zimmytws/iStock via Getty Images

When we last covered America First Multifamily Investors, L.P. (NASDAQ:ATAX) we were unimpressed with the valuation. Since we expected interest rates to rise at the long end, we were looking for a sharp drop in tangible book value for this one. We rated it at a hold, noting that this was just grazing our “sell zone”.

There remains room for ATAX to move down and catch up to these as investors price in the actual changes to income and book values. At 1.20X-1.25X our estimated price to tangible book value, this falls very close to our sell zone. We rate it neutral for now.

Source: Interest Rate Changes Will Impact 2022

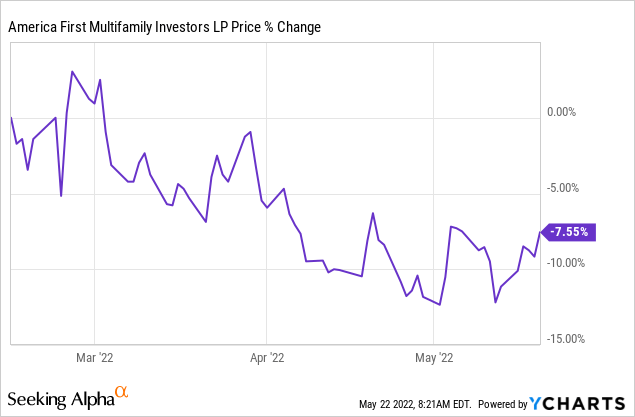

ATAX delivered a weak performance from that point and at its trough was down about 12% from that article date.

We look at the landscape today after the recently released Q1-2022 results with a broader scope of getting tax-advantaged income.

ATAX & Mortgage REITs

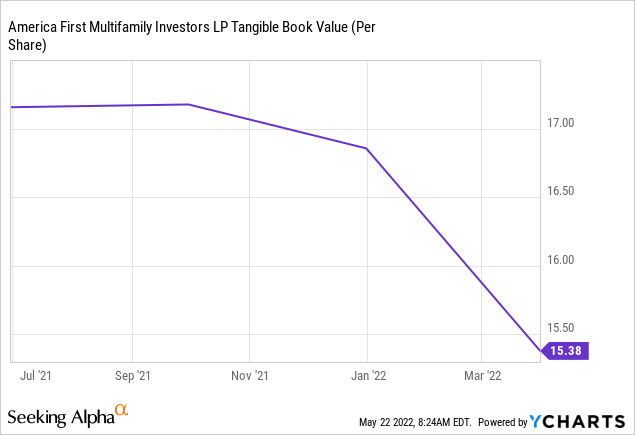

Our key reason for staying out, had to do with expensive valuations. This was not readily apparent as the book values had not been marked down, yet. We did get that though in Q1-2022 as the mortgage bond selloff picked up steam.

Tangible book value dropped a solid 10% per share. As we had previously explained, ATAX remains one of the few real estate investments where tangible book value is very close to NAV. The bulk of its assets include mortgage revenue bonds versus physical real estate. The former is reflected at fair value based on GAAP, whereas the latter is nowhere close to its fair value under the same system.

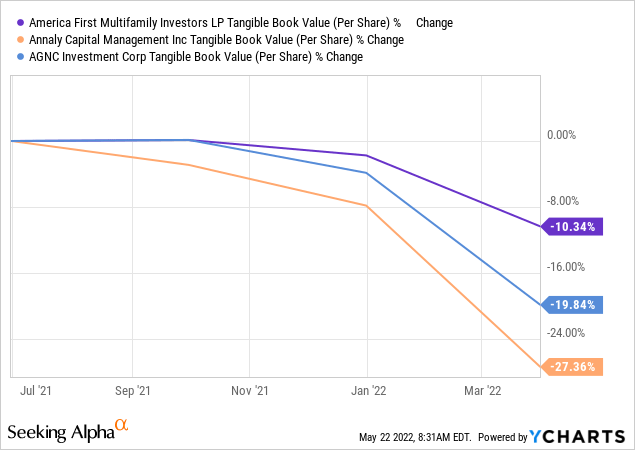

One other way to look at ATAX is to think of it as a far less leveraged mortgage REIT.

Below you can see the drop in tangible book value per share for ATAX, AGNC Investment Corp. (AGNC) and Annaly Capital Management, Inc. (NLY) over the last year.

