Solana worth has lately proven sturdy indicators of restoration, main analysts to foretell a bullish breakout that might see the SOL worth surpass $200.

Analysts anticipate that the present development is a precursor of a big bullish breakout as Trump tariffs fears finish and the Bitcoin worth recovers above the $94k resistance.

Is Solana Worth Prepared for a Bullish Breakout?

Solana worth has been buying and selling in a contained range-bound channel for a number of months, as depicted between October 2024 to April 2025. Throughout this time, the cryptocurrency set the vital assist degree at $147.48 and the worth has been rebounding off this degree of assist.

In accordance with Crypto Normal analyst, the worth motion has fashioned an ascending triangle sample. This sample normally factors to the bulls’ market continuation and may lengthen their transfer in direction of the higher resistance degree, which is $288.51.

The ascending triangle implies that the worth of Solana is steadily rising because the demand for the token additionally rises, with the formation of upper lows. This sample is usually considered an accumulation formation when consumers constantly drive the worth up in anticipation of a breakout. A breakout above the $288.51 could open the door for extra features, taking SOL to $350 to $390 within the subsequent few months.

Institutional Adoption Might Propel Costs Greater

One more reason that might additional push Solana’s worth up is the demand from institutional buyers, reminiscent of SOL ETFs which have utilized to the SEC and are ready to be accredited. Amid the swearing-in of a brand new SEC chair, the market anticipates an finish to the uncertainties in rules which will result in the inflow of institutional funds into Solana and different cash.

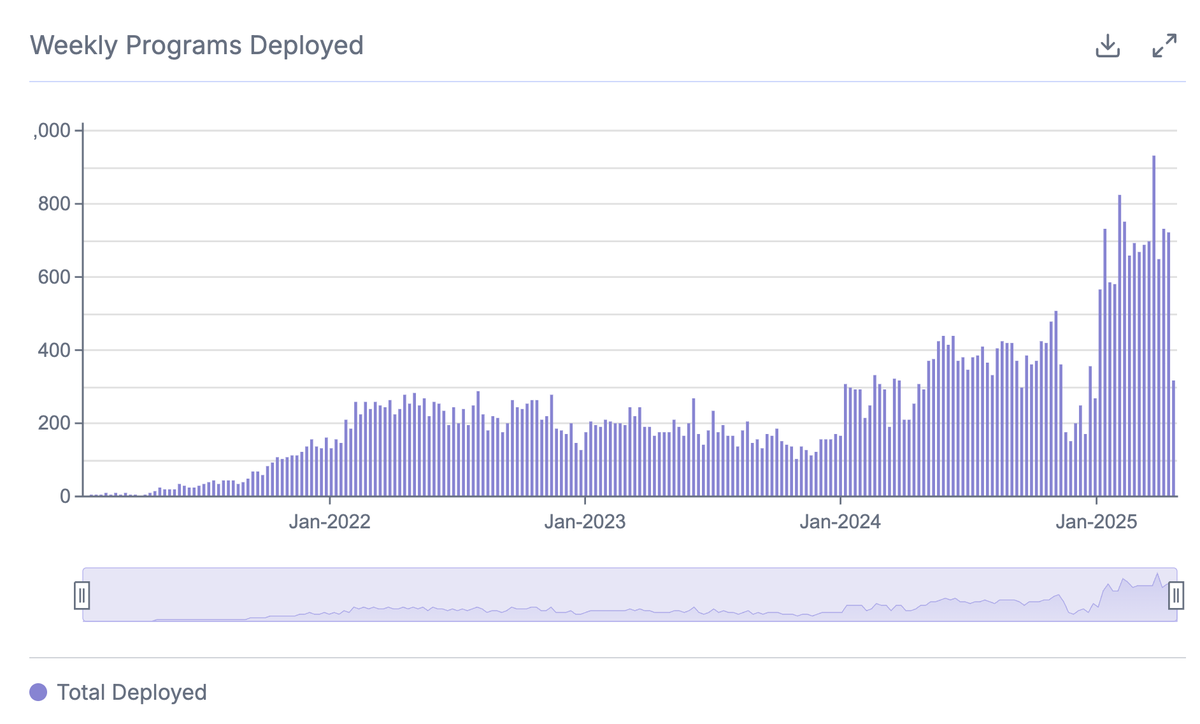

On an analogous be aware, the excessive variety of deployments on the Solana blockchain means that adoption and utilization are additionally on the rise. As extra builders construct on the platform, the case for additional development in SOL’s worth strengthens.

A number of analysts, like Peter Brandt, have additionally said that Solana may surpass Ethereum in the long run, which bolsters its long-term projections. Ought to institutional adoption improve, it may present extra upward stress on Solana’s worth and presumably even push it previous $200.

Technical Indicators Counsel Bullish Outlook

To additional assist the bullish stress, technical evaluation of the SOLUSD worth chart factors to a big bull run. From the 1-day worth chart, the Bollinger Bands are increasing, which suggests the rising fluctuations within the SOL worth. A

mid this development, the worth of SOL has crossed the higher Bollinger Band which is an indication of excessive volatility and uptrend motion. If the worth is above the center band (blue line), it indicators that this sample could stay in management, which is a bullish sign.

As well as, Solana’s chart reveals a falling wedge formation. This sample, a bullish reversal fashioned by converging development traces with decrease highs and better lows, hints at a serious transfer incoming.

Solana’s latest breakout above the higher trendline of this wedge may very well be the start of a big upward transfer. After this breakout, analysts goal $275 as a possible worth zone, reflecting a considerable upside from the present worth.

Disclaimer: The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: