Jack Ma when requested the place Alibaba inventory worth was going Andrew Burton

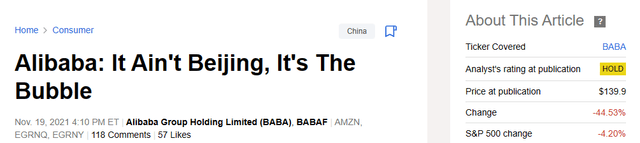

On our earlier protection of Alibaba Group Holding Restricted (NYSE:BABA), we emphasised that the inventory was in worth territory however unlikely to provide huge returns. That stemmed from prioritizing macro over the micro and disregarding the potential spin-off profit.

We predict that this “six levels of separation” concept of spinning off all these items by BABA would possibly cut back regulatory threat however will considerably improve overhead prices. It would additionally lower pricing energy additional. We price the inventory a maintain and suppose that these bullish ought to play it utilizing lined calls.

Supply: Six Levels Of Separation

That concept was an outlier and it was attention-grabbing to see BABA drop sharply on its earnings launch because it introduced that it’s going to now not spin-off the Cloud Intelligence Group. Let’s look the outcomes, the valuation and replace why we consider buyers could make some dough right here.

A Step Again

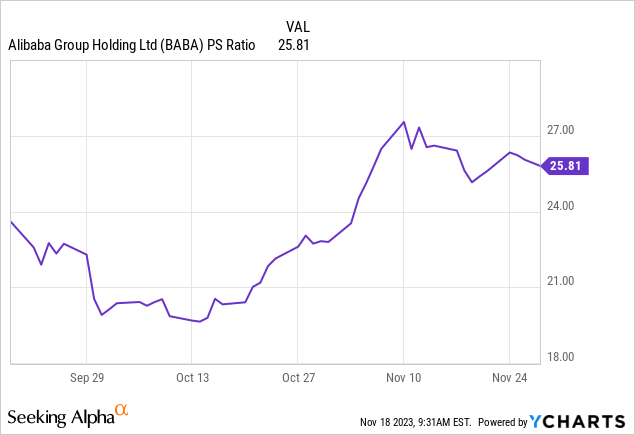

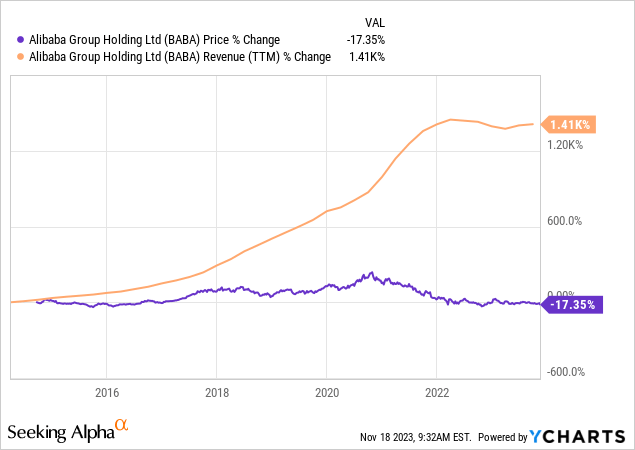

Earlier than we get to these outcomes, it’s useful to see simply how a lot valuation compression or growth can play a task in returns. Think about on the day of the US itemizing somebody informed you that BABA’s revenues shall be up 1400% inside a decade they usually nudge you to enterprise your complete returns.

Most novice buyers would enterprise that you’d doubtless see near the identical stage of complete returns. Clever buyers as in those who have lived by a few bear markets and know what valuation metrics are vital, if requested the identical the identical factor can be extra conservative. They might word the terribly costly nature of the itemizing (worth to gross sales of 24X), and would maybe go along with a 200%-300% complete return prospect.

However nobody noticed this.

