MicroStrategy (Nasdaq: MSTR), now rebranded as Technique, has developed from an enterprise software program firm right into a daring, Bitcoin-centric funding car. Beneath the management of Govt Chairman Michael Saylor, Technique has develop into the most important company holder of Bitcoin on the planet — and its inventory is now seen as a high-beta proxy for BTC itself.

However with the crypto market heating up once more in 2025, does MicroStrategy inventory symbolize a compelling alternative… or an over-leveraged hypothesis?

Let’s break it down.

🚀 Bitcoin Holdings Replace: Over 531,000 BTC and Counting

As of April 2025, Technique holds 531,644 BTC, acquired at a complete price of $35.92 billion. This interprets to a mean buy value of roughly $67,556 per Bitcoin.

The corporate’s newest Bitcoin buy was introduced in mid-April, when Technique acquired 3,459 BTC for $285.8 million funded by an fairness sale. The whole market worth of its BTC holdings now exceeds $45 billion, relying on value fluctuations — a staggering place that dwarfs the scale of its legacy enterprise operations.

| Date | BTC Holdings | Avg Buy Worth | Complete Value (USD) | Market Worth (at $83K BTC) |

|---|---|---|---|---|

| Apr 2025 | 531,644 BTC | $67,556 | ~$35.9 billion | ~$44.1 billion |

📈 MSTR as a Leveraged Bitcoin Wager

As a result of Technique has funded lots of its Bitcoin purchases utilizing debt and fairness dilution, the corporate successfully acts as a leveraged Bitcoin ETF. When BTC rises, Technique’s steadiness sheet inflates dramatically. When BTC falls, losses are amplified.

