Updated on June 27th, 2022 by Nikolaos Sismanis

Alkeon Capital Management is a privately-owned registered investment adviser out of New York. The company was formed in 2002 as a spin-off from CIBC Oppenheimer.

Two key individuals govern the firm: Takis Sparaggis, President and CIO, and Alex Tahsili, who performs the Managing Director role.

They both oversee Alkeon Capital Management’s portfolio, currently valued at approximately $49.9 billion, of which around $24.3 billion is allocated in public equities.

Investors following the company’s 13F filings over the last 3 years (from mid-May 2019 through mid-May 2022) would have generated annualized total returns of 4.8%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 16.1% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of Alkeon Capital Management’s current 13F equity holdings below:

Keep reading this article to learn more about Alkeon Capital Management.

Table Of Contents

Alkeon’s Approach To Investing

Alkeon has stayed away from the spotlight for decades, publishing limited information regarding its operations and investment philosophy. An interview with management from its early days, however, reveals essential info which seems to hold up in the present day.

Its research process is a 100% bottom-up, fundamentally-driven, research-concentrated procedure to investing. Their flagship strategy involves identifying significant potential returns in Technology, Media, Telecom (“TMT”) in the broadest of scope. Applying a bottom-up strategy implies that Alkeon focuses on individual securities rather than on the overall movements in the securities market.

Mr. Sparaggis, who holds the final word for any investment, aims for a 12 to 24-month time horizon for Alkeon’s holdings and discourages short-term trading. Alkeon avoids timing the direction of the market and aims to generate alpha based on its exceptional stock-picking skills. It also has an elaborate network of industry contacts, with whom it is in continuous talks in order to identify industry trends before they become apparent to Wall Street.

Alkeon is primarily focused on investing in stocks with impressive growth rates. Many investors hesitate to invest in this type of stock due to their excessive price-to-earnings ratios but Alkeon has proved competent in identifying high-growth stocks that produce outsized returns. Notably, the average price-to-earnings ratio of the stock portfolio of Alkeon currently stands at 57.43.

In terms of risk management, the company’s in-house risk manager is responsible for periodic checks to ensure diversification among individual securities and sectors, liquidity, and overall fund exposures.

Finally, Alkeon manages its clients on a pari passu basis. In other words, clients are treated in an equal-footing manner, managed without preference. By comparison, some hedge funds may differentiate among multiple classes of clients, based on their available capital and reputation.

Alkeon’s Portfolio & Top Holdings

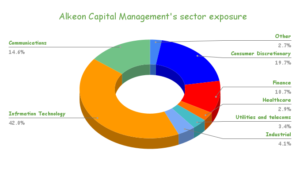

Around 1/3 of Alkeon’s portfolio consists of public equities, while the rest embodies several options, as hedge funds often do to alleviate their risk profile. The picks reflect management’s tech and consumer discretionary-oriented strategy. These two sectors occupy around 62% of Alkeon’s portfolio collectively.

Source: 13F filings, Author

Out of Alkeon’s 114 individual stocks, the top 10 holdings account for around 31.2% of its public-equities part of the portfolio. That figure reaches about 48.5% when it comes to its 20 larger picks, which indicates a relatively concentrated allocation of funds.

However, no holding accounts for more than 5.6% of the total portfolio, which is quite unique among the various funds we have covered. That being said, the fund’s sector diversification may be a bit weak due to the almost exclusive focus of Alkeon on tech and consumer discretionary stocks.

During the period covering Alkeon’s latest 13F filing, the fund initiated and sold the following noteworthy securities:

New Buys:

- Tesla Inc (TSLA)

- Workday Inc (WDAY)

- Adobe Systems, Inc. (ADBE)

- American Express Co (AXP)

- DocuSign Inc (DOCU)

- Salesforce.com Inc. (CRM)

New Sells:

- Costco Co. (COST)

- ANSYS, Inc. (ANSS)

- Aspen Technology Inc (AZPN)

- Trip.com Group Ltd (TCOM)

- TAL Education Group American Depositary ADR (TAL)

As of the fund’s latest 13F filing, the following are the top 10 holdings of Alkeon:

Source: 13F filings, Author

Meta Platforms, Inc. (META)

Meta Platforms has had a place in Alkeon’s portfolio since Q3-2014 and is now the fund’s largest holding.

Meta is a tremendous cash cow, but with a problem. With strong financials, a healthy balance sheet, and the best social media platform for advertisers, Meta has been dominating the social media industry. The company reported an all-time high bottom line of $19.37 billion in FY2021, amid great user growth, notwithstanding now decelerating to the single digits.

For these reasons, it would not be a complete surprise if Meta paid a dividend at some point in the future.

On the other hand, the stock has failed to attract a higher multiple, as the steep scrutiny it has faced over the past few years have had an impact on the valuation. Speculation over the company’s huge spending toward “The Metaverse” has also spurred uncertainty. The stock is only trading at around 16.0 times its underlying earnings, despite its consistent profitability and future growth prospects.