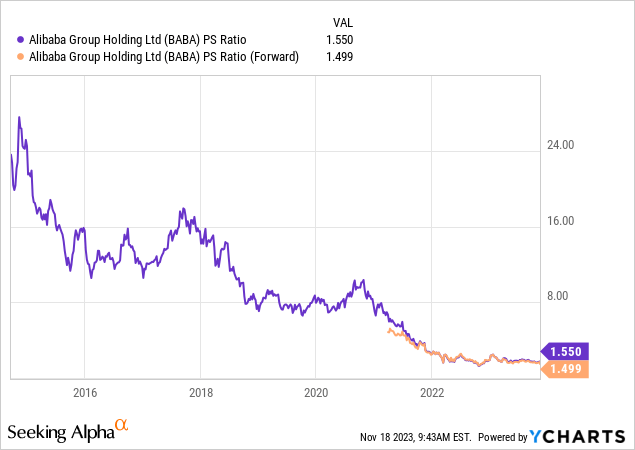

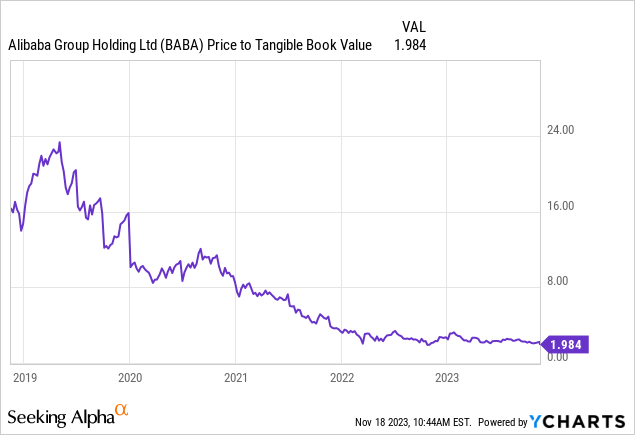

That beginning worth to gross sales a number of has actually compressed.

This is likely one of the key (though least talked about) causes for diversification. Even once you get the fundamental thesis completely appropriate, you can’t power the market to present it the right a number of. So in the event you guess your retirement on few shares like these, nicely, you gained’t be retiring.

Quarterly Outcomes

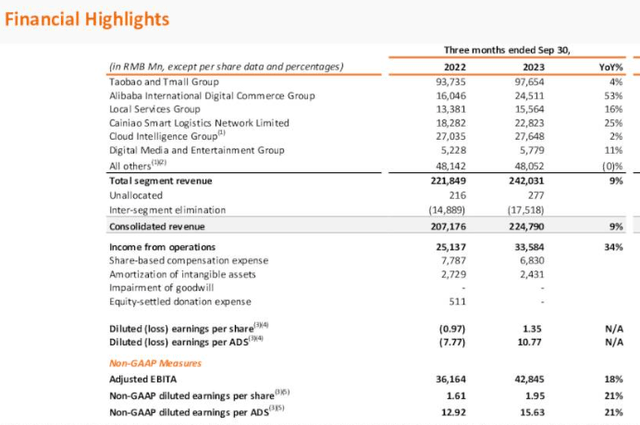

BABA delivered a stable quarter, relative to expectations and revenues expanded at a pleasant 9% clip.

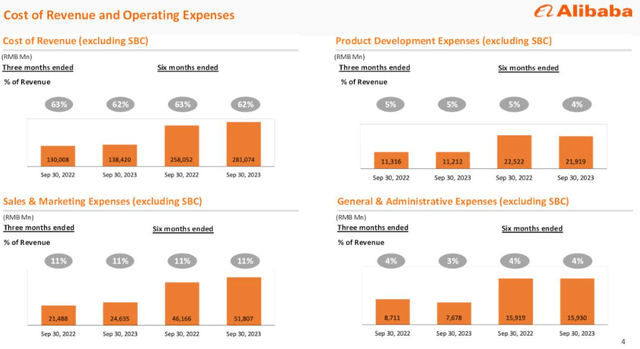

BABA Presentation

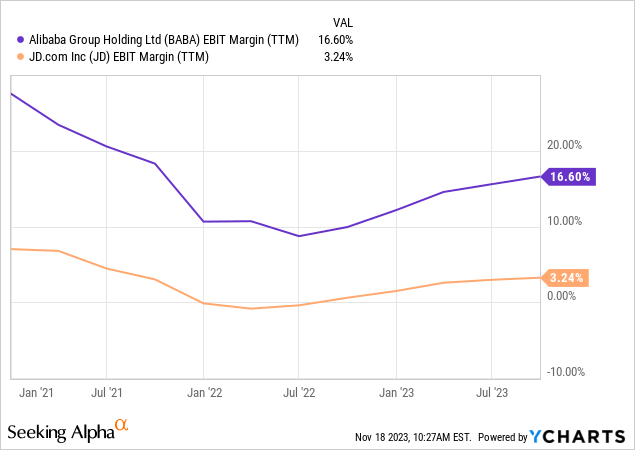

Earnings from operations non-GAAP earnings moved up even quicker at brisk double digit tempo. BABA’s value management was in full show right here and it stays probably the most worthwhile amongst the Chinese language on-line retailers.

BABA Presentation

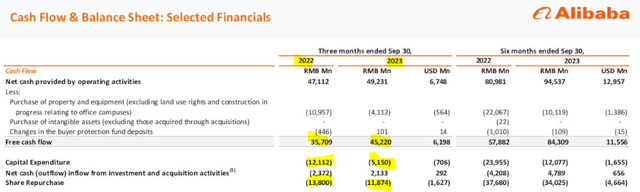

The money deployed in the direction of share repurchases was a tad small for many bulls and got here in decrease than what we noticed final 12 months.

