Manuel Milan

Efficiency Evaluation

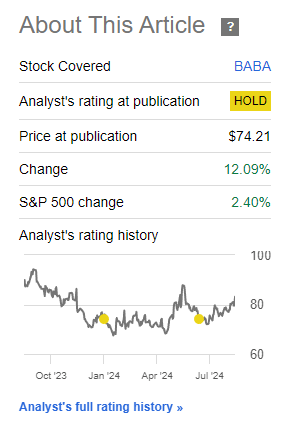

In my final protection of Alibaba (NYSE:BABA), I had rated the inventory a ‘Impartial/Maintain’. Since then, the inventory has outperformed the S&P 500 (SPY) (SPX).

Efficiency since Writer’s Final Article on Alibaba (Searching for Alpha. Writer’s Final Article on Alibaba)

Nonetheless, I’m not too fussed about lacking this run up, as I consider it’s nonetheless early days for a full-fledged turnaround. Therefore, I anticipate additional possibilities to build up the inventory over time.

Thesis Replace

Upon launch of Q1 FY25 earnings, BABA inventory rose as sell-side analysts remained overwhelmingly constructive on the inventory:

BABA Ranking by Wall St (Searching for Alpha)

Some famend traders similar to Michael Burry have additionally develop into extra bullish, as current 13-F filings present an elevated portfolio weight in BABA from 8.74% to 21.26%.

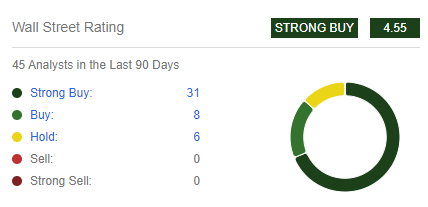

That is regardless of considerably lackluster total income progress:

TTM Complete Income (CNY bn) (Firm Filings, Writer’s Evaluation)

And an absence of enchancment in working margins (as mentioned later on this article).

Now, I too am turning bullish on Alibaba inventory as I word the next:

- There are some progress shoots in Cloud and AIDC

- Margin growth is probably going as administration focuses on monetization

- Valuation is engaging, however this time with catalysts

- Technicals are turning bullish for an preliminary leg up

- China Retail Gross sales are a key monitorable

There are some progress shoots in Cloud and AIDC

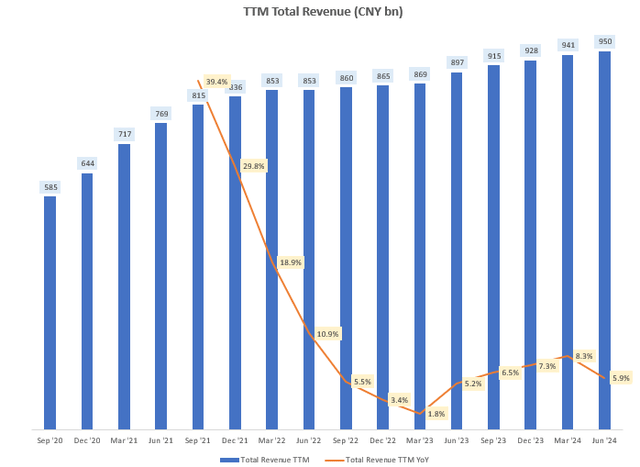

There’s a clear progress acceleration in Alibaba Cloud’s revenues because the TTM YoY progress charges have rebounded to the high-teens stage:

TTM Cloud Intelligence Group Income (CNY bn) (Firm Filings, Writer’s Evaluation)

This progress is pushed principally (greater than half) by AI-related merchandise and workloads:

…public cloud income [is] sustaining double-digit progress. AI-related product revenues sustained a triple-digit progress persevering with to extend its share of public cloud income… greater than half of that anticipated progress will likely be pushed by AI merchandise

– CEO, Head of Core E-Commerce Yongming Wu within the Q1 FY25 earnings name

Main indicators of progress are additionally sturdy, since Alibaba Cloud’s clients are having considerably elevated budgets for spending this 12 months:

What we see definitely amongst our personal cloud clients is that their AI budgets for this 12 months are greater, considerably greater than what they have been final 12 months.