With its ARPU (average revenue per user) still very strong, Meta’s financials are more than likely to continue expanding rapidly. Meta’s investment case today does not only include the potential for a significant upside but also comes with a great margin of safety.

If such a valuation expansion never appears, and Meta continues to trade at a forward P/E of around 16.0, at an EPS growth rate of 10%-15% in the medium term (which the current user and APRU growth trajectory and ongoing stock repurchases could reasonably sustain), investors should achieve equally satisfactory returns with a constant valuation multiple.

Meta Platforms stock currently accounts for 5.6% of the fund’s total holdings.

Alphabet (GOOGL)(GOOG)

Alphabet offers several well-known products, such as Google, Android, Chrome, Google Cloud, Google Maps, Google Play, YouTube, as well as technical infrastructure. While the company’s expansion has lasted for more than a decade and a half, it is still a high-growth stock.

Revenue growth has re-accelerated, with the company posting growth of over 41% last year, despite the deceleration caused during the first couple of quarters during the initial pandemic outbreak. The company is one of the most attractively priced stocks in the sector as well, trading at around 19.1 times its forward earnings, despite its consistent growth, massive moat, and strong balance sheet.

With its robust profitability, Alphabet has accumulated a cash and equivalents position of $133.9 billion. As a result, the company can comfortably afford to invest in its long-term bets such as Waymo, and in the meantime return cash to its shareholders through buybacks. Alphabet has repurchased $52.18 billion worth of stock over the past four quarters, retiring shares at an all-time high rate.

Alkeon trimmed its position by 13% during the quarter. The stock accounts for around 5.1% of its portfolio and is the fund’s second-largest holding.

QUALCOMM Incorporated (QCOM)

QUALCOMM is a relatively new position in Alkeon’s portfolio. The fund initiated a position in Q4 2021, yet QUALCOMM quickly ascended amongst the fund’s top holdings.

“Quality Communications” was started in the living room of Dr. Irwin Jacobs in 1985. The company’s first product and service was a satellite used by long-haul trucking companies that could locate and message drivers. Qualcomm, as it is known today, develops and sells integrated circuits for use in voice and data communications. The chip maker receives royalty payments for its patents used in devices that are on 4G and 5G networks.

The company has grown earnings-per-share at a rate of 6.6% per year over the last decade. Its agreements with Apple and Huawei, a declining share count, and leadership in 5G should allow the company to grow in the coming years. We also believe that demand for 3G/4G/5G headsets will increase following a recovery from the COVID-19 pandemic.

QUALCOMM also numbers 20 years of consecutive annual dividend increases, featuring a 5-year dividend-per-share CAGR of 5.11%.

QUALCOMM is Alkeon’s third-largest holding, making up 4.0% of its portfolio. The fund boosted its position by 10.2% compared to the previous quarter.

Synopsys develops electronic design automation software products used to compose and test integrated circuits. Both the company’s top & bottom lines have expanded rapidly over the past few years, as Synopsys benefited greatly from the growing global demand for chips.

Analysts are currently expecting annualized earnings growth in the double-digits over the medium term. However, trading at a forward P/E of over 37.6 while still not paying a dividend, current investors face a very thin margin of safety.

The position was trimmed by 9% during Alkeon’s latest quarter. It is the fund’s fourth-largest position.

Cadence Design Systems, Inc. (CDNS)

Cadence Design Systems offers software, hardware, services, and reusable integrated circuit design blocks internationally. The company’s functional verification services, comprising of emulation and prototyping hardware, allow its clients to perform chip verification.

The company’s revenues and net income have been expanding at a very consistent and rapid pace over the past decade. A dividend has yet to be initiated, nonetheless.

Cadence has had a place in Alkeon’s portfolio since late 2014. The fund trimmed its position by 2% during the quarter, but still owns around 1.51% of the company’s outstanding shares. It’s now the fund’s fourth-largest holding.

Microsoft (MSFT):

Found amongst the top holdings of the majority of the funds we have covered, Microsoft is Alkeon’s sixth-largest holding, occupying 2.5% of its portfolio. The fund trimmed its position by 22% during the quarter.

Microsoft is a mega-cap stock with a market capitalization of $1.85 trillion.

Supported by the company’s strong profitability, management has been consistently raising buybacks over the past decade to further reward its shareholders. The amount allocated to stock repurchases has reached new all-time highs over the past four quarters, at nearly $31.1 billion.

Revenue growth remains in the double-digits, so it’s likely to see capital returns accelerating moving forward. The company is also growing the dividend at a double-digit rate, though at the current yield, which stands below 1%, investors should expect the majority of their future returns in the form of capital gains.

Despite that, Microsoft’s cash position has been growing continually, with the company currently sitting on top of a massive $104.6 billion cash pile.

Further, while many companies had chosen to utilize the ultra-low interest rate environment over the past several years to raise cheap debt and buy back stock, Microsoft’s remained prudent and thoughtful. Not only are current earnings extensively covering buybacks (~60% buyback “payout ratio”), but long-term debt has been substantially reduced from $76 billion in mid-2017 to around $48.1 billion as of its last report.