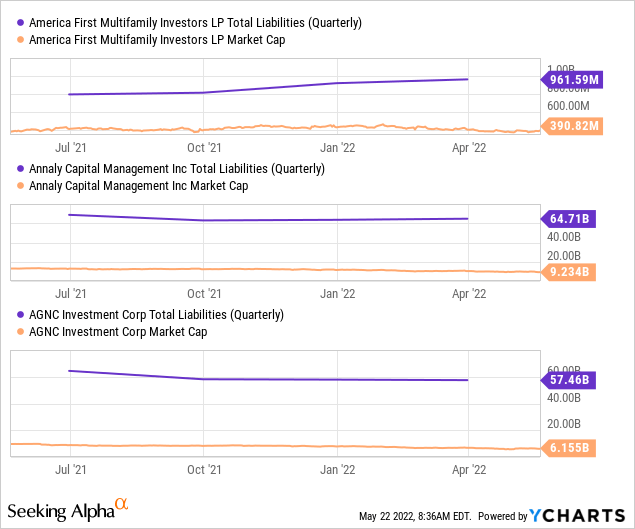

ATAX’s tangible book drops far less, despite using less hedges, as it uses way less leverage. You can see this by examining total liabilities to market capitalization.

The drop in tangible book value while notable in the case of ATAX, likely overstates the damage to some extent. A key reason is that ATAX also owns actual apartments and those likely are appreciating in value over time. That is not reflected in the falling tangible book value. Under GAAP we actually see the reverse where depreciation pushes this aspect of the asset lower. ATAX actually booked a large gain on sale of a property during Q1-2022.

In March of this year the Vantage at Murfreesboro property was sold for a gross sales price of $78.5 million or approximately $273,000 per unit. This transaction returned $12.2 million in original contributed capital to us along with $17 million in capital gains and preferred return realized upon sale. Our overall return of the property was at 2.69 times multiple of invested capital.

Source: Q1-2022 Conference Call Transcript

Hence NAV is greater than tangible book value and likely closer to $17.00 in our opinion.

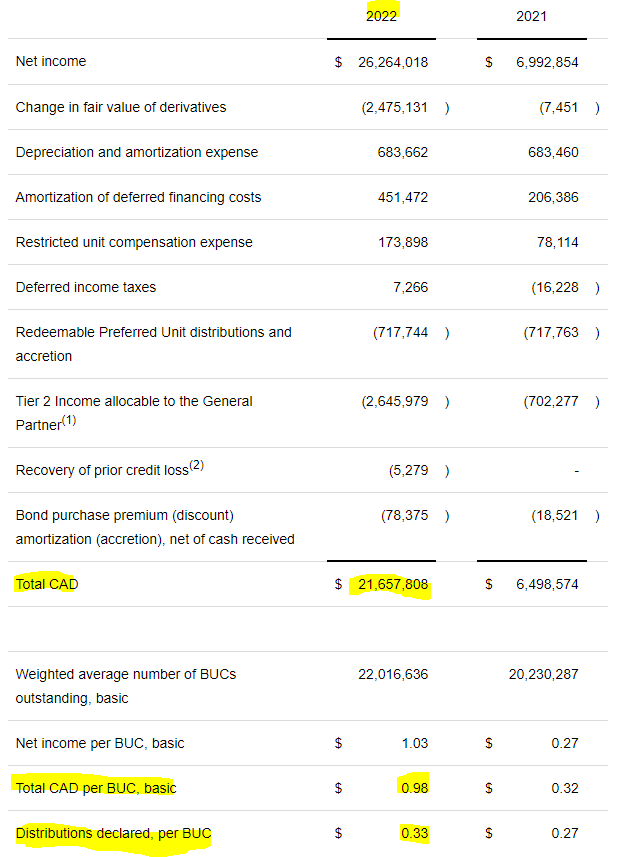

One other aspect that went really well for ATAX was the cash generated during the quarter. This was likely an outlier quarter, but nonetheless, the 3X coverage of the distribution was very impressive.

– (ATAX Q1-2022 Results)

This combination of lower leverage and real assets makes ATAX an interesting alternative to mortgage REITs.

