RiverNorthPhotography

Advance Auto Components (NYSE:AAP) finds itself in a troublesome place making an attempt to navigate margin enchancment and a troublesome aggressive value atmosphere throughout a interval of nonetheless fairly excessive inflation.

Firm Profile

AAP is an aftermarket components automotive supplier that serves each skilled and do it your self (DIY) clients. The corporate sells model identify, OEM, and its personal model automotive alternative components via psychical shops and department areas, in addition to via e-commerce websites. Skilled clients represented about 59% of its gross sales in 2022.

The corporate operates shops and branches underneath a number of names. It has over 4,400 shops underneath the Advance Auto Components model, together with over 300 hubs. These shops serve each skilled and DIY clients and carry about 23,000 SKUs. It additionally owns 330 Carquest shops and serves over 1,300 independently owned shops that function underneath the Carquest identify. The idea carries about 25,000 SKUs and caters extra to professionals.

Its Worldpac idea, in the meantime, has over 300 branches, a few of that are branded as Autopart Worldwide. It providers primarily skilled clients and has over 285,000 SKUs. It specialised in imported OEM components.

Alternatives and Dangers

It’s been a tough yr for AAP, with the inventory down over -50% this yr. Terrible Q1 earnings, decreased steering, and a slashed dividend led the inventory to say no -39.3% the session following its Q1 earnings report.

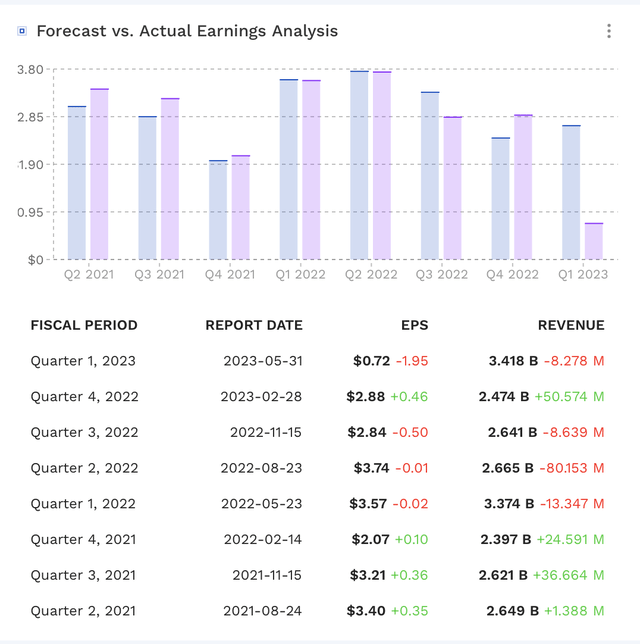

AAP has had difficulties hitting steering in current quarters, lacking income and EPS estimates 4 of the previous 5 quarters. From a income perspective, the Q1 miss was really the smallest, lacking the consensus by simply $8.3 million towards $3.4 billion in gross sales. Nonetheless, EPS of 72 cents badly missed analyst expectations for EPS of $2.67.

AAP Earnings Vs Estimates (FinBox)

First-quarter gross sales have been a bit disappointing rising 1.3%, with comps down -0.4%. The corporate blamed decrease tax refunds, which damage the enterprise in March, together with a milder winter which impacted chilly climate gross sales. Nonetheless, margins have been the massive offender, each in Q1 and going ahead.

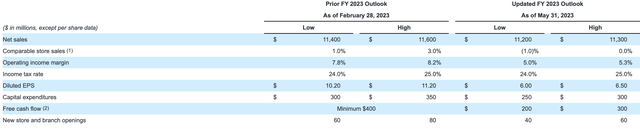

Gross margins fell -162 foundation factors within the quarter and the corporate decreased its gross margin steering by -250 foundation factors. Competitors and pricing look like the 2 principal culprits.

