Ilija Erceg

Air Lease Company (NYSE:AL) is a reputation that seems on most worth screens. At first look, it seems low cost, with a market cap of $4.6 billion, a PE ratio of 10, and sporting a not insignificant 1.9% dividend. With life again to regular and air site visitors again to pre-Covid highs, many traders may consider Air Lease as a secure wager. Nevertheless, a better have a look at the corporate’s financials ought to trigger traders to rethink any resolution to speculate.

The inventory is definitely much more costly than it first seems when contemplating the corporate’s whole internet debt place of $18.7 billion, giving Air Lease Company a complete enterprise worth of $23.3 billion. Sure, that debt is backed by arduous belongings (jets and planes), however it’s a putting quantity nonetheless. $18.7 billion of internet debt is particularly regarding when in comparison with the corporate’s damaging free money stream.

Previously 5 years, Air Lease Company has managed to generate roughly $1.3 billion per yr in working money stream, whereas spending a mean of $3.6 billion per yr on capex. The online result’s free money stream of damaging $2.3 billion per yr. Consequently, the corporate is closely reliant on exterior financing to remain afloat, having issued $9 billion value of bonds within the earlier 5 years.

Air Lease Corp Financials

| ($hundreds of thousands) | 2018 | 2019 | 2020 | 2021 | 2022 |

| Web Revenue | 511 | 587 | 516 | 437 | (97) |

| Working Money Circulate | 1,250 | 1,390 | 1,090 | 1,380 | 1,380 |

| Capital Expenditure | (3,780) | (4,840) | (2,680) | (3,230) | (3,640) |

|

Free Money Circulate |

(2,530) | (3,450) | (1,590) | (1,850) | (2,260) |

| Web Debt Issuance | 2,010 | 2,000 | 2,900 | 451 | 1,590 |

Supply: SEC filings

All of this debt issuance won’t be a priority if the corporate was issuing bonds to develop and develop its reportedly worthwhile enterprise, but it surely’s not even doing that. The corporate has reported internet revenue of roughly $500 million per yr constantly between 2018 and 2021 (sure, together with 2020!), and in 2022 they reported a small lack of $100 million because of the write-down of belongings affected by the Russia-Ukraine battle. In 2023 the corporate is once more set to report roughly $500 million of internet revenue.

I all the time prefer to remind myself when researching shares and taking a look at monetary accounts that accountants can work the numbers and paint as fairly an image as they like on the revenue assertion, however the money stream assertion is all the time revealing. The reality at Air Lease Company will not be nice. The most effective investments are made within the shares of firms that generate plenty of free money stream, and are in a position to pay down money owed and return cash to shareholders within the type of dividends and buybacks – Air Lease Company will not be one such firm.

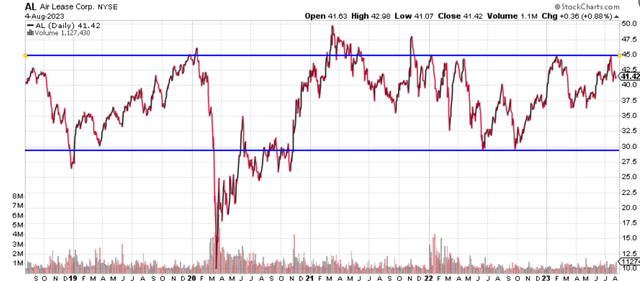

Including to my considerations concerning Air Lease Company is the truth that the inventory is approaching the highs of its historic buying and selling vary. As proven, the inventory at present sits at a value of $41 per share, and traders have not often bid this inventory above $45 previously 5 years.

Stockcharts.com

Traders who purchase now are paying a value for the inventory that leaves little or no room for error and approaching a full valuation. Take into account as effectively that the working outcomes are unlikely to enhance within the close to future as US air site visitors has returned to regular and stabilized, leaving little room for progress.

For these causes, traders ought to be cautious when contemplating an funding in Air Lease Company’s inventory.

Whereas the inventory seems low cost at first look, the corporate’s excessive debt burden and damaging free money stream are regarding, particularly when working outcomes are little modified previously 5 years. The truth that the inventory is approaching its historic buying and selling vary highs means that there is probably not a lot upside potential from right here. Traders could be sensible to attend for a extra engaging entry level earlier than contemplating investing on this inventory.