Hello everybody,

A fast replace on Aletheia, my AI-driven analysis & buying and selling mission.

✅ Check Section v1 — Abstract

-

Interval: early July → 3 Aug 2025 (~1.5 months).

-

Threat mannequin: mounted 0.5% per commerce.

-

Efficiency: +$2,274.02 web (≈ +4.55% on 50k). Revenue issue 2.98, win charge 65% (13/20), largest win $889.92, largest loss −$256.93.

-

Drawdown: Max stability DD 0.67% (−$339.55).

-

Positioning: 20 shorts, 0 longs throughout v1.

-

Finish snapshot: Stability $52,274.02, Fairness $52,803.14 at report time.

Throughout the first month Aletheia climbed to roughly +5%, then a quick dropping cluster appeared. I paused v1 and up to date the agent to filter the reasoning patterns linked to these losses.

Full Commerce Historical past and Account studies are hooked up so you may audit each ticket.

🧭 Aletheia Net App — Public Preview

Discover how Aletheia turns world information into reasoned hypotheses and curated, broker-agnostic commerce setups.

🧩 How the agent works (Residence)

A visible, end-to-end move of the pipeline with guardrails:

- All the time-on monitor → enrich → speculation tree → proof engine → place synthesis → execution & governance.

- Gatekeeper checks at key handoffs; clear standing and outcomes.

📊 Dashboard

Reside situational consciousness in a single place:

- KPIs & trendlines (win/loss, RR distribution, publicity, setup throughput).

- International Impression Map (country-level choropleth by mentions, zoom/hover, prime areas).

- Protection by sectors, themes, areas; current notable occasions and outcomes.

🧠 Occasion Explorer

Drill from information occasions to full reasoning trails.

- Filters: Fast (Right this moment / This week / This month) and Superior (date vary, themes, areas, sectors, textual content search, outcomes).

- Occasion web page: context & enlargement (entities/areas/sectors/themes), progress, selections, department & place counts.

- Department web page: speculation particulars, proof & quotation path, gatekeeper verdicts, path & latency, plus generated positions.

💹 Commerce Setup Explorer

Browse all setups and soar straight to the reasoning that produced them.

- Filters: date, image(s), path, standing (open/closed/expired/discarded), consequence labels (e.g., tp2_hit , sl_hit ).

- Inline charts and compact playing cards (thesis, entries/targets/stops, threat mannequin, present standing).

- One-click open to the originating occasion or department path.

⚡ Fast Actions

Three playing cards to get transferring quick:

- Dashboard → metrics & map

- Occasion Explorer → occasions → branches → proof

- Commerce Setups → browse & audit outcomes

👉 Net App: https://aletheia.giize.com

🔍 4 Instance Setups From v1

Under are 4 actual tickets from v1. Click on the path hyperlink to examine the complete reasoning within the app.

🟢 CRWD (Crowdstrike Holdings Inc) – 📍 Entry: 450.62 | TP1: 430.40 ✅ TP2: 410.18 ✅

Catalyst: Palo Alto Networks is in talks to amass CyberArk in a deal valued at roughly $20 billion, doubtlessly reshaping the cybersecurity market.

Reasoning path: https://aletheia.giize.com/Event_Explorer?occasion=9594&department=26994

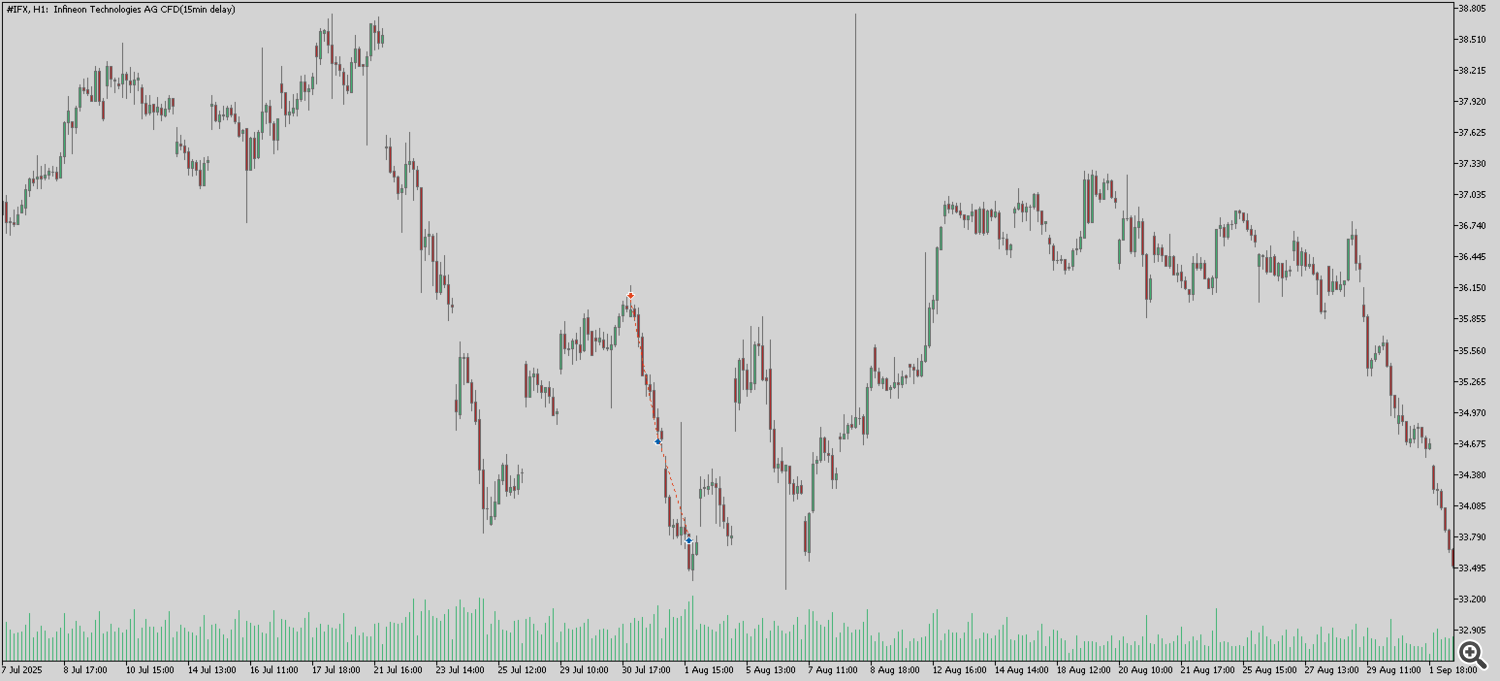

🟢 IFX (Infineon Applied sciences AG) – 📍 Entry: 35.949 | TP1: 34.823 ✅ TP2: 33.697 ✅

Catalyst: Intel cancels deliberate semiconductor fabrication initiatives in Germany and Poland and consolidates testing and meeting operations in Vietnam and Malaysia.

Reasoning path: https://aletheia.giize.com/Event_Explorer?occasion=8483&department=24067

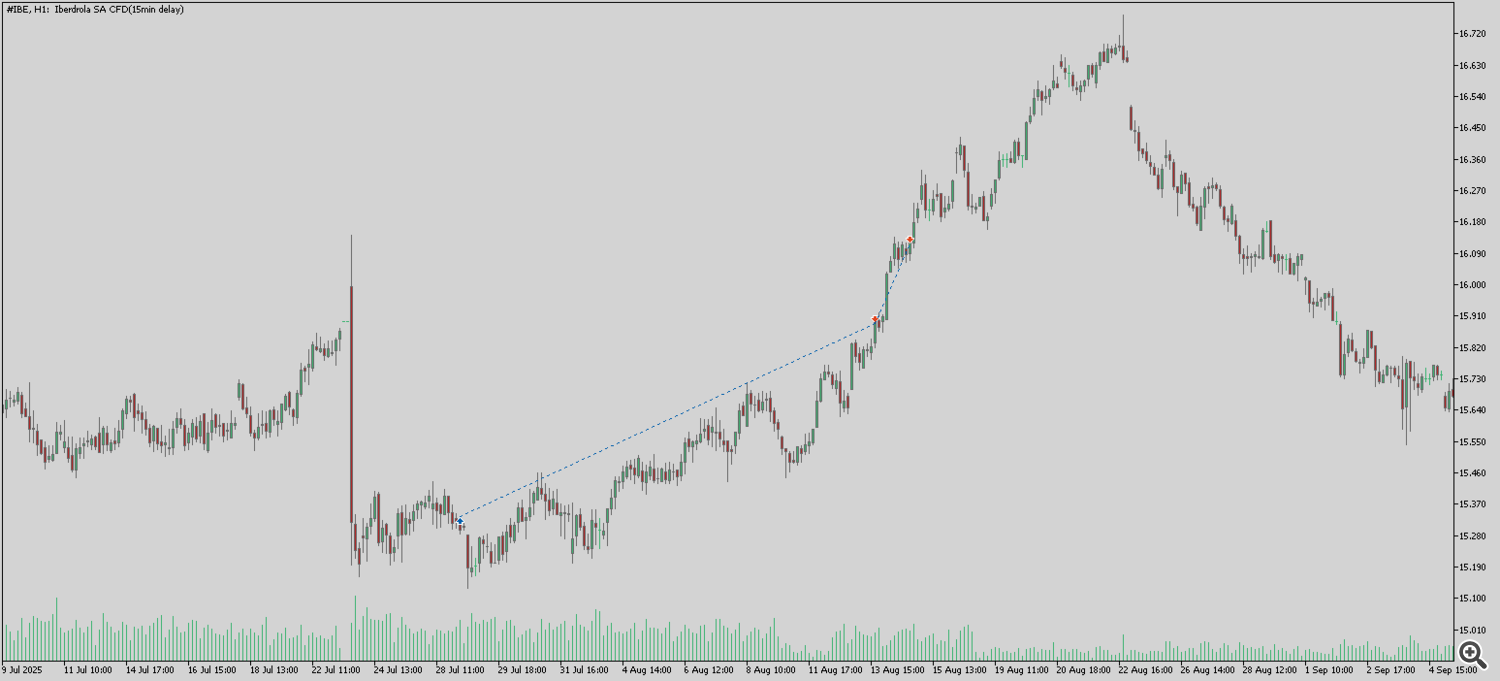

🟢 IBE (Iberdrola SA) – 📍 Entry: 15.32 | TP1: 15.69 ✅ TP2: 16.06 ✅

Catalyst: Authorities raises most value paid to wind farm builders for electrical energy.

Reasoning path: https://aletheia.giize.com/Event_Explorer?occasion=8384&department=23805

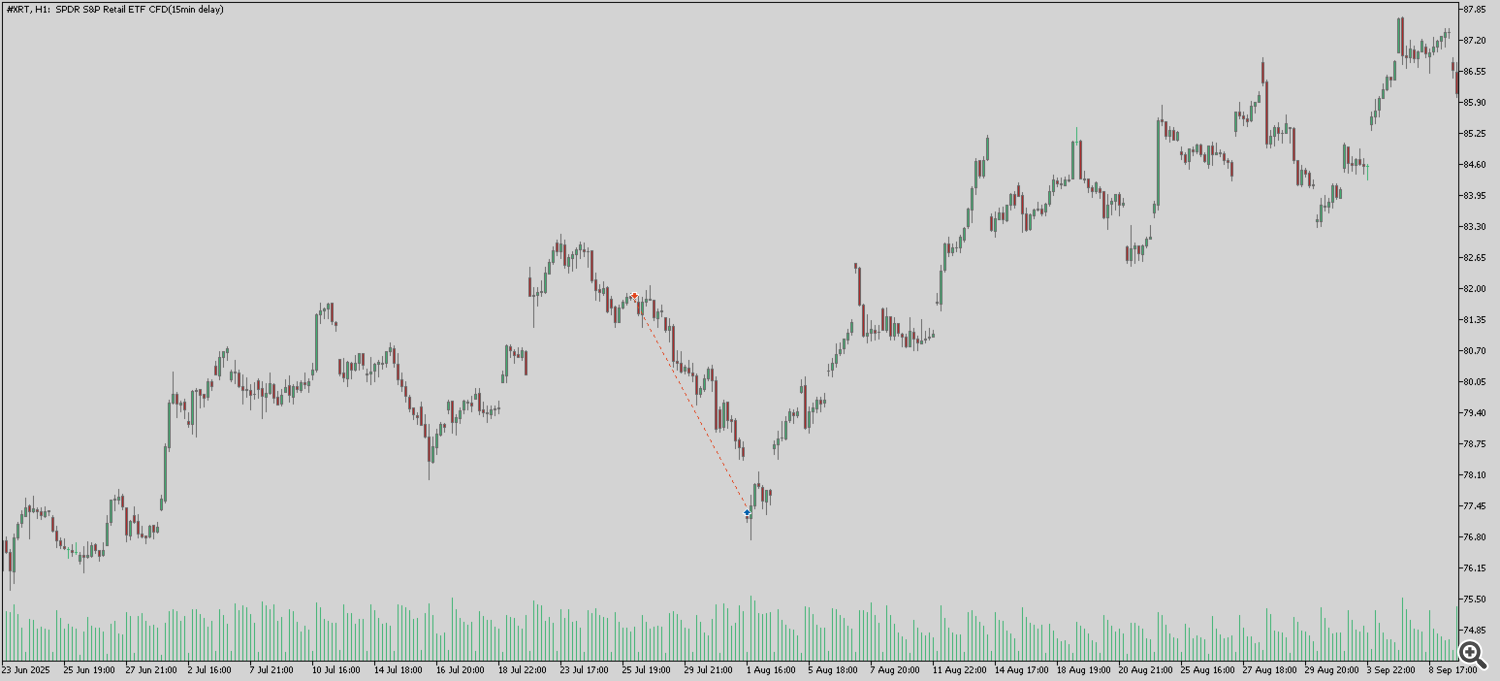

🟢 XRT (SPDR S&P Retail ETF) – 📍 Entry: 81.8 | TP1: 80.01 ✅ TP2: 78.22 ✅

Catalyst: U.S. corporations raised costs for items and companies in July, citing tariffs as a key issue contributing to inflationary pressures.

Reasoning path: https://aletheia.giize.com/Event_Explorer?occasion=8392&department=23833

🔄 What modified after pausing v1

-

New Reasoning Auditor (steady studying).

Scans the whole reasoning path to validate that analyses are grounded in stable proof. Repeatedly up to date as extra setups and outcomes arrive.

Why it issues: filters out weak, oblique logic and favors direct, causal impression between occasion → asset. -

Proof gating tightened (carried ahead).

Stricter supply high quality & recency checks; patterns linked to v1 losses are down-weighted or blocked.

Why it issues: reduces speculative, large narratives slipping into setups. -

Websearch protection & parsing improved.

Broader area help + higher parsers enhance profitable extractions and quotation depth.

Why it issues: extra (and cleaner) sources, fewer blind spots. -

Image Matcher upgraded.

Tighter ticker/venue mapping and battle decision to chop image mismatches.

Why it issues: improves asset focusing on accuracy earlier than orders are shaped. -

Targets & RR optimizer (from v1 historical past).

Re-tuned goal choice utilizing all historic setups: shorter entry→SL, longer entry→TP1/TP2 distances.

Why it issues: raises common anticipated R whereas controlling draw back. -

MT5 execution security (lot-step conscious).

Orders that have been too giant for dealer constraints at the moment are auto-split into smaller tickets so threat per setup stays precise.

Why it issues: constant place sizing → extra sturdy dwell habits. -

Partial-closure reliability repair.

Edge circumstances that did not set off TP1/TP2 partials have been corrected; state sync improved.

Why it issues: predictable profit-taking and cleaner P/L attribution. -

Setup QA go (carried ahead).

Validator rejects imprecise or duplicate theses; enforces readability earlier than something can grow to be a commerce.

Why it issues: higher-quality setups, fewer noisy entries.

Anticipated v2 impact: Fewer however higher-conviction trades, tighter threat, clearer audit trails.

🚀 Check Section v2 — Beginning Now

I’m kicking off v2 with the up to date pipeline and the brand new internet app.

Be a part of v2: in the event you’d wish to comply with alongside, evaluation setups, or stress-test reasoning, soar in: