Andrii Borodai/iStock by way of Getty Photos

Alderya – Overview

Aldeyra (NASDAQ:ALDX or the Firm), is a small cap, development-stage biotech firm with a portfolio of RASP (reactive aldehyde species) modulating compounds. The lead drug is a topical remedy for dry eye illness, reproxalap, that lately obtained an entire response letter (CRL), a rejection from the FDA. The Firm believes it has a transparent path to offer extra knowledge and acquire approval for reproxalap in early 2025. The Firm additionally has different oral and intravitreal injection merchandise in earlier phases of growth.

The Firm ended 2023 with $142M in money and is anticipated to burn roughly $40M in 2024. The Firm signed an possibility settlement with AbbVie to license its lead asset. Execution on a scientific program to fulfill the FDA and acquire approval for reproxalap is the important thing for the AbbVie to train the license possibility. 2024 is a pivotal yr for ADLX.

AbbVie Possibility Settlement

Final fall, the Firm additionally introduced an possibility settlement to collectively develop, manufacture and commercialize reproxalap with AbbVie within the US, and to offer an unique license to AbbVie outdoors of the US. As a part of the settlement, AbbVie paid the Firm $1M on closing of the settlement, and one other $5M in mid-December as an possibility extension price. This clause was probably negotiated as a result of the Firm knew it was going to obtain a CRL, and massive pharma by no means likes to purchase something till uncertainties are mitigated.

If absolutely exercised, the Firm would obtain an upfront fee of $100M, $100M upon US approval of reproxalap, one other $200M in extra regulatory and industrial milestones, a 60%/40% P&L share within the US and tiered royalties on ex-US gross sales. The choice expires the sooner of 10 days following US approval of reproxalap and April 30, 2025. Whereas not disclosed, it’s regular for the extra milestones to be linked to extra regulatory approvals (EU for instance) and industrial milestones (first yr of $500M in annual income for instance).

Path to Reproxalap Approval

The Firm had a PDUFA date of November 23, 2023 for reproxalap. In October, the Firm obtained minutes from the FDA that recognized a scientific knowledge hole within the NDA submission. The Firm subsequently expressed the assumption {that a}) they’d probably obtain a CRL in November, and b) they imagine a single allergen chamber trial would fulfill the FDA’s request for extra scientific knowledge.

In January this yr at JPM, after which once more following the submitting of the 10-Ok, I spoke with administration to get an replace on the regulatory path for reproxalap. The trail mentioned in October and November centered on a single allergen chamber trial filed beneath a particular protocol evaluation (SPA) course of. Extra lately, after the Firm and AbbVie had extra time to think about the optimum path, the Firm might run three scientific trials. Two redundant allergen chamber cross-over scientific trials, that are low-cost, quick research. Then one extra examine to develop what knowledge could possibly be included on the eventual label, however not wanted to obtain approval. The redundant trials enhance the likelihood of success, and well timed resubmission of the NDA. (Possible suggestions from AbbVie, as small corporations don’t often select redundant paths.)

The Firm acknowledged that they’d affirm their path to the funding group as soon as they finalize the assembly minutes from their latest FDA discussions concerning the ultimate protocol(s). I might anticipate that affirmation would come within the type of a convention name to permit Q&A, probably within the first week of April. I imagine that affirmation, if it consists of timing and luxury that the extra scientific knowledge will meet the FDA’s wants for approval, then I imagine there will probably be a rise in worth following a full standing replace on the trail to approval, which additionally would offer perception on the trail for AbbVie to train its possibility settlement.

