Solskin

Enterprise Introduction

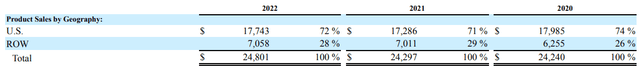

In line with Amgen (NASDAQ:AMGN) 2022 10-Okay,

Amgen focuses on areas of excessive unmet medical want and leverages its experience to attempt for options that enhance well being outcomes and dramatically enhance folks’s lives. A biotechnology pioneer, Amgen has grown to be one of many world’s main impartial biotechnology firms, has reached hundreds of thousands of sufferers around the globe and is growing a pipeline of medicines with breakaway potential.

AMGN sells its merchandise to healthcare suppliers, together with physicians or their clinics, dialysis facilities, hospitals, and pharmacies in over 100 international locations however primarily within the US.

2022 10K

Within the US, gross sales are achieved via pharmaceutical wholesale distributors and the three largest ones are McKesson Company (MCK), AmerisourceBergen Company (ABC), and Cardinal Well being (CAH), every representing greater than 10% of whole revenues for every of the years 2022, 2021 and 2020.

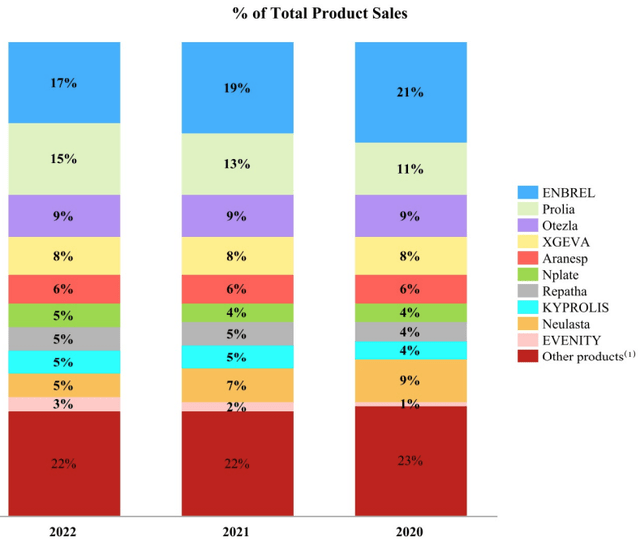

AMGN has a number of blockbuster medicine. The highest 4 generate 49% of the whole gross sales for every of the years 2022, 2021, and 2020. In 2022, Enbrel introduced in $4.21 billion for treating severely energetic rheumatoid arthritis, Prolia made $3.72 billion for the remedy of postmenopausal ladies with osteoporosis at excessive danger of fracture, Otezla is used for the remedy of adults with plaque psoriasis and made $2.23 billion, and XGEVA is used for prevention of skeletal-related occasions ($1.98 billion).

2022 10K

Causes Why Buyers Like AMGN, and Causes for Warning

1. Excessive Dividend Yield

I’m fairly positive that you’re studying this since you are interested in the delectable dividend 3.79% yield that AMGN is providing on the present inventory worth of $225.01 as of three July 2023. Nevertheless, I’m not a yield-chaser and I don’t advocate that for you. Past the yield, this text examines if AMGN can proceed to maintain the dividend payout which reached $4.2 billion in fiscal 12 months 2022 on the again of $26 billion of income and $6.6 billion in internet earnings. In her Might 2023 notice to buyers, Morningstar analyst Karen Andersen stays assured that the present dividend payout won’t hamper AMGN from rising its enterprise. She wrote:

We see Amgen’s present stage of dividend cost (roughly $4 billion yearly) and share repurchases (more likely to fall under dividend cost following the Horizon deal) is acceptable, because it maximizes returns to shareholders however nonetheless leaves some free money circulation remaining to repay debt because it comes due or help M&A. We see Amgen’s present stage of dividend cost (roughly $4 billion yearly) and share repurchases (more likely to fall under dividend cost following the Horizon deal) is acceptable, because it maximizes returns to shareholders however nonetheless leaves some free money circulation remaining to repay debt because it comes due or help M&A.

Nevertheless, even when the dividend is more likely to be protected for now, I’ll warning buyers to keep up vigilance because the dividend payout ratio has greater than tripled from 13.86% (on a GAAP foundation) in 2011 to 64.1% (on a GAAP foundation) in FY 2022.

