It’s not a simple time for anybody to be navigating the world proper now – what with financial, social and environmental headlines always reminding us of the instability of issues. It’s much more troublesome for Gen Zs; people who’ve skilled setbacks and missed out on milestones because of the pandemic however nonetheless have to face the realities of gaining a strong footing in life and establishing a path in the direction of monetary independence. A commonality seen throughout each Canada and the US is that Gen Zs, (the era roughly outlined as being born between 1997-2012) usually tend to report experiencing stress and anxiousness than older generations.

Whereas 18-26-year-olds throughout the border share on this similarity, Canadian Gen Zs usually tend to report that they really feel a way of management over their psychological well being than their American counterparts. What’s driving this distinction? Naturally, it must be acknowledged that the social on-goings reminiscent of coverage modifications within the US undoubtedly are a contributing issue. Exterior of the social atmosphere, nevertheless, Mintel’s analysis finds that spending accountability may additionally be a contributing motive. Particularly, Canadian Gen Zs usually tend to report holding main accountability for spending on their very own leisure actions and hobbies than American Gen Zs. Being answerable for one’s personal purchases in classes that the cohort leans on to spend their free time and specific themselves is probably going giving them a larger sense of management over their very own lives and a larger sense of independence.

So what areas are Canadian Gen Zs centered on? When awarded a hypothetical $500 spending spree, clothes and consuming out had been the highest areas they might spend in. What’s necessary to notice right here is that as a result of Canadian Gen Zs usually tend to be making these purchases themselves, manufacturers and firms in these sectors maintain the potential to attach with Canadian 18-26-year-olds extra deeply than with American ones. The important thing to doing so is to assist them deal with themselves and to supply choices that match into the place they’re at proper now.

Diving into the Gen Z mindset – the Me Mentality

Mintel’s World 2023 Pattern Me Mentality discusses how for the final two years, customers have needed to put their very own wants on the again burner in favor of a neighborhood mindset. Bear in mind, this mindset got here at a value for Gen Zs – they missed out on main milestones like proms, misplaced jobs resulting from being extra extremely represented within the service sector, and even missed out on internships as kick-starters to careers whereas corporations reduce on operations. All at a stage in life the place they’re attempting to ascertain themselves and set themselves up for future success. There’s a actual sense that Gen Zs really feel that life isn’t going as deliberate. Now greater than ever, they’re eager to make up for misplaced time and desirous to re-focus on themselves. Manufacturers that acknowledge their hardships, make them really feel like they’re doing okay proper now, and empower them with instruments and assets to take concrete steps to maneuver ahead and obtain future successes would be the ones that win.

3 methods for advertising and marketing to Canadian Gen Z customers

Finally, Gen Zs want to realize again a way of management and stability within the quick time period, they usually should be arrange with instruments that may empower them heading in the right direction to attain success sooner or later. Listed here are three methods to think about.

1. Have fun small wins to reassure them they’re doing okay

Whereas finishing on a regular basis mundane duties could look like no massive deal, bringing consideration to the completion of such duties would assist to focus on to the section that there are achievements being made every day. In a way, these small accomplishments are small indicators of success – one thing that would maintain significance when the long run feels unsure and issues really feel uncontrolled proper now. Manufacturers that may be there to assist rejoice these small successes will assist present a way of reassurance that they’re doing okay and assist them to be ok with the place they’re at proper now.

2. Actually, put some management of their palms by means of personalization/customization

Being eager customers of social media, Gen Zs are extra seen to others than ever. They’re not simply passively on social media however actively selling themselves and their pursuits, as seen with 42% of Gen Zs creating content material of their free time (eg TikTok movies, or recording a podcast). Which means that outward expression of individuality and uniqueness is a continuing level of consideration for Gen Zs. Certainly, Mintel information confirms this because the section is extra doubtless than older generations to depend on their bodily look to showcase who they’re and specific their individuality.

You will need to observe that personalization can go effectively past clothes and meals. For instance, dermatologist-recommended skincare model, Cetaphil, launched a complete pores and skin analyzer to assist customers to make extra knowledgeable selections about their skincare routine. The person takes a selfie after which the Cetaphil AI Pores and skin Evaluation makes use of AI know-how to match the selfie to a database of 70,000 numerous pores and skin photos. The instrument then creates a personalised report for the person offering details about their pores and skin sort, pores and skin issues and proneness to numerous pores and skin circumstances. This stage of customized understanding permits customers to make decisions extra confidently that may enable them to greatest improve their outward look.

3. Financial uncertainty now necessitates instruments to assist them achieve management of funds beginning proper now

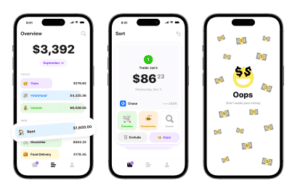

As they give the impression of being in the direction of the long run, financial uncertainty and inflationary circumstances could make attaining future monetary plans like homeownership really feel extra daunting and out of attain. The fact is that Gen Zs and Millennials are taking longer to realize these monetary milestones. Whereas funding apps are aplenty, empowering them with instruments to discover ways to set up strong monetary footing now could be key. This implies beginning with the fundamentals – issues like funds administration, constructing credit score, and understanding the implications and penalties of utilizing options that make it simpler to purchase issues now like BNPL (Purchase Now Pay Later) choices. Sensible instruments just like the user-friendly budgeting app Oops, a monetary app that went viral on TikTok for permitting individuals to mark once they make an impulse buy and holistically get a way of how a lot they spend on impulse, can be key to serving to younger customers funds and preserve observe of their funds.

What we predict

Whereas the urged methods are broad, the principle factor to think about is that Gen Zs are distinctive and have skilled unprecedented circumstances at a really informative time of their lives, rendering playbooks of older generations much less related. Because the cohort seems to be to construct themselves up in the direction of a profitable maturity, it should be acknowledged that challenges can be distinctive to every and the top objectives may also range accordingly. Which means that extra customization and personalization are wanted to assist them be the celebrities of their very own present, and with a lot uncertainty, work should be performed to assist present the instruments that meet them the place they’re at.

For added client information and analysis on Canadian Gen Z customers, contact us as we speak.