maybefalse/iStock Unreleased by way of Getty Photos

Article Thesis

Alibaba Group Holding Restricted (NYSE:BABA) is about to grow to be a really completely different firm because of the spin-offs it plans. Breaking apart the corporate will unlock worth that has, up to now, not been realized. Alibaba has now taken step one to interrupt up the corporate, as its logistics unit is getting ready for an IPO that may assist the corporate elevate a minimum of $1 billion. The valuation could be very low, progress has not too long ago been robust, and with the breakup continuing, I consider that there’s a catalyst for compelling returns within the foreseeable future.

What Occurred?

Alibaba Group has, earlier this yr, come to the conclusion that the mixed worth of the corporate’s many various enterprise models is price greater than what the market is giving the corporate credit score for. With a purpose to unlock this worth, Alibaba plans to spin off a number of of its companies. It will permit traders to select the companies they’re most comfy with — or those they deem most interesting — for funding, which ought to make the “conglomerate low cost” vanish.

Whereas this strategic shift has been introduced months in the past, Alibaba has now taken the subsequent step. In keeping with latest studies, Alibaba’s logistics unit, which is known as Cainiao Community Expertise, is getting ready for an preliminary public providing. An IPO submitting may occur as early as subsequent week, in response to these studies. Additionally, Cainiao Community Expertise is in search of to lift a minimum of $1 billion. We do not know but concerning the valuation, however even though Cainiao will not be essentially the most precious franchise for Alibaba, it ought to simply be price a number of billions of {dollars}. Whereas the IPO itself will not be overly materials for Alibaba and its traders, it’s nonetheless excellent information that issues are progressing, and that Alibaba is following by on its plans to separate up the corporate into a complete of six completely different firms.

Alibaba’s Efficiency

In China, which stays Alibaba Group’s most necessary geographic market by far, financial progress has been considerably uneven lately. Lockdowns, an actual property disaster, commerce tensions, and so forth have weighed on financial progress, which has additionally had an affect on Alibaba’s progress efficiency lately:

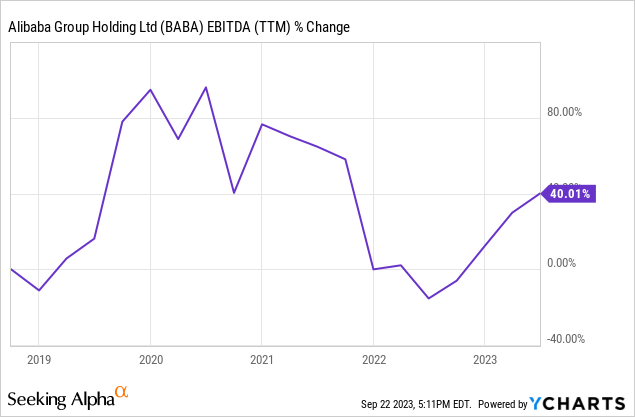

Alibaba’s trailing twelve months EBITDA has peaked in early 2020, which means the Q3 2019 to Q2 2020 interval was one of the best from a profitability perspective. In 2022, outcomes have been weaker, however issues have improved meaningfully within the very latest previous.

Throughout the latest quarter, Alibaba’s fiscal Q1, the corporate showcased income progress of 14%, which was above the latest pattern, and which beat estimates simply. It seems like the tip of lockdown measures has been optimistic for Alibaba, possible as a result of client sentiment in China bettering, which is optimistic for discretionary spending.

Even higher, nevertheless, was Alibaba’s revenue efficiency. The corporate was capable of flip a 14% income progress price right into a 32% EBITA progress price — revenue progress was greater than twice as excessive as the corporate’s gross sales progress price. That was a significant enchancment in comparison with earlier quarters when Alibaba was going through margin headwinds as a result of elements comparable to growing regulation, progress investments, and so forth. However with Alibaba’s administration now extra centered on creating worth for shareholders, together with by way of the split-up of the corporate, it’s not stunning that administration can also be placing increasingly more concentrate on bettering income. Whereas gross sales progress and working leverage performed a job in bettering income, a concentrate on making the corporate extra environment friendly performed a job as nicely. This contains, for instance, headcount reductions within the firm’s cloud unit — naturally, a decrease headcount helps enhance the expense aspect of BABA’s operations.

Working earnings progress was even higher than the corporate’s EBITA progress price through the interval, as adjusted working revenue soared 43% on a year-over-year foundation. Internet earnings progress was much more excellent, with a 48% enhance in comparison with the earlier yr’s quarter. That was akin to the earnings per share progress price over the identical timeframe, which was a little bit of a disappointment — regardless of robust absolute progress, BABA was not capable of develop its earnings per share sooner than its internet earnings. Since Alibaba has been spending billions on buybacks during the last yr, one may have anticipated that earnings per share progress can be even higher than the already very robust internet earnings progress price that the corporate recorded during the last yr.

Enterprise progress throughout the latest quarter was broad-based, as Alibaba Group noticed encouraging leads to completely different enterprise models. Taobao, which shall be mixed with Tmall in a single firm, noticed a pleasant 7% day by day lively person enhance. For a enterprise that already has very robust market penetration in its house nation, a person progress price like that is very interesting, I consider.

Alibaba’s Native Companies Group, which mixes companies comparable to Ele.me (a supply platform) and Amap (a navigation app), noticed very robust gross sales progress of 30% through the quarter. Whereas that group makes up lower than 10% of BABA’s company-wide revenues, the unit ought to rise in significance if progress could be maintained on the present stage.

Cainiao Sensible Logistics Community, the unit that may possible IPO in Hong Kong quickly, additionally confirmed very good progress, with a income achieve of 34%. That was pushed by worldwide enlargement. Cainiao continues to open up new sorting facilities in its worldwide enterprise, thus I consider that there’s a good probability that the enterprise will proceed to generate interesting gross sales progress within the coming quarters as nicely.

BABA: Buying and selling At A Low Valuation

Throughout the first quarter, Alibaba Group earned $2.40 per share. If the corporate have been to generate related income within the coming three quarters, earnings per share for the present yr would complete $9.60. As we speak, Alibaba Group’s shares are buying and selling at $88, which might pencil out to an earnings a number of of simply above 9.

In fact, there is no such thing as a assure that the corporate shall be equally worthwhile through the coming three quarters, relative to the primary quarter. However even based mostly on present earnings per share estimates by Wall Road analysts, the earnings a number of for the present yr is simply 9.4. And since Alibaba Group was capable of beat the consensus earnings per share estimate for the primary quarter simply, I consider that there’s a good probability that Q2-This autumn will include optimistic surprises as nicely.

Different valuation metrics additionally counsel that Alibaba is fairly low cost at present. The enterprise worth to EBITDA a number of, based mostly on present estimates, is simply 6.5, for instance. Oftentimes, EV/EBITDA ratios of lower than 10 are thought-about low — and BABA trades nicely beneath that stage at present.

Whereas low cost shares can stay low cost if there is no such thing as a catalyst for larger valuations and costs, investing in low cost shares nonetheless has benefits. First, the draw back potential is far more restricted when one buys an organization buying and selling at a single-digit earnings a number of, in comparison with shopping for shares of an organization that trades at a method larger valuation. Second, as soon as there’s a catalyst for the next valuation, shares can rally rather a lot, even with out turning into overly costly. If BABA’s valuation have been to develop to a high-teens earnings a number of, for instance, shares may double — and that will nonetheless not signify a really excessive valuation.

With BABA splitting up its operations, I consider {that a} catalyst for the next valuation may certainly materialize over the approaching quarters. And even when the valuation stays low, BABA’s shares may nonetheless climb so long as income proceed to develop within the coming quarters.

Takeaway

Alibaba Group has been buying and selling at a reasonably low valuation for fairly a while. The break-up of the corporate ought to assist unlock worth, thus it’s nice to see that issues are progressing on that entrance. Add interesting enterprise progress, and BABA might be well-positioned for enticing returns over the subsequent yr or so. I stay lengthy and I’m trying ahead to seeing how the enterprise split-up will play out.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.