– CEO, Head of Core E-Commerce Yongming Wu within the Q1 FY25 earnings name

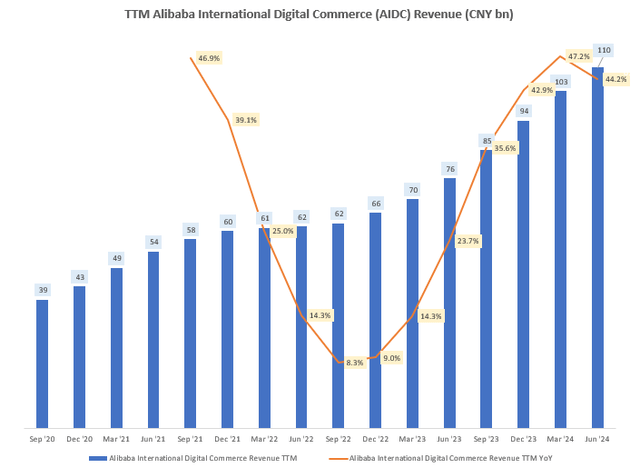

The corporate can also be seeing spectacular progress in its Alibaba Worldwide Digital Commerce (AIDC) enterprise:

TTM Alibaba Worldwide Digital Commerce (AIDC) Income (CNY bn) (Firm Filings, Writer’s Evaluation)

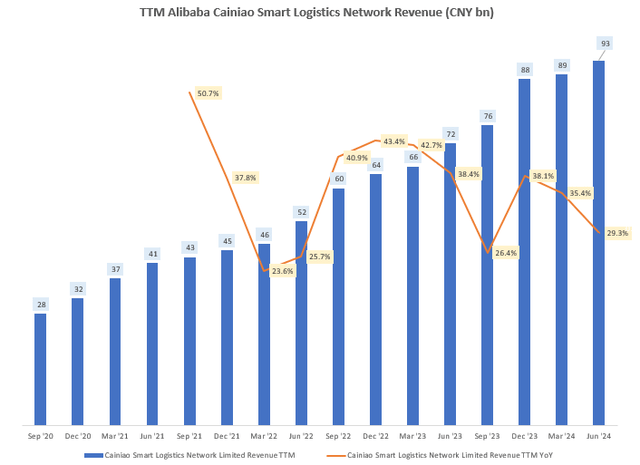

Right here, the expansion comps are extraordinarily favorable; Q1 FY25’s 44.2% TTM YoY is on the again of an already sturdy 23.7% TTM YoY in Q1 FY24. A key driver of this progress is elevated exercise in AliExpress on account of enhancements in consumer expertise, expanded assortment, product placement and presentation. That is bolstered by optimized logistics in Cainiao that has “considerably diminished common supply time”, which has additionally been mirrored in sturdy nearly 30% TTM YoY progress in that section:

TTM Alibaba Cainiao Sensible Logistics Community Income (CNY bn) (Firm Filings, Writer’s Evaluation)

Altogether, I consider the mixed 32.5% income combine coming from these 3 progress segments – Cloud Intelligence, AIDC and Cainiao – are indicative of some significant progress shoots in Alibaba.

Margin growth seemingly as administration focuses on monetization

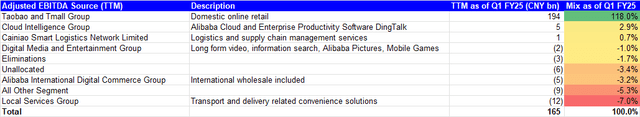

In my initiating protection of Alibaba inventory, I had recognized margin growth as a key upside threat as the corporate’s unprofitable segments transition towards profitability:

Adjusted EBITDA Combine for Q1 FY25 (Firm Filings, Writer’s Evaluation)

