A brand new day, a brand new intervention by Chinese language coverage makers. However we’ll get to the options in a second. Let’s begin with the issues.

A part of this started within the mid-Nineteen Nineties when a metallic business employee from a small rural village, Hui Ka Yan, had an thought: to borrow cash to purchase land. Promote houses on the positioning earlier than they’re constructed. Use the money to pay lenders and finance the following actual property undertaking. As lots of of thousands and thousands of Chinese language have been transferring from rural areas to the cities and home costs started to rise quickly, this concept was an enormous success and finally grew to become Evergrande, China’s largest property group.

The remainder is rather more latest historical past: as is usually the case, the corporate pushed its leverage too far; by the start of the 2020s Chinese language property gross sales began to say no and banks and buyers grew to become extra cautious about lending to property builders. Evergrande sought completely different types of financing, however as early as 2021 it began having issues promoting its bonds. By the tip of that yr, Evergrande’s complete liabilities had reached $300 billion. The cash-strapped firm struggled to pay suppliers and full houses. Its property revenues plunged. Lastly the autumn started to speed up: buying and selling within the group’s shares was suspended in March 2022 in Hong Kong and some weeks in the past the corporate filed for chapter safety within the US in its try to orderly restructure its overseas debt.

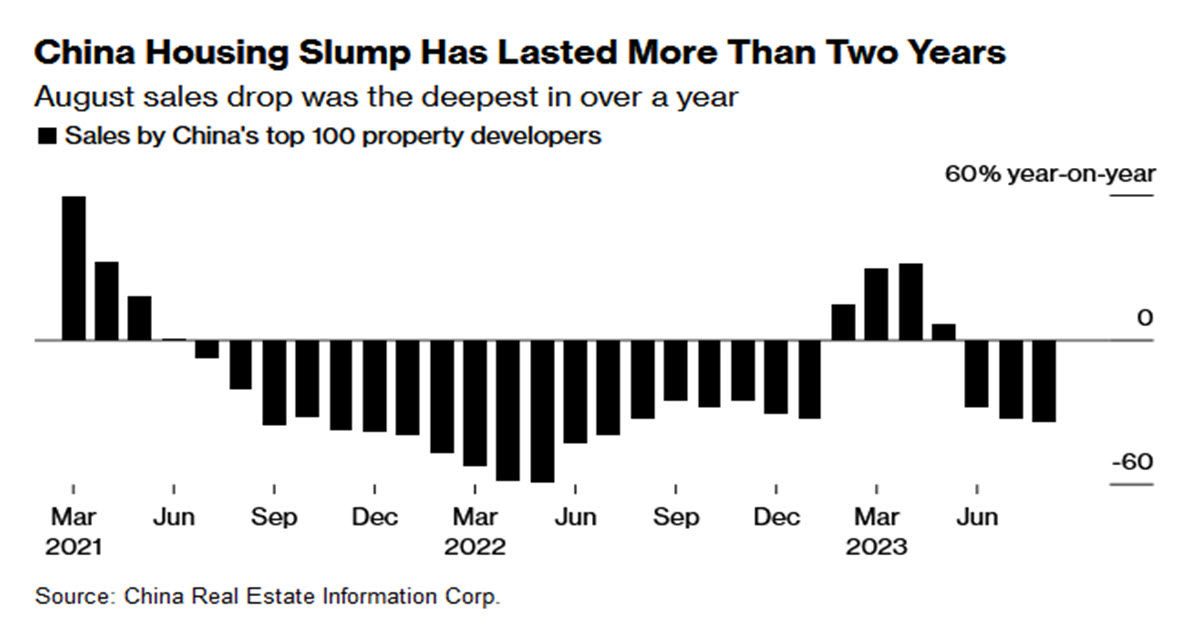

In the meantime, the issue has turn into wider: dwelling gross sales have been plummeting for at the least two years now, as you may see within the above Bloomberg chart, and costs are additionally falling: two days in the past, one other now-famous actual property big – Nation Backyard – posted losses of $6.72 billion for the primary six months of the yr and, after lacking the cost on two coupons on USD-denominated bonds in August, formally warned of a default threat.

The property market in China is price 29% of GDP.