BABA Presentation

The plus to this restraint is that at the least BABA stays in a greater place than corporations like PayPal (PYPL) that blew money away shopping for again inventory at multiples of the present worth. The main focus of the information was the cloud unit and its gross sales regarded fairly weak.

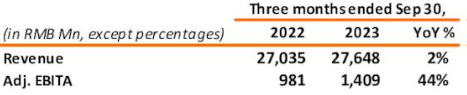

BABA Presentation

However extra importantly, BABA determined to name off the IPO.

First, we introduced in our earnings launch that Alibaba won’t pursue a full spin-off of Cloud Intelligence Group in mild of uncertainties created by current U.S. export restrictions on superior computing chips. As an alternative, we are going to give attention to growing a sustainable development mannequin based mostly on rising AI-driven demand for networked and extremely scaled cloud computing providers.

Second, in August, Cainiao Sensible Logistics filed its prospectus and utility for an IPO on the Hong Kong Inventory Change. Whereas the success of an IPO transaction is topic to market circumstances and related approvals, we’re assured of the enterprise fundamentals of our logistics unit.

Supply: BABA Convention Name Transcript

Outlook

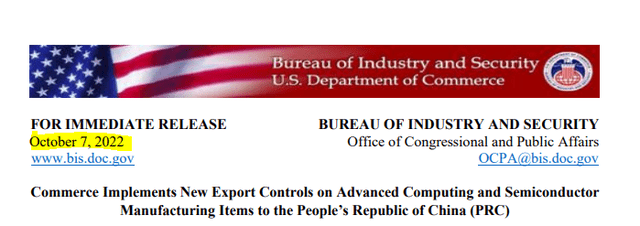

Traders had been hoping for a cloud unit itemizing to avoid wasting them and it gained’t be taking place any time quickly. We do need to stress right here that the income development of BABA’s cloud unit is remarkably weak and we doubt it could be gamechanger. Nonetheless it’s unusual that the spin-off was stopped for the explanations instructed. Administration talked about the current export ban to China led to the halt of the cloud phase spin-off. Actually the US is cracking down tougher on this and we simply bought information on Utilized Supplies, Inc. (AMAT) the opposite day being within the crosshairs. Nonetheless, there was an export ban of types in place for fairly a while. In reality the most important developments passed off greater than a 12 months in the past.

BIS

So BABA knew this was on the desk and had introduced the IPO concept anyway. A extra logical cause, and one we predict BABA didn’t get into, was in all probability that the unit is unlikely to garner the form of a number of that the road expects. It would additionally require very heavy capex to maintain it aggressive and each these argue for conserving it inside the BABA fold.