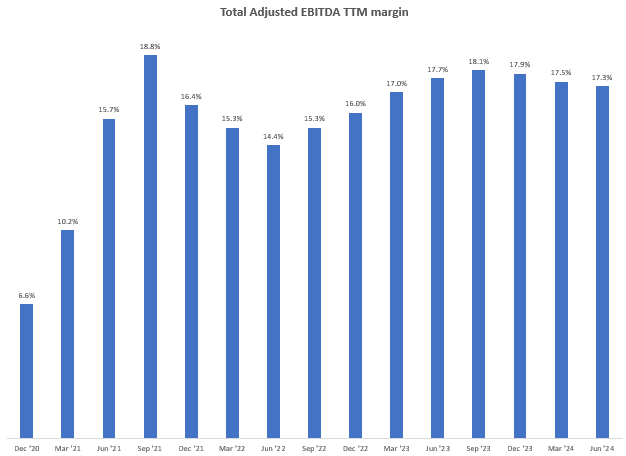

However I used to be dismayed by an absence of progress on this entrance after This autumn FY24, which has continued this quarter as BABA’s adjusted TTM EBITDA margins have been principally regular at round 17%:

Complete Adjusted EBITDA TTM Margin (Firm Filings, Writer’s Evaluation)

Nonetheless, I’m extra optimistic in regards to the margin growth thesis taking part in out now as a result of administration appears to be focusing extra explicitly on monetization of the loss-making companies. Certainly, administration has now disclosed a concrete 1-2 years timeline for reaching breakeven. This provides me some consolation and assurance on margin development:

…we have carried out strategic realignments throughout our key Web know-how companies by means of a radical analysis of their product capabilities and market competitiveness whereas sustaining product competitiveness, most of those companies will now place the next precedence on monetization… We anticipate most of those companies to breakeven inside 1 to 2 years and step by step contribute to profitability at scale.

– CEO, Head of Core E-Commerce Yongming Wu within the Q1 FY25 earnings name

Valuation is engaging, however this time with catalysts

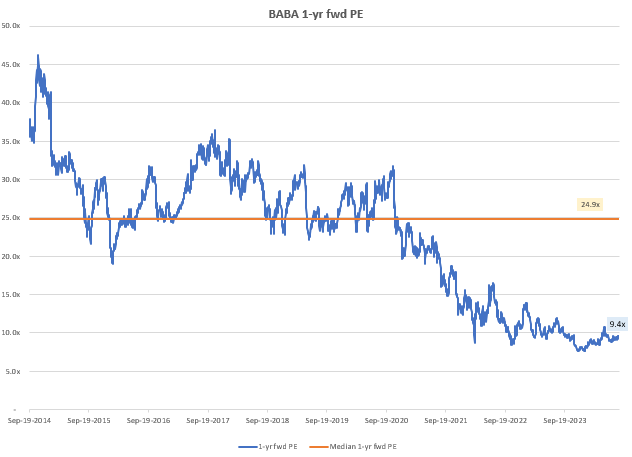

At a 9.4x 1-yr fwd PE, BABA trades at a hefty 62.3% low cost to its long term 1-yr fwd PE of 24.9x, which, I consider, is kind of low even after assuming some de-rating results because of the dangers of investing in China. Nonetheless, it has been at these discounted ranges for some time and nonetheless, I had not been satisfied of a purchase.

So what’s completely different this time?

I’m extra assured of the catalysts within the type of progress within the 3 companies aforementioned and the margin growth of unprofitable enterprise segments. Importantly for incremental thesis validation checks, there’s a clear 1-2 12 months timeline for these catalysts to steadily play out.