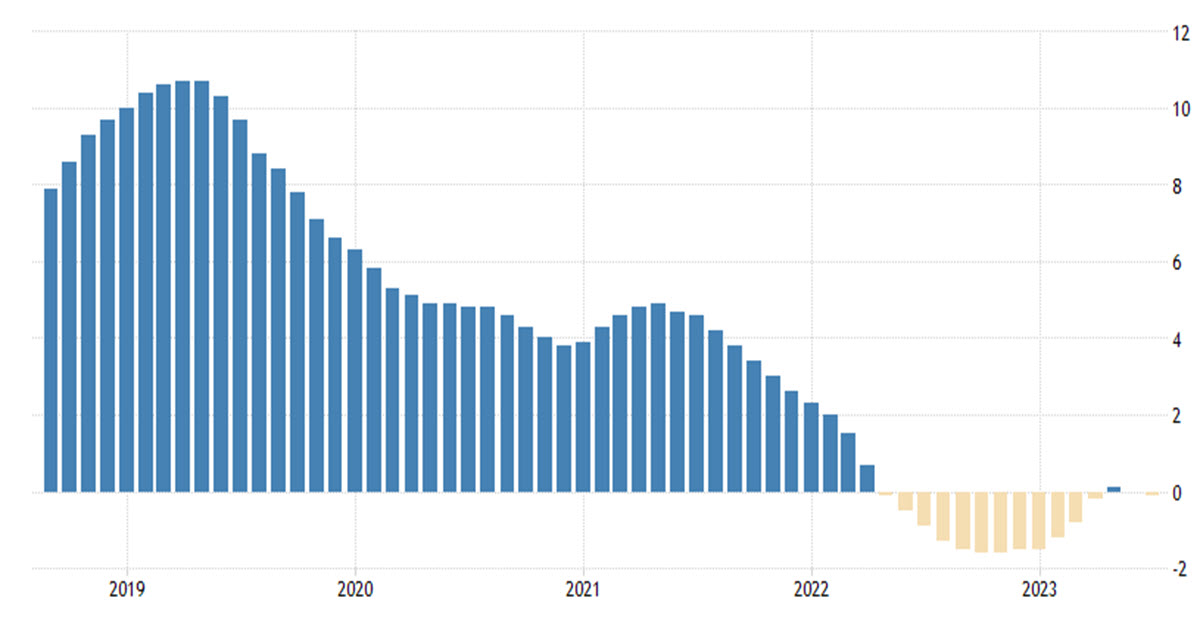

Dwelling Costs, yr on yr change

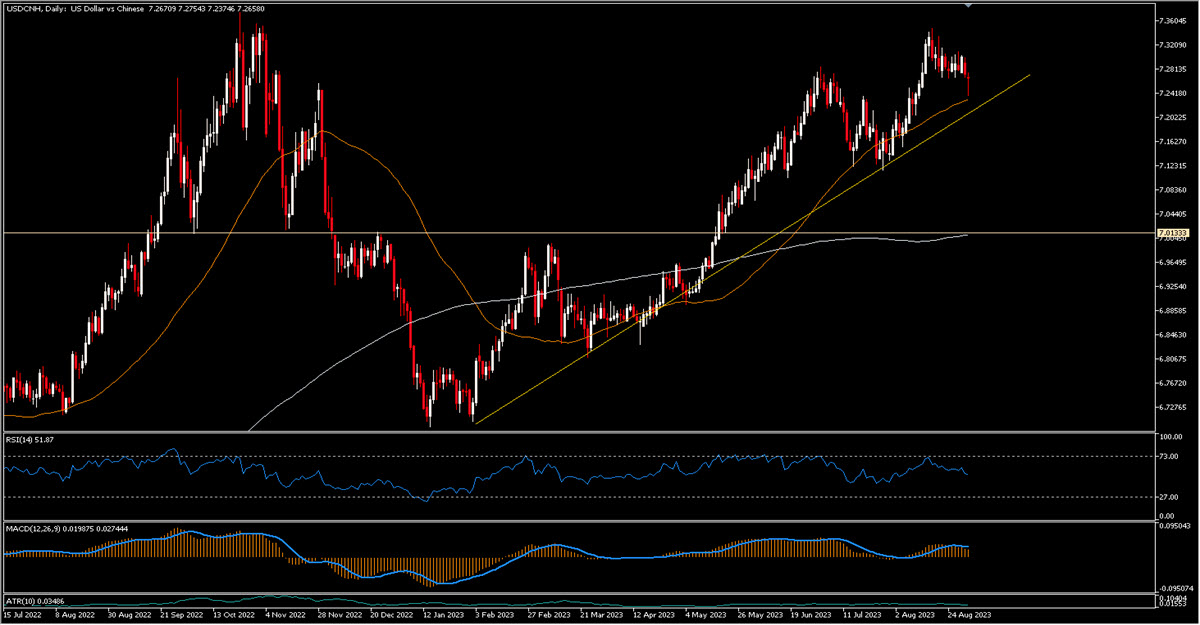

Beijing’s Central authorities and the PBOC try onerous to revive the economic system. They’ve quite a lot of instruments at their disposal (at the beginning a USD 3trillion overseas change reserve) which they’re dealing with fastidiously, weighing the outcomes. 2 weeks in the past the Central Financial institution lowered its one-year mortgage prime fee to three.45% from 3.55% however surprisingly left its five-year mortgage prime fee unchanged at 4.2%. This was adopted final week with a shock lower to 2 different short- and medium-term charges, and the inventory market was given a lift by a decreased levy on buying and selling. Nonetheless, the strain on charges helped weaken the Yuan, which fell to ranges of seven.30 towards the USD. And it’s on this stability between stimulating the economic system with out weakening the native foreign money too shortly that the coverage maker has moved. China’s main state-owned banks have been noticed promoting US {Dollars} to purchase Yuan in onshore spot overseas change market a number of occasions over the past weeks. And as we speak there have been 2 different strikes: down cost minimums for first-time homebuyers have been lower to twenty%; and the FX reserve ratio for banks has been lower by 200bps to 4% to rein in Yuan weak point (can now promote extra overseas foreign money in change for CNH).

China will definitely be in hassle, however don’t underestimate its capability to withstand. USDCNH trades decrease at 7.26 this morning.

Click on right here to entry our Financial Calendar

Marco Turatti

Market Analyst

Disclaimer: This materials is offered as a normal advertising and marketing communication for data functions solely and doesn’t represent an impartial funding analysis. Nothing on this communication incorporates, or ought to be thought-about as containing, an funding recommendation or an funding suggestion or a solicitation for the aim of shopping for or promoting of any monetary instrument. All data offered is gathered from respected sources and any data containing a sign of previous efficiency just isn’t a assure or dependable indicator of future efficiency. Customers acknowledge that any funding in Leveraged Merchandise is characterised by a sure diploma of uncertainty and that any funding of this nature entails a excessive stage of threat for which the customers are solely accountable and liable. We assume no legal responsibility for any loss arising from any funding made primarily based on the knowledge offered on this communication. This communication should not be reproduced or additional distributed with out our prior written permission.