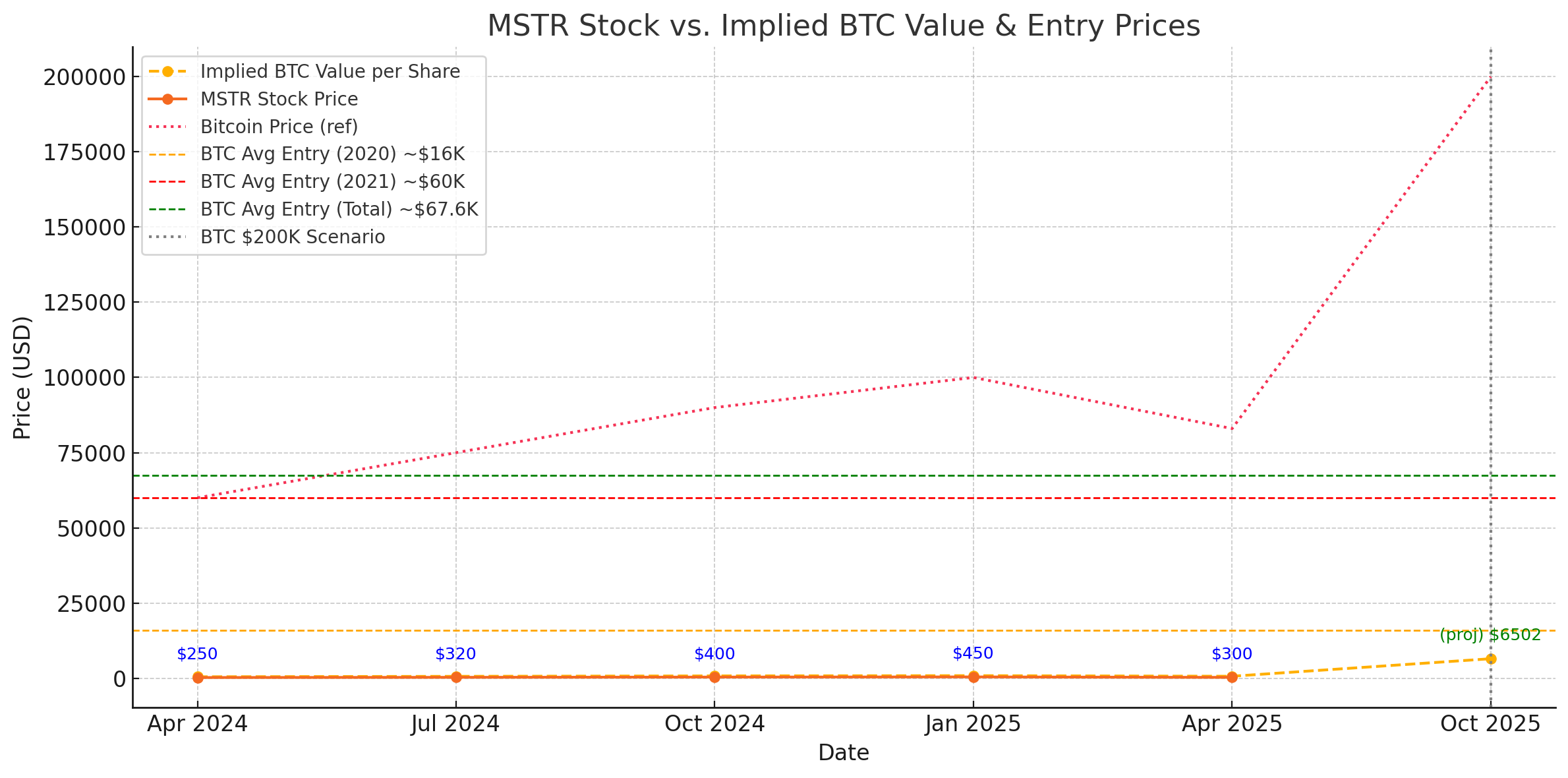

A current chart (see under) evaluating MSTR inventory value with Bitcoin and the implied per-share worth of Technique’s BTC holdings exhibits how carefully the inventory tracks BTC — although not on a 1:1 foundation:

💡 Implied Valuation: What Occurs If Bitcoin Hits $200K?

Let’s discover a bullish state of affairs: What if Bitcoin hits $200,000 on this cycle?

If that occurs, Technique’s 531,644 BTC could be price over $106 billion. After subtracting estimated debt of ~$2.3 billion and dividing by ~16 million shares, the implied internet asset worth (NAV) per share could be:

📌 Implied NAV/share = ~$6,500

That’s greater than 2x the present inventory value.

| BTC Worth | BTC Worth (B) | Implied NAV/share |

|---|---|---|

| $83,000 | $44.1B | ~$2,615 |

| $200,000 | $106.3B | ~$6,500 |

📊 Relative Valuation & Entry Worth Context

To additional perceive the danger/reward profile, it’s useful to look at Technique’s BTC entry factors:

-

🟧 2020 Entry: ~$16,000

-

🔴 2021 Excessive Buys: ~$60,000

-

🟩 Blended Common: ~$67,556

Technique’s common entry value means that at present Bitcoin ranges (~$83,000), the corporate is already in sturdy revenue territory — particularly for its early purchases. If BTC tendencies increased, the return on holdings might be exponential.

⚠️ Dangers and Caveats

Whereas the upside potential is gigantic, so are the dangers:

-

Excessive Leverage: With over $2 billion in debt, Technique is uncovered to draw back volatility.

-

Shareholder Dilution: Frequent fairness choices to fund BTC purchases dilute shareholder worth.

-

Speculative Nature: The corporate’s fortunes are actually nearly completely tied to Bitcoin — not software program.

🔮 Closing Phrase: MSTR Inventory Outlook

If Bitcoin enters a sustained bull market and reaches $200K or past, Technique might see its inventory value multiply. As a leveraged BTC play, MSTR offers uneven upside — however carries actual draw back threat in a crypto bear market.

For bullish crypto traders, MSTR could also be probably the most aggressive (and rewarding) methods to experience the subsequent wave.

✅ Bull Case: $6,500+ per share if BTC hits $200K

⚠️ Bear Case: Continued dilution and volatility if BTC stagnates or crashes

💡 Verdict: A high-stakes, high-reward Bitcoin car — not for the faint of coronary heart

Right here’s one other option to spend money on MSTR by a leveraged choices revenue etf known as MSTY – a Yield Max ETF

Hey there! I’m Russ Amy, right here at IU I dive into all issues cash, tech, and infrequently, music, or different pursuits and the way they relate to investments. Method again in 2008, I began exploring the world of investing when the monetary scene was fairly rocky. It was a troublesome time to begin, nevertheless it taught me hundreds about learn how to be good with cash and investments.

I’m into shares, choices, and the thrilling world of cryptocurrencies. Plus, I can’t get sufficient of the newest tech devices and tendencies. I consider that staying up to date with know-how is vital for anybody considering making smart funding decisions at this time.

Know-how is altering our world by the minute, from blockchain revolutionizing how cash strikes round to synthetic intelligence reshaping jobs. I feel it’s essential to maintain up with these adjustments, or threat being left behind.