maybefalse/iStock Unreleased via Getty Images

Thesis

Most investors like to fancy themselves as emotionally-detached value hunters, and follow Warren Buffett’s creed: ‘be greedy when others are fearful’. But the truth is, investors hope to buy at valuations that reflect ‘extreme fear’, but without the actual ‘extreme fear’. This is hardly possible, as you cannot have one without the other.

Alibaba stock is once more clouded by an extremely fearful outlook, with the stock trading once again in the mid-70s. The last time Alibaba (NYSE:BABA) traded at similar levels (in mid-March), the stock aggressively rebounded by nearly 70% in the blink of one trading week. I am not saying that Alibaba stock will once again deliver this spectacular rebound – but it could. Respectively, what are the odds of another 70% sell-off?

Seeking Alpha

Reflecting on Alibaba’s excessively distressed valuation, I argue the stock is a strong buying opportunity, regardless if an investor is trading short- or long-term.

Challenges Are Real

Let me acknowledge that Alibaba’s challenges are real. There are three major headwinds that I would like to point out:

First and most obvious, I would like to highlight that the ‘growth miracle’ in China has cooled down significantly. Since about four quarters the economy in China has been pressured by a real-estate crisis that has been referenced as China’s ‘Lehman moment’. Moreover, while western economies have mostly managed to defeat (or ignore) the negative impact of the Covid-19 pandemic, China is still struggling: only recently the CCP has order new lockdowns in parts of major cities, including Shanghai and Beijing. And as long as the zero-Covid policy persists, economic growth and productivity inevitably suffers.

Secondly, China’s internet/tech companies such as Alibaba, Tencent (OTCPK:TCEHY) and Meituan (OTCPK:MPNGF) have experienced strong regulatory tightening. While the worst seems to be behind – given that no major action against tech/internet giants has been taken since months – the elevated risk exposure persists. And accordingly, investor sentiment remains spooked.

Finally, geopolitical tensions over Taiwan pressure the role of the Chinese economy in the global world order – as international companies reconsider their exposure to China and consequently their exposure to an economic loss in case of economic decoupling. A few weeks ago, the major US banks have highlighted that they would leave China, if ordered by the U.S. government to do so. The latest political risk is connected to the escalating technology war between U.S. and China. The U.S. has already taken action to limit China’s access to AI chip imports — this will inevitably slow China’s internet/tech firms in their ambitions to build new innovations such as autonomous cars, VR/AR ecosystems and AI-based automation processes.

Likely Already In A Recovery

But China’s headwinds should in any case be temporary. As Ray Dalio has recently highlighted in an interview: (emphasis added)

I want to make clear, from me knowing the leaders (in China), that they are reasonable people … but there is a lot of uncertainty and a lot of problems … that are temporary. They are temporary but could be longer-lasting.

… There is also the question: are they still in favor of free market and free enterprises? From my understanding, they do not want to mess with that system very much …

… I think the longer term picture in China is still bright.

Despite all the negativity surrounding the Chinese economy, the outlook is far from bad. In fact, economists expect that the Chinese economy’s year over year growth will trend close to 5% through 2027.

Moreover, there are very good reasons to believe that China may already be in an economic recovery. In a press release commenting on Q2, Alibaba management highlighted that: (emphasis added)

Following a relatively slow April and May, we saw signs of recovery across our businesses in June … We are confident in our growth opportunities in the long term.

And in the analyst call, Chief Financial Officer Toby Xu added, that Alibaba’s business sees…

… [a] positive trend of recovery continuing through July

Similar statements have been made by Baidu (BIDU) and JD (JD). Thus, I believe Alibaba’s upcoming results for the September quarter will likely highlight improving economic condition.

Also, with regards to the internet/tech crackdown, conditions are improving. Notably, premier Liu He pledged multiple times that the CCP is actively aiming to “support the healthy development of the platform economy” (here, here, here).

Valuation Is Too Attractive To Ignore

Personally, I believe that BABA’s heightened risk profile is more than discounted by an attractive valuation. Investors should consider that BABA stock is currently trading at a one-year forward P/E of x10.5, a P/B of x1.3 and a P/S of about x1.4. These multiples are by far at the lowest levels in the company’s trading history.

Investor should also consider that Alibaba should remain a structural growth company. I would like to highlight that in past five years, Alibaba has managed to grow at a compounded annual growth rate of grown of 42%, which is almost double of Amazon’s (AMZN) respective CAGR of 22%.

As I have highlighted in my previous article, I continue to strongly believe that Alibaba stock should be fairly valued at about $133.92/share. This would now imply almost 100% upside for the stock (as the base case scenario!).

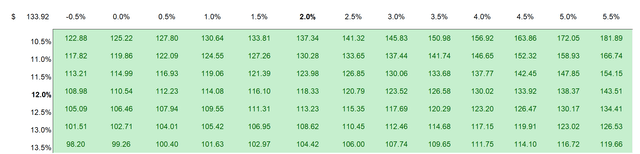

Even if an analyst considers very aggressive cost of equity assumptions (anchored around 12%) and low growth expectations (anchored on about 2%), the risk/return profile is highly attractive. Even with aggressive assumptions, BABA looks clearly undervalued. Note the sensitivity-analysis table below.

Analyst Consensus; Author’s Calculation

Conclusion

I understand that investing in Alibaba remains risky (see section ‘challenges are real’), but I also strongly believe that the current share price valuation of BABA stock more than discounts the risk profile.

In my opinion, a slight change in sentiment could spark an aggressive short-term rally for the stock, perhaps similar to the 70% price appreciation in mid-March. What could deliver this change in sentiment? Well, there could be a few notable considerations: The zero-Covid policy ends; the CCP pushes new economic stimuli following the 20th Communist Party Congress; Alibaba’s results for the September quarter turn out better than expected; and geopolitical tensions fade.

As Ray Dalio commented about China’s economy, so I believe BABA’s depressed valuation ‘is temporary but could be longer-lasting’. I remain highly confident that eventually the stock will trade once again at a fair valuation, which I see at $133.92/share.