Earnings PR

On its Q1 earnings name, outgoing CEO Tomas Greco mentioned:

“By way of aggressive pricing, we have talked previously that based mostly on our analysis, an important standards for an installer to make selections above their components provider begins with availability, adopted by consistency of supply and relationship. Pricing has traditionally been the third or fourth standards for an installer. Nonetheless, if the hole between our value and rivals turns into too vast, value turns into an even bigger issue. Final yr, we noticed a relative value place inside professional climb to unacceptable ranges because of altering aggressive dynamics surrounding price-related investments. We have performed appreciable work testing completely different value factors throughout classes and geographies to find out the most effective strategy to drive elevated transactions and progress in our professional enterprise. This work helped us refine value targets for every class relative to competitors, be it a standard competitor or wholesale distributor. Because of improved availability, together with the investments we made inside professional to attain aggressive value targets by class, we noticed improved efficiency in each transactions and models relative to the fourth quarter. This was greater than offset by much less year-over-year progress in common promoting value relative to the fourth quarter. As a way to maintain our focused aggressive value place in Q1, we had much less value realization than deliberate, which put considerably increased stress on our product margin charge.”

Bettering gross margins and successful again pockets share from clients would be the largest alternatives for AAP going ahead. For the previous, the corporate plans to optimize its stock. It’ll promote some merchandise it’s carrying in stock at discounted costs to transition to different merchandise which have increased margins. In lots of instances, this will probably be shifting to higher-margin owned manufacturers. Nonetheless, this transition ought to have the other impact within the close to time period whether it is discounting decrease margin stock to eliminate it.

To win again buyer pockets share, in the meantime, the corporate’s costs may even must turn out to be extra aggressive. Shifting extra to owned manufacturers also can assistance on this entrance, and the corporate additionally plans to work with suppliers and to take a extra holistic strategy with strategic sourcing.

AAP must stroll a high quality line to regain margins and keep value aggressive. Having pricing points throughout a powerful inflationary atmosphere, in the meantime, is a double whammy. On the similar time, Greco is ready to retire on the finish of the yr, and a brand new CEO has not but been named. Taking up on this atmosphere, gained’t be a simple activity.

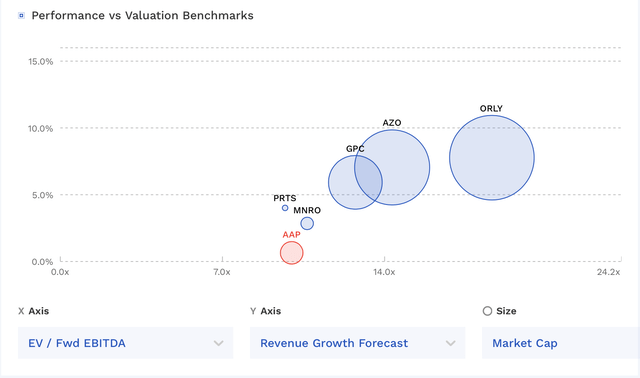

It seems that Real Components (GPC), which I wrote about in March, is probably going taking it to smaller corporations like AAP. GPC has been making loads of tech and analytics investments to make higher choice on pricing. AAP must put money into these areas to catch up.

Outdoors of the aggressive value stress points, the macro atmosphere stays one other potential threat. Nonetheless, the automotive components enterprise does are typically countercyclical, as if the financial system weakens, folks typically have a tendency to carry onto their automobiles longer, resulting in extra repairs.

Valuation

AAP trades at a 9.9x EV/EBITDA a number of based mostly on the 2023 EBITDA consensus of $867.2 million. Primarily based off of the 2024 EBITDA consensus of $905.1 million, it trades at round 9.5x.

On an EV/EBITDAR foundation, it trades at 5.5x.

It trades at 12.3x ahead EPS, with analysts projecting 2023 EPS of $5.78.

It’s projected to develop income underneath 1% in 2023, improve to 2% progress in 2024.

It’s one of many least expensive shares amongst friends, but in addition one of many slowest growers.

AAP Valuation Vs Friends (FinBox)

Conclusion

AAP’s inventory has taken a giant hit, nevertheless it has a tough line to stroll to have the ability to compete on value and enhance margins. On the similar time, there’s uncertainty relating to the corporate’s route with its present CEO heading into retirement. In the meantime, leverage is creeping up and the corporate slashed its dividend by -83%.

Presently, I’d want to pay up only a bit to get the bigger, higher run firm in GPC. AAP may turn out to be a takeover goal down the road, however that’s not one thing I’m going to guess on presently. As such, I’m largely impartial on the identify.