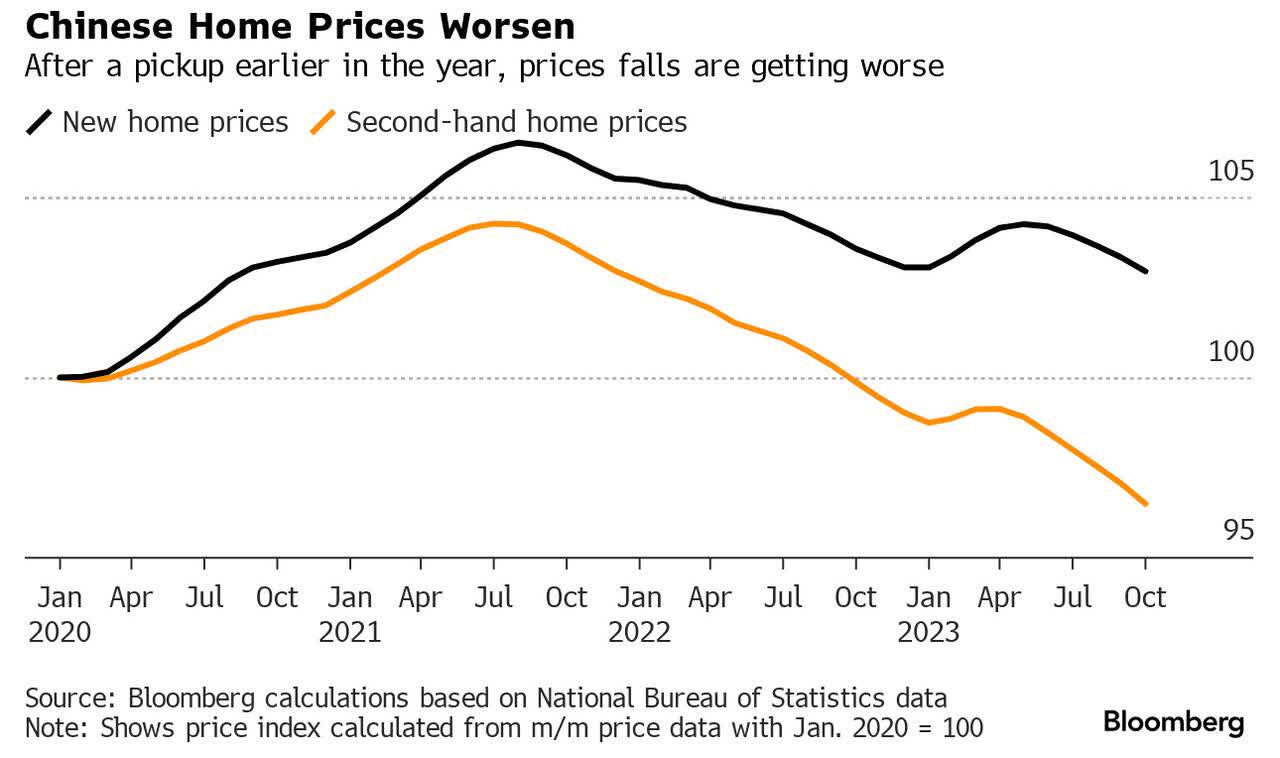

The larger subject for BABA, and one we’ve got harped on endlessly, continues to be the housing bubble fallout.

Whereas third-quarter gross home product figures launched Wednesday surpassed expectations on sturdy client spending, the information factors to troublesome months forward for the world’s second-largest economic system as efforts by President Xi Jinping’s authorities to stabilize the property sector and avert deflation have proven little impact.

Housing market challenges had been evident in worth knowledge for September, which confirmed new house costs in main cities falling by probably the most in practically a 12 months at the same time as measures to encourage house purchases got here into impact. The huge actual property sector contracted 2.7% within the third quarter, the most important quarterly drop this 12 months, based on China’s statistics bureau.

Supply: BNN Bloomberg

We’ve got to emphasize right here that whereas the pic under reveals the drop, we’re nonetheless within the second or third innings of this fallout.

Bloomberg

The official stats are additionally underestimating the magnitude of the decline, presumably consciously, to stop a full scale panic.

House-price knowledge in lots of international locations are based mostly on complete market transactions, but China makes use of selective samples,” mentioned Chin, the pinnacle of analysis for Asia Pacific at CBRE Group Inc. “When a market goes down, the true market situation is difficult to be mirrored in such knowledge.”

In Hangzhou, near the place Alibaba is headquartered, house costs in some neighborhoods are down 25% to twenty-eight% from a peak round October 2021, brokers mentioned. In Lianyang, a downtown space widespread with expats and financiers in Shanghai, residential costs have slid 15% to twenty% from report highs in mid-2021, they mentioned.

High cities, as soon as thought of resilient in opposition to a housing downturn, aren’t immune. Costs of present houses in at the least 5 widespread districts of Shenzhen have slumped 15% previously three years, based on a July report by property analysis institute Leyoujia. The southern hub is the nation’s least inexpensive housing market.

All knowledge sources in China, be it authorities or non-public ones, face “important challenges” for compiling a portfolio that’s comparatively steady for monitoring house costs, Goldman Sachs China economists led by Wang Lisheng wrote within the July report. Of their evaluation of China house worth measures, they mentioned there may be “no good” gauge.

Supply: Fortune

We predict this being the most important bubble recognized to man, the fallout will span at the least a decade as belongings get repriced to client revenue. Retail gross sales stay weak in such an atmosphere. BABA maintains constant profitability and excessive margins, relative to different on-line retailers like JD.com (JD).

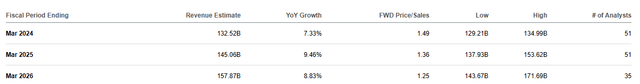

However that may be an issue in a weak economic system as folks flip worth aware. BABA’s estimates right here nonetheless look optimistic for what we see forward.

Looking for Alpha

Extra disappointments are in retailer for 2024.

Verdict

BABA was “low cost” once we first wrote on it.

Looking for Alpha

It’s after all, even cheaper now. We confirmed the worth to gross sales a number of earlier within the article and now we’re displaying the worth to tangible e-book a number of.

This has compressed as BABA has accrued tons of money and investments on its stability sheet. This provides one other buffer to the bull case right here and BABA stays poised to deploy extraordinary quantities of money move in the direction of shareholder returns relative to its market capitalization. The not too long ago introduced inaugural dividend was one other step in the proper course. The inventory has long run potential right here, regardless of some huge headwinds. It has develop into a price play, from a development inventory extraordinaire. Nothing says it gained’t develop into a fair greater worth play as tax-loss harvesting takes maintain. We proceed to consider that lined calls will outperform the frequent fairness lengthy and therefore price this as a Maintain.

Please word that this isn’t monetary recommendation. It could seem to be it, sound prefer it, however surprisingly, it isn’t. Traders are anticipated to do their very own due diligence and seek the advice of with an expert who is aware of their goals and constraints.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.