It is impressive that a stock with a market capitalization of $1.85 trillion still has such a strong growth momentum. Shares are also trading at a forward P/E ratio of around 23.3, which could signal an opportunity against the company’s strong growth velocity, especially from Azure. Due to Microsoft’s robust growth and financials, it’s likely that investors won’t let shares trade at much of a discount going forward, despite the underlying shaky macroeconomic environment.

KLA Corporation (KLAC)

KLA Corporation is a supplier to the semiconductor industry. The company supplies process control and yield management systems for semiconductor producers such as TSMC, Samsung, and Micron. KLA was created in 1997, through a merger between KLA Instruments and Tencor Instruments, and has grown through a range of acquisitions since then.

KLA Corporation’s earnings-per-share growth has historically come from a mix of revenue growth, margin improvements, and share repurchases. The revenue growth outlook remains strong, as KLA has been able to grow its sales considerably during the last couple of quarters. The majority of KLA’s revenues come from product sales, but service revenues are becoming increasingly important. This is a positive in the long run, as a higher rate of recurring service revenues should help KLA’s top line become less cyclical.

The company has also grown its dividend per share for 12 consecutive years now, featuring a 5-year DPS CAGR of 14.22%.

KLA has had a place in Alkeon’s portfolio since Q2-2017. The fund trimmed its position in the company by 4% during the previous quarter. KLA is now Alkoen’s seventh-largest position, comprising 2.4% of its portfolio.

Taiwan Semiconductor Manufacturing Company Limited (TSM):

Taiwan Semiconductor Manufacturing is the world’s largest dedicated foundry for semiconductor components. The company is headquartered in Hsinchu, Taiwan. American investors can initiate an ownership stake in Taiwan Semiconductor through American Depository Receipts on the New York Stock Exchange, where they trade under the ticker TSM with a market capitalization of US$440.7 billion.

As the leader in the semiconductor manufacturing industry, it is unsurprising that Taiwan Semiconductor has generated tremendous growth over the last decade. Indeed, the company has compounded its adjusted earnings-per-share by 16.0% per year over this time period. The company exhibits a remarkably strong balance sheet as well. Since very few companies are debt-free, the exceptional balance sheet of the semiconductor manufacturer is a testament to the strength of its business model, which does not require debt to fuel growth and generates ample free cash flows.

Taiwan Semiconductor is Alkeon’s eighth-largest holding. The position was left relatively unchanged compared to the previous quarter.

Lam Research Corp. (LRCX)

Lam Research Corporation was founded in 1980 and headquartered in Fermont, California. The company designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used to fabricate integrated circuits worldwide. Lam is a major supplier of wafer fabrication equipment and services to the semiconductor industry.

Lam Research has grown its revenue by an impressive 20.12% growth rate over the past ten years and 18.33% over the past five years. Earnings per share have increased by over 32.4% over the past five years.

Alkeon increased its position in the stock by 19% during the last quarter. The stock now accounts for 2.0% of Alkeon’s holdings and is the fund’s ninth-largest position.

Visa (V)

Visa is the world’s leader in digital payments, with activity in more than 200 countries. The stock went public in 2008, and its IPO has proven to be one of the most successful in U.S. history. The company’s global processing network provides secure and reliable payments around the world and is capable of handling more than 65,000 transactions a second. In the fiscal year 2021, the company generated nearly $12.3 billion in profit.

On April 26th, 2022, Visa reported Q2 fiscal year 2022 results for the period ending March 31st, 2022. (Visa’s fiscal year ends September 30th.) For the quarter, Visa generated revenue of $7.2 billion, adjusted net income of $3.8 billion, and adjusted earnings-per-share of $1.79, marking increases of 25%, 27%, and 30%, respectively.

These results were driven by a 17% gain in Payments Volume, a 47% gain in Cross-Border Volume, and a 19% gain in Processed Transactions. As a result of economic sanctions imposed on Russia by the U.S., European Union, United Kingdom, and others, Visa announced in March 2022 that they were suspending operations in Russia and since they are no longer generating revenue from activities related to Russia. Russia accounted for roughly 4% of total net revenues for the first half of fiscal 2022 and the full year of fiscal 2021.

During the quarter, Visa returned $3.7 billion to shareholders via dividends and share repurchases.

Visa is Alkeon’s tenth-largest position. The fund boosted its position by 54% during the latest quarter, resulting in Visa accounting for 1.9% of its total holdings.

Final Thoughts

Despite Alkeon’s low profile and preference to not attract media attention, the company is a silent achiever. Its performance has lagged lately as a result of the ongoing sell-off that has primarily occurred in technology and growth equities. Still, in the past Alkeon has delivered market-beating performance by unlocking the alpha potential on multiple stocks, providing its clients with excellent investment returns.

You can download an Excel spreadsheet with metrics that matter of Alkeon Capital Management current 13F equity holdings below:

Additional Resources

See the articles below for analysis on other major investment firms/asset managers:

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.