2. Regular Previous Efficiency

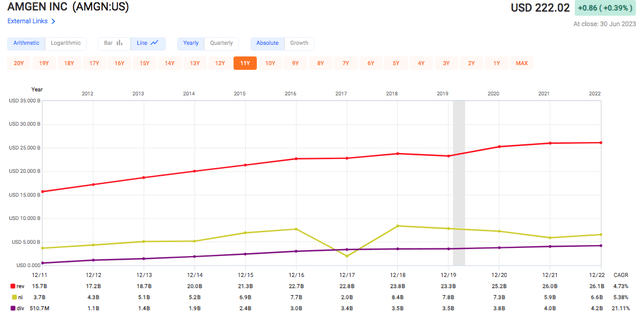

Buyers discover AMGN a sexy candidate as a result of it has dependably grown income, earnings, and naturally the dividend.

Quick Graph

Over the previous eleven years (the interval chosen is for the aim of together with the expansion of the dividends which the corporate began issuing in 2011), AMGN has grown revenues by a CAGR of 4.73%, internet earnings by 5.38%, and dividends by a formidable 21.11%.

It’s straightforward to see that AMGN appeals to each earnings buyers in addition to dividend progress buyers. Throughout Q1 2023 earnings name, CFO Peter Griffith stated:

We plan to proceed to meaningfully improve our dividends. We proceed to anticipate share repurchases to not exceed $500 million in 2023.

That echoed administration’s dedication to rewarding shareholders via dividends and share buybacks. Within the Q1 2023 10Q, the next function was famous:

We intend to proceed to spend money on our enterprise whereas returning capital to stockholders via the cost of money dividends and inventory repurchases, thereby reflecting our confidence sooner or later money flows of our enterprise and our want to optimize our value of capital

And along with the remaining $7.0 billion of authorization remaining obtainable below AMGN’s inventory repurchase program, it’s clear that the corporate intends to proceed with its shareholder-friendly practices.

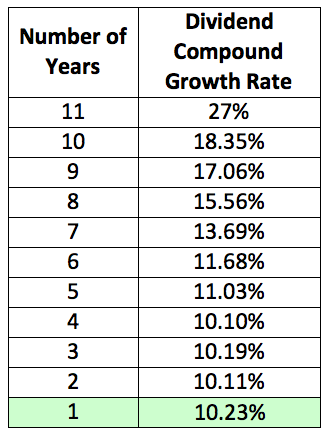

As soon as once more, I wish to warning buyers to keep up vigilance. When the dividend is rising at a charge (21.11%) that’s far increased than income (4.73%) and internet earnings (5.38%), a rise within the dividend payout ratio is to be anticipated. Buyers should be conscious {that a} decline within the dividend progress charge has already occurred.

Authors’ compilation utilizing knowledge from Quick Graph

Though it appeared to have plateaued at a progress charge of 10% previously 4 years, it’s doable and even perhaps advisable for future dividend progress charges to be pegged to the expansion charge of the income and internet earnings with the intention to have a extra sustainable dividend payout.

3. Sturdy Line of Merchandise

As talked about within the introduction, AMGN has an enormous array of merchandise, and the highest 4 (Enbrel, Prolia, Otezla, and XGEVA) generated 49% of the whole gross sales for the previous three years, every bringing in between $1.98 billion to $4.21 billion in 2022.

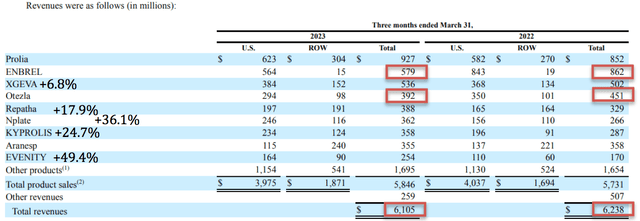

Due to this fact, analysts and buyers had been involved to see declining gross sales in two of the 4 top-blockbuster merchandise when in comparison with the identical quarter in 2022, Enbrel by 32.8% and Otezla by 13.1%. These two declines overshadowed the positive factors made by Prolia (8.8%) and Xgeva (6.8%), in addition to the double-digit positive factors made by different merchandise (see desk under). Because of the total sturdy gross sales, Amgen managed to beat Q1 2023 estimates for earnings however missed the estimates for gross sales.

Income Per Product in Q1 2023 vs Q1 2022

Zack’s analysis on 30 June 2023 famous that,

… elevated pricing headwinds and aggressive strain are hurting gross sales of a lot of Amgen’s merchandise, together with some biosimilars. Growing biosimilar competitors for some legacy merchandise and weak point in key manufacturers like Otezla and Lumakras create potential income headwinds.

Administration’s Q1 2023 commentary on year-over-year worth erosion additionally anxious buyers. Throughout the board, worth erosion occurred for AMGN’s merchandise, and the next had been highlighted: Enbrel, OTEZLA, KYPROLIS, LUMAKRAS, MVASI and KANJINTI.

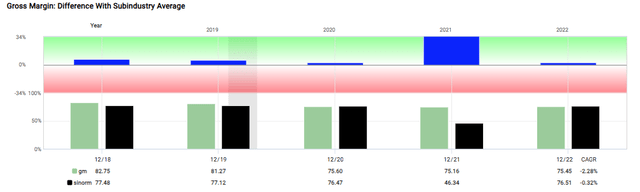

Ought to buyers be involved? I feel that buyers ought to stay vigilant as a long-term development of sustained worth decreases will naturally decrease margins and income. Over the previous 5 years, AMGN’s gross margins have been declining, from 82.75% in 2018 to 75.45% in 2022.

Quick Graph AMGN Gross Margins

Gross margins for its friends improved and exceeded AMGN’s in 2022, one thing that occurred in 4 out of the previous 21 years.

Nevertheless, I’m not overly anxious about this, as AMGN continued to be very worthwhile. Its working margins and internet margins persistently hover round 35% and 25% respectively. Additionally, going again to the “Income Per Product in Q1 2023 vs Q1 2022” desk above, buyers ought to acknowledge and take coronary heart for the sturdy progress in a lot of the merchandise in AMGN’s portfolio.

And whereas I’ll all the time take administration’s optimism with a pinch of salt, I famous that administration expressed cautious optimism about the remainder of the 12 months. Administration defined that a part of the rationale for worth declines in among the merchandise is supposed to keep up its market share within the face of intensifying competitors, and competitors goes with the territory so the actions taken by administration to decrease costs in such conditions aren’t shocking.

4. Sturdy Merchandise and Promising Pipeline

When evaluating any pharmaceutical firm, it’s essential to take a look at the efficiency of the highest merchandise.

Amgen (AMGN) Presents At 41 st Annual Healthcare Convention

As well as, additionally it is essential to review the dimensions of the pipeline and AMGM has a promising pipeline concentrating on three therapeutic areas, specifically irritation, oncology, and common medication.

Knowledge from Amgen (AMGN) Presentation At forty first Annual Healthcare Convention

Along with this pipeline, present FDA-approved merchandise are additionally below investigation for purposes in several areas of therapies, comparable to Repatha for decreasing LDL-C ranges, and Lumakras for treating non-small cell lung most cancers, colorectal most cancers and different stable tumors.

Keep in mind the information and uproar round shortages of diabetes medicine like Ozempic and Trulicity as a result of many individuals together with celebrities had been shopping for and taking these as weight-loss medicine? AMGN has a promising candidate within the pipeline often called AMG133, already shifting right into a Part 2 examine.

In January of 2023, AMGN launched its biosimilar product Amjevita to rival AbbVie’s Humira. Extra on this late.

Within the earlier sections, each dangers and alternatives had been mentioned. Within the subsequent part, the main focus shall be extra on the opposite dangers (or uncertainties), a few of which AMGN has no management over.

4 Dangers and Uncertainties

1. Tax Woes with the IRA

This isn’t new information. Again in August 2022, the Wall Road Journal reported that AMGN “owes billions of {dollars} in again taxes and penalties after the allegedly improper shift of almost $24 billion in income to a Puerto Rico subsidiary” so as to not pay taxes.

That matter has but to be resolved, however it’s already inflicting points with its deliberate acquisition of Horizon Therapeutics. In recent times, AMGN has been on an acquisition spree (just like the Chemocentryx acquisition that was concluded in October 2022 which added Tavneos to its product lineup in addition to three early-stage drug candidates that concentrate on chemoattractant receptors and different inflammatory ailments and an oral checkpoint for most cancers) to beef up its portfolio of merchandise in anticipation of the patent expiration of a lot of its merchandise (extra on this later), and the acquisition of Horizon is meant to convey related advantages by including the product Tepezza. Nevertheless, when Q1 2023 gross sales of Tepezza declined by 19% in comparison with its 2022 outcomes, buyers turned anxious with regard to the soundness and prospect of this proposed acquisition which can add to AMGN’s already heavy debt.

2. The pending acquisition of Horizon Therapeutics

The Federal Commerce Fee (FTC) has filed to dam AMGN’s acquisition of Horizon Therapeutics. Though in keeping with this Wall Road Journal article, FTC’s premise of anticompetitive conduct is shaky at greatest, which implies AMGN’s acquisition has a excessive probability of succeeding, the actual fact is the acquisition must be pushed again to Q3 of 2023, and buyers hate uncertainties of any types.