Valuation & Outlook

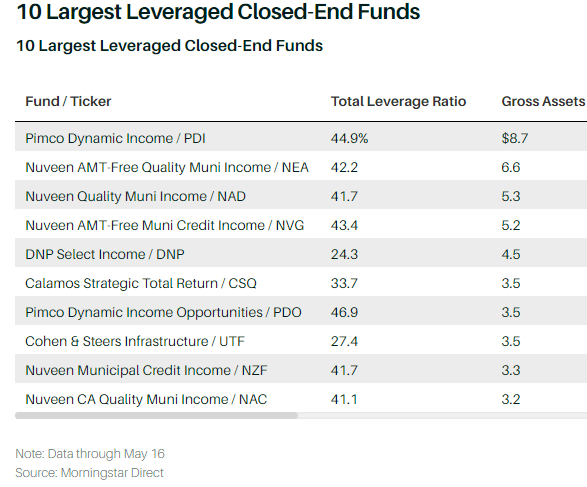

Investors hate paying taxes and that is probably the reason we see that half of the largest leveraged closed end funds focus on muni bonds.

Morningstar

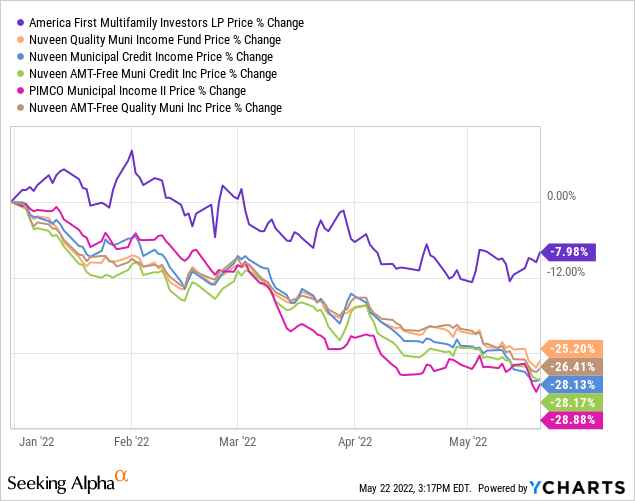

Interestingly, these all including Nuveen AMT-Free Quality Muni Income (NEA), Nuveen Quality Muni Income (NAD), Nuveen AMT-Free Muni Credit Income (NVG) & Nuveen Municipal Credit Income (NZF), have all fallen about 25%. PIMCO Municipal Income II (PML), which is not in the list above, but popular nonetheless, has dropped almost 30%.

ATAX is an alternative to even this space as the bulk of its income is actually shielded from taxes. That advantage does come with a K-1 though. While we have seen investors do all kinds of silly antics to avoid a K-1, we don’t think these are remotely as scary as everyone makes them out to be. ATAX’s partially tax-shielded income also came with a better yield and lower volatility than these funds.

How We Played It

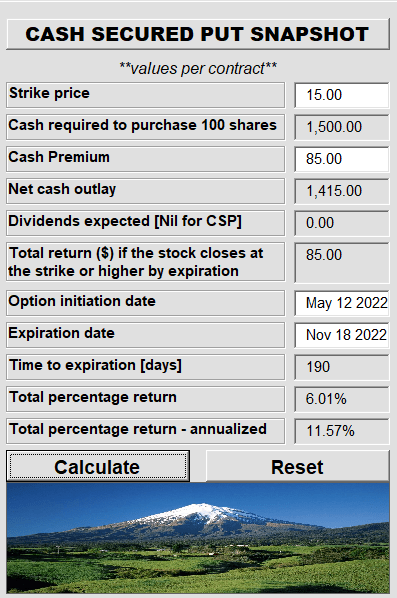

ATAX now trades at about 1.1X tangible book value (using numbers from Q1-2022) but realistically, we are looking at again closer to 1.15X, thanks to further declines in mortgage bond values in Q2-2022. In an ideal world, we would want to pick this up under the tangible book value and after interest rates have done all the damage that they can. On the latter aspect, we are little more relaxed as we think a good deal of the damage has been done. Of course, the price is far higher than tangible book, so we took a slightly different approach. We decided to sell the $15.00 Cash Secured Puts for 85 cents on May 12.

Trapping Value

This gives us a great risk adjusted entry at $14.15, should ATAX trade below $15.00 on November 18, 2022. The yield on this is also quite competitive with the stock itself.

The main advantage though, is the good buffer between the strike price and the stock price. This reduces us the volatility of our portfolio during the worst of times and allows us to only land up purchasing at the best possible price. At the current price we remain neutral on the stock but do note that we would buy this directly under $15.00/share.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.