Ирина Мещерякова/iStock through Getty Pictures

The journey business has rebounded properly from the COVID-19 catastrophe, and Airbnb (NASDAQ:ABNB) has benefitted in some ways. Nevertheless, a number of indications that financial bother is brewing make the patron discretionary sector harmful.

After its spectacular current run, it’s time to take earnings in Airbnb.

What Occurred

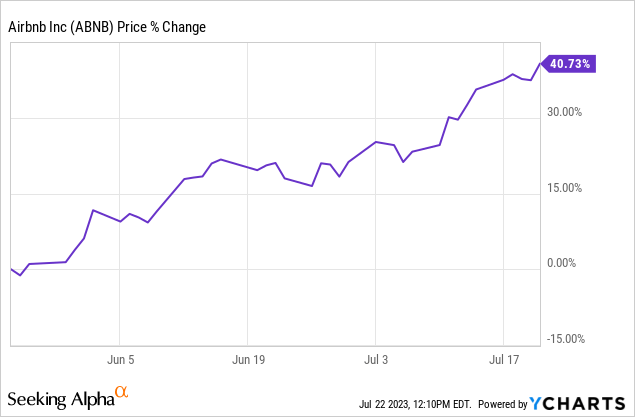

Once I first coated Airbnb right here, with a purchase score, I wrote that my goal entry level was $102 per share whereas it was buying and selling at $118. The inventory swooned as I started to choose up shares on the best way. Though it by no means fairly dropped to $102 (it briefly touched $104), I used to be content material with a median foundation of $108.

The inventory rocketed 40% in two months as traders did an about-face, specializing in synthetic intelligence (AI) and speaking about reaching new all-time highs quite than a possible recession and concern over client spending.

Airbnb has an incredible enterprise mannequin. The corporate went lean in the course of the pandemic and maintained that whilst issues returned to regular. It discovered that having a small cohesive workforce of wonderful staff outperforms a bigger fragmented group. We are able to all relate from our personal profession experiences.

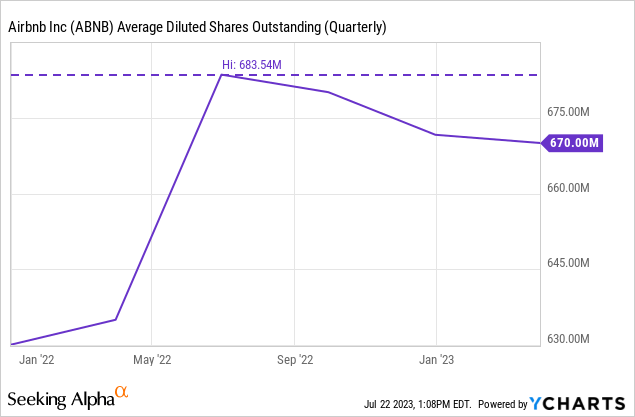

Revenues grew 75% from 2019 to 2022, reaching $8.4 billion, and Airbnb grew to become internet worthwhile for the primary time in a BIG means: a 23% internet earnings margin and a improbable 40% free money margin. The money inflows led the corporate to start a share buyback program, and the diluted shares excellent are actually dropping, as proven under, and may proceed to take action.

Airbnb’s capital-light enterprise deserves extra consideration.

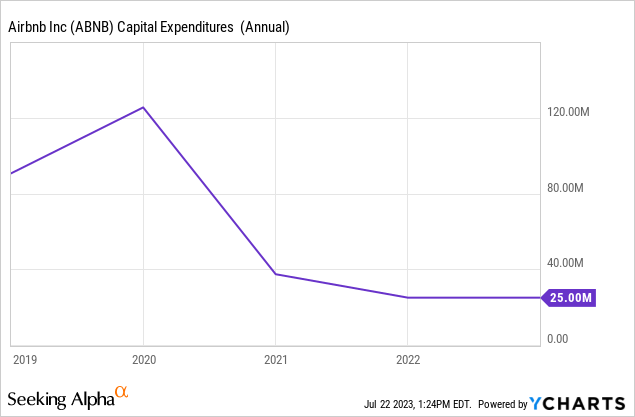

Capital expenditures, or CapEx, happen when a enterprise makes use of money to buy property (like places of work, buildings, and factories) and gear (machines, servers, and the like). These money outlays do not seem on the earnings assertion, solely within the investing part of the assertion of money flows. For that reason, many traders overlook it. However it’s critically necessary.

Take corporations A and B, which make the identical internet earnings. However A wants factories, vehicles, and intense capital outlays for logistics to run the enterprise, and B would not. The latter has far more money left over to purchase again shares, make acquisitions, pay dividends, or make investments again into the enterprise.

At its core, Airbnb is a software program firm. And the platform has been constructed. So we see CapEx wants declining precipitously under.

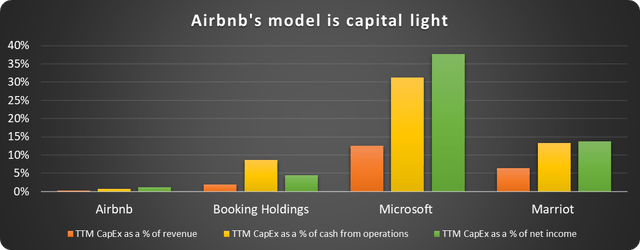

Lastly, right here is Airbnb’s CapEx outlays in comparison with different software program and journey corporations:

Information supply: Searching for Alpha. Chart by creator.

This mannequin means the market will assign Airbnb a better price-to-earnings (P/E) ratio than friends.

Administration must defend the model, laser-focus on customer support and popularity, and the enterprise shall be profitable.

Nevertheless, the worth is simply too wealthy now, and a pullback is required for the inventory to turn out to be a Purchase once more.

Two causes to promote Airbnb (for now)

Let’s begin with the valuation.

There isn’t any must chase progress shares. There aren’t any dividends to overlook, so typically it is best to take earnings and look forward to a gorgeous value.

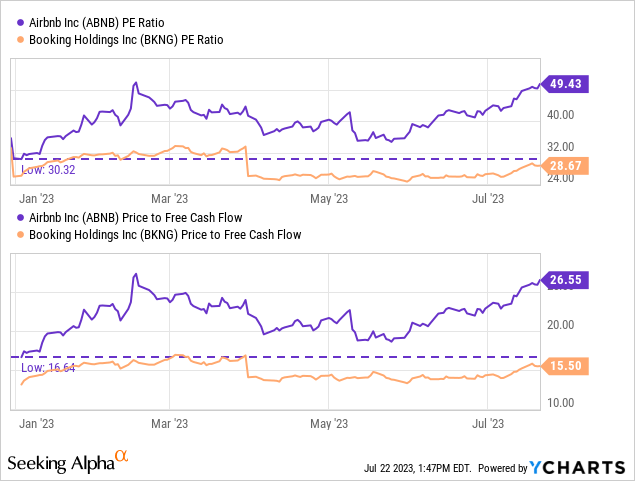

As talked about above, Airbnb deserves a better P/E than its friends; nevertheless, it has grown from 30x to 50x YTD, far outpacing opponents like Reserving Holdings (BKNG), as depicted under.

The worth-to-free money move ratio can also be at a zenith. In my article linked above, I wrote that I used to be a purchaser at a P/E of 30 and underneath, nevertheless it’s not engaging at 50.

Three causes the near-term image is murky for client discretionary shares.

I’m sometimes not massive on investing based mostly on macroeconomic indicators. I choose to decide on terrific corporations and maintain for the lengthy haul. Nevertheless, being too inflexible is not good observe. Reserving a 38% achieve that took underneath two months is the proper transfer right here. The buyer discretionary business is about to really feel intense strain – even when traders are singing a cheerful tune now.

#1. Job numbers are smaller than they seem.

Many within the media are singing the praises of current job experiences. The reported numbers have been spectacular. However many individuals don’t notice that the primary experiences are simply estimates. The Bureau of Labor Statistics (BLS) experiences the prior month’s numbers simply days after the month ends. Then the figures are revised in later experiences and reported within the final paragraph. Right here is an excerpt from the report launched in Could:

The change in complete nonfarm payroll employment for February was revised down by 78,000, from +326,000 to +248,000, and the change for March was revised down by 71,000, from +236,000 to +165,000. With these revisions, employment in February and March mixed is 149,000 decrease than beforehand reported.

The reported numbers have been revised downward each month in 2023 by a median of round 20%. If the identical occurs to the June determine, it’ll mark a low level for the 12 months.

#2. Traders are grasping and flat-footed.

The worry and greed index measures investor sentiment in a number of methods and charges them from excessive worry to excessive greed. Excessive greed typically alerts that shares are irrationally excessive and a correction is coming. Excessive worry is once we wish to be consumers, because it exhibits that shares are oversold.

Six of seven components are actually within the greed vary, with 4 being firmly within the excessive greed vary.

On the similar time, the VIX (VIX), which measures volatility, is extraordinarily low, suggesting traders are too complacent. It is a dangerous mixture.

#3. Shopper spending shall be affected.

American client spending is the bedrock of the financial system, and it has been terribly resilient within the face of inflation and rising rates of interest – however this can not final eternally. The impact of rising rates of interest takes many months to be totally realized. In spite of everything, we do not all exit and purchase automobiles or apply for credit score proper after they’re raised. Shoppers have but to really feel the complete impact of the Federal Reserve’s inflation struggle.

CNBC experiences that American bank card debt is at an all-time excessive (and remember about Purchase Now Pay Later debt), and the quantity of people that spend every thing they make every pay interval (over 50%) is a recipe for catastrophe.

If issues go South, client spending on holidays and different luxuries may plummet.

The underside line: It is time to e-book positive factors.

We do not have to exit a complete place when headwinds are coming, nevertheless it’s large to cement earnings by lowering it till the inventory is compelling once more.

Airbnb is a superb enterprise, now worthwhile and creating terrific free money move. However the sky-high valuation, extreme greed out there, and ugly image for client discretionary spending make it a promote for now.