3. Patent Cliff

What’s much more worrying is the pending patent cliff. Enbrel, its top-selling product which treats ailments like rheumatoid arthritis, is already going through competitors from AbbVie’s Humira. In line with this text by Fiercepharma,

… 9 merchandise within the Massive Biotech’s choices face patent expirations between 2021 and 2030. Amongst them, TNF blocker Enbrel, bone med Prolia/Xgeva and inflammatory illness remedy Otezla make up 41% of the corporate’s estimated 2025 whole income.

Otezla, which Celgene bought to Amgen in 2019 for $13.4 billion to win antitrust clearance for its BMS merger, might lose 81% of its income, or almost $2.7 billion, between 2025 and 2030, sell-side consensus confirmed. Enbrel and Prolia/Xgeva additionally must brace for greater than 50% erosion throughout that interval, with losses of $1.6 billion and $2.9 billion, respectively.

AMGN’s administration definitely is aware of this higher than anybody else, therefore its quite a few acquisitions in recent times, in addition to its funding into its promising pipeline. I imagine that it is a actual risk, and it’s one which the administration is actively addressing, and meaning extra prices invested in R&D and acquisition, prices concerned in opening up new markets for present merchandise, and the following improve in long-term debt are more likely to occur.

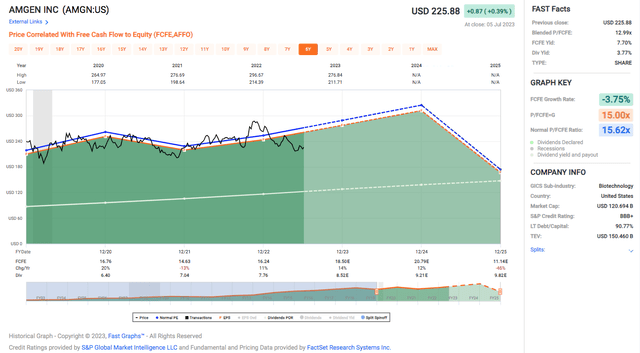

FactSet analysts anticipate free money circulation, from which dividends are paid, to fall sharply in 2025. That may improve the dividend payout ratio to 88.2%, which continues to be protected however undoubtedly a lot much less so than the present payout ratio.

Quick Graph

That is the factor about investing in firms like AMGN and AbbVie (ABBV) – patent cliffs will occur constantly over the course of the corporate’s existence. ABBV’s case is current sufficient for me to make use of it as a blueprint to foresee what’s and shall be taking place to AMGN. When ABBV, like AMGN, was going through its Humira’s expiration in 2023, the share worth fell 7.6% from April 2022 to December 2022, and after its expiration this 12 months, it fell an extra 17.4% from January 2023 to July 2023 as income is predicted to fall sharply towards Humira’s competitors; seven Humira biosimilars have already obtained FDA’s approval.

ABBV didn’t merely await the axe to fall. It used authorized means to carry off opponents for a few years which made it troublesome for Humira’s biosimilars to enter. And though the decline in Humira gross sales is predicted in 2023, it won’t be a complete collapse.

AMGN did that too when it fended off competitors with Enbrel from Sandoz’s FDA-approved biosimilar etanercept (or Erelzi), which obtained approval in 2016 however needed to await 8 extra years earlier than it will possibly begin to promote it. In line with this Forbes article,

Producers of originator biologics have been particularly adept at erecting boundaries to entry. Many originator biologics that must be eligible for biosimilar competitors face none, and those who do are solely confronted with competitors after exceedingly lengthy delays, largely brought on by protracted patent disputes.

Simply as AMGN had prolonged the patent expiration of its top-selling Enbrel to 2029, an additional 17 years after its unique patent was alleged to have expired in 2012, I’m sure that AMGN will proceed to combat tooth and nail to ringfence the profitability of the prevailing top-selling medicine which are additionally nearing patent expiration. The uncertainty as all the time is whether or not the courts will aspect with AMGN’s authorized efforts, particularly in an atmosphere that’s shifting in direction of pricing medicine decrease.

AMGN’s inventory worth has already fallen by 22% since November 2022 and I can’t be shocked to see additional drops when patent-expiration-related information seems sooner or later. Nevertheless, with its BBB+ credit standing, optimistic money circulation, sturdy money steadiness, and administration’s expertise in making accretive acquisitions and in defending the profitability of its present best-sellers, AMGN ought to have the ability to handle the above challenges adequately. Buyers simply must go in with their eyes huge open, and when future information on expiring patents seems, and the following sell-offs that may occur, AMGN buyers ought to reassess AMGN’s future by analyzing the expansion of the opposite medicine aside from the highest 4, and the progress made within the pipeline.

