Shahid Jamil

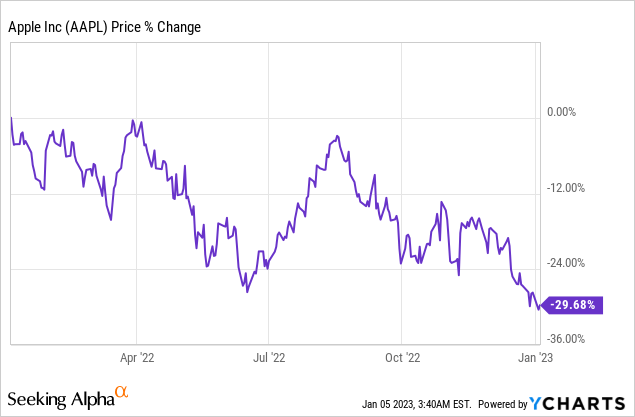

Shares of Apple Inc. (NASDAQ:AAPL) skidded to a brand new 1-year low on Tuesday because of rising issues concerning the affect of rising Covid-19 infections in China in addition to probably weakening demand for shopper electronics in 2023. Considerations over softening shopper demand are linked to an accelerating decline of machine shipments in Q3’22, decrease anticipated iPhone shipments in This fall’22 and uncertainty surrounding China’s financial reopening. Apple’s EPS and income estimate tendencies are unfavorable and the market now expects Apple to see weak progress in FY 2023. With dangers to shopper demand rising, buyers shopping for the pullback too early danger shopping for a falling knife!

Fragile market setup doubtless result in weak prime line progress for Apple in FQ1’23

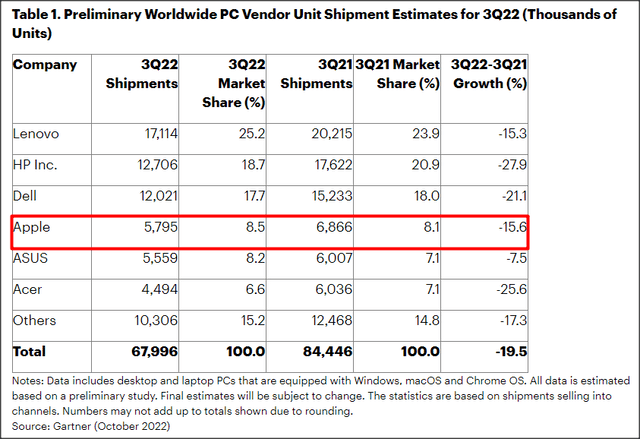

Based on information compiled by Gartner, a consulting firm, worldwide PC shipments declined 19.5% within the third-quarter with main OEMs, together with Apple, seeing appreciable quantity declines within the PC, laptop computer and cellular machine segments. Apple’s machine shipments declined 15.6% year-over-year in Q3’22 and most main producers noticed steep, double-digit quantity declines in shipments as nicely.

Supply: Gartner

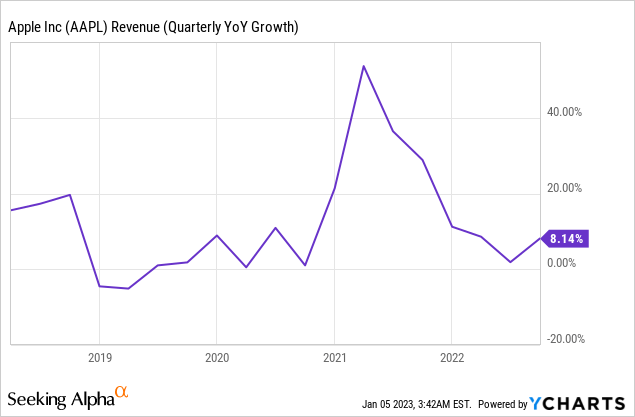

Gartner hasn’t launched its estimate for This fall’22 international machine shipments but, however likelihood is that the numbers should not going to look nice because of excessive inflation, weakening shopper demand and excessive stock ranges within the business. Because of this, Apple’s income progress has began to decelerate dramatically: within the September-quarter, Apple reported solely an 8.1% enhance in revenues to $90.1B with {hardware} progress particularly slowing down arduous.

Trendforce, a market intelligence supplier, estimates that slowing demand in addition to labor shortages in China may end in a 22% yr over yr decline in iPhone shipments in Q1’23. The iPhones phase is the biggest enterprise for Apple, chargeable for 47.3% of web revenues within the final quarter, and a slowdown on this enterprise is more likely to have an outsized affect on Apple’s valuation going ahead.

Again in November 2022, Bloomberg already reported that Apple overestimated iPhone demand. Apple reacted to cooling demand for the iPhone 14 and was stated to count on to provide 87M iPhones in 2022, 3M iPhones lower than initially anticipated.

