photoman

Airbnb (NASDAQ:ABNB) has seen its enterprise increase following a pandemic reopening. But despite the sturdy elementary outcomes, the inventory has crashed together with the remainder of the tech sector as valuations rapidly reset. In contrast to many tech friends, ABNB is extremely worthwhile, posting 42% GAAP web margins within the newest quarter. That margin profile locations ABNB among the many most worthwhile names within the sector. For these seeking to put money into the tech sector, ABNB presents secular progress with out having to sacrifice on profitability.

ABNB Inventory Value

ABNB has crashed from all-time highs, however not as a lot as many tech friends. A lot of which may be attributable to the truth that enterprise stays red-hot within the present economic system.

I final lined ABNB in August the place I rated the inventory a purchase on account of the ten% web money place and share repurchase program. The inventory has since declined by 15%, serving to to additional enhance the worth proposition.

ABNB Inventory Key Metrics

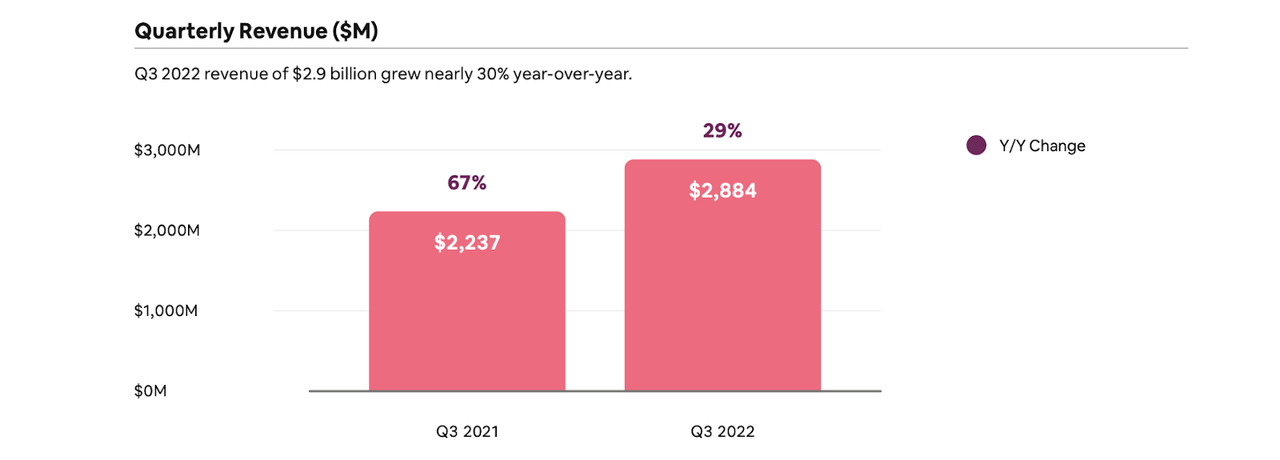

In its most up-to-date quarter, ABNB managed to indicate 29% YOY income progress. That’s a powerful outcome contemplating that the corporate was lapping powerful comparables and the macro image stays powerful. But that progress charge could also be understating the power as progress was really 36% on a relentless forex foundation.

2022 Q3 Shareholder Letter

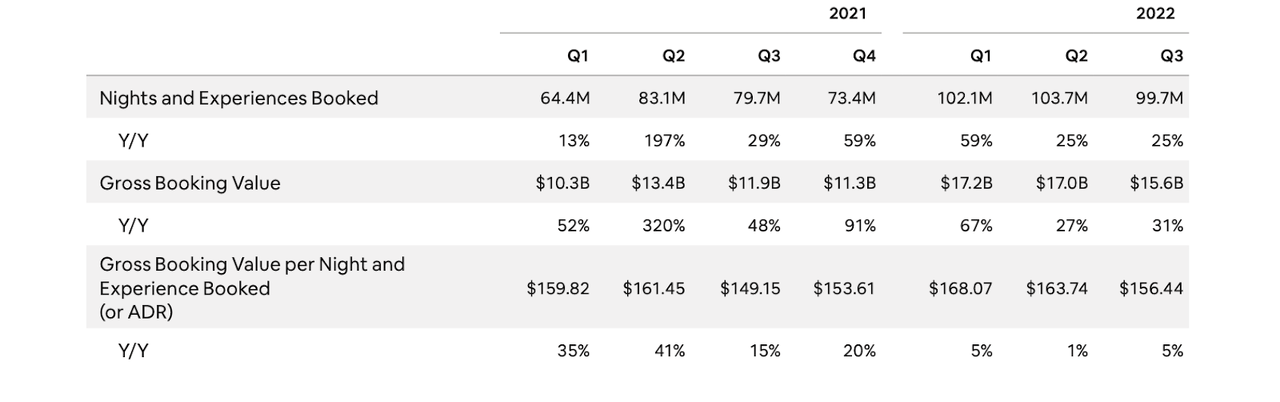

Final 12 months’s outcomes have been partially pushed by strong progress within the common day by day charge (‘ADR’). In 2022, ADR progress has been minimal with the majority of the expansion coming from a rise in nights booked.

2022 Q3 Shareholder Letter

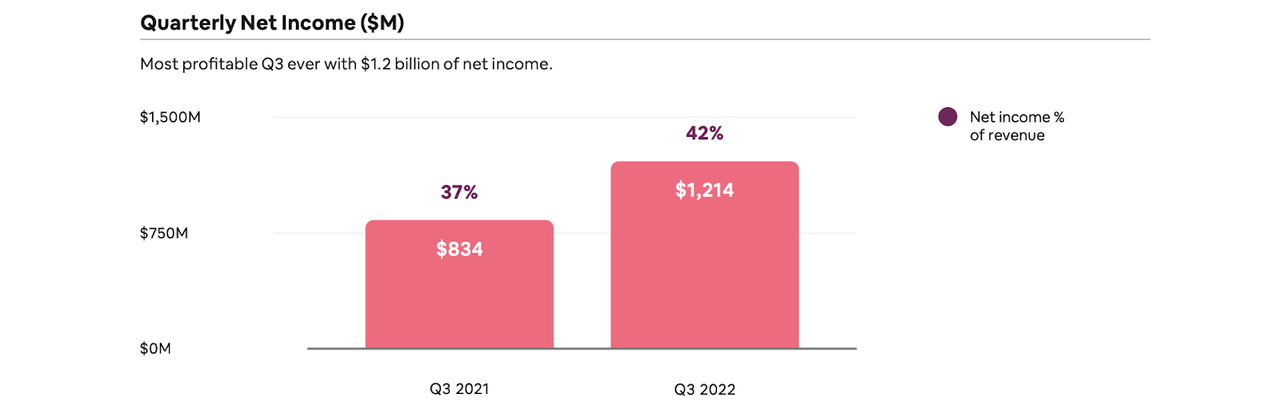

It’s not nearly income. ABNB delivered $1.2 billion in quarterly web earnings and I be aware that this can be a GAAP metric. That represented an astounding 42% web margin.

2022 Q3 Shareholder Letter

How is ABNB capable of ship sturdy outcomes amidst a troublesome macro backdrop? Administration famous that whereas shoppers are pulling again on spending, journey is one space the place there hasn’t been as a lot pullback. On the convention name, administration said their attainable rationalization as follows:

And I believe the explanation why is simply because many individuals at the moment are working from dwelling, the mall is now Amazon. The movie show is now Netflix, individuals nonetheless need to get out of their home. They nonetheless need to have recollections. They nonetheless need to have significant experiences. And I believe that’s why they proceed to show to Airbnb.

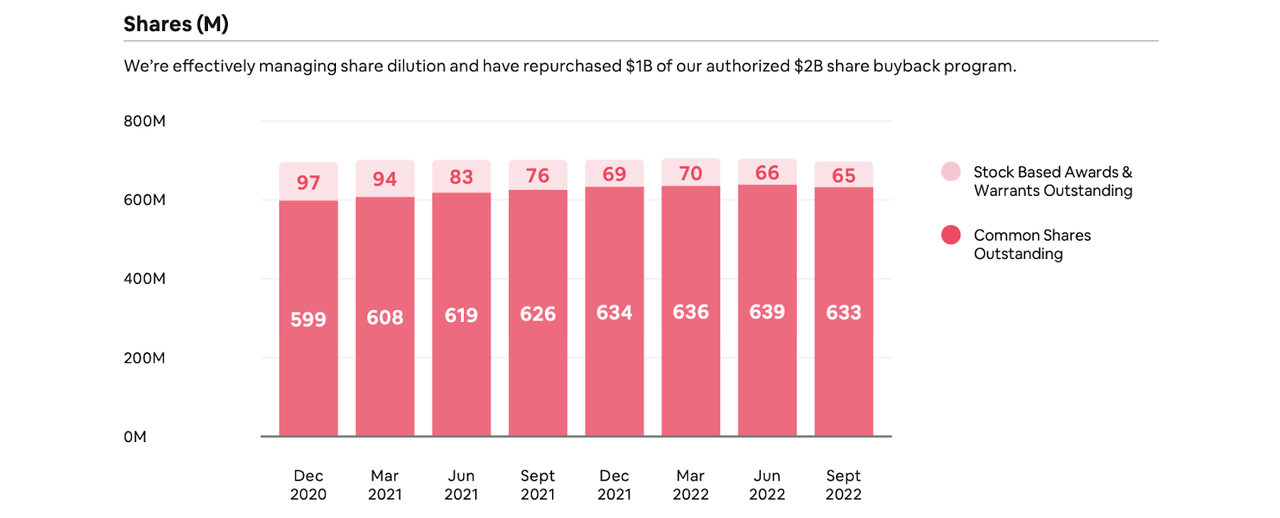

Within the first quarter, the corporate had approved a $2 billion share repurchase program. ABNB has already repurchased $1 billion of that program, resulting in shares excellent to say no sequentially.

2022 Q3 Shareholder Letter

ABNB ended the quarter with $9.6 billion of money, $4.8 billion in funds held on behalf of company, versus $2 billion of debt. Even excluding funds held on behalf of company, that web money place represented 12% of the present market cap.

Wanting forward, ABNB expects income to develop as much as 23% YOY to $1.88 billion. On a relentless forex foundation, YOY progress is predicted to be as much as 29%. Administration famous that the projected deceleration in progress charges is attributable attributable to a troublesome comparable because the fourth quarter of 2021 was an inflection level after Delta and earlier than the Omicron variant.

Is ABNB Inventory A Purchase, Promote, or Maintain

At first look, ABNB could seem similar to some other journey web site like Expedia (EXPE). However ABNB could also be totally different. In my opinion, ABNB represents a thesis on the gig economic system for every thing housing. Proper now ABNB primarily caters to quick time period stays, however administration notes that long-term stays (as outlined by longer than a month) symbolize 20% of complete gross nights booked. Over time, I can see ABNB taking a reduce of the long term rental market. ABNB was began amidst the Nice Monetary Disaster and provided owners a technique to earn additional earnings. That will show to be a related incentive as soon as once more within the present macro setting.

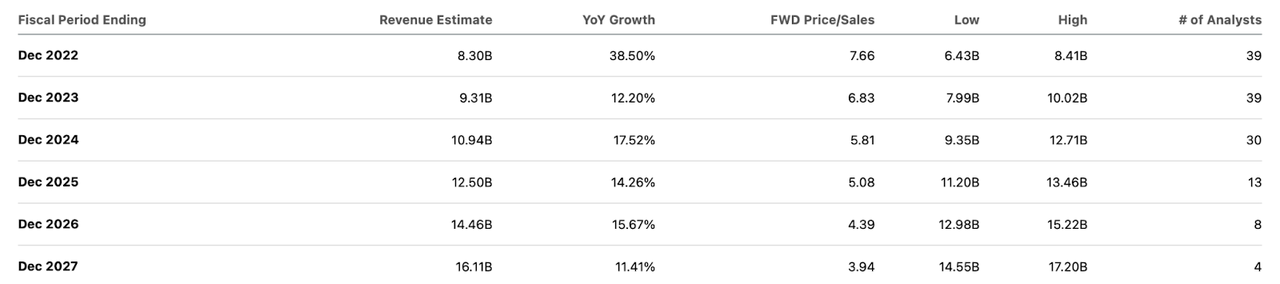

At latest costs, ABNB was buying and selling at 39x earnings and seven.6x gross sales. ABNB is predicted to maintain double-digit top-line progress over the approaching years. That expectation is cheap contemplating the above thesis.

Searching for Alpha

I might see ABNB sustaining 40% web margins over the long run. Primarily based on 15% progress and a 1.5x value to earnings progress ratio (‘PEG ratio’), I might see ABNB buying and selling at 9x gross sales, or a inventory value of $132 per share over the subsequent 12 months.

What are key dangers? The close to time period danger could also be that of peak earnings. Similar to what number of e-commerce operators are displaying minimal progress this 12 months, ABNB would possibly see an analogous deceleration subsequent 12 months. The shares of e-commerce operators have been hit laborious as soon as that deceleration turned evident – ABNB inventory may also get hit as nicely. The profitability at ABNB may not be sufficient to defend itself from such volatility as names like PayPal (PYPL) have been additionally extremely worthwhile previous to their crashes. The long term danger is that if ABNB finally ends up being no totally different than EXPE. ABNB has generated such sturdy margins partially attributable to gross sales & advertising making up solely 17% of income 12 months so far. In distinction, gross sales & advertising made up 50% of income at EXPE. Briefly, EXPE appears to have misplaced worth in uniqueness as many vacationers first search on Google (GOOGL) for lodging wants. ABNB doesn’t but endure from the identical difficulty and thus has not needed to make investments so closely in promoting, however as opponents deliver on extra stock, I anticipate competitors to drive ABNB to spend extra on gross sales & advertising. I’ve mentioned with subscribers {that a} basket of undervalued tech shares might be one of the best ways to reap the benefits of the tech inventory crash. ABNB matches proper in with such a basket because it presents a gorgeous mixture of secular progress and profitability.