4. Gross sales of AMGN’s Amjevita

Lastly, the gross sales of Humira’s rival didn’t go in addition to deliberate, a lot in order that “Amjevita” was not even talked about within the Q1 2023 earnings name. Nevertheless, I imagine that the gross sales of this product are simply within the early innings, and with time the gross sales staff will do its job of reaching out to extra clients.

Conclusion

No person likes uncertainties. Nevertheless, the one certainty in investing is that inventory costs go up, and they’ll go down. Simply because AMGN’s inventory worth declined shouldn’t instantly sign a discount for worth buyers to plow into the corporate. Reasonably, worth buyers ought to look at the strengths of the enterprise (profitability, industry-leading margins, double-digit progress in lots of present merchandise, shareholder-friendly practices), and the areas of alternatives (pipeline), at the side of the weaknesses (patent cliff, declining gross sales in 2 prime performers) and threats (competitors, regulators, uncertainties concerning the success of latest acquisitions).

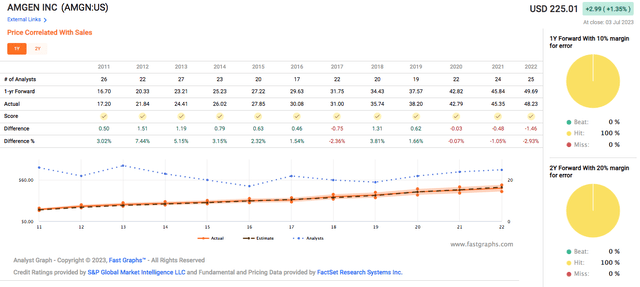

Administration is essential to navigating the challenges of an {industry} as robust and aggressive because the one which AMGN is in. Over the previous 12 years, it’s evident that the administration has achieved a wonderful job in rising gross sales 12 months after 12 months, even via the pandemic, and has been giving nice steering to analysts, which signifies administration’s brutal honesty and in-depth data when it assesses its enterprise.

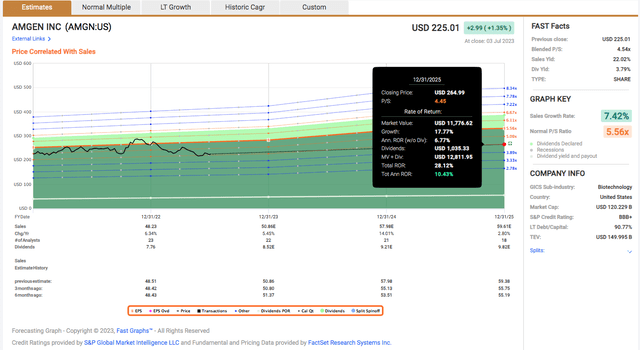

Quick Graph

Traditionally, AMGN’s gross sales CAGR has ranged between 6-7% in more moderen years to 12% when contemplating a 20-year interval. Taking a conservative strategy to think about a margin of security, assuming that AMGN trades at a P/S of 4.45 which is decrease than each the blended P/S of 4.54 and its regular P/S of 5.56, AMGN continues to be in a position to present a ten.43% whole annualized charge of return by 2025, a 17.7% capital acquire in two-and-a-half years. Due to this fact, I imagine that the uncertainties are already priced in on the present worth ranges of round $220-$225.

Quick Graph

Again to certainty and uncertainty. I’m lengthy AMGN and imagine that it’s undervalued now. I do assume that the dividend continues to be protected, however I don’t advocate holding an outsize place as a part of being prudent, and I can’t be investing in AGMN merely for its excessive dividend yield as a result of AMGN. As a substitute, I’ll proceed to watch its gross sales and earnings as an energetic investor. As Peter Lynch famously stated,

In case you can observe just one bit of knowledge, observe the earnings (assuming the corporate in query has earnings). I subscribe to the crusty notion that ultimately earnings make or break an funding in equities. What the inventory worth does in the present day, tomorrow, or subsequent week is simply a distraction.

Though I imagine that the times of double-digit progress charges in earnings will not be so achievable in the present day, I do imagine that it’s nonetheless firm to personal in a single’s portfolio. To me, 3.79% is price some effort on my half to fuss over. Allow us to as prudent buyers monitor the earnings of this glorious firm, and belief within the administration who has been doing job to proceed to do their greatest within the curiosity of shareholders.