Portfolio

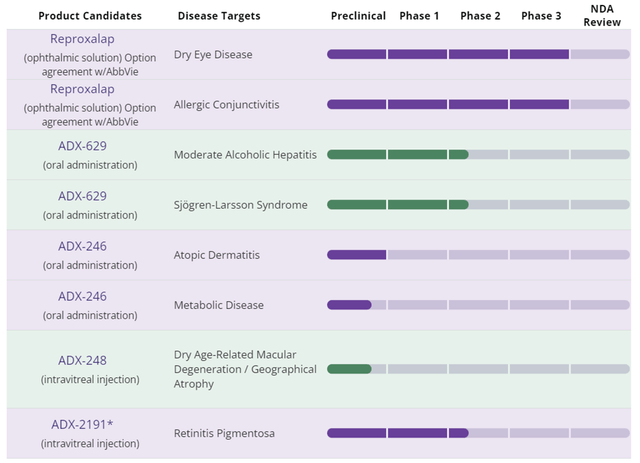

Aldeyra Web site

Determine 1: Aldeyra Product Pipeline

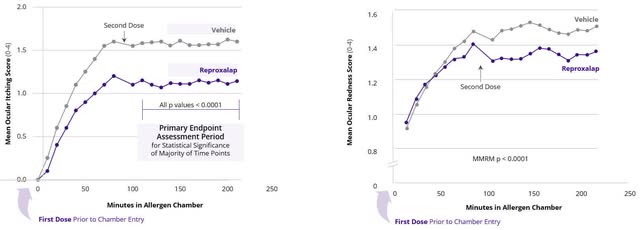

Reproxalap can also be beneath growth for Allergic Conjunctivitis. In two separate part 3 trials, reproxalap confirmed a statistically vital enchancment in ocular itching versus automobile. The Firm plans to debate the trail to regulatory submission for Allergic Conjunctivitis following the resubmission of the NDA for dry eye illness, anticipated in 2H 2024.

Aldeyra 2023 10-Ok

Determine 2: Ocular Itch Enchancment Information

Behind reproxalap, the Firm has a sequence of RASP inhibitors. RASP are implicated within the irritation pathway by binding to, and disrupting the conventional perform of molecules within the cell. In a standard wholesome cell, RASP-metabolizing enzymes are liable for muting the results of RASP. In illness states, these enzymes aren’t capable of forestall the pro-inflammatory activation of RASP. Aldeyra’s science is targeted on creating molecules to inhibit RASP pro-inflammatory activation. The entire different molecules are at varied early phases of growth with restricted affected person knowledge.

ADX-629 is being developed for Sjögren-Larsson Syndrome, a uncommon illness involving the buildup of fatty alcohols and fatty aldehydes due to a mutation in how the physique makes fatty aldehyde dehydrogenase. This small examine is being run by an out of doors investigator.

ADX-629 can also be being developed for alcoholic hepatitis. This very small examine is underway, with knowledge anticipated within the second half of 2024.

ADX-629 confirmed promise for atopic dermatitis in an eight affected person, 90-day, open-label examine. The Firm will transfer ahead on this indication with its subsequent technology compound, ADX-246. One can assume ADX-246 is a greater molecule with longer patent life.

In addition they have ADX-248, which is anticipated to be examined in a part 1/2 in dry AMD sufferers with a darkish adaptive deficit.

The entire different packages are within the early phases of growth, and have restricted affected person knowledge, if any. They every have a thesis which appears believable. Nevertheless, when modeling the corporate, little or no, if any, worth could be ascribed to those different property.

Patent Place

Reproxalap’s composition of matter patent expires in 2028, which with a Hatch-Waxman extension, provides stable US safety till 2033. Past that, it’ll all rely on the energy of their technique of use and formulation patent portfolio on the product. Ex-US, the Firm has acknowledged that the composition of matter patent to run out in 2026. EU patent expiration will not be as essential as the ten yr advertising exclusivity (8 years of information exclusivity and 10 years of promoting exclusivity, plus 1 extra yr if a brand new indication is filed on the drug in that timeframe) for that area.

The entire different molecules within the portfolio have composition of matter patents that expire between 2026 and 2041. As some are focused at orphan indication, there will probably be no less than seven years of exclusivity within the US and 10 years within the EU, if they’re developed and permitted. Due to this fact, as with most new molecular entities, IP safety will probably be a mix of composition of matter, formulation and technique of use patents, plus regulatory exclusivity.

Administration Group

The Firm has an skilled board and is led by an skilled investor and operator in dr. Todd Brady. The CFO is interim and has audit accountant coaching. Dr. Brady probably does all the investor communications. The Firm does have a VP of Business Technique, however doesn’t seem to have the best personnel for a industrial launch. The industrial partnership with AbbVie is essential for monetizing reproxalap.

|

Chairman |

Richard Douglas, PhD

|

|

Chief Government Officer |

Dr. Todd Brady

|

|

Chief Monetary Officer (Interim) |

Bruce Greenberg

|

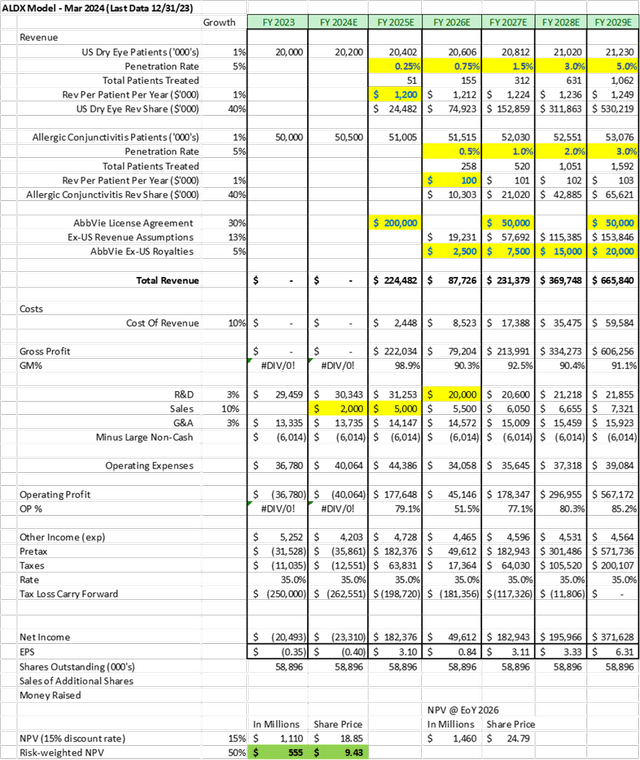

Proforma Mannequin

When modeling the Firm, I made the next baseline assumptions:

- AbbVie workouts possibility for reproxalap in 2025 – paying $100M – then pays the primary $100M milestone for US approval

- The mannequin assumes one other $50M milestone for EU approval in 2027, and one other $50M milestone for attaining $500M in annualized gross sales in 2029 (each pure assumptions, as particulars of these later milestones aren’t disclosed, apart from a cumulative $200M in extra milestones attainable

- 40% income share in US, with off-setting prices for gross sales included in ALDX P&L

- $1,200 per yr per handled dry eye affected person, and $100 per yr per handled allergic conjunctivitis affected person

- 5% peak penetration in each dry eye and allergic conjunctivitis

- R&D spend decreases after reproxalap approval – focuses on early-stage RASP packages

- No new shares issued throughout modelling interval as a result of milestone funds exceed money necessities

Analyst Analysis

Assuming one makes use of a 15% low cost price, and danger weights the approval and deal train at 50%, the mannequin suggests a good worth of $9 per share at the moment. With a optimistic confirmatory scientific trial, and an AbbVie possibility train, every share could possibly be value north of $19. The mannequin suggests a $25 share worth by the tip of 2026 if reproxalap will get permitted, AbbVie licenses the drug, and the Firm begins to earn extra milestones.

If the trial fails, and AbbVie walks away from the license in early 2025, then the Firm would nonetheless have virtually $100M in money. The Firm could be valued at lower than money due to the burn concerned with the early stage packages – probably hitting $1.

Potential Dangers and Potential Surprises

- Financing: The Firm had $142M is money on the finish of 2023, and is projected to burn $40M in 2024. The chance of future financings is low.

- Valuation: Since This fall 2023, the biotech market has surged. Excellent news is as soon as once more leading to will increase in inventory worth. Valuation fashions as soon as once more might have relevance to inventory worth.

- AbbVie Partnership or Sale: The most effective-case state of affairs within the quick time period is that AbbVie decides to purchase the Firm earlier than they train the choice. That would end in a worth north of $10, with no extra danger. If AbbVie waits, sees good knowledge, then workouts, the Firm could possibly be value extra in the long run.

- EBIT Firm: Within the occasion AbbVie walks away, then the Firm might want to discover one other accomplice or launch reproxalap themselves. That may be a price destroying occasion, as small corporations have had a really onerous time commercializing medicine in a manner that maintains a excessive share worth. When that occurs, the corporate could be valued at a a number of of EBIT, which might decrease the inventory worth significantly.

Conclusion

ALDX is actually a single asset firm who’s on the verge of an FDA approval for dry eye illness and of consummating a license cope with AbbVie. If these two occasions happen, the inventory could possibly be value north of $20. The Firm doesn’t want any cash to see the end result of those steps.

I anticipate the Firm to host a convention name to obviously articulate its technique and techniques to realize these two objectives which are required to reward long run shareholders. 2024 must be a yr of execution. If performed correctly, then the sky is the restrict. In the event that they fail, then a fireplace sale at a $1 would be the probably consequence. Fingers crossed for execution.