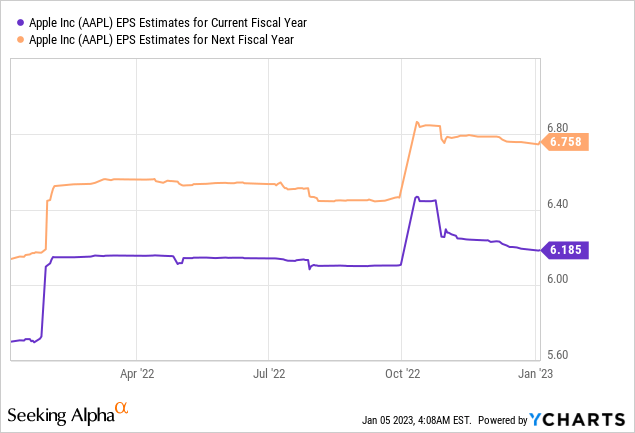

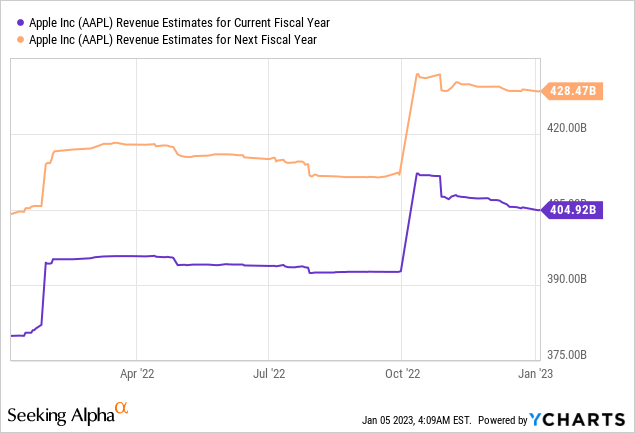

Muted progress expectations: analysts do not count on a lot from Apple in FY 2023

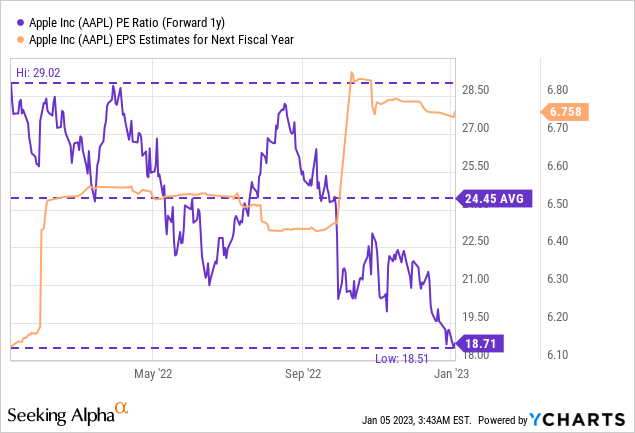

Apple goes to report earnings for its first fiscal quarter of FY 2023 on February 2, 2023 and the estimate development signifies that analyst are more and more bearish on the corporate’s progress prospects. Within the final 90 days, EPS estimates for Apple’s FY 2023 have declined persistently because of rising worries about China’s reopening prospects and down-ward EPS revisions outmatch up-ward EPS revisions by a ratio of 37:2. For FY 2023, analyst count on just one.2% EPS progress for Apple.

The image doesn’t look significantly better for Apple’s income estimate development: Analysts now count on Apple to develop its prime line solely 2.7% in FY 2023 to $404.9B. If the reopening in China doesn’t go nicely and COVID-19 infections proceed to soar, I consider that Apple’s estimate development may worsen in Q1’23.

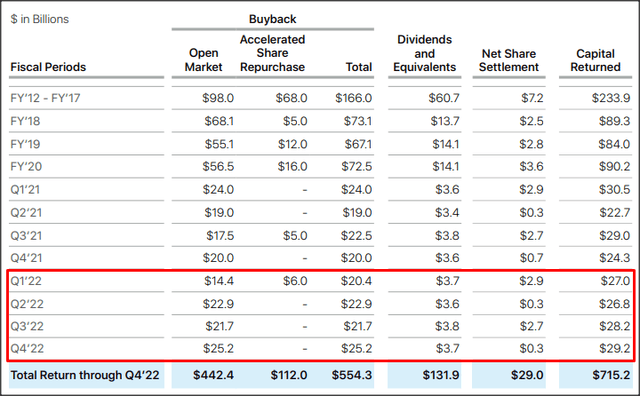

Inventory buybacks and Apple’s valuation

Inventory buybacks may make a distinction for Apple in gentle of accelerating down-side dangers and likewise assist stabilize the inventory in an more and more unpredictable working atmosphere. Apple has a historical past of financing beneficiant inventory buybacks. Within the fourth-quarter, Apple repurchased $25.2B of its shares available in the market and buybacks in FY 2022 totaled $84.2B. With Apple’s inventory making a brand new 1-year low this week (and the valuation changing into extra enticing), inventory buybacks now make extra sense than at any time within the final yr.

Supply: Apple

Apple has misplaced about 30% of its worth within the final yr and the corporate’s market cap most lately dipped beneath $2T. Based mostly off of earnings, Apple is buying and selling at a ahead P/E ratio of 18.7 X which is 24% beneath its 1-year P/E ratio. Provided that Apple is anticipated to develop its EPS nearly 1% this yr, I do not consider that Apple is particularly low-cost.

Dangers with Apple

Proper now, I consider that slowing shopper demand and a delayed reopening of the Chinese language economic system because of hovering COVID-19 infections may additional weigh on Apple’s quantity shipments in all machine segments within the close to time period. Because of this, Apple is a probably severe slowdown in {hardware} gross sales and prime line progress with margins additionally more likely to come beneath strain in FY 2023. China accounted for about 18.8% of Apple’s consolidated gross sales in fiscal 2022 so a delayed reopening of the Chinese language economic system and weakening shopper spending may create valuation headwinds for Apple’s shares.

Closing ideas

Apple at present has all of the hallmarks of a falling knife: (1) The inventory lately slumped to a brand new 1-year low, (2) Unfavorable sentiment overhang has been created as mirrored in declining EPS and income estimates, and (3) Client spending headwinds in a high-inflation world strongly point out that Apple’s inventory has additional to fall. Whereas shares of Apple have grow to be less expensive these days, the working atmosphere is challenged and it may worsen if machine cargo estimates point out that the down-turn within the shopper electronics market accelerated within the fourth-quarter. Though inventory buybacks may assist Apple offset weak point in working situations, the general setup signifies that Apple goes to see a revaluation to the down-side!