shapecharge

A few month in the past, I detailed why I used to be shedding religion in know-how big Apple Inc. (NASDAQ:AAPL). A lot of information factors had been suggesting that future gross sales weren’t doing in addition to anticipated, partly due to an absence of latest product releases this fall. Whereas my premise turned out to be appropriate relating to the corporate, shares haven’t acted the way in which I’d have usually anticipated. At this time, I’d like to debate why that’s, and why my stance on the inventory has modified.

A few weeks in the past, we acquired fiscal fourth quarter outcomes from Apple (AAPL) for its September-ending quarter. The highest line variety of $89.5 billion was simply forward of analyst estimates, however the road common had come down by greater than $1.1 billion because the August report. The iPhone was the one product phase to point out year-over-year progress, and it, alongside the iPad and Companies, beat their particular person respective estimates. On the flip facet, Wearables got here in slightly below and the Mac line fell a bit quick. Key outcomes in comparison with the previous two fiscal This autumn intervals will be seen within the graphic under. The change column represents the year-over-year change from This autumn 2022 to This autumn 2023, whereas modifications for margins and tax charges are the precise proportion distinction between the 2 intervals.

This autumn Key Outcomes (Apple Earnings Releases)

Apple reported stable positive factors when margins. Product margins had been up fairly properly, maybe on account of an efficient worth increase for this yr’s slate of iPhones. The excessive margin Companies phase additionally confirmed some enchancment, and it’s turning into a bigger portion of Apple’s complete over time, serving to the corporate’s vast gross margin determine. Administration was additionally in a position to hold working expense progress very restricted, serving to drive working margins over 30% for the quarter. With a decrease tax price and assist from the buyback, earnings per share progress got here in at greater than 13%, with the reported quantity beating the road by 7 cents. Administration’s means to manage its price construction implies that the underside line can nonetheless impress a bit even when the highest line doesn’t.

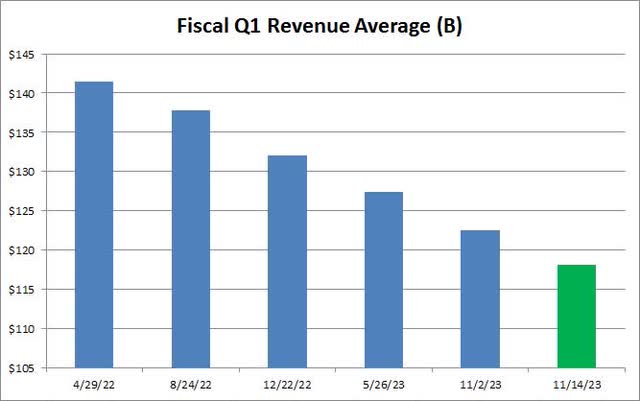

In my earlier article on Apple, my greatest fear was an absence of income progress. For the primary time in a number of years, the corporate had simply reported 4 quarters of year-over-year income declines. Because the chart under reveals, Avenue analysts had reduce their common Q1 income estimate by greater than $18 billion within the roughly 18-month interval going into the This autumn report. I nonetheless thought there have been a lot of headwinds coming Apple’s method, together with competitors from Huawei and no iPad refresh this yr, together with the corporate’s headset not coming till calendar 2024.

It turned out that my stance on Apple the enterprise was appropriate, as a result of on the convention name, administration stated revenues within the December 2023 (fiscal Q1 2024) interval can be much like the yr in the past quarter. The road was on the lookout for about 4.6% progress within the vacation interval, and the present common estimate under in inexperienced now represents simply 0.8% progress over final yr’s interval. Some analysts tried to defend the corporate by pointing to the calendar shift final yr including an additional week to that yr’s gross sales interval, however this was a identified merchandise that I’ve mentioned for a lot of months and may have already been factored into estimates.

Fiscal Q1 Income Common (Searching for Alpha)

Initially, Apple shares tumbled when steerage was given, falling under $170 in that after-hours session. Nonetheless, shares have greater than recovered since, and are actually only a stone’s throw from their all-time excessive. Why is that this? Effectively, all of it has to do with the U.S. financial system. The October jobs report was not nice, and month-to-month wage progress was lower than anticipated. Since then, gasoline costs have come down much more, and we had a few respectable bond auctions. On Tuesday, shopper inflation information was a bit cooler than anticipated.

Consequently, we’ve seen bond yields come down significantly in current weeks. On October twenty second, the 10-Yr yield (US10Y) was slightly below 5%, nevertheless it closed on Tuesday at 4.44%. With each new information level that means the Federal Reserve may be executed mountaineering charges, the market rallies properly, as we noticed once more on Tuesday. I’ll nonetheless word that Apple is up 5.70% since reporting earnings, but that quantity has really trailed the Invesco QQQ ETF (QQQ) that tracks the NASDAQ 100, which itself is up 6.02% over this time.

As of Tuesday’s shut, Apple shares are buying and selling at greater than 28.5 instances their anticipated earnings per share for this fiscal yr ending subsequent September. That’s dearer than once I beforehand lined the identify, however the market appears keen to pay that quantity as a result of charges are fairly a bit decrease. Additionally, though income progress appears to be stagnant proper now, the above talked about margin progress has earnings per share progress seeking to be extra spectacular than beforehand thought. Continued sturdy internet earnings drives substantial money circulate right here, and that advantages shareholders by dividends and an enormous share repurchase plan.

With the general market dynamic altering in current weeks, I’m thus upgrading Apple shares again to a maintain immediately. I can not say that I’d purchase Apple Inc. shares proper now, given the tepid income progress state of affairs and excessive valuation, mixed with a ten% rally from the post-earnings low in simply a few weeks. Nonetheless, the market appears a lot much less nervous about U.S. inflation presently, and if the Fed is really executed with elevating charges, large-cap tech is more likely to head larger transferring ahead. Ultimately, whereas my view of Apple’s enterprise was appropriate, the inventory shook off the unhealthy information with the general market rallying.