BABA 1-yr fwd PE (Capital IQ, Writer’s Evaluation)

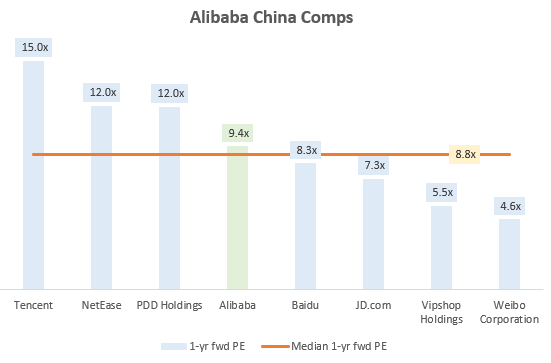

On a comparable valuation foundation vs different Chinese language web friends, Alibaba trades at a small 6.4% premium to the 8.8x median 1-yr fwd PE of the compset:

Alibaba China Valuation Comps (Capital IQ, Writer’s Evaluation)

In addition to BABA, the Chinese language peerset consists of Tencent (OTCPK:TCEHY), NetEase (NTES) (OTCPK:NETTF), PDD Holdings (PDD), Baidu (BIDU) (OTC:BAIDF), JD.com (JD) (OTCPK:JDCMF), Vipshop Holdings (VIPS) and Weibo Company (WB)

I consider the long-runway progress prospects of Alibaba Cloud make a valuation premium vs its peer group (greater than the present 6.4%) well-deserved. One solely wants to take a look at Google (GOOG) (GOOGL), Microsoft (MSFT) and Amazon (AMZN) to understand the worth of cloud distributors.

Observe that Searching for Alpha’s 1-yr fwd PE for Alibaba is a bit greater at 13.32x. Additionally, the sector median PE is proven to be 17.02x. I believe these variations to the values I’ve used are on account of:

- Variations within the particular person 1-yr fwd PE inputs used to kind the general consensus 1-yr fwd PE determine. Regardless, this doesn’t change the general level that Alibaba is deeply discounted vs its historic buying and selling multiples.

- Variations within the firms used within the peerset that defines the sectoral median. For instance, I’ve solely in contrast Alibaba to different Chinese language comps. It is because I feel it isn’t applicable to match it with US analogues similar to Amazon, since doing so wouldn’t respect the valuation reductions rightly utilized to Chinese language securities on account of decrease confidence in a secure regulatory atmosphere.

Technicals are turning bullish for an preliminary leg up

If that is your first time studying a Searching Alpha article utilizing Technical Evaluation, you could need to learn this publish, which explains how and why I learn the charts the way in which I do. All my charts mirror complete shareholder return as they’re adjusted for dividends/distributions.

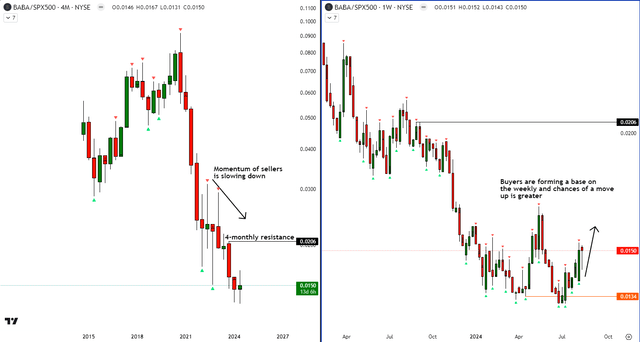

Relative Learn of BABA vs SPX500

BABA vs SPX500 Technical Evaluation (TradingView, Writer’s Evaluation)

On the relative technicals vs the S&P 500 entrance, I discover that the momentum of the sellers’ progress is fading because the measurement of recent decrease lows are shrinking. Furthermore, the ratio chart appears to be forming a base on the weekly chart. Synthesizing these two observations collectively, I consider there are greater possibilities of a transfer up (comparable to outperformance) towards the 4-monthly resistance.

China Retail Gross sales revival is a key monitorable

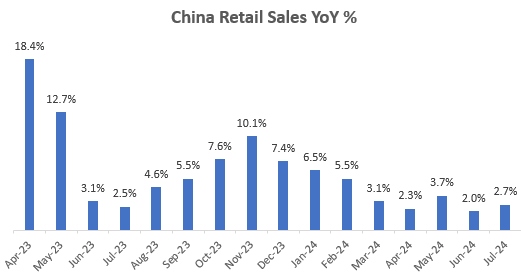

Alibaba generates 46% of its TTM revenues and 118% of its adjusted TTM EBITDA from Taobao and Tmall Group, which kind the China Commerce (home on-line retail arm) of the corporate. Given Alibaba’s scale, I consider the month-to-month China’s Retail Gross sales knowledge is a helpful indicator of future quarterly earnings:

China Retail Gross sales YoY % (Buying and selling Economics, Writer’s Evaluation)

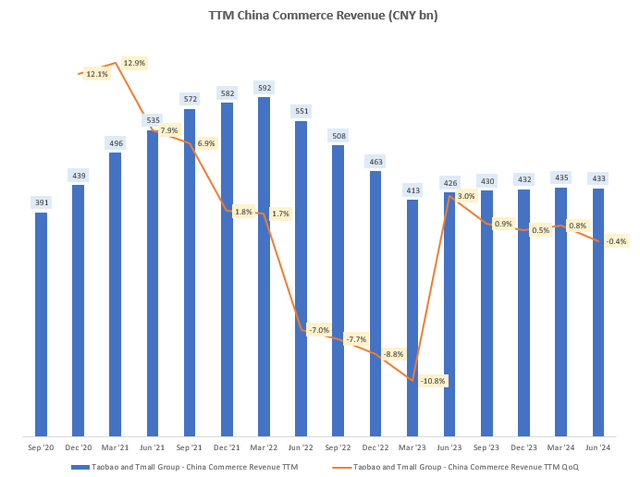

To this point, the expansion observe in China’s Retail Gross sales continues to be gradual at 2-3%. Therefore, it isn’t a lot of a shock that Alibaba’s TTM China Commerce Income progress can also be principally stagnant at round $430 million for the previous 4-5 quarters:

TTM China Commerce Income (CNY bn) (Firm Filings, Writer’s Evaluation)

I do not consider July 2024’s China Retail Gross sales print of two.7% is sufficient to buck the stagnant progress development on this largest section for Alibaba. Nonetheless, I proceed to trace this macro variable to attempt to establish progress revival factors previous to the official quarterly releases.

Takeaway & Positioning

Regardless of lackluster income progress and no margin enchancment, Alibaba inventory stays an awesome favourite of Wall St and a few famend traders similar to Michael Burry, who has elevated his complete stake in BABA to a portfolio weight of 21%. I’ve been hesitant to share the identical enthusiasm for Alibaba till now:

I consider Alibaba Cloud, Alibaba’s Worldwide Digital Commerce and its Sensible Logistics Community, which altogether make up 32.5% of TTM revenues, are all experiencing progress shoots. Administration’s renewed concentrate on monetization with a concrete 1-2 12 months timeline to breakeven on at the moment unprofitable companies additionally reinvigorates my optimism on margin growth. With these catalysts and favorable relative technicals vs the S&P 500, I discover the discounted valuations at a mere 9.6x 1-yr fwd PE engaging.

One key monitorable I am monitoring is China’s Retail Gross sales figures, as that would offer helpful clues on a rebound in Alibaba’s most materials (46% of TTM revenues and 118% of TTM adjusted EBITDA) albeit stagnant section of China Commerce.

Ranking: ‘Purchase’

Tips on how to interpret Searching Alpha’s rankings:

Robust Purchase: Anticipate the corporate to outperform the S&P 500 on a complete shareholder return foundation, with greater than typical confidence. I even have a web lengthy place within the safety in my private portfolio.

Purchase: Anticipate the corporate to outperform the S&P 500 on a complete shareholder return foundation

Impartial/maintain: Anticipate the corporate to carry out in-line with the S&P 500 on a complete shareholder return foundation

Promote: Anticipate the corporate to underperform the S&P 500 on a complete shareholder return foundation

Robust Promote: Anticipate the corporate to underperform the S&P 500 on a complete shareholder return foundation, with greater than typical confidence

The standard time-horizon for my views is a number of quarters to round a 12 months. It’s not set in stone. Nonetheless, I’ll share updates on my adjustments in stance in a pinned remark to this text and may publish a brand new article discussing the explanations for the change in view.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please pay attention to the dangers related to these shares.