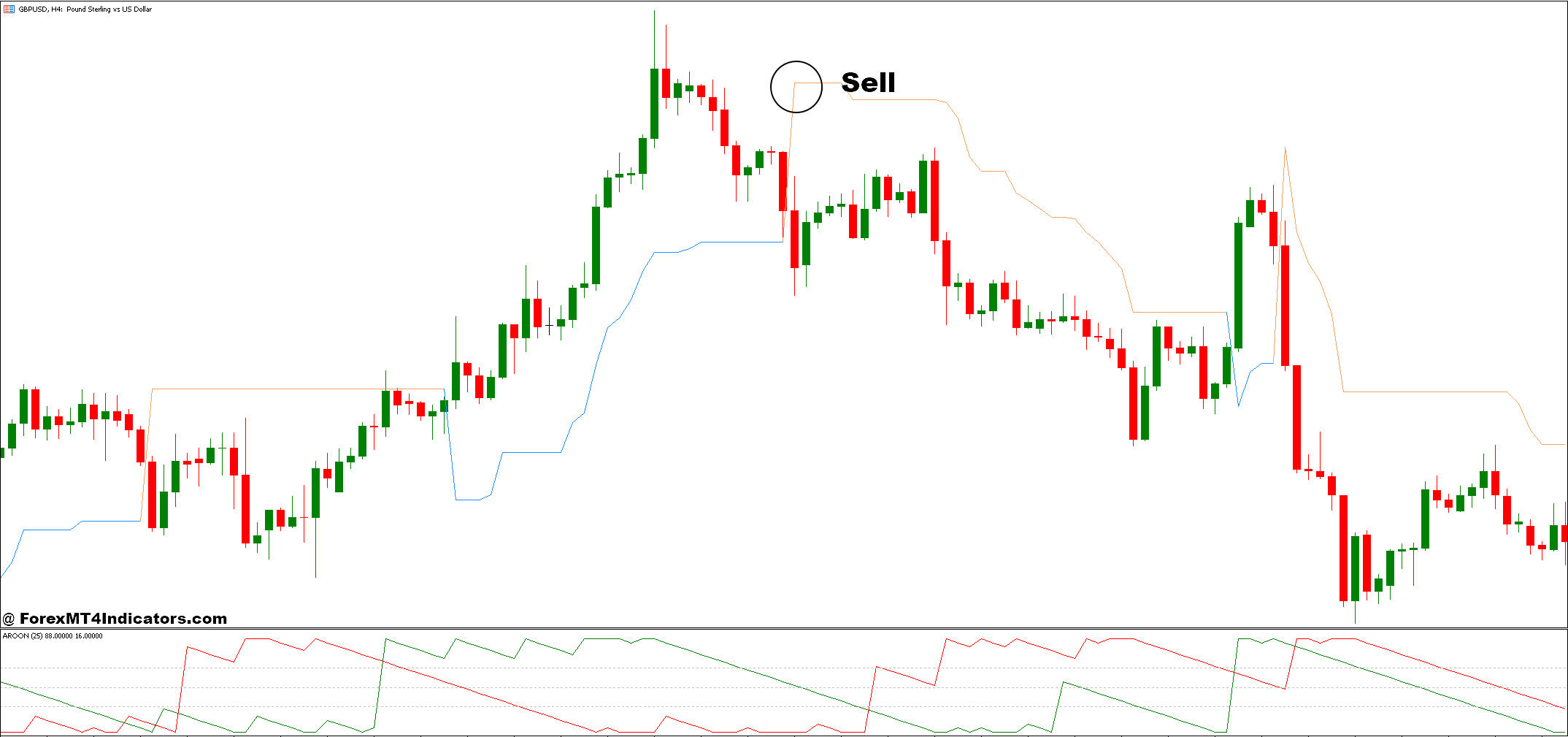

Promote Entry

- AROON Down line is above the AROON Up line, indicating a downtrend.

- AROON Down is above 50, suggesting a powerful downtrend.

- Value approaches a volatility pivot resistance stage.

- Search for value to battle to interrupt by way of this resistance stage and present indicators of reversal.

- Look ahead to a bearish candlestick reversal sample (e.g., taking pictures star, bearish engulfing, or night star) on the resistance stage to verify the continuation of the downtrend.

- Place cease loss simply above the current volatility pivot resistance stage or swing excessive.

- Set take revenue on the subsequent volatility pivot help stage or a predefined risk-reward ratio.

Conclusion

The AROON and Volatility Pivot Foreign exchange Buying and selling Technique gives merchants a dynamic and efficient strategy to navigating the markets by combining development evaluation with adaptive value ranges. The AROON indicator helps establish the energy and route of the development, whereas the Volatility Pivot indicator gives essential help and resistance ranges primarily based on market volatility, enabling merchants to make extra knowledgeable choices.

Advisable MT4 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

- Unique 50% Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 50% Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Associate Code: 𝟕𝐖𝟑𝐉𝐐

Click on right here beneath to obtain